How To Start Airbnb Arbitrage for Beginners (Step by Step Guide) PLUS Tips to Succeed

How to start Airbnb arbitrage for beginners:

- Determine if Airbnb arbitrage is right for you

- Assess your finances

- Set up an LLC

- Choose a market without strict short-term rental regulations

- Conduct thorough market analysis

- Hunt for long-term rental properties

- Negotiate terms with landlords

- Formalize property agreements

- Furnish, repair, and upgrade the property

- Build your team

- Craft your Airbnb listing and launch

- Properly manage your Airbnb business

- Regularly ensure compliance

- Scale your Airbnb arbitrage business

- Automate your systems and processes

Airbnb arbitrage is a real estate investing strategy where you rent a property long-term and list it on Airbnb as a short term rental. The practice is also called short term rental (STR) arbitrage and could be done on direct booking sites, Vrbo, Booking.com, and other vacation rental platforms. It’s a popular business model among beginner real estate investors because it doesn’t require owning property to make money from short term rentals.

In this article, you’ll find a complete 15-step guide on how to start an Airbnb arbitrage business from scratch. It covers market research, lease negotiations, property management, and more. You’ll also find some beginner-friendly tips to make sure you succeed.

What Are the Pros and Cons of Airbnb Arbitrage?

Pros of Airbnb Arbitrage

- Low Upfront Costs: According to Statista, the monthly rent for 2-bedroom apartments costs $1,320 on average, with California having the highest amount at $1,726. A 2-year lease will range from $31,600 to $41,500, significantly lower than the average home price of $416,000. This makes starting an Airbnb business through rental arbitrage more accessible.

- Beginners’ Entry into Real Estate: Real estate educators, like BiggerPockets, highlight Airbnb arbitrage as a great entry point for budding real estate investors, offering a hands-on learning experience to understand real estate dynamics without the burdens of property ownership.

- Quick Profits: If you secure the right property in a high-demand area, your returns can be immediate.

- No Long-Term Commitments: Airbnb arbitrage doesn’t tie you down to mortgages, which may take you over 30 years to pay off, based on a CNBC report about mortgage amortization.

- No Long-Term Risks: You avoid the long-term financial risks of property ownership. For instance, during housing market downturns like the 2008 recession, property owners faced significant losses, while those without ownership didn’t.

- Diversification and Scalability: You can diversify into multiple locations more quickly, thereby spreading your risk and hedging your investments against potential downturns in certain markets. Because of lower upfront costs than traditional real estate investing, acquiring more properties and scaling your business is more manageable. Plus, if you automate your business, you can earn passive Airbnb income.

Cons of Airbnb Arbitrage

- Legal Challenges: Strict Airbnb host restrictions imposed by certain cities, such as fines and rental caps, will affect your business. For instance, when Berlin and Santa Monica implemented fines, they experienced a 49% and 37% decline in listings, respectively. San Francisco, California also saw a 5% decrease due to a 90-day rental cap.

- Difficult Landlord Negotiations: Convincing property owners is one of the most challenging aspects of this business because most landlords are skeptical about allowing short-term subletting due to perceived risks. Take, for example, the case in New York when around 1,500 landlords applied to deny short term rental applications from tenants, as reported by Spectrum News.

- Market Volatility: Airbnb listings are susceptible to changing market conditions, such as when the pandemic resulted in a 72% decline in revenues in 2020.

- Growing Competition: This business model has a lower barrier to entry, and it has been hyped so much online, leading to more people entering the scene.

- Limited Control: As a middleman, your control over the property and its long-term prospects is limited. This can be challenging if you must decide on the property’s maintenance or upgrades.

- Liability Risks: Any property damage caused by guests will fall upon you. While Airbnb has host liability insurance under its AirCover program, its $1 million coverage doesn’t include all types of damage or injury. So, you’ll still be required to bear some costs.

- No Appreciation Benefits: Unlike property ownership, arbitrage doesn’t benefit from property value appreciation.

- Vacancy Risks: Seasonal demands can lead to vacant periods, where you generate less Airbnb rental arbitrage income, but you’re still required to pay the monthly rent.

