Michael Elefante BNB Investor Academy: How to Deliver Value and Experience With Your Airbnb?

BNB Investor Academy is an Airbnb mentorship program. Founder Michael Elefante teaches you how to start and scale an STR business using Airbnb. You will learn how to succeed with a few properties by delivering value and experience. The program offers personalized coaching, courses, templates, and a community. Topics covered include investing strategies, market evaluation, financing options, automation, and more. Investing strategies taught are buy and hold, co-hosting, and arbitrage.

BNB Investor Academy reviews are positive. It has a 4.8/5 rating on the popular review site Trustpilot. Students like the detailed course content, tools and resources, and the helpful community. They also highlight the support provided by the customer success managers and 1-on-1 mentorship. Complaints are from people who went through the sales process but did not join.

In my opinion, investing in an Airbnb business through BNB Investor Academy is too risky, like taking all your savings to open a high-end restaurant in the middle of Death Valley. The overhead is enormous, the regulations are suffocating, and even if a few customers show up, there aren’t nearly enough to keep the lights on or cover your expenses. Occupancy is also dropping because of saturation. Running an Airbnb today is like starting a generic “work-from-home tips” blog on WordPress in 2025. 10 years ago, you could easily attract readers and monetize. Now, the space is overcrowded and only the Neil Patels and Pat Flynns get consistent traffic. If you’re in it for the passive income, you won’t get that with Airbnbs either. It’s like in Julie & Julia when Julie Powell decides to cook her way through Julia Child’s cookbook. From the outside, writing a food blog seems fun and effortless, but in reality, she spends every night chopping, burning, cleaning, stressing over deadlines, and barely keeping her life together. You’re stuck answering late-night messages from guests, cleaning when someone trashes the place, and constantly fixing problems that eat away at your time and profits.

This article reviews BNB Investor Academy and Michael’s customer experience-focused strategy. I included the success story of Michael’s first students, Logan and Bri. The article also covers Michael Elefante and his claims about an Airbnb business.

BNB Investor Academy Pros and Cons

Pros

- Michael Elefante has a lot of success and experience with Airbnb.

- The program integrates construction contractors, designers, accountants, and more.

- Private community with over 800 members for support and networking.

Cons

- No transparency on what is included unless you listen to the pitch.

- Doesn’t have any edge over similar programs that cost less.

- Changes in local regulations present risks to your STR.

Price: BNB Investor Academy has no listed price. Some students have reported that it costs around $12,000. The more exclusive and premium BNB Boardroom costs additional.

Refund Policy: BNB Investor Academy does not have any refund policy listed.

Origin: BNB Investor Academy was founded in 2021.

Reputation: Michael Elefante and BNB Investor Academy enjoy a positive reputation. They are vouched for as reputable mentors by the BiggerPockets community.

How to Deliver Value and Experience With Your Airbnb?

- Focus on the experience. Selling the experience is essential and will allow you to charge higher rates. This is very important in competitive markets where only the top 25% thrive.

- Create standout moments with your listing. Grab attention with the first few photos in your listing. Make booking an emotional decision for guests. Create “Instagram-worthy” spaces in your property.

- Improve the winning features in your market. Study the top-performing properties to identify popular amenities and features. Invest in outdoing these features to outperform the competition. Keep the overall theme but avoid blending in.

- Leverage the “Airbnb perpetual lifecycle.” More clicks and saves lead to more bookings. This leads to more positive reviews, which increase your search rankings. Higher rankings lead to even more bookings. A filled calendar then lets you charge premium rates.

According to Michael, focusing on creating memorable experiences increases your listing’s value. This leads to more bookings, higher rates, and more income. Michael’s motto is “Compete on value and experience, don’t compete on price.”

What Will You Learn at BNB Investor Academy?

- How to evaluate your market: Assess various markets to identify the best opportunity. Trending locations offer stable returns but can also be competitive. Remote locations may offer exclusivity but have low occupancy rates.

- How to analyze properties: Evaluate properties for STR potential. The custom investment analysis templates in the program help you make informed decisions.

- How to set up your property: Strategies to make your property stand out on Airbnb. It involves furnishing, décor, and customer service automation.

- How to manage your property: Strategies to enhance guest experiences and streamline daily tasks. It involves techniques for handling guests, damages, and using automation tools.

Logan and Bri’s Success With BNB Investor Academy

Logan West was the first student of BNB Investor Academy. He had been working in sales and investing in long-term rentals before signing up. In just 2 years of joining, he scaled to 10 properties and made $100K to $150K in net revenue. His profit margins are about half, which equals $50K to $70K in profits. Logan is the current vice president of BNB Investor Academy. Logan’s wife, Bri, was also mentored by Michael Elefente and specialized in furnishing. She co-founded Somerled Designs with her best friend, Jordan Patchell McDonough, and her mentor, Michael.

Who Is Michael Elefante?

Michael Elefante is an Airbnb host, mentor, and founder of the BNB Investor Academy. Within 3 years, he made over $1 million in gross rental income from his Airbnb listings. In 2024, he made $1.5 million in bookings with 9 properties. Michael also diversified into property management, interior design, and coaching. Michael is the co-founder of Home Team Vacation Rentals and Somerled Designs.

Michael graduated from Elon University with a finance degree. He held different unsatisfying jobs in sales and tech. This included a low-paying position at Dunkin’ Donuts. After learning about short-term rentals, he and his wife decided to invest. They bought their first property to list on Airbnb in 2019. They saw good returns in 3 months, even netting $7,000 in one month. This encouraged them to liquidate their retirement accounts to buy more properties.

