Dan Ryder Review: DeFi and Cryptocurrency Pros & Cons + Alternatives

Updated On

Dan Ryder is most known for founding the Crypto Cashflow Collective, an online course that teaches people how to make passive income through crypto without mining or trading. He claims his students are making hundreds to thousands of dollars per day using the knowledge that he provides. Dan Ryder has no new business ventures recently. He also hasn’t been updating his socials.

There are very limited review online about Dan, his courses, and services. While online reviews are limited, Ryder Media’s site features positive testimonials. Dr. Blake Livingood praised Dan for helping grow his clinic, and other professionals commend his advertising and strategy skills. Dan Ryder’s programs are legitimate, but potential investors should be cautious of the volatile crypto market.

In the 2025 WAGMI Miami event, Dan Ryder said: “17% are already in crypto, about 46 million people, leaving 83% or another 225 million to go to come into the market. So, yes, Bitcoin has crossed $100,000, but we still have 225 million people who have not yet participated in these markets. So it’s super early.” While I agree that many people have still not discovered crypto or DeFi, it’s an industry with a high learning curve. In my opinion, doing DeFi in crypto is like the Red Bull energy drink that brings instant bursts of energy. The spike (tokens/bitcoin growth) feels amazing, but the crash (price swings) hits twice as hard, leaving you worse off than before. Even if your yield farm pays well, a 20% APY means nothing if the coin drops 80%. Setting up wallets, bridges, networks, and verifying transactions feels like doing surgery blindfolded. One wrong address or gas fee mistake, and your funds vanish forever. Plus, once tokens are drained or locked, there’s no customer support, no refund, no undo button. Even tiny vulnerabilities can be exploited for millions.

Investing in the crypto market, whether trading or staking, can be as rewarding as it is volatile. It’s a great way to generate passive income. However, the risks involved can cause you to lose a lot of money. It’s crucial to approach it with caution and a well-thought-out strategy. Given the high-risk nature of the market, making informed investment decisions is necessary. Carefully weigh the factors against your financial goals and risk tolerance before deciding to trade in the cryptocurrency market.

This Dan Ryder review covers the pros and cons of his courses and services, his life story, and his business ventures like Ryder Media and Crypto CashFlow Collective. We also discuss the profitability and challenges of the crypto market. Towards the end, we look at the major differences between cryptocurrencies & DeFi and the local lead generation business model.

What are Dan Ryder Pros & Cons?

| Pros | Cons |

|---|---|

| Dan Ryder doesn't just try to get as many people as he can into his program. | There isn't much information about him regarding his business endeavors. |

| Dan is upfront about his business model not being for everyone. | There aren't any reviews or testimonials posted aside from those on his websites. |

| Purchasing his course and services offers access to exclusive groups and resources. | His social media following is not as huge as other crypto gurus. |

| Dan is an investor and trader himself. | Some reviews show a lack of detailed information about the exact mechanisms of how his Crypto CashFlow Collective generates income. |

| Price | The cost of Dan Ryder's course and services are not reflected in its website. |

|---|---|

| Training | Most of Dan Ryder's courses and services involved self-faced modules and live sessions. |

| Group | Dan Ryder has an exclusive group with his students in the Crypto CashFlow Collective. |

| Refund Policy | Dan Ryder's refund policy offer 72 hour no questions asked refund period. |

| Origin | Dan Ryder's digital marketing course and services started in 2013. |

| Reputation | Dan Ryder has a mixed but generally positive reputation based on the limited available information online. His following is not as huge as other crypto experts. However, he is well-regarded for his digital marketing and crypto education expertise |

Who is Dan Ryder?

Dan Ryder is an entrepreneur, digital marketer, and crypto expert. He started off working a 9-5 job in health care before looking into passive income. He founded Ryder Media. An agency dedicated to helping businesses convert more sales through his knowledge of how to make money with digital marketing. His clients have seen a 4X customer growth while achieving over a 350% increase in actual revenue. Finding success in digital marketing, he expanded his horizons and started making a fortune in Crypto. Dan has developed a business model that doesn’t require selling, trading, or advertising. He does it by leveraging Pool Driver Rewards, a semi-automated process of facilitating other people’s crypto trading. He teaches all of this to his students in his online course, Crypto CashFlow Collective.

