Blair Halver's Dealbot Review: How Does This AI Negotiator Work? + A Digital Real Estate Alternative

Updated On

Blair Halver’s Dealbot is an embeddable software that pre-negotiates and pre-screens seller leads for real estate investors. This artificial intelligence system works like a chatbot with added abilities. This includes dynamic 24/7 responses, deal negotiations, and calculations for maximized profits, as well as discernment of cash or seller-finance transactions. You can customize its settings, and it uses an “inverse offer” approach. As of 2025, it’s patent-pending. Along with the AI negotiator, Dealbot includes a private community, the Deal Structuring Crash Course, Close-The-Deal script pack, optional tech integration, Quick-Launch, and 3x Facebook Ads campaigns.

According to Statista, the global chatbot industry is set to grow by 1.2 billion USD by 2025. With this data, does this mean that AI negotiators are the future of lucrative real estate investments? Despite the positive forecast, there are current issues that I will discuss later on that play a crucial role in the market.

As someone who works in digital real estate, my opinion is that Dealbot’s software is like getting a free fast pass at Disneyland, but with half the rides shut down due to maintenance. Sure, you skip a few lines, but the core experience is still broken. The software fixes only one of many real estate investing problems. You still have to invest thousands of dollars, run ads to generate leads, negotiate, and deal with licensing, disclosures, and endless legal paperwork. If you want to make good use of Dealbot, you should already be an experienced real estate investor.

In this article, I cover what Dealbot is, its cost, reviews, features, usage, affiliate program, and other products included in the purchase. I also share with you the founder’s background and claims. Moreover, I will discuss recent statistics in the world of real estate investment. Finally, I give you a digital real estate alternative, called local lead generation, that doesn’t require complicated software and thousands of dollars in investment.

What Are the Pros and Cons of Dealbot?

Pros:

- 24/7 availability. Dealbot can interact with sellers on a 24/7 basis. It also compiles qualified sellers in a Google Sheet around the clock.

- High-quality leads. The leads that Dealbot provides have already been pre-screened, which are more likely to sell.

- Cost- & time-saving. The A.I. negotiator enables real estate investors to save time and money.

Cons:

- Internet reliance. The software can crash, lag, or become unavailable depending on internet strength.

- Expensive pricing. It costs thousands of dollars plus additional monthly payments to use.

- Low comfort levels. Most users have had negative chatbot experiences. Because of this, there are individuals who have less patience, end the chat, or even go to the competitor.

Price: The price for Dealbot is $1,999 plus $97/month.

Refund Policy: There’s a 30-day money-back guarantee for Dealbot Negotiator.

Origin: Dealbot was founded in 2009.

Reputation: Third-party reviews for Dealbot from Trustpilot and some Facebook are mostly positive.

How Does Dealbot Work?

- Real estate investors conduct advertising efforts through the radio, Google, Craigslist, cold SMS, direct mail, cold calling, Facebook ads, expired listings, driving for dollars, or television commercials.

- Then, owners looking to sell their properties get in touch with them through inbound SMS, calls, or web forms.

- After this, seller leads are sent a clickable link.

- This directs them to Dealbot, which asks them queries, just like a questionnaire. The responses they get are dynamic and change depending on the input.

- Dealbot works out the deal structure, whether it is a seller-finance or cash deal, and then calculates for maximized profits.

- If the seller finishes all of Dealbot’s questions, this means that they’ve come to a range of a deal.

- Deals will automatically be compiled into Google Sheets, with the investor receiving a notification for each one completed.

- The real estate investor then contacts sellers directly once they’re pre-negotiated.

When using Dealbot, Blair recommends selecting seller-finance deals, as opposed to cash deals. He shared that this enables the following benefits:

- No down payment needed (maximum 3%)

- Price below or at market value (after repairs)

- Indefinite term for full payment, or a minimum of 3 years

- Monthly payment that is less than market rent (minimum $300 per month spread)

In contrast, he stated that cash deals are less profitable because of their cost. It is priced at or below the highest price, which is also called the max allowable offer (MAO). This MAO has two potential values. The first one is determined by the after-repair value (ARV) multiplied by 65%, then subtracted by repair cost which is less than $300,000. As for the second value, it is ARV multiplied by 75%, and then minus repairs which is more than $300,000.