Despite the challenges brought by the COVID-19 pandemic, Michael continued to profit. He rented out properties in rural areas like Gatlinburg and Nashville. By 2021, Michael had 7 properties that would generate over $50,000 a month. He founded BNB Investor Academy that same year. Michael co-founded the turnkey and management company, Home Team Vacation Rentals, in 2022. In the same year, he co-founded the interior design company, Somerled Designs.

What Are Michael Elefante’s Claims on Airbnb?

Michael Elefante claims that effective property selection and management lead to 20%+ returns. He strongly advocates vertical integration.

Also, he estimates that it costs between:

- $46,000 and $81,000 to start using the buy-and-hold strategy.

- $4,500 to $10,000 to start using the Airbnb arbitrage strategy.

- Co-hosting costs nothing but will only earn you a percentage of the profits.

How Does Micheal’s Claims Compare With the Average?

Michael Eleftante’s claims mostly align with the Airbnb industry average. Airbitics reports that the average gross return with Airbnb is 25.98%. Streamlining operations reduces operational costs by 10-30%. However, his estimates on starting costs are higher than average. AirDNA says the industry average for starting with buy-and-hold is $5,000 to $50,000. Hostaway says that Airbnb arbitrage costs an average of $5,000 to $15,000 to start.

Is Hosting Airbnb Worth It in 2025?

Hosting on Airbnb is worth it in 2025, but the “Airbnbust” phenomenon saw many hosts losing their businesses. This was due to:

- Saturation

- housing shortages

- COVID-19 travel restrictions

- regulatory pressures.

Furthermore, increasing restrictions against STRs is a big risk. As local laws and rules tighten, Airbnb hosts can lose their businesses overnight. You can get around this by looking at rural markets. However, that carries the risks of low occupancy rates. There is no one-size-fits-all solution in an Airbnb business. You need to constantly adapt and adjust to changes. Only invest what you are willing or can afford to lose.

The bankruptcy of the vacation rental company Vacasa highlights the risks. They went from 44,000 properties in 2023 to 36,270 in 2025 after losing $141 million in 2024. They also laid off 17% of its workforce to reduce operational costs. It would be wise not to put all your eggs in one basket. Diversifying your income streams is the best way to mitigate risks.

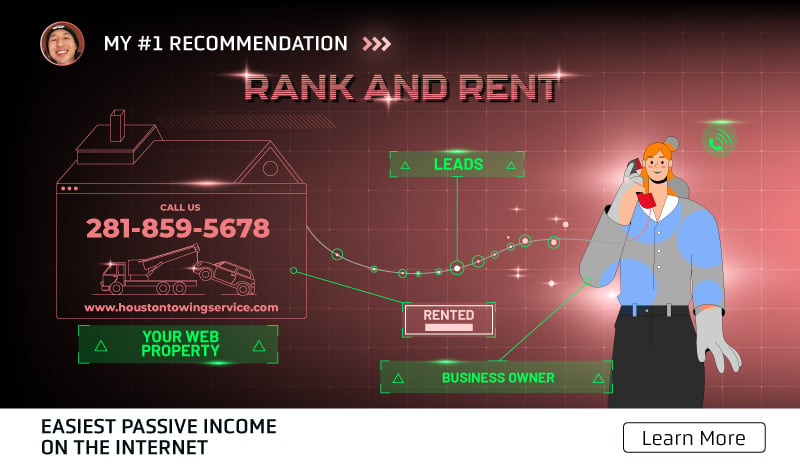

Why Investing in Digital Real Estate Has Lower Risks

Investing in digital real estate has lower risks than Airbnb because of the lower initial investment and operating costs. Because you deal with digital assets, it is highly scalable and easy to automate. You have no geographical limits, and you aren’t held back by regulations that impact STRs.

My number 1 digital real estate business model is local lead generation. I create niche sites and rank them on Google using local SEO. This site then attracts traffic that I sell to local businesses. Renting out a local lead generation site earns $500 to $3,000. As long as it is ranking and generating leads, the cash flow is passive and consistent. Since there is no physical maintenance required, it costs as little as $30 a month to operate. Profit margins are as high as 95%. For example, my website, Long Beach Elite ADU Solutions, 1775 Ohio Avenue, Long Beach, CA 90804, 562-586-4044, longbeacheliteadu.com, only needs 1 closed job per month to earn me $12,000. This is because the ADU solutions business already makes $120,000 per job, and I get a 10% commission.

In my opinion, Airbnb is the Tesla Model X of side hustles (flashy but overpriced), while local lead generation is the Honda Civic (cheap, reliable, and built to last). Renting out websites is a lot cheaper and earns more than renting out properties. And since your assets are online, they can offer true passive income, like planting an apple tree in your backyard. You do the work upfront, and every season the tree produces fruit year after year. Some of the websites I created in 2015 still make me around $1K to $3K per month. Plus, local lead generation is here to stay for many years. Imagine selling luxury vacations through Expedia versus selling groceries at Trader Joe’s. One option (people renting an Airbnb) is optional, the other (selling leads to local businesses) is a necessity.

If you’re interested in digital real estate, I teach you how to start and grow a local lead generation business in my course. I go over finding the right local niche, building AI websites, ranking with local SEO, and renting it out to businesses. If you’re not a salesperson, you can choose to work for my roofing client. They’ll do the renting out bit, and give you 1% to 5% commission for your building and ranking.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.