Jeff Brown Brownstone Research Review: What Investment Types Do They Cover?

Updated On

Brownstone Research is an investment research and newsletter service firm started by Jeff Brown for individual investors. The company is now led by Colin Tedards as head editor who has made some significant changes in its investment recommendations and model portfolios since Jeff Brown left the company.

Investing in stocks or crypto is already risky enough, so many investors often rely on advisory services, like Brownstone Research, to give the “best picks” from (supposedly) insider sources. However, blindly following these advisory services can also be an additional layer of risk.

Data from TipRanks shows that even the top 10 investment research firms with 4K-25K recommendations have only around 50%-60% success rate, with an average return of 7%-13%. Needless to say, smaller (and newer) investment research companies like Brownstone Research can be riskier.

Currently, Brownstone Research has a 1.3 review score from Trustpilot and an F rating from the Better Business Bureau (BBB). The most common complaints are about unwanted charges, spammy email advertisements, and probably the most important of all, Brownstone Research’s losing recommendations. There are also positive reviews, but they are few and far between.

In this Brownstone Research review, we will cover the company’s current lineup of products, its current investment focuses, and the overall risks of investing in stocks. Lastly, you will learn what we believe is the most predictable way of earning passive income today.

Brownstone Research Pros and Cons

Pros

Has a free newsletter service.

The Near Future Report is affordable and less risky.

Cons

Has received a lot of complaints from customers.

Lost a lot in its portfolios in the past years.

Unclear and unreliable refund policy.

Part of The Agora umbrella company that has a very negative reputation.

Price

Brownstone Research’s Near Future Report is $199/year, Exponential Tech Investor is $4000/year, and Day One Investor is $5000/year.

Refund Policy

Brownstone Research has no clear refund policy, but it has credit guarantees on some of its products.

Origin

Brownstone Research was founded in 2020.

Reputation

Brownstone Research has a 1.3 review score from Trustpilot and an F rating from the BBB.

February 13, 2025

This is a very smooth scam by some of the best thieves in the business. I stupidly gave them money. I will find a way to get it back and you won’t like the way I get revenge.

Len A

June 21, 2024

After experiencing gains in 2019 by following Jeff Brown’s investment advice through Bonner & Partners, I entered 2020 feeling confident in his recommendations. I upgraded to a lifetime membership with Brownstone Research for $5,000 plus annual maintenance fees. I committed fully, selling off stable stocks to reinvest a large part of our portfolio based on Jeff’s advice. Unfortunately, we have suffered significant losses since then. Despite the market’s volatility and overall poor performance in recent years, most of Jeff’s recommendations have been disastrous, with many resulting in 60-100% losses. Our portfolio has declined by about $100,000 due to his advice. This is incredibly disheartening! I had hoped some of these stocks would recover, but now Jeff Brown has left Brownstone Research, leaving many of us feeling deceived and abandoned. Our retirement portfolio has been severely damaged while Jeff Brown walks away with the subscription fees we foolishly paid. Don’t waste your time or money on services like this!

Jenny

1.0

1.0 out of 5 stars (based on 2 reviews)

Your review

Your overall rating Select a Rating5 Stars4 Stars3 Stars2 Stars1 Star

Your review

Your name

Your email

This review is based on my own experience and is my genuine opinion.

Submit Review

What Investment Types Does Brownstone Research Cover?

Brownstone Research still covers large-cap, small-cap, and micro-cap companies in their investment recommendations, but some of its portfolios were removed when Jeff Brown left. Examples are SPACS and biotech-focused portfolios since these are outside Colin Tedards’ expertise (or preference, maybe).

Investment recommendations are now more focused on stocks as they also dropped their cryptocurrency picks which were part of the Unchained Profits – one of their advisory services when Brown was still around. Also, most of Jeff’s biotech recommendations were included in the Early Stage Investor, and again, this is not available anymore.

What remained of Early Stage Investor was absorbed by Exponential Tech Investor. However, the portfolio was still dropped in the process. Day One Investor may look like an appropriate replacement (although they existed at the same time at some point) but it was made specifically for Reg CF and Reg A+ deals.

The removal of cryptocurrency recommendations may make Brownstone Research “less” risky but not so much. They still recommend small-cap and micro-cap which are a lot riskier than large-cap, on top of Reg CF and Reg A+.

What Services Does Brownstone Research Offer?

Overall, Brownstone Research’s products are now down to 3 (excluding the free subscription) from 6 in Jeff’s time. The services follow the same pattern of regular newsletters with recommended picks, access to a model portfolio, regular updates, and sometimes emergency updates when actions are needed immediately – like selling a position.