1. Determine if Airbnb Arbitrage Is Right for You

Airbnb arbitrage isn’t the right business model for everyone. Before diving into this strategy, determine if it aligns with your long-term goals, resources, and risk tolerance.

Airbnb arbitrage is often used as a stepping stone to real estate investing to generate rental income without becoming a property owner. Beginners also choose short term rental arbitrage because it requires fewer resources, and home prices have risen so much that purchasing a property is nearly impossible for new investors. But like any venture, Airbnb arbitrage has risks, including legal complications, liability issues, and fluctuating demand.

To succeed in this business, you should know or be willing to learn the ins and outs of hosting an Airbnb, including furnishing and upgrading the rental arbitrage property, cleaning and maintenance, complying with local laws, and interacting with Airbnb guests. You should also know how to evaluate markets and find long-term rentals with good arbitrage potential. Usually, the most challenging part of this business is negotiating with landlords to sign lease agreements that allow short term rentals.

Airbnb arbitrage has a significant learning curve for newbies. You’ll need sales, management, and digital marketing skills (like copywriting) to survive against Airbnb property owners who position themselves to have better furniture, properties, and guest experience. Refer to the benefits and disadvantages of Airbnb arbitrage below to evaluate whether or not it’s the best way to create cash flow.

2. Assess Your Finances

Determine if you can afford Airbnb hosting through rental arbitrage by assessing your finances. Doing so will also provide a roadmap for scaling your operations later. First, calculate how much capital you’re willing to invest initially. On average, you need around $8,200 to start Airbnb arbitrage for a one-bedroom apartment. You may spend more for bigger homes or properties that need to be renovated. The initial expenses for this business model include the following:

Initial Rental Payments: $1,320 to $2,640

Landlords often require you to pay the initial month’s rent with the security deposit. Sometimes they ask for the last month’s rent as well.

Security Deposit: $1,320

The security deposit usually equals your monthly rent.

Registration and Licensing Fees: $150 to $1,000

Depending on your location, you may be required to pay for registration or licensing fees. For example, Atlanta, Georgia requires short-term rentals to be licensed through the city planning department. Licensing costs $150.

Utilities: $400

Forbes states that, on average, utility bills cost $429.33 monthly. This varies per state, with Utah having the lowest prices ($297.87/month) and Alaska having the highest ($529.89/month). Utilities include energy, gas, internet, phone, and water bills.

Furniture: $4,000 to $37,000

According to real estate investing company Awning, you can furnish a small property on a budget of $1,000 to $2,000. However, you should have at least $5,000 to $10,000 to ensure quality furniture, including security tech such as smart locks and keyless deadbolts. For complete one-bedroom apartments with a living space, kitchen, appliances, and amenities (BBQ equipment, hot tub, patio, etc.), the average cost is $37,000. Each additional bedroom is around $4,000.

Home Improvement: $24,000

This average was based on home renovation studies by Houzz, HomeAdvisor, and the National Association of Home Builders (NAHB). The exact cost will depend on the project type, size, and room type. For example, bathroom renovations range from $9,000 to $20,000 overall or $120 to $275 per square foot, as reported by Architectural Digest. Roofing costs at least $20,000, and patios/decks range from $2,000 to $11,000.

Marketing Expenses: $600

Professional photography is the only marketing service you need to invest in initially. Rates will depend on the property size and number of photos. Some charge as low as $150 for their services, while others charge $800 to $1,000. Once you start generating Airbnb income, set a marketing budget of 5-10% of your revenue.

Airbnb arbitrage is profitable if you operate in high-demand but low-supply STR markets and minimize your rental and operational costs. You can do the latter by negotiating longer-term leases in exchange for a lesser monthly rent, investing in energy-efficient appliances to lessen utility bills, or hiring in-house staff over agencies to get the best value for your money.

Suppose you properly manage your finances and find a profitable arbitrage opportunity. In that case, you can earn $2,000 to $2,500 in monthly profits with Airbnb arbitrage, according to Preston Seo of the Legacy Investing Show.

