Ryan Stackhouse & Jess Reed’s Cashflow to Freedom Academy Review — NNN Investing Pros, Cons & Alternatives

Cashflow to Freedom Academy by Ryan Stackhouse and Jess Reed is an online course and program that teaches you how to make money with by investing in commercial real estate with triple net lease properties (NNN). Triple net lease properties are commercial properties where the tenant or lessee agrees to pay all real estate taxes, building insurance, and maintenance.

As a commercial real estate investor looking to focus on triple net leases, you must be prepared for the challenges ahead. Finding tenants to agree to a NNN is no small task and your initial investment in a commercial property is not inexpensive. Raising money to purchase a property is also intricate. A real estate investing business, whether residential or commercial, is high maintenance. There are many moving parts that are out of your control, such as delays in inspections, issues with funding, poor communication, and more.

In my opinion, investing in commercial real estate using triple net-lease properties as taught by Cashflow to Freedom Academy is like depending on Moody’s credit ratings for peace of mind, which looks solid on paper until a single downgrade shakes the entire foundation. The investor’s income stream hinges entirely on one tenant’s financial health, so if that tenant’s balance sheet falters, the supposedly “hands-off” asset quickly turns into a liability. The Leaning Tower of Pisa’s periodic closures for structural repairs capture the vacancy and re-letting risk. When a site built for one purpose shuts down, getting it functional again takes time, effort, and money. Likewise, a single-tenant NNN property can sit idle for months while you shoulder taxes, insurance, and renovation costs just to lure a new occupant.

This review breaks down the curriculum, pricing tiers, top risks, who benefits, real-world ROI scenarios, and the program’s reputation. At the end, We’ll also look at both NNN and local lead generation side by side to see which one delivers the kind of stability I value most.

What Are the Pros and Cons of Cashflow to Freedom Academy?

Pros

- Jess and Ryan have built a real estate investment portfolio of over $40 million.

- They share their Rolodex of industry contacts that took them over 10 years to build.

- You learn how to raise money legally and remain compliant with the SEC.

Cons

- Real estate investing, residential or commercial, doesn’t pay you a predictable, passive income each month.

- Months and years can pass without you finding tenants.

- Expensive program

Price: Cashflow to Freedom Academy offers a range of levels and pricing per level.

- The Freedom Foundations course costs $297.

- The Bronze Package costs $5,000.

- The Silver Package costs $15,000 and $5,000 each year after.

- The Gold Package costs $25,000.

Refund Policy: No transparency with their refund policy.

Training: The Freedom Foundations course has 4 video training modules. Each of the other levels unlocks more tools and mentorship opportunities.

Group: Private Facebook mastermind group only for the Silver and Gold packages.

What Are the Top 3 Risks with Triple Net Lease Properties?

1. Not finding tenants willing to sign a NNN lease

Finding tenants that will sign an NNN lease will be difficult. Most tenants would not want to take on the responsibility of having to take control of the maintenance and upkeep of their space on your investment property. There is more that a tenant has to take care of and tenants may view it as a job. Unless a tenant is looking to stay long term, has the capital to cover all the costs, and will do so, you will have a hard time renting your rental property. Months and years can pass without you finding a tenant, which means you won’t have any positive cash flow.

2. Lower rents

When dealing with triple net lease properties, rents are lower. Rents are lower since the tenants are assuming the expenses of the property, which includes real estate taxes, building insurance, and maintenance. This is all besides the rent and utilities they are paying. You also have to factor in that you won’t be spending any of the money you make on any maintenance repairs. Nevertheless, your profit margins on the rental income will be low.

3. Landlord might overestimate operating costs

As a landlord, you might overestimate the operating costs when determining how much rent your clients have to pay you each month. If this happens, you tenant won’t be happy if they find out they are also taking on some of those costs. It could cause them to ask for you to lower the rent and to pay them back everything you overcharged. This is all very uncomfortable and can hurt your reputation because you will look like don’t know what you’re doing.

What Is the Cashflow to Freedom Academy Overview?

Freedom Foundations

In this 4 module course, Jess and Ryan share everything they’ve learned from the real estate and mortgage investment industry.

Module 1 - Introduction to Real Estate Investing

In module 1, they give you an overview of what passive income is, how to forecast your wealth, how to figure your annual return, and how they got started in commercial real estate investing.

Module 2 - Residential Real Estate vs. Commercial Real Estate: What are the pros and cons?

In this module, they highlight the different types of commercial real estate investing, which are:

- Airbnb

- BRRR Method

- House Hacking

- Flipping

Module 3 - Case Studies: Residential & Commercial Real Estate Investing

Here, they show you real life examples of how profitable commercial and residential real estate can be.