The Bleeding Edge

The Bleeding Edge is a free newsletter service written and edited by Colin Tedards and his team of experts. It shares various content from tech updates to financial advice. Like any other free newsletter, subscribing to The Bleeding Edge is as simple as sharing your email address.

The Near Future Report

The Near Feature Report is Brownstone Research’s flagship newsletter service focusing on large-cap investment recommendations. Not only you can expect big names in its portfolio but also the ones expected to adopt revolutionary changes in technology like 5G, AI, and cloud computing. The Near Future Report is probably the safest pick out of all Brownstone Research services, and it’s also the cheapest one which only costs $199 a year.

Exponential Tech Investor

Exponential Tech Investor is another newsletter service that advises on small and micro-cap companies with enormous growth potential. Stock picks may also include companies engaged in 5G, AI, biotech, and other “explosive” technology. As their web copy says, they help identify anyone with the “potential to be the next Apple, Amazon, or Netflix.” This is obviously riskier than The Near Future Report and it costs $4000 a year.

Day One Investor

Day One Investor is a newsletter advisory service that helps identify and recommend startups with huge potential. It helps identify Reg CF and Reg A+ investment opportunities to guide regular investors in taking the earliest positions. This is probably the riskiest of all Brownstone Products, but it does help some startups. The cost of Day One Investor is $5000 a year.

Brownstone Unlimited

Brownstone Unlimited is an all-in-one subscription service where you can access all of Brownstone Research’s products. It also promises its members to be a priority on the latest announcements and services. You have to call Brownstone Research to learn the price of this program.

Who Is Brownstone Research For?

Brownstone Research is for investors who want to stay up-to-date with the latest trends and receive informed investment recommendations. The provided model portfolios are also helpful for beginner investors. Overall, investment research firms, like Brownstone Research, are for anyone too busy to collect and analyze industry data on their own to make informed investment decisions.

What Are the Brownstone Research Complaints?

Brownstone research complaints are usually about unwanted charges, failed refund requests, spammy emails, and the company’s losing investment picks. Some complaints are still directed at Jeff Brown, but not much was said about Colin Tedards.

Brownstone Research BBB Complaints

Brownstone Research’s BBB complaints are mostly about unwanted charges and failed refund requests. It’s also important to note that Brownstone Research is not BBB accredited and is rated F – the lowest BBB rating.

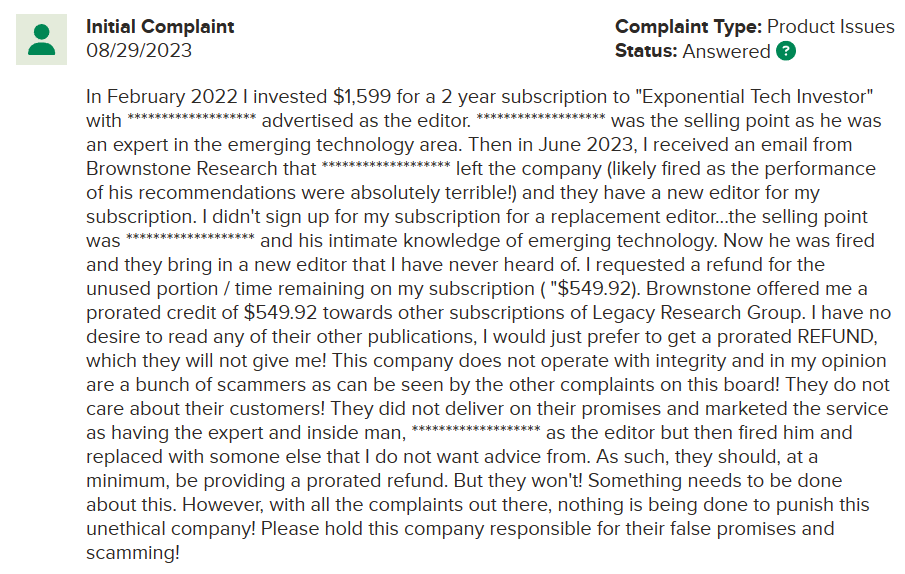

The following complaint is about a failed refund request for a subscription to Exponential Tech Investor. The customer requested a refund when they learned about the editor’s replacement, but instead, they received a prorated credit that can be used for other Legacy Research Group services.