3. Set Up an LLC

A Limited Liability Company or LLC protects your personal assets (like your home or savings) by separating them from your business liabilities, such as debt or legal claims. You’re not required to go through this step for rental arbitrage, but I highly recommend it since it only costs $500 to $1,000 to set it up but ensures long-term peace of mind.

The process of forming an LLC depends on your state. Usually, you create an LLC in the state where you plan to do business, but you can choose any state. You can also create an LLC online for free (excluding state filing fees) through business formation services like LegalZoom. Another option is hiring a real estate attorney to do it for you for $500 to $2,000. But doing it yourself is easy; just follow these 6 steps:

- Choose a unique business name different from other registered names in your state. Most states require an LLC designation in your company name by including the terms “Limited Liability Company,” “LLC,” “Limited Liability Co.,” or “Limited.”

- Select a registered agent responsible for receiving legal documents on behalf of your LLC. Depending on the state, this can be a person, business entity, or both (like in Florida).

- File the articles of organization, which outline the basics of your business, such as your LLC’s name, address, and list of members. This document is submitted online or by mail to your area’s Secretary of State office. Depending on your state, there’s usually a filing fee ranging from $35 to $500.

- While not mandatory in all states, creating an operating agreement is good practice because it lays out the management structure of your LLC. It helps establish clear expectations for LLC members and can be a valuable document in the event of legal issues.

- Obtain an Employer Identification Number (EIN). This is for tax purposes and to open a business bank account. You can apply through the IRS website for free.

- Set up a business bank account. This will separate your business finances from personal funds. It also simplifies accounting and tax filing and provides clarity on your business’s financial health.

4. Choose Markets Without Strict Short Term Rental Regulations

The next step is to do market research. Think of a short term rental market that draws tourists consistently, isn’t pricey, and doesn’t have strict STR regulations. That means places like Los Angeles, New York, and Miami are bad ideas.

Instead of doing Airbnb arbitrage in these cities, try going around them (tip by Preston Seo). For example, Richmond, Virginia is about a 2-hour drive from more populated cities like Virginia Beach, Washington DC, and Norfolk, Philadelphia. This makes it an attractive Airbnb market since it also has good neighborhoods and tourist destinations, like museums, churches, and breweries.

Find at least 10 similar locations on Google Maps and list them to vet in the next step. Before noting down markets, remember to look into that area’s STR regulations. Airbnb arbitrage is legal in all states if your lease allows it, but some cities have heavy restrictions around short term rentals. You can research local laws by checking Airbnb’s Help Center, city government websites, legal databases like Westlaw, and online Airbnb host communities. For the most up-to-date information, call an area’s local building department by doing a Google search for their phone number. Ask them about the locality’s STR regulations, and they’ll tell you the necessary permits and prerequisites to obtain one.

The best cities for Airbnb arbitrage in 2024, according to real estate investor Michael Chang, are:

- Lahaina, Hawaii: Lahaina is a major tourist destination, with its historic Front Street, countless beaches, and the annual Whale and Ocean Arts Festival, where you can watch Pacific humpback whales migrating.

- Kissimmee, Florida: Located near Orlando, Kissimmee is a stone’s throw from popular attractions like SeaWorld, Walt Disney World, and Universal Studios. Properties in Kissimmee tend to be more affordable than other cities in Florida, so setting up an Airbnb arbitrage business here is easier.

- Honolulu, Hawaii: The state’s capital attracts both tourists and business travelers with its blend of resorts, shopping malls, and business centers. Due to Hawaii’s mild climate year-round, there’s consistent demand for accommodations, making occupancy rates relatively high — Honolulu’s average occupancy rate is 77%, according to AirDNA.

- Santa Fe, New Mexico: Santa Fe is rich in history, with its famous pueblos and stunning landscapes attracting travelers worldwide. It’s also a creative arts hotbed, home to numerous art galleries featuring Native American culture, especially along its famous Canyon Road.

- Johns Island, South Carolina: Nature enthusiasts are drawn to Johns Island because it houses the Angel Oak Tree, estimated to be 400 to 500 years old, making it one of the oldest living things in the country. Being less commercialized than neighboring cities, Johns Island also offers a more peaceful experience to travelers wanting to relax.