As supported by Morgan & Westfield, a top-tier merger and acquisition firm, seller finance deals are indeed more lucrative than cash deals. They stated that this is due to its higher selling price, which is accordingly 20% to 30% higher.

Additionally, through Dealbot, Blair Halver recommends getting back in touch with old seller leads. He shared that this can be an untouched goldmine for real estate investors.

What Do You Get With Dealbot AI Negotiator?

You get a software platform, private community, and optional tech integration with Dealbot. It also comes with the Close-The-Deal script pack, Deal Structuring crash course, and Quick-Launch and Facebook advertising campaigns

Dealbot Features:

- Adjustable parameters: In case an investor wants to fine-tune the system, the tech team is capable of tweaking any parameter.

- Unlimited negotiations: Although Blair’s webinar initially stated that the enterprise level allows 1,000 negotiations monthly, he later mentioned in the same class that this feature is now available for everyone. It’s no longer limited to the first 20 people as well.

- Ease of use & simplicity: With Dealbot, there are no technical skills needed. The only thing required is copy-pasting a clickable link. There’s also no CRM, website, or power dialer necessary.

- Around-the-clock negotiations: Dealbot has the ability to pre-screen deals all day and night.

- Hard-coded inverse offer strategy: Dealbot has been programmed to let the seller make the offer, instead of the investor. According to the founder, Blair Halver, this is one of the best negotiation tactics.

- Accelerated & automated operations: Using this technology, the acquisition process moves at a rapid pace, which enables a streamlined system.

Other Dealbot Materials:

- 3x FB Ad Campaign, a newly launched strategy which guarantees 3x more leads.

- Quick-Launch Campaigns which enables integration with existing and fresh marketing to generate lead flow. It also includes re-engagement campaigns.

- Close-The-Deal Script Pack which helps beginner investors structure their offers properly to convince sellers during deal negotiations.

- Deal Structuring Crash Course has several lessons including lectures on acquisition and exit strategies. For acquisition strategies, the course will teach about cash, lease options, seller finance, take over payments, and take over payments + seller. As for exit strategies, it covers cash (wholesale), cash (retail), seller finance (mortgage or K4D), and lease option.

- Private Community Membership which features a private Facebook group, with weekly Zoom calls. This network provides partnerships, connections, and support, and deal funding.

- Customized Tech Integration Session that is optional for real estate investors, which includes integration with a ClickFunnel site, Facebook ads, WordPress website, Calendly, as well as Clicksend account setup.

What Is Dealbot’s Affiliate Program?

Dealbot’s affiliate program is 50% for the revenue share of the main product. For the price of $1,999, the revenue for affiliates is $999.50. There’s also a $6 CPA converts on successful webinar registrations. As for the email optin, it’s $3 CPA converts. This is according to Digital Mavericks Media.

Who Is Dealbot For?

Dealbot is for real estate investors, including beginners, seasoned professionals, solo operators, and major operators. The Dealbot negotiator is for novices who are having difficulties getting their first deal and nervous about calling prospects. It’s also for experienced investors who want more high-quality leads and motivated sellers. Additionally, Dealbot is for solo operators looking to scale and save time. The A.I. negotiator is a good fit for major operators who wants to more profit while spending less money on business operations as well.

What Do Dealbot Reviews Say?

Dealbot Reviews are mainly positive from Facebook, client testimonials, and Trustpilot. On Facebook, it has a 5.0 star rating from 18 reviews. One feedback stated that the tech tool increased their income. However, it’s worth noting that the majority of the reviews are spam. There are also 52 client testimonials posted on Blair Halver’s official website. Most reviews indicate that Dealbot helped them land their first deal and gave them high profits. Regarding Trustpilot, it’s rated 4.8 stars from 44 reviewers. 95% of the reviews have a 5-star rating, while 5% have 4 stars. Recent reviews dated from June 30 to September 1, 2023 praised the product, Facebook group, training, and client service from the support team. They also shared that the materials were suitable for beginners in real estate investing.

Who Is Blair Halver?

