Alex Zastre Capital Advisory Blueprint Review: What Is a Capital Advisory Business?

Updated On

Alex Zastre’s Capital Advisory Blueprint is a mentorship and partnership program for starting a capital advisory business. The program runs for about 6 months, in which you will have all you need to start, operate, and scale a capital advisory firm. The program includes training, 1-on-1 coaching, done-for-you business setup, email campaigns, in-house legal counsel, and access to networks.

Capital Advisory Blueprint reviews from members are sparse and I could not find any online. On the Capital Advisory sales video, Alex mentions some names of successful members and how much they made. However, the details are limited and there is no way to verify these stories.

The Capitol Advisory Blueprint will try to teach you a business model that will make you feel like Sean Parker from The Social Network. In that movie, Justin Timberlake plays the go-between between Mark Zuckerberg and tough investors. In my experience of connecting customers with services, I’ve noticed that getting high-ticket clients to lock into your offers is like trying to catch a rainbow trout with your bare hands. One technique involves “tickling” the fish to lull it into a trance. If you can accomplish that, you can grab it before it realizes it’s dinner. In order to get a client to give you $120K upfront, you’ll have to have the right priming technique and act at the exact right time. If you don’t, they will slip between your fingers. Over the last 11 years I’ve seen over and over how important it is to have the evidence of your success do the talking for you. When I approach a business, I’m already presenting my ranked website - piled with leads - on a silver platter.

This article reviews Capital Advisory Blueprint, the business model it centers on, and success stories from partners like Vincent Paris and Cooper. Included is a list of what the program provides, such as the lead generation and outreach systems, backend operations training, and ongoing support. You will also learn about Alex Zastre and his claims about the program.

Capital Advisory Blueprint Pros and Cons

Pros

- Unlimited 1-on-1 mentorship

- Direct access to ongoing support

- In-house legal council

Cons

- Over the top claims about the capital advisory business model

- No verifiable reviews or testimonials

- Expect to spending more than suggested

Price: The Capital Advisory Blueprint costs $50,000. Monthly operating fees range from $3,000 to $10,000 a month.

Refund Policy: Capital Advisory Blueprint has an extensive refund policy with strict conditions. If you do not make $100,000 in monthly cash flow in revenue within 180 days of completion, you can apply for a refund.

Origin: Alex Zastre founded the capital advisory firm and parent company, Savvy Capital, in 2019.

Reputation: Capital Advisory Blueprint has a good reputation.

What Is a Capital Advisory Business?

A capital advisory business is a service-based model where you help businesses raise money from investors. You act as a middleman or deal-maker that connects businesses with often large capital investments ($5M to $150M) from private equity firms, venture capitalists, hedge funds, or family offices. The process can be simplified into 5 steps.

- Find clients: Target companies, often startups, that need large investments for expansion and product development. You can also target companies that are looking to go public (IPO or SPAC)

- Charge your engagement fee: You can charge an upfront fee of $15K to $150K. This fee would cover consulting, materials, and outreach. Alex says that this high-ticket fee shows the client that you are serious.

- Structure your offer: Create a pitch deck and prepare financials and projections. Build an interesting investment story to persuade your potential client. Make sure your offer complies with regulatory requirements, such as SEC policies.

- Connect your investors: Set meetings between businesses and investors. Alex says to match based on the investor type, stage, and appetite

- Earn your commission: Take 1% to 5% of the total capital raised as your “success fee.” Alex claims that a $50 million investment deal can earn you $50K to $2.5 million. As an alternative, you can take 5% to 10% equity instead.

Capital Advisory Blueprint Success Stories

Vincent Paris was making $30K a month with his agency before joining Capital Advisory Blueprint. He scaled to $250K a month in engagement fees and even made $7 million in success fees from closing a $250 million deal. He is currently making $400K a month consistently.

Another partner named Cooper was making $5K a month with his email marketing agency. He pivoted his agency after joining Capital Advisory Blueprint. Cooper raised $30 million in 8 months, which earned him over $300K.