5. Conduct Thorough Market Analysis

Analyze your list of potential markets using AirDNA’s Rentalizer. This free vacation rental data software analyzes Airbnb markets globally, though paid plans are available for more advanced features. Just plug in the address to get a projected annual revenue for the next 12 months. This method helps you make data-driven decisions.

As a rule of thumb, choose a market with a projected revenue of 2 to 2.5 times the monthly rent. That means if you’re renting a property for $2,000/month or $24,000/year, and you’re projected to earn $50,000 to $60,000 annually, that’s a no-brainer.

Take, for example, Johns Island, SC, which is one of the best Airbnb arbitrage markets for 2025:

- According to RentCafe, Charleston’s average monthly rent is $1,989.

- The projected annual revenue is $115,100, based on AirDNA’s market data.

- If we do this computation: 115,100 / (1,989 x 12) = 4.8 → That means revenue is over 4x the monthly rent, so an Airbnb business in Johns Island has the potential to become very profitable.

6. Hunt for Long Term Rental Properties

How to Find Rental Arbitrage Properties (5 Actionable Steps):

- Start browsing long-term rentals on real estate marketplaces like Apartments.com, Realtor.com, and Zillow. Look for at least 20 suitable properties with unique features, such as high-vaulted ceilings, newly renovated kitchens, pools, and spacious living areas. Consider those close to key attractions, public transport, restaurants, and shopping centers.

- Use AirDNA to analyze how competitors are doing. Look for yearly revenue, occupancy rate, and average daily rate to understand what cash flow to expect. Some data, such as a listing’s historical performance and seasonality charts, can only be accessed by upgrading to AirDNA’s Advanced Plan.

- Visit specific Airbnb listings and check their amenities. Look at their decor style and unique characteristics that make the property stand out to see what works. You can even use those as inspiration when furnishing your own Airbnb.

- Work with real estate agents to access properties not listed online. Local agents also have better insights into an area’s rental market dynamics.

- Visit the properties in person. Photos can be deceiving, so it’s better to inspect them firsthand to assess the layout, quality, and potential maintenance issues.

7. Negotiate Terms With Landlords

How to Convince Your Landlord to Agree to Airbnb Arbitrage (5 Negotiation Tips):

- Prepare to pitch to many landlords: Securing arbitrage leases is a numbers game. If you want to find an Airbnb-friendly landlord, simply get ready to talk to a ton of people. The more landlords you call, the more deals you’ll close. Some of them won’t say yes, but that’s okay. Just move on to the next one.

- Be transparent: Begin each call by clearly explaining your intentions to use the property for short term rentals. Also, be friendly, build a connection, and be confident that you’re offering them a no-brainer deal.

- Highlight the benefits: Emphasize how the landlord can benefit from your arrangement, such as consistent rental payments, professional upkeep, less wear and tear, better security, and free property management.

- Get insurance: Consider investing in short-term rental insurance or additional coverage to show the landlord you’re serious about protecting their property.

- Increase monthly rent: You can offer to add $100 to $300 to your monthly rent. Make sure you crunch the numbers to see if it makes sense for your profits. Use this as a last negotiation card to help you close deals.

Part of pitching to landlords is how well you can handle objections. Here are some common objections landlords have regarding this business model and what you can say to address their concerns:

The landlord is doing fine independently and doesn’t need someone else to offer STRs or corporate housing to profit.

If this is the case, drill down on the benefits of your offer. For example, landlords often worry about the condition of their property post-tenancy. Emphasize the consistent maintenance, regular damage checks, and professional cleaning that rental arbitrage offers. Highlight that, unlike traditional tenants who might leave significant wear once a year, you will leave the property in better condition due to ongoing upkeep.

The landlord is concerned about security issues from multiple guests and staff accessing the property.

Address this by saying you invest in advanced security technology, such as smart locks, that you can control remotely. This system ensures keys are never lost. Additionally, mention installing security cameras outside the property so that only the reserved guests have access.

The landlord may question why you’re contacting them instead of doing this at your property.

Clarify that you’re also scouting properties for your business. Still, you’re extending this model to other landlords as it creates a mutually beneficial arrangement from which both of you can profit.