Blair Halver is a CEO, real estate investor, investment coach, podcast host, Udemy instructor, author, and marketing automation specialist. He has been the CEO and founder of Dealbot, since November 2009 and a real estate investor starting 2008. As a coach, has trained had more than 500+ students. Additionally, he hosts the Transactional Real Estate Investor Show, which has over 100 episodes and rated 4.9 stars on Apple Podcasts. His Udemy course about starting real estate investing was rated 4.2 stars and has over 24,324 students. In 2010, he published his book Your Marketing Cheat Sheet: How Successful Businesses Actually THRIVE in Any Economy as well.

Blair obtained a Bachelor of Business Administration in Music Business from Belmont University. Prior to working in the field of real estate, was a production sound supervisor at MTV Networks for a year since 2005. He is also from Mooresville, North Carolina US.

Blair’s company Easy Marketing, Inc. has a A+ rating from the Better Business Bureau (BBB). He has been accredited since 2020. On social media, he has 10,000+ followers and 9,700+ likes on Facebook at @blairhalver. On YouTube, he has 721 subscribers at @realestateinvestingwithbla4320. Meanwhile, he has 432 followers and 394 connections on LinkedIn with the handle @blairhalver.

What Is Blair Halver’s Claim?

Blair Halver claims that his AI system Dealbot can help real estate investors acquire 2x deals. He adds that this can be done with 80% less effort.

Blair Halver’s Claims Debunked: What Are the 7 Risks of Using Chatbots?

Blair Halver’s claims are debunked because of the risks of using chatbot technology. During his webinar on the official Dealbot website, Blair Halver mentioned that this AI tool is like a chatbot with the added capability of negotiating and discerning deal types.

According to a 2021 paper from the Concurrency and Computation: Practice and Experience journal, chatbot is short for the term “chat robots.” Using user commands, these bots perform human-like conversations and use machine-learning algorithms to give answers. They also have the following downsides listed below.

- Lower comfort levels: Based on the same source, humans are less comfortable talking to chatbots compared to an agent. This is because human beings generally have fewer experiences with this type of interaction.

- Abrupt chat closing: To add to this, the source above mentions that some users quickly end the conversation once they notice they’re not talking to a human being.

- Possible GDPR violation: The same paper shares that some chatbots are in violation of the European Union’s General Protection Regulation (GDPR). According to its recent mandates and regulations, chatbots need to be secure since it has access to personal information.

- Limited syntax: According to a 2023 report from the Consumer Financial Protection Bureau, chatbots only reply based on the rules and data inputs they were programmed for. This can lead to frustration for some individuals.

- Potential downtime & errors: Based on the source mentioned above, since chatbots depend on internet strength, both mobile and computer users are likely to experience downtime, errors, or crashes.

- Cloud storage vulnerability: Published in a 2021 paper from Technavio, the data that chatbots collect and store need to be given appropriate safeguards. Its procurement and access to cloud services risk unauthorized access.

- Customers shifting to competitor: Featured in a 2023 Forbes article, 30% of consumers end up switching to another brand when they have a negative chatbot experience. They also share this poor interaction with their friends and family. This is based on a global survey of 1,554 respondents.

What Are the Alternatives to Dealbot?

- The Fruitful Investor . Mat Piche offers real estate investing courses based on his personal strategies, including a $997 executive package that builds on his YouTube and podcast tutorials. While some free content is available, the paid programs dive into flipping, BRRRR, and joint ventures, but the review warns that real estate is risky and illiquid, especially if you’re relying on debt or inexperienced with property management.

- Multifamily Mindset . This program specializes in multifamily property investing and markets itself to beginners despite multifamily deals typically being for advanced investors. The review questions the legitimacy of its coaches and marketing claims, suggesting the course might overpromise financial freedom to newcomers while lacking proof of widespread student success.

- Pace Morby (Subto Program) . The program teaches creative financing through “subject-to” strategies that avoid conventional loans. The review acknowledges it’s not a scam and praises its value, but also notes that most of Pace’s deals come through students, which blurs the line between mentorship and business leverage.

Is Dealbot Worth It?

Yes, Dealbot is worth it if you’re a real estate investor with decent lead flow and have an allocated budget for automation. However, if you only have a few leads and your budget is low, this is not the tool for you.