This complaint is probably talking about Colin Tedards’ replacement of Jeff Brown as editor. Brownstone Research responded to this complaint by saying that Colin has enough credibility and credentials to continue the service, so the subscription can still hold.

Colin Tedards’ credentials aside, Brownstone Research doesn’t have a clearly defined refund policy on all of its products. But they do have a credit guarantee which the customer received in this case.

To get your money back from Brownstone Research, call them and request either a credit or cash refund. You will most likely receive a credit, as shown in many BBB complaints.

Here’s another complaint that talks about an unwanted charge from Brownstone Research.

It appears that the complainant was not even aware of registering with Brownstone Research. The company responded that the customer registered to Near Future Report in June 2021 for $49 and it auto-renewed for a yearly $129 in 2022. The same happened in June 2023.

I’d like to take the side of Brownstone Research in this one unless the registration was a result of a false advertisement. Also, why didn’t they cancel after the first year? Information is very limited here.

This next complaint claimed that they did cancel the subscription almost immediately after the registration but were still charged for the auto-renewal.

It looks like the cancellation was not noted, as evident in Brownstone Research’s response. The same goes for the following complaint.

A lot of other complaints are like this. We all know that unwanted charges are not uncommon for auto-renewal subscriptions, but it shouldn’t be an issue if the service is giving results in the first place.

Brownstone Research Trustpilot Reviews

Trustpilot reviews on Brownstone are usually about spammy email marketing, losing stocks, and unfulfilled promises from promotional content. There are positive reviews (4 and 5 stars) but they date back to 2021. Brownstone Research has an overall review score of 1.3 in Trustpilot.

The following review talks about receiving spammy email promotions even after the cancellation of their subscription. Brownstone Research responded that they already included the reviewer’s email in the Do Not Promote list.

Brownstone Research, and the other Legacy Research Group publications, usually conduct promotional webinars to hype up certain stocks and then offer free insider content. However, to get this “free” content, you have to sign up for a subscription to one of their products. It looks like the following reviewer didn’t receive the free content even after registering.

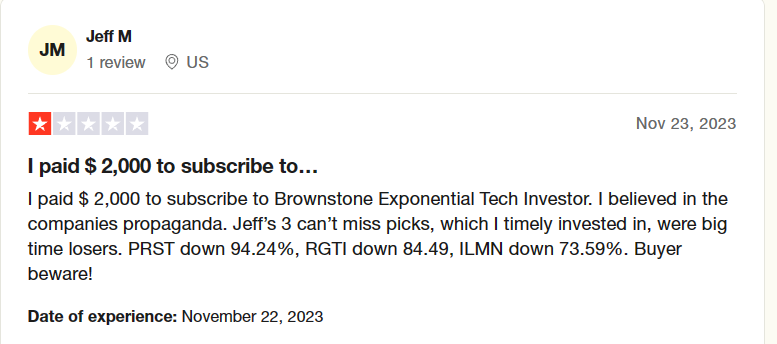

And the following review talks about Jeff Brown’s losing picks.

Brownstone Research Reddit Reviews

Surprisingly, the top Reddit reviews on Brownstone Research, specifically for Jeff Brown, are generally positive. They talk about how they miss the man’s newsletters for how informative they are.

Here’s a response from the r/Stockteasers subreddit in which the Redditor talks about how disappointed they are for not being able to read Jeff’s analyses anymore. They also excuse him for the losses as they were caused by the general downturn of tech stocks.

Jeff has his own platform now, the Brownridge Research, but the following Redditor may not have discovered it yet at the time.

Jeff Brown surely has a lot of followers, which speaks volumes about his writing prowess. And they are still willing to follow him even after suffering huge losses.

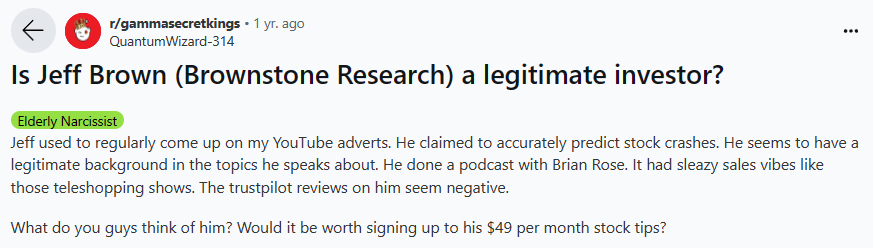

But those were just from one subreddit, though. The following Reddit post inquires about Jeff Brown’s legitimacy given his overhyping tactics. The response talks about how bad the recommendations are.