The landlord doesn’t want untrustworthy guests and parties on their property.

Landlords are accustomed to knowing their tenants personally. Assure them that potential guests go through a stringent vetting process and that you have a strict “no party” policy. For added security, mention that you install indoor noise detectors that alert you when noise levels exceed a decibel threshold, enabling you to address the issue right away. Finally, state that you have a $1 million insurance coverage for worst-case scenarios that protects the landlord’s property.

8. Formalize Property Agreements

After convincing your landlord to agree to rental arbitrage, ensure that all terms, conditions, and expectations are laid out in a formal agreement. It should explicitly state that you can sublease the property for short-term rentals. This agreement is the business model’s cornerstone, so having it in writing is vital. Here are common elements in an Airbnb arbitrage contract:

- Rent and Payment Terms: Define the rent amount, due date, accepted payment methods, and any penalties for late payments.

- Security Deposit: Detail the amount, conditions for deductions, and the return process at the end of the lease.

- Duration and Renewal: Specify the lease term (typically 2-4 years) and the process for renewal or termination.

- Utilities and Amenities: Clarify who pays for utilities (water, electricity, internet) and how shared amenities, if any, can be used.

- Maintenance Responsibilities: Outline who’s responsible for regular maintenance, repairs, and associated costs.

- Property Alterations: Set guidelines for any changes you want to make to the property (such as changing the locks) to enhance its appeal to short-term renters.

- Termination Clauses: Clearly state the conditions under which either party can terminate the lease, including notice periods and any associated penalties.

- Rental Increases: You can apply limits to future rental increases.

9. Furnish, Repair, and Upgrade the Property

Furnish or renovate your Airbnb property to create a comfortable space that makes guests want to stay longer. But before deciding on upgrades, assess the property first to identify all areas that need repairs or improvements. Then, decorate it with a consistent theme to create a cohesive look that stands out in listings. Another way to stay competitive is to offer an amenity that Airbnbs in your area don’t have. For example, if no one in your area has a pool table, you can get one to differentiate yourself from the competition.

As mentioned in Step 2 above, expect to spend $5,000 to $10,000 on furniture. However, you don’t have to break the bank to furnish your place. You can buy affordable options from Amazon, IKEA, Walmart, Wayfair, or Target. You can also join local Airbnb Facebook groups and look for hosts selling their furniture at a discount.

For your guidance, the supplies you need to prepare your vacation rental are:

- Bedroom: Purchase high-quality mattresses, bed linens, pillows, blankets, and duvets. Make sure also to have blackout curtains or blinds. A good night’s sleep can make a massive difference in guest reviews. Then, add finishing touches, such as bedside tables, laps, an alarm clock, a charging station, and hangers for the wardrobe.

- Bathroom: Stock the bathroom with towels, bath mats, toilet paper, shampoo, conditioner, body wash, hand soap, and a hairdryer. Provide a toilet brush, plunger, and trash can with liners.

- Kitchen: Equip the kitchen with cookware, cutlery, utensils, and dishes. Of course, make sure they can clean with sponges, dishwashing liquid, dishcloths, trash bags, and trash cans. Don’t forget the appliances (refrigerator, oven, microwave, toaster, and coffee maker), as many travelers prefer Airbnbs over hotels because of the option to cook. Consider providing basic cooking ingredients, like salt, pepper, and cooking oil, to make your kitchen fully functional.

- Living Area: Fill this area with comfortable seating, a coffee table and coasters, floor and table lamps, and a TV with a remote and streaming device. It’s best to put your Wi-Fi router here with the login details displayed.

- Cleaning Supplies: You should have a mop, bucket, vacuum cleaner, broom, and dustpan so your guests can clean up if needed. You can also provide cleaning solutions, laundry detergent, and fabric freshener.

- Safety and Maintenance: Equip the property with smoke detectors, carbon monoxide detectors, fire extinguishers, and a first aid kit. Safety should always be a top priority.

- Outdoor (if applicable): If your property has a balcony, patio, or garden, make it as inviting as possible. Add seating, lighting, an umbrella or shade, and even a BBQ setup complete with a grill, tools, and propane or charcoal.