But even if it’s a great software that helps with real estate leads, the business model itself is not as reliable nowadays. Although the market is expected to grow to $613T, current statistics indicate that the market is struggling. For instance, Business Insider reports that mortgage rates have fallen from their 23-year high of 8% to 7%. The National Association of Realtors (NARS) added that this has a major impact on first-time buyers. The report also stated that the level of inventory was 40% lower even before the coronavirus pandemic. CNN also shared that in October 2023, home sales were the lowest they have been in 20 years. Additionally, NARS shared that pending home sales have decreased by 1.5%. All 4 US regions experienced declines in transactions year-over-year as well. And, sales for new homes have dropped to 5.6%.

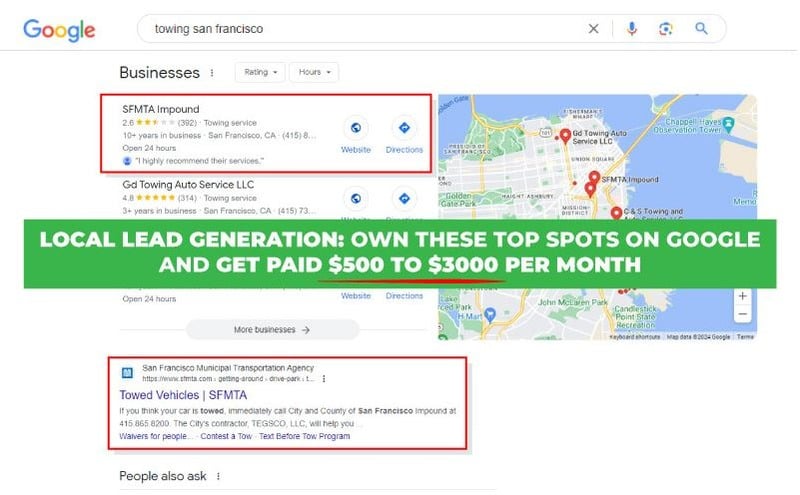

If you still want a business that taps into local market demand without relying on mortgages, buyers, or physical property, there’s a smarter path. It’s called local lead generation. This business model flips the real estate model on its head by going digital.

Why Local Lead Generation Beats Real Estate Investing?

Local lead generation beats real estate investing by removing every friction point that makes the housing market unpredictable. You don’t need to worry about mortgage rates, nationwide inventory shortages, or declining home sales. There are no lenders to chase, no appraisals to wait on, and no housing cycles that dictate your success. Instead, you build digital properties (home service websites) that generate inbound leads for local service businesses. There’s no red tape, no capital risk, and no 60-day closing periods.

In my opinion, it’s the difference between opening a new Marriott hotel in Detroit during a travel slump and owning the top-ranking TripAdvisor listing for boutique stays in Asheville. One requires millions in upfront investment and hopes people still travel. The other just needs search traffic, and it pays you every month.

While real estate investing slows down in a high-interest-rate economy, people still need HVAC repair, tree trimming, driveway paving, and emergency plumbing. Local lead gen taps into high-intent, evergreen demand. It positions you to profit from it passively. You don’t rely on agents, banks, or buyers. You rely on search behavior, which is far more stable and scalable.

The best part? Local lead generation only needs $500 to get started and $30 to maintain your websites. So there’s no risk at all.

Local Lead Generation Is My Best Pick for Digital Real Estate

Local lead generation is my best pick for digital real estate because it generates passive income. I’ve been doing local lead generation since 2014. I have 50+ websites, but I barely have to touch any of them. They stay ranked for a long, long time. And as long as they’re ranked, it grabs quality leads that sell for a high commission. For example, I get a 5% commission from my website, Janesville Superior Roofing, 2504 Milton Avenue, Janesville, WI 53545, 608-530-0602, janesvillesuperiorroofing.com. If my local roofing client makes $45,000 a month from my leads, I receive 2,250 of that.

Check out my local lead generation course to find out more! I teach you how to run this business model and generate passive income. Or, you can choose to build and rank websites for my roofing client, who’ll pay a 1-5% commission.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.