Dan Ryder started his journey while he was working in healthcare. After earning his doctorate, he worked as a director-level pharmacist for over a decade. Dan studied in the United States Air Force, Air University. He took 600 hours of intense training and education, receiving a certificate for leadership. Dan Ryder also did a tour of activity duty during his time with the Air Force. However, during his time in the Air Force, he realized he did not want to continue working his typical 9-5 job. Someone introduced Dan to the direct sales industry, and he observed a massive growth in e-commerce. In 2013, he committed to start a new career in the online world.

He spent 4 years studying and learning different marketing strategies. Dan accumulated knowledge about e-commerce, but did not want to sell his products. He turned his attention to affiliate marketing but could not find a product that he was passionate about. He spent thousands of dollars on his e-commerce educator. Dan realized he could build a business catered to helping other businesses. In 2018, he founded Ryder Media, a digital marketing agency that helps businesses get more sales conversions.

Since then, he has looked for more ways to create passive income online and eventually found his way to Crypto. Discovering a new model, he partnered up with Jesse Singh and founded Crypto CashFlow Collective.

Dan Ryder doesn’t keep an active social media presence. He has accounts on big platforms such as Facebook, YouTube and Twitter. Dan Ryder’s Facebook page has seen no updates since 2021. His Twitter account is fairly new, created in 2022, and does not contain any information about his business. He also has a YouTube channel under the name DeFiDan, but he has posted no content since the date of its creation.

Dan Ryder has received 3 Two Comma Club awards from ClickFunnel. To receive an award from ClickFunnel would mean that he has reached a million dollars in affiliate sales. This means that Dan Ryder has about 3 million in affiliate sales.

Dan Ryder has released none new business ventures recently. He continues to manage Ryder Media and spends most of his time instructing his students on Crypto CashFlow Collective.

What is Crypto CashFlow Collective?

Crypto Cashflow Collective is an online course instructed primarily by Dan Ryder and co-founded by Jesse Singh. Unlike most crypto coaches who teach you how to mine or trade. Dan teaches a different method of generating passive income through Crypto by staking your tokens.

What are the Contents of Crypto CashFlow Collective?

- Module 1: Introduction to Cryptocurrency: Dan Ryder explains what it is cryptocurrency, how it works, and why it’s important.

- Module 2: Setting Up Your Trading Account: Dan guides you through setting up your trading account, choosing the right exchange, and securing your funds.

- Module 3: Understanding Cryptocurrency Charts: Dan teaches you how to read cryptocurrency charts, how to interpret them, and how to use them to make informed trading decisions.

- Module 4: Trading Strategies: Dan shares his basic to advanced techniques to help elevate your trading skills.

- Module 5: Risk Management: Dan teaches everything from setting stop-loss orders to managing your emotions.

- Module 6: Advanced Trading Techniques: Dan shares margin trading and short selling.

What is Ryder Media?

Ryder Media is a digital marketing agency designed to help entrepreneurs boost their sales and get more conversions. Dan Ryder created Ryder Media in 2018. He applied the methods that he used himself to generate over 3 million dollars in sales with affiliate marketing and has helped his clients see over a 350% increase in actual revenue.

What Services Does Ryder Media Provide?

- Omnichannel Advertising: They run ads for you on multiple platforms such as YouTube, Facebook, and TikTok.

- Marketing Attribution Tracking: You receive access to attributing tools and they implement and manage a marketing tracking plan to give you more insights into growing your business.

- Conversion Rate Optimization: They can build pages or optimize existing funnels. They build your conversions without affecting already built systems.

- Lead Nurturing Campaigns: They provide in-house contact relationship management software to nurture your leads across multiple platforms.

What are People Saying About Dan Ryder?

People from various platforms have generally positive opinions about Dan Ryder and his programs. In a YouTube of Jesse Singh, who is one of Dan’s business partners, shared that by following Dan’s methods, his test investment of $1,000 yielded $300 monthly. A YouTuber named Kyle posted a review of Dan’s DeFi CashFlow course. He said he was skeptical and wary at first because. This is because he already spent over $100,000 on various online courses in search of a successful career transition. He said that Dan mostly emphasized his marketing awards. To Kyle, this suggests strong sales skills rather than product quality.

Mat Gunson posted a video reviewing the Simple DeFi Cash Flow System by Defi Dan. He admits that he hasn’t used the DeFi Dan system but provides insights based on his knowledge. He initially thought it was about owning a trading platform. He warns that staking can be financially risky, although low-risk staking exists.