Module 4 - Real Estate Lease Structures and How We Use Them

In the last module, they give you an overview of lease structures, and 2 more case studies. One of a single-family home and another, a commercial syndication deal.

As a bonus, you learn:

- How to do a deal from beginning to end

- Steps to get started immediately

- Mindset training, new habits, and breaking through barriers

- Asset protection and tax strategies to implement

Price: The Freedom Foundations course costs $297.

Bronze

This level is for the commercial real estate investors who want to fly solo. You get access to Jess and Ryan’s self-paced mastermind course, and their full list of industry contacts. According to them, their contacts can help you save up to $20K in startup costs.

Price: The Bronze Package costs $5,000.

Silver

With the Silver level, you get everything offered in the Bronze level along with access to the private Facebook group. You only get access to the group for 6 months. In the FB group, they host live coaching calls each week.

Price: The Silver Package costs $15,000.

Gold

With the Gold level, you get everything in the Bronze and Silver levels. With Gold, you get lifetime access to the private Facebook group, an invitation to two live weekend events with Jess and Ryan, and assistance with designing your lifestyle.

Price: The Gold Package costs $25,000.

Who Is Ryan Stackhouse?

Ryan Stackhouse is a successful real estate investor from Nashville, Tennessee. He grew up in a small town in Indiana. In 2006, he attended The Art Institute of Indianapolis. At 22 years old, he started working in the mortgage business as a mortgage loan officer. Ryan worked that role at banks, including Bank of America, Huntington National Bank, SunTrust, Wells Fargo, and more. In 2017, he founded The Ryan Stackhouse Mortgage Team and helped people purchase homes. In 2019, he founded Stackhouse Holdings and is now partnered with Jess Reed, coaching the Cashflow to Freedom Academy course.

Who Is Jess Reed?

Jess Reed is from Nashville, Tennessee. Before getting into real estate, he sold home security systems. In 2012, he got his real estate license and started buying single-family homes. Over time, he found himself working 80 hours per week and didn’t like the fact he was the one getting phone calls when the toilet broke or when there was a water leak. This made him realize he had to make a change. He and Ryan had done a lot of deals since Ryan was working in lending. In 2017, they partnered on a commercial deal in Clarksville, Tennessee. Jess learned a lot from Ryan in the commercial space and now the two have a portfolio of over $40 million.

What Are the Cashflow to Freedom Academy Testimonials?

Chris shared his testimonial in 2021 and gave thanks to Ryan and Jess for everything they have done for him. Having access to their industry contacts made a difference in his business. They had access to commercial real estate brokers, attorneys, insurance agents, and more. Their team helped Chris avoid getting involved in real estate deals that made little sense.

Adam also shared his testimonial in 2021. After completing the Cashflow to Freedom Mastermind program, and said joining was well worth the money he invested. He said that Ryan and Jess break everything down step by step and are always available outside of the bi-weekly coaching calls for questions. Now, Adam said that after going through the program, he feels more confident.

What are the Cashflow to Freedom Academy Alternatives?

Jerryll Noorden from SEO for Real Estate Investors teaches you how to generate highly motivated seller leads using the search engine optimization strategies Jerryll shows you. When you join, they provide you with a high converting website design, one-on-one mentoring, 15 video training modules, a private Facebook group for support, and Jerryll even checks your progress.

Price: SEO for Real Estate Investors costs $25,000.

More Info: SEO for Real Estate Investors Review

Generate Agent Leads by Prab Mangat is another real estate course that teaches you how to start or scale your real estate marketing consultancy. Prab’s goal is to get you to land your first ten real estate marketing clients in just a few weeks. Prab shares the strategies for scaling your real estate marketing consultancy past $100K per month and how to automate your entire process.

Price: Generate Agent Leads costs between $5K and $15K.

Is Investing in Triple Net Lease Properties Profitable in 2025?

Investing in triple net lease properties is profitable in 2025 as long as you have the capital to invest in large commercial properties and the patience to seek tenants who will agree to a NNN lease. If you understand how unpredictable commercial real estate is and don’t expect to see a return on investment quickly while still paying your bills, then you can be profitable.

The issue with investing in triple net lease properties and commercial real estate is that there are too many unpredictable variables. Finding tenants who will agree to signing a triple net lease is difficult and because there may be unexpected costs for tenants, they may not want to sign on. If too much time passes and you don’t find tenants for your property, it will be difficult for you to make any money, especially if you took out a loan to purchase a property.

