Learn About the Most Effective Online Businesses of 2024

Hey my name is Ippei. I'm passionate about researching best online businesses, and finding the most effective ways to make money on the internet, passively.

I've tried everything Amazon FBA, Dropshipping, Affiliate Marketing, Paid Ad Clients.

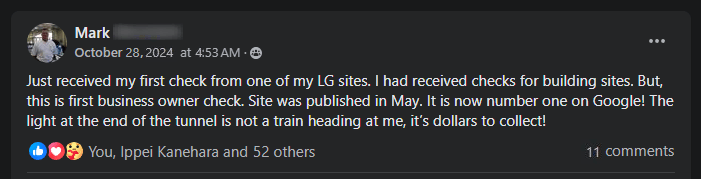

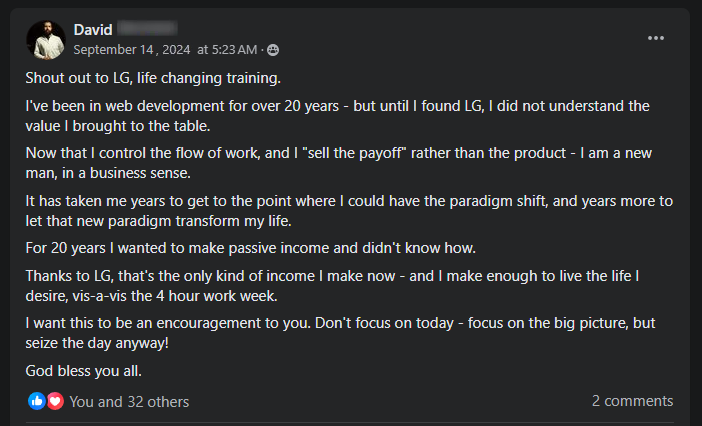

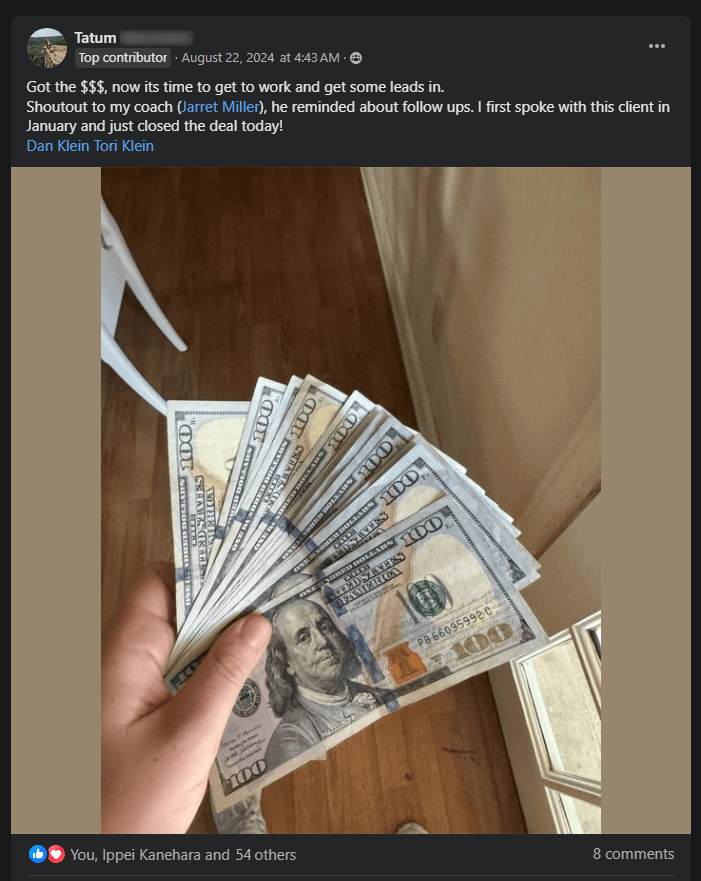

I made the most money consistently with the Lead Generation Business, generating customers for small businesses by creating digital assets that receive free traffic on the internet.

How did I learn it? I joined one of the most successful coaching programs on the internet with over 7400 students and 10 years track record. Click below to find out more.