There are many more mentioned throughout the Capital Advisory Blueprint sales video. Unfortunately, we have no way of verifying any of these success stories. Alex only briefly mentioned their stories, but provided no proof for any of them.

What Does Capital Advisory Blueprint Provide?

- Capital raising strategy and offer creation training: Learn to identify high-multiple growth sectors. Learn how to recruit qualified directors and advisory board members to strengthen your corporate structure. You get FINRA compliant marketing materials, including website, investor deck, teaser, and social media presence. You also get corporate structure recommendations aligned with your strategic objectives.

- Lead generation and outreach systems: You get access to private email servers for unlimited large-scale outreach and LinkedIn automation tools. Learn outreach scaling techniques and use tracking systems to optimize lead generation.

- Deal organization and sales mastery training: You get access to industry databases including PitchBook, Preqin, Crunchbase, and other essential resources. You also get training on prospecting, engagement, and closing strategies. Template agreements for capital raising, mergers and acquisitions, and other transactions are also included.

- Backend operations and capital placement training: You get access to an exclusive network of investors and bankers. Learn compliant deal structuring through registered broker-dealers (Finalis Inc in US, EMDs in Canada). You also get deal fulfillment and client management templates and systems.

- Ongoing support and mentorship: You can request unlimited 1-on-1 consultations and get feedback through phone and text phone. You also have access to Capital Advisory’s professional network and references.

- Compliance and legal guidance: You get regulatory compliance training to ensure proper business operations. Learn the registration and licensing requirements for operating in various jurisdictions.

Who Is Alex Zastre?

Alex Zastre is a serial entrepreneur and capital advisor from Vancouver, Canada. He is an expert at raising capital and investor connections, mid-market transactions, digital marketing, and business scaling. Before studying business administration from the Beedie School of Business at Simon Fraser University, Alex was a sponsored semi-professional skier. In 2016, he founded the media company, Online.Simple, which organized merch drops, sponsorship, videos, and more. Alex got his Series 82, Securities Industry Essentials (SIE), and Series 63, FINRA certifications in 2024. In 2019, Alex founded SavvyCapital, which helped raise $200M for clients within 2 years.

What Are Alex Zastre Claims About Capital Advisory Blueprint?

- Make $15K–$150K upfront and earn millions in success fees.

- Book 10–30 meetings a day using the IMF Method.

- Bypass spam filters and reach decision-makers directly.

- Stay 100% SEC compliant and save over $10K on legal fees.

- Close multi-million-dollar deals with zero finance experience

How Realistic Are Alex’s Capital Advisory Blueprint Claims?

Alex Capital Advisory Blueprint claims are realistic but unlikely. His claims are on the highly optimistic side and are not common. Here’s a breakdown of the realities of each of his claims:

- Clients would only agree to a $15K to $150K upfront fee if they think you are credible and offer value. This means you need to build a track record first before clients would trust you enough to pay a high-ticket fee. Without institutional credibility, it will be impossible to close and earn millions in success fees.

- Booking 10 to 30 meetings per day, even with the Investor-Message Fit (IMF) method, is highly unlikely. Investor calendars are always full and most ignore cold outreach. Booking that many booking requires a large outbound machine, warm data, and daily domain rotation to avoid blacklisting. This scale is only possible with a large team.

- Bypassing spam filters consistently is very difficult because of evolving email security standards (DMARC, SPF, DKIM, Google spam updates). There is no guarantee that your emails will even reach the inbox and not be sent to spam. Decision-makers at large firms also rarely reply to cold emails.

- As a broker, you are required to have a broker-dealer license. This means you will need to study and qualify for the certifications. The only other way would be to hire someone who is licensed. Saving $10K a month on legal fees only applies if you’re replacing expensive retained law firms.

- Closing multi-million-dollar deals with zero finance experience is virtually impossible. These high-level deals involve complex negotiations, regulatory risk, and due diligence. Clients expect professionalism and not just confidence. Your chances of success as a complete beginner are close to 0%.