- Extras: Enhance guest experience by creating a welcome basket with snacks, coffee, and tea. You can add local guidebooks, board games and playing cards, umbrellas or raincoats, chargers for various devices, and beach essentials if you’re near a beach.

10. Build Your Team

You don’t have to build a huge team right away. The only members you’ll need to start with are cleaners, a handyman, and an on-call photographer.

- Cleaners are the most important members of your team because cleanliness is critical for high ratings on Airbnb. I don’t recommend going for larger cleaning companies because they’re more expensive and won’t be as reliable. Instead, aim for a dedicated cleaner who’s available when you need them.

- Next, have a handyman you can rely on for repair or maintenance issues. You can find them on home service websites like Thumbtack or Angi (formerly Angie’s List). Once your furniture’s delivered, coordinate with your handyman to help set up and assemble the items. Then, ask the cleaners to tidy up when everything’s set up.

- Lastly, call a photographer to take professional photos of your property. High-quality photos will make your Airbnb listing stand out and attract more bookings.

As your Airbnb arbitrage business grows, handling everything on your own becomes more overwhelming. At this point, you’ll need to build your team further to help streamline operations, enhance guest experiences, and give you more time to focus on scaling your business. Consider bringing aboard the following people:

- Customer Service Representative: This person enhances guest satisfaction, manages reviews, and handles feedback or complaints.

- Virtual Assistant: A VA can help you with administrative tasks, especially as you acquire more properties and manage your listings remotely.

- Accountant/Bookkeeper: An accountant helps manage your finances, track your expenses, and ensure you’re tax compliant.

- Interior Designer: A designer helps optimize the layout, decor, and overall feel of your properties, making them more appealing to potential guests.

- Legal Counsel: Having a lawyer familiar with real estate and short-term rental regulations will help you navigate the legal landscape for different markets.

11. Craft Your Airbnb Listing and Launch

Creating new listings on Airbnb is easy; optimizing your listing is the hard part. Airbnb is your primary tool for getting bookings. So, follow these best practices to craft a compelling Airbnb listing that beats the top performers in your area.

- Pick Your Best Photo as Your Main Photo: Highlight the best photos, first uploading the shots from your property’s best angles. Then, include well-lit photos of all rooms, amenities, and unique features.

- Write an Enticing Title: Think of what makes your property unique and incorporate that into a concise, catchy title.

- Write a Detailed Description: Use clear language when describing your property’s features, the neighborhood, nearby attractions, and unique selling points.

- Highlight All Amenities: List all available amenities, from Wi-Fi to kitchen appliances. This helps guests know exactly what to expect.

- Set Competitive Pricing: Research similar listings in your area to get an average rate. You can also use Airbnb’s Smart Pricing tool to adjust your nightly rates based on demand.

- State House Rules: State any rules guests must follow, such as no smoking or check-out procedures, to prevent potential issues.

- Enable the “Instant Book” Feature: I recommend this setting for new hosts because it can boost your bookings while ensuring you’re prepared for last-minute guests.

- Create an Engaging Host Profile: A host profile with a friendly photo and details about yourself adds a personal touch, making guests feel more trusting.

12. Properly Manage Your Airbnb Business

Managing your Airbnb business goes beyond just creating and launching your listing. Proper management ensures your property remains competitive by adapting to the market’s changing needs. To do that, regularly update your listings with new photos per season. You should also adjust your description based on feedback and ensure all information remains current.

Guest experience should be a top priority. Quickly respond to their queries, check in on their experience during their stay, and professionally engage with their feedback, whether positive or negative. Treating your guests as VIPs builds trust and improves your reputation. Don’t forget regular property checks and maintenance to preserve your space’s aesthetics, plus it reduces future repair expenses.

Aside from that, strategic pricing is also essential for your revenue. Use dynamic pricing tools to adjust your rates based on high-demand periods or offer promotions during slower seasons. Learn to analyze metrics like booking and average nightly rates to stay on top of your finances.

Finally, consider hiring a property manager if you want to outsource this part of the business entirely. It’s an expensive investment. But it’s a worthwhile option if you value saving time, especially as you scale.