Is Subscribing to Brownstone Research Worth It?

Yes, subscribing to Brownstone Research is worth it, but we wouldn’t recommend any other product than the Near Future Report. The other products are just too expensive for their risks while the Near Future Report has already stood the test of time – it was always the best seller so it’s less likely to just disappear like the other ones. It’s also focused on large-cap stocks which are generally less risky than small-cap and micro-cap.

Brownstone Research is not a scam, even with all the complaints and losses that its portfolios suffered. Also, being part of The Agora umbrella company (that has a very negative reputation) does not make it any less legitimate as an investment advisory firm.

Who Is Jeff Brown?

Jeff Brown is a technologist, investment analyst, and angel investor, with hands-on executive experience in AI, machine learning, semiconductors, and other leading technologies today. He founded Brownstone Research as an offshoot of Bonner & Partners, which is also part of The Agora as an umbrella company.

Before starting his career as a full-time investment analyst, Jeff Brown served in multiple leadership positions in companies like Juniper Networks, NXP Semiconductors, Trident Microsystems Japan, and Qualcomm. He currently heads Brownridge Research which he founded not long after he parted with Brownstone Research.

Jeff Brown’s most notable ratings are NVIDIA, AMD, Taiwan Semiconductors, and a few more others. He has always been praised for his easy-to-follow and insightful analyses of emerging techs – a skill Jeff developed over the years of working with various tech companies in an executive capacity.

He got his bachelor’s degree in Aeronautical and Astronautical Engineering from Purdue University and a master’s in Corporate Finance from the London Business School. Jeff Brown is currently based in New York City.

What Is Jeff Brown’s Net Worth?

Jeff Brown has an estimated net worth of $28 million as of 2021. There is currently no more verifiable information about Jeff’s actual net worth, even his compensation as the CEO and editor of Brownstone Research.

Is Jeff Brown Related to a Real Estate Fraud Scheme?

No, Jeff Brown from Brownstone Research isn’t related to any real estate fraud scheme. His real name is “Jeffery” Brown, and he is not the same person as Jeffrey Brown who pleaded guilty to a multimillion-dollar fraud scheme in Dallas, Texas, in 2011. Also, at that time, he was working at NXP Semiconductors Japan and never had anything to do with Quadwealth – the company involved in the said fraud scheme.

Why Did Jeff Brown Leave Brownstone Research?

Brownstone Research never released an official explanation for why Jeff Brown left the company. Many speculated that it was because of the huge losses from the portfolios that Jeff handled. This speculation was not unfounded, though.

Here’s an email that Jeff’s subscribers received when he left Brownstone Research (someone posted it on Reddit).

So, they basically said that it was really because customers were losing with Jeff Brown’s recommendations. And Jeff also admitted as much when he answered a letter from his follower in Brownridge Research.

“As for my departure from Legacy Research and Brownstone Research, it was unfortunately not in my control.

On June 9, 2023, I was told I no longer needed to research/write any more. That was it.

The most painful part for me is that I lost my connection to my subscribers. We were working through the tough bear market together.

That stretch between November of 2022 through the second quarter of 2023 encompassed some of the longest hours I’ve ever worked to try and make sense out of what was happening in the markets, how they were being manipulated, and when we would come out of the mess.”

Who Is Colin Tedards?

Colin Tedards is an entrepreneur, investor, and a popular stock investment Youtuber with over 120K subscribers. He took over as editor for Brownstone Research, replacing Jeff Brown. He made his first stock investment in 1999, and several important investments in 2008 and 2009. His first huge payoff was in 2016 when he secured a 900% gain from a small logistics company.

In 2021, he helped his subscribers lock in a 3181% gain on The Join Corp (JYNT). As early as 2014, Colin Tedards already started writing for Seeking Alpha as an investment analyst. There he focused on micro-cap companies and made notable calls on Logic Marks, Full House Resorts, Upland Software, and several other companies.

Colin Tedards graduated from California University Stanislaus majoring in Business Management and Finance.

Are Trading Courses a Better Way to Stay Ahead on Investment Opportunities?

No, taking trading courses is not a better way of staying ahead of investment opportunities. However, they can be useful for beginners who want to learn the basics of trading. Most trading courses teach basic fundamental and technical analysis, with more focus on either one. Just be cautious of trading courses promising a secret strategy in trading because there’s no such thing.

What Are the 3 Major Risks of Trading?