4 Ways to Earn as a Middleman With Little Capital

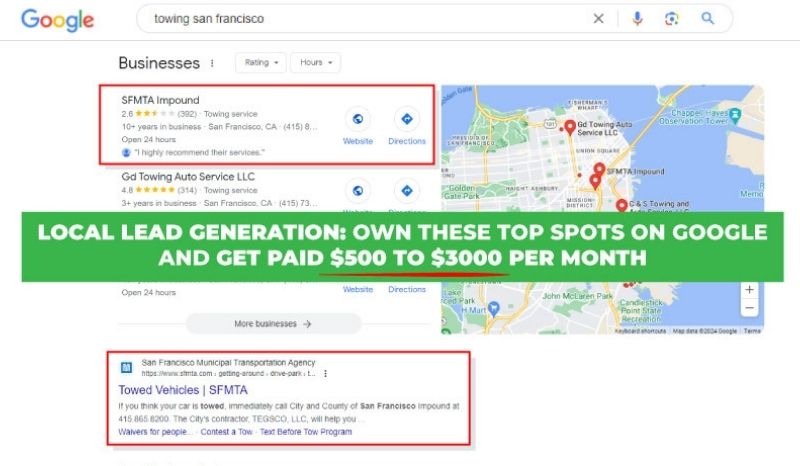

- Lead Generation: Earn $500 to $50,000 a month by renting out SEO optimized websites to businesses. This way, you connect customers actively searching online for these services with the right businesses. This method is mostly passive and is easily scalable.

- Shopify Dropshipping: Earn $1,000 to $3,000 selling products online without keeping inventory. You connect buyers to suppliers by listing products at your own online store. You earn from the price difference while the supplier takes care of the inventory and shipping.

- Affiliate Marketing: Earn a few hundred to $10,000 a month by promoting other companies’ products or services using affiliate links. As the middleman, you are connecting customers to companies solely through marketing. You earn a commission for every sale or lead generated through your referral link.

- Dropservicing: Earn $1,000 to $10,000 a month by connecting clients with freelancers. You resell services like graphic design, copywriting, or video editing on freelancing platforms like Fiverr or Upwork. As the middleman, you will act as a sort of manpower and management agency.

These are the top ways to earn as a middleman with little capital. There are many other middleman methods, but they often require a substantial investment.

What Is My Number 1 Middleman Business Model?

My number 1 middleman busines model is local lead generation. It earns me over $52K a month in passive income. Using local SEO, I create high-traffic sites and rent them out to local businesses. They pay me monthly rent for the consistent leads that they receive. My profit margins are as high as 95% since I do not run any marketing campaigns. You can start this business with as low as $500 in initial investment.

In my opinion, my sites like Long Beach Elite ADU Solutions 1775 Ohio Ave Long Beach, California 90804 562-586-4044, https://www.longbeacheliteadu.com are like a renewable resource. You have a massive reservoir of water like how Lake Mead was after 1935. Hoover Dam is the barrier that holds it back from the Colorado River. The reservoir is like all the local business you can tap into. The Hoover Dam represents all the friction points potential customers face when they need everyday services. Replace that customer friction with a ranked website and you’ll be hit with overflowing, whitewater rapids of leads that are practically begging you to take them downriver. And local businesses are parched for the water you provide. That Accessory Dwelling Unit site can sometimes land over $243,024 in jobs from my site, which gives me a 10% commission of $24,302.

However in 2025, Lake Mead is more like Capital Advisory Blueprint’s business model. The reservoir has been getting more shallow as the decades pass. Likewise, there are only a limited number of high-ticket businesses you can land. Eventually, your passive income will be as dead as the skeletons they find in the muck as Lake Mead dries up.

On the other hand, my local lead generation business is not only vibrant and alive - it’s also highly replicable. Since you only need to update a site if it drops in ranking, you have all the time you need to focus on scaling. The scaling process is like taking photocopies, changing a few minor details for each one. It’s as easy as repeating the rank-and-rent steps. These are the top qualities that make local lead generation my top business model for 2025.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.