With real estate, you are relying on other people to do their part. Whether it’s not finding the ideal tenants, a lack of communication or the lack of urgency some people may have, there are too many things that can hold you back from making money.

You can make money investing in commercial rental properties, but it doesn’t offer you the financial independence that local lead generation does.

How Much Can You Make With NNN?

You can earn around $50,000 to $120,000 per year on a $1 million property with NNN. Here are 3 estimated ROI scenarios.

Conservative multi-tenant retail NNN

- Purchase price: $800,000 | Downpayment (25%): $200,000

- Annual NOI after tenant pays expenses: $56,000 (7% cap)

- Cash-on-cash: 28% first-year pre-debt service if seller financing; after mortgage expect 8–12%.

Stabilized single-tenant NNN (credit tenant)

- Price: $1,200,000 | Down: $300,000 | NOI: $72,000 (6% cap)

- Predictable rent but lower vacancy risk — payback period often 8–12 years assuming rent increases.

Value-add small retail conversion (higher risk)

- Purchase: $600,000 | Rehab: $100,000 | Total: $700,000

- After lease-up NOI: $70,000 (10% stabilized)

- Higher upside but 12–36 months of elevated risk.

Final Verdict: Is Cashflow to Freedom Academy the Best Path to Monthly Income?

Cashflow to Freedom Academy is not the best path to monthly income if you’re looking for speed, control, or consistency. Jess Reed and Ryan Stackhouse offer a deep dive into commercial investing, but the nature of triple net leases means you could wait months or longer just to secure one viable tenant while continuing to pay holding costs. Real estate deals often stall due to inspections, funding delays, or market shifts, and what looks passive on paper quickly becomes hands-on in real life. If your goal is dependable income with fewer bottlenecks, you may want to rethink the route.

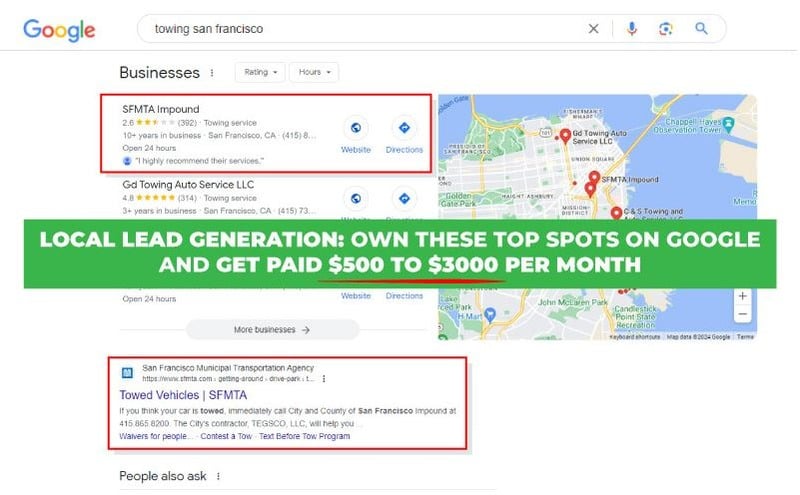

Is Local Lead Generation More Sustainable Than Triple Net Lease Investing?

In my opinion, local lead generation is more sustainable than triple net lease investing because you’re not dependent on a single tenant, a million-dollar loan, or complex lease structures.

Comparing investing in commercial real estate using triple net-lease to local lead generation is like the International Space Station versus the Great Wall of China. The International Space Station runs flawlessly only when every system and crew member performs without interruption. That dependence mirrors NNN investing, where returns hinge on the tenant’s stability and timely payments. The Great Wall of China was built to stand for centuries with minimal upkeep and still draws attention long after construction ended. Similarly, local lead generation sites continue to attract leads long after the initial ranking.

Why Is Local Lead Generation a Strong Digital Asset Model?

Local lead generation is a strong digital asset model because it offers control, scalability, and recurring income without the friction of traditional business models. Once you build and rank a site around a high-intent keyword, it becomes a valuable piece of digital real estate that local service providers are willing to pay for each month. You’re not dependent on tenants, supply chains, or lenders. You own the traffic, set your terms, and scale by replicating the process across new niches and cities.

A client of mine is Long Beach Elite Hardwood Flooring, 4525 Atlantic Avenue, Long Beach, California 90807, 562-566-2835, https://www.longbeacheliteflooring.com/. In the month that 7 of my leads closed for $33.5K, I earned $3,350 from 10% commissions.

If you’re ready to build income-producing assets that work while you sleep, take a closer look at how local lead generation works.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.