There are very limited reviews about Dan Ryder’s courses and services online. However, on his Ryder Media website, you can find a few testimonials about how they found success with Dan and his team. For instance, Dr. Blake Livingood from Livingood Daily said that Dan has been instrumental in helping them grow their local clinic. He calls working with Dan the most rewarding.

Other testimonials are from Brian Dickson, a 7-figure Facebook ads expert. He describes Dan as a powerhouse in Facebook and YouTube advertising. Lisa Anne, owner of Stock Media, relies on Dan and his team for ads and funnel strategies. Rudy Bekker, a marketing software and app developer, praises Dan’s ad-tracking skills.

Is Dan Ryder a Scam?

Dan Ryder is not a scam. He sells actual products and services that can help you generate more income. His websites show testimonials of local businesses that he’s helped over the years. There isn’t much information about his endeavors or the experiences of his clients. The Crypto CashFlow Collective is still fairly new. This is why there aren’t many reviews or testimonials from successful clients. However, he shares a lot of information on what you can expect when starting.

What Makes Dan Ryder Different From Other Crypto Coaches?

Dan Ryder is very upfront about how his business works. He doesn’t claim that you can get started with just a low investment or that just about anyone can do this type of business. His goal isn’t to just get people to buy his course. He focuses on building partnerships with his students and looks for people who can make long-term investments. He teaches a different method that doesn’t focus on trading or mining and instead leverages Pool Rewards.

What are the 4 Risks of Staking in Cryptocurrencies?

1. Lockup Periods

Some crypto platforms require you to lock up your tokens for a certain amount of time. You won’t be able to do anything to your crypto assets while they’re staked. If you suddenly decide to unstake your tokens, you can’t access them until the staking period is done.

2. Volatile Market

Investing in the crypto market, however, you may do it, is a tremendous risk. The value of cryptocurrencies can rise and fall within hours. If you purchase any digital asset, you’re taking an enormous risk, as its value can crash at any time.

3. Technical Errors

Asides from dealing with the volatility of the market, technical errors can also pose a threat. If the platform you’ve staked your tokens in suddenly crashes, you could lose all your assets. Computer malfunctions can also reduce your rewards if you make a mistake.

4. Theft

Hackers have stolen nearly $2 billion worth of cryptocurrency in 2022, according to CNBC. You need to make sure your digital wallet and the network you’re using are secure from cyber robbery.

Is Crypto Trading Worth It in 2025?

Yes, crypto trading in 2025 can be worth it. It is one way you can earn money investing in digital real estate . But it comes with significant risks and considerations. On the positive side, investors know that cryptocurrency markets have the potential for high returns. If market conditions are favorable, investors can make significant gains in a short period. For instance, a trader called Crypto Scoop posted in Binance Square that he started investing at $1,300. He distributed it equally among stable currencies, IEO and ICO, weekly trading, daily trading, and long-term investments. After several months, his money grew to $4,100. He taught his brother how to trade with his $4800 and today his bank exceeded $25,600.

In addition, the cryptocurrency market has matured since its early days. You can see increased adoption, better trading platforms, and improved regulatory frameworks. There are a wide variety of cryptocurrencies and trading strategies available. This provides many opportunities for diversification and potential profits. Innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain technology continue to grow. This is accessible to anyone with an internet connection. Many platforms offer user-friendly interfaces and educational resources. However, there are several downsides to consider, such as:

- Volatility: Cryptocurrencies are highly volatile, with prices subject to significant and rapid changes. This can lead to substantial financial losses.

- Regulatory Uncertainty: Despite progress, regulatory environments for cryptocurrencies can still be uncertain. It also varies widely between countries. New regulations could impact market dynamics and accessibility.

- Security Risks: While security has improved, risks such as hacking, fraud, and scams remain prevalent in the crypto space.

- Complexity: Successful crypto trading requires a deep understanding of the market. You need exceptional technical analysis, and you must stay updated with news and trends. It can be time-consuming and complex.

- Emotional Stress: The high volatility and potential loss can cause emotional stress. This can lead to poor decision-making.

Success in trading is achievable through continuous education, strong risk management, and staying informed on market trends and regulatory changes. Utilize reputable sources, consider courses like Dan Ryder’s Crypto Cashflow Collective, diversify your portfolio, and balance short-term trading with long-term investments.

What are the Alternatives Courses for Learning Cryptocurrency?

