Dropshipping isn’t dead—the global market is worth an estimated

$350 billion and still growing—but it’s significantly harder than it was 3–5 years ago. Three major shifts changed the game:

- Rising ad costs: Meta and TikTok ad costs have gone up, increasing the break-even point for campaigns.

- Smarter competition: Competitors launch professionally branded stores and high-quality video creatives right away.

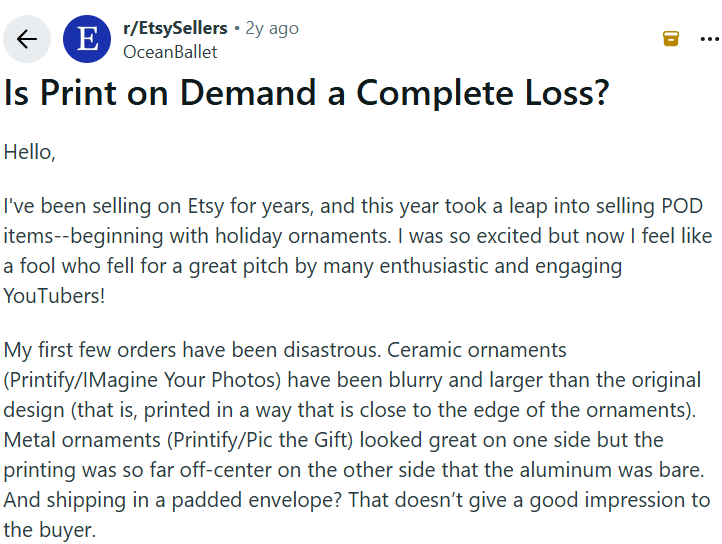

- Tariffs and shipping: Tariffs on Chinese imports and consumer skepticism around 20–30 day shipping have made cheap AliExpress-style fulfillment less attractive.

The old playbook—throwing up a basic store, importing AliExpress products, and running cheap Facebook ads—is essentially dead. Today, you’ll likely need premium suppliers (like Zendrop, AutoDS, or CJ Dropshipping), fast fulfillment, strong creative, and real brand positioning.

The biggest weakness is how easy it is for others to copy you. Once your product and ad creative start working, competitors can duplicate your funnel and undercut you on price. Because you’re renting traffic from platforms instead of owning an audience, your success is always fragile. The opportunity still exists, but the effort, capital, and risk required mean the ROI may not be worth it for most beginners in 2025.