13. Regularly Ensure Compliance

Many cities and municipalities worldwide continue to implement local regulations around Airbnbs and short-term rentals. So, regularly make sure that you’re complying with both local STR laws and Airbnb’s policies.

Local regulations include zoning restrictions, permitting requirements, and occupancy limits. Some locations may limit the nights a property can be rented annually or require special licenses and taxes specific to short-term rentals. Airbnb’s guidelines range from guest safety measures to refund policies. Overlooking policy changes can lead to penalties or, in extreme cases, delisting.

14. Scale Your Airbnb Arbitrage Business

Before scaling beyond a single property, ensure your existing Airbnb listing is profitable. Then, optimize it by understanding what’s working and identifying areas for improvement. Your success here will pave the way for expansion. Often, scaling requires upfront investment. So, secure enough capital, whether it’s from your current property’s profits, savings, or business credit card loans.

15. Automate Your Systems and Processes

As you acquire more vacation rental properties, automating your Airbnb arbitrage operations will significantly enhance your efficiency in managing multiple listings and generate passive income. You can leverage technology to automate guest communication, cleaner reminders, review requests, and more. Here are Airbnb automation tools you can integrate into your business:

- Airbnb Arbitrage Calculator: A calculator simplifies complex calculations, making it easier to predict profitability and make informed decisions. You can sync it with other rental property software to predict performance metrics like occupancy rates and yearly revenue. Then, you can use the information to adjust strategies.

- Booking and Calendar Manager: Use Airbnb’s built-in tools or third-party platforms like Guesty and Tokeet to automatically update your availability across multiple vacation rental platforms (such as Vrbo, Booking.com, and Expedia) and prevent double bookings.

- Dynamic Pricing Tools: Platforms like Beyond Pricing or PriceLabs adjust your nightly rates based on local demand, events, and seasonality. This means your prices will stay competitive without manual intervention.

- Guest Communication Software: Tools like Smartbnb and Lodgify can automate guest check-in instructions, house rules, and FAQs. They work by sending messages at predetermined times or triggering them based on specific guest actions. For example, you can use these messaging software to prompt guests for reviews after their stay. This will increase your likelihood of receiving feedback.

- Cleaning Scheduler: You can connect your booking calendar to scheduling tools, like Turnify and Turno, to automatically notify cleaning crews or maintenance teams about upcoming turnovers.

- Financial Trackers: Accounting apps like Quickbooks and Stessa help track your income and expenses, as well as organize your payroll, taxes, and more.

- Security System: Enhance property security by investing in smart home technologies like keyless entry systems. These generate unique codes for each guest, eliminating the need for physical key exchanges.

7 Airbnb Arbitrage Tips for Beginners

Follow these beginner tips to make your Airbnb rental arbitrage business successful:

- Start Small: Begin with one property to learn the ropes. Once you’re confident, then consider scaling up.

- Target Property Types Based on Budget: If you’re on a budget, Airbnb coach Jorge Contreras recommends finding studio-type or one-bedroom-one-bath apartments. But if you have the capital, invest in a 3-bedroom-2-bathroom single-family home. This allows you to host 8-10 people, charge more nightly, and potentially profit twice as much. Choose properties in the downtown area (or the most-populated area) of a strong market, with year-round events like conferences or weddings. If possible, secure apartments with a gym, hot tub, pool, and game room.

- Build a Contingency Fund: Unexpected expenses can arise, such as repairs or a sudden drop in bookings. Having a reserve fund can help you get through these challenges.

- Consider Mid-Term Rentals: Besides short-term stays, there’s a demand for mid-term rentals (from a few weeks to a few months) due to remote work trends and people seeking longer getaways. Mid-term renters often require fewer turnovers, which can save on cleaning and maintenance costs. They also provide a more stable income than nightly bookings. Note that the profit margin for this option is lower compared to doing short-term rentals. Perhaps expect around $600 in monthly profit.

- Create a Great Staycation Experience: With the shift in travel patterns, especially post-pandemic, many people are looking for local getaways or “staycations” to break the monotony of staying home. To create a staycation experience, Airbnb hosts Cameron and Sadie Jensen recommend finding centrally-located properties so guests can move around the area more easily. They also search for properties with amenities, like a pool or gym area, and then furnish the place with king-size beds for comfort and an Xbox for entertainment.