Trading is risky, although it’s not impossible to predict how the market will play out. Investment research and advisory firms made a business out of this possibility, which is also an effective way of influencing the markets – buying rallies do affect stock prices.

But as we’ve seen, recommendations from research firms like Brownstone Research can still lose. That’s because trading is much more complicated than it looks.

So, here are the 5 major risks of trading to help you level your expectations.

1 – Market Risks

Market risk is the possibility of losing money because of fluctuations in the stock prices or the market as a whole. This is what advisory firms are trying to read. The problem is it also involves political causes, economic changes, and even natural disasters. Some changes are just impossible to predict – like no one predicted the COVID-19 pandemic.

2 – Liquidity Risks

Still closely related to market risks, liquidity risk is the risk of not being able to sell stocks quickly or at a reasonable price. Most of the time, losing stocks with negative prospects ahead have lesser liquidity. So, if you want to exit badly, the other investors are probably thinking the same. This can result in the stocks diving deeper because no one wants to buy them.

Liquidity issues are pretty common with options trading. Here’s a Reddit post about a Redditor sharing his concerns with his option’s liquidity.

Another responded that it still depends on the market conditions, and illiquid option chains can be difficult to exit out of at a fair price.

3 – Behavioral Risks

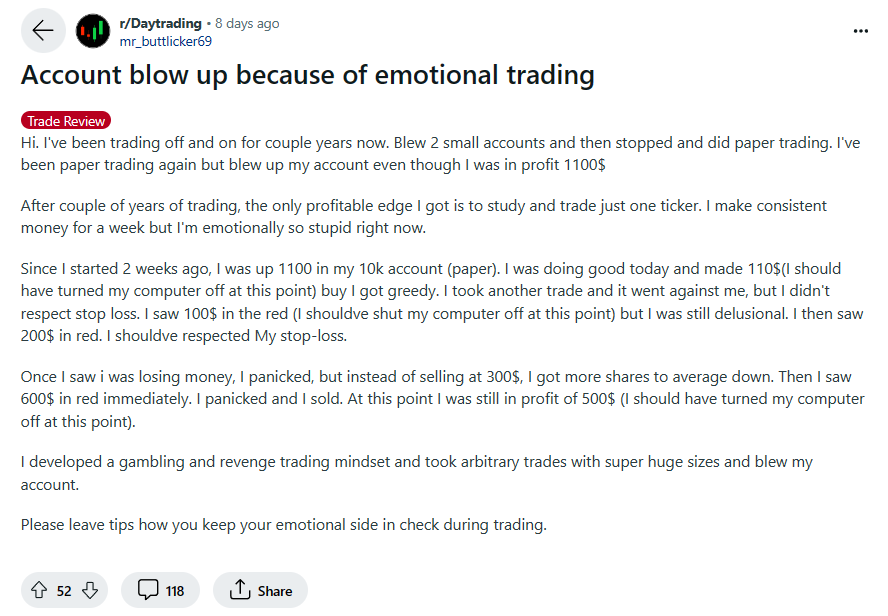

Behavioral risk is the risk of making emotional decisions resulting in deviations from ones investment plan. It can also manifest in overconfidence in a stock. Of course, your behavior is something that you can control, but only with enough practice. This problem is common for beginners – and everyone starts as a beginner.

The following Redditor shares how panic and greed affected his trading performance.

Earn Monthly Predictable Income With Local Lead Generation

The age old “statistics” in trading that 90% of traders lose still holds true today. And it will probably remain true as long as trading exists. Research firms and trading advises may help guide investors in making informed decisions, but even informed decisions are not 100% foolproof. But it’s not that trading is a bad idea as a whole. In fact, you can invest in relatively stable stocks to safeguard your money from hyperinflation.

If you want to earn a predictable income, there’s a business model that you can rely on for long term in this digital age – and that is local lead generation. Most people are now using search engines in their day-to-day lives, from inquiring about almost anything to finding the right service to avail. Search engines are at the core of local lead generation.

In this model, you’ll be ranking a website in search engines for local keywords in a specific niche. But there’s no need to fight a losing battle and choose highly competitive niches or keywords. When you successfully rank a site, you can rent it out to businesses for a fixed rate (I rent out my sites for $500-$3000 a month). Local businesses want leads, but at times, they don’t have the means to get them from the world of search engines. Your ranked website can generate these leads for them.

Income from local lead generation is more predictable, and scalable than investing in stocks or cryptocurrencies. Sure, it’s not easy at first, but it’s not as risky as trading that can literally blow away your lifetime savings in a matter of minutes.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.