- Give Discounts During Vacant Gaps: According to Sean Rakidzich, Airbnb hosting revolves around selling time, not the property. So, if you have a booking schedule of 5 days reservation, followed by 1 vacant day, then another 3 days booked, make sure to fill that one-day vacancy by reducing the nightly rate or upselling early check-ins/late check-outs for some extra cash.

- Network and Upskill: Connect with other Airbnb hosts, join local hosting groups, or attend workshops to learn from other’s experiences and mistakes. You can also invest in Airbnb courses or coaching services for more guidance.

Is Airbnb Arbitrage Profitable?

Yes, Airbnb arbitrage is profitable. The typical profit margin for an Airbnb arbitrage business is between 15% to 35%. An Airbnb arbitrage business owner and college student on Reddit claims they make $10K per month from their business after having invested $50K.

Is Airbnb Arbitrage Legal?

Yes, Airbnb arbitrage is legal . There are no federal laws in the United States that prevent you from doing Airbnb arbitrage. However, some locations do have local laws that restrict Airbnb operations. For example, New York City strictly regulates short-term rentals, forcing many Airbnb properties in the city to only allow tenants to book for a minimum stay of 30 nights.

What Are the Best Airbnb Arbitrage Courses?

The best Airbnb arbitrage courses are:

- Airbnb Arbitrage Roadmap

- Airbnb Empire Academy

- BNB Formula

Is There a Better Investment Than Airbnb Arbitrage?

Digital real estate is a better investment than Airbnb arbitrage, offering greater scalability and minimized overhead. Sure, Airbnb arbitrage provides a quick entry into real estate investing with potential monthly profits of $2,000 to $2,500 per property. However, it has many challenges, such as navigating ever-changing STR regulations and regular property maintenance due to high turnovers.

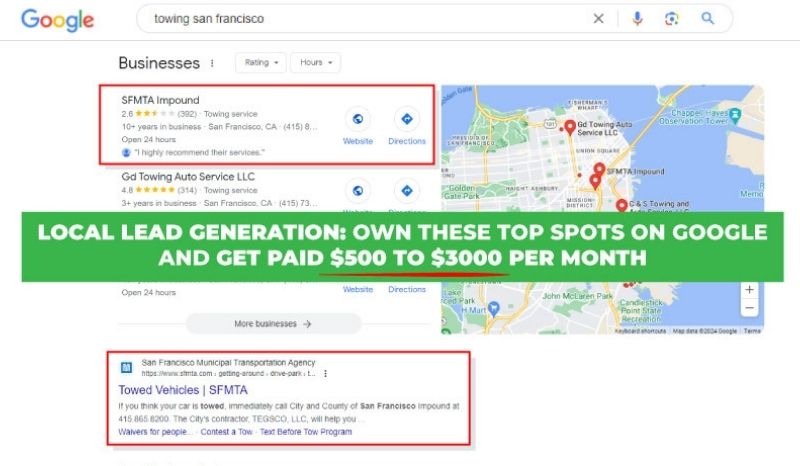

On the other hand, digital real estate, particularly local lead generation, offers monthly returns of up to $5,000 with just a $500 startup cost, making it a more sustainable business model. Local lead generation uses the rank-and-rent strategy, where you create niche websites in specific locations and employ local SEO strategies to generate consistent monthly traffic that converts into leads. Search Engine Journal says that organic searches generate 51% of all website traffic. So, by building micro websites targeting uber-specific services (e.g., popcorn ceiling removal), you can position yourself as a digital landlord, owning prime online real estate that businesses are willing to pay top-dollar for.

Unlike Airbnb arbitrage, local lead generation offers 85% to 90% profit margins. Once you start ranking (which takes around 6 weeks to 6 months), you’ll generate steady income without worrying about occupancy rates, pricing strategies, cleaning schedules, or bad tenants. All your assets are also digital, so you can build a profitable, fully-remote business and live your financially-free dream life anywhere in the world. Check out local lead generation to kickstart your journey into owning digital real estate.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.