- University Grade Trading Education by Thomas Kralow teaches students how to build a full-time or part-time income through structured crypto trading rather than speculation. It includes lessons on technical indicators, market psychology, and risk management. While not fully “passive,” it equips you with the knowledge to make informed trades and develop long-term strategies. It’s ideal for those who want control and discipline in their trading approach instead of relying on trading bots or staking platforms.

- The Crypto Code by Joel Peterson and Adam Short centers on WaveBot, an automation tool that trades crypto for you using preset algorithms designed to capitalize on market volatility. Like Dan Ryder’s Crypto CashFlow Collective, it promotes a semi-passive model where technology handles the trading side while you oversee results. The program appeals to those who want exposure to crypto gains without spending hours analyzing charts, though profitability depends on bot performance and market conditions.

- Decentralized Masters by Tan Gera dives deep into the Decentralized Finance (DeFi) ecosystem, showing you how to earn passive rewards by staking tokens and providing liquidity on platforms like Aave, Uniswap, and Curve. It closely mirrors Dan Ryder’s model, teaching users how to build yield-based income streams using blockchain protocols instead of trading or selling products. This course is best suited for those comfortable navigating crypto wallets, smart contracts, and DeFi risk management.

Final Verdict: Is Dan Ryder Worth Learning From?

Dan Ryder is worth learning from for investors who already understand crypto fundamentals and want to earn yield through staking without traditional trading or mining. His background in marketing and digital strategy gives the course a structured, professional edge, making it appealing to those looking for an organized entry point into DeFi.

However, the crypto industry’s volatility, technical complexity, and lack of platform transparency make it extremely high-risk for beginners. While the potential for profit exists, success heavily depends on timing, market stability, and personal risk tolerance, all of which are outside the student’s control. For those seeking genuine passive income, this model can feel unpredictable and stress-inducing rather than automated and reliable.

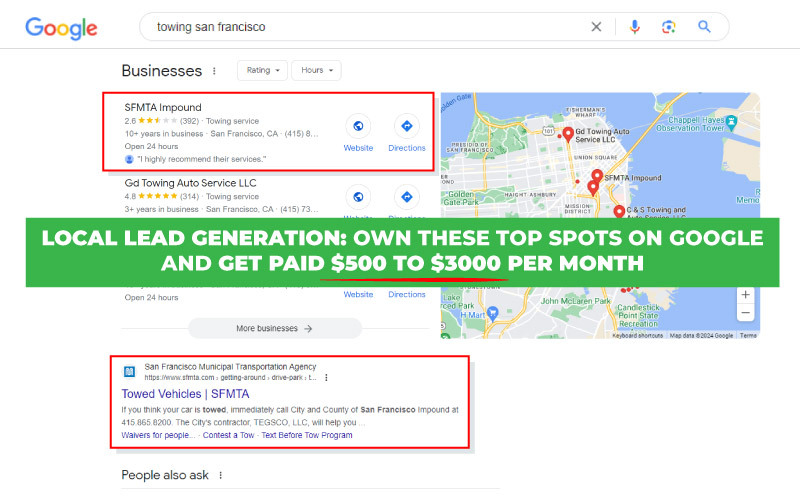

If you’re a beginner, or if you’re looking for a lower-risk model that can compound over time without market swings or technical hurdles, consider local lead generation, where you build digital assets that rank organically, rent them to local businesses, and generate stable, recurring income without speculation.

Is Local Lead Generation More Stable Than Crypto Investing?

In my experience, local lead generation is more stable than crypto investing because it operates with already established markets. Your returns come from small business owners paying for real leads, not from inflated tokens or liquidity schemes. The income is consistent, recurring, and tied to genuine demand like the Amazon River that flows year-round. The current never stops because it’s fed by consistent rainfall (high demand) that keeps the income stream alive and moving. In contrast, crypto investing can result in unpredictable gains or losses. Cryptocurrency investments are more high-risk in nature. With local lead gen, you don’t need to memorize seed phrases, swap networks, or worry about gas fees. Setting up a lead gen site takes hours, not weeks of blockchain tutorials. Every part of it (domains, hosting, and SEO) is beginner-friendly and fixable.

Also, analyzing local market SEO is easier than predicting the behavior of the cryptocurrency markets. Success in local lead generation relies on marketing skills, SEO expertise, and an understanding of local markets. These are skills you can develop and refine over time, unlike the luck and timing often associated with crypto investments. Local lead generation follows established and proven business models. Whereas, the crypto market is relatively new and still evolving, making it harder to predict long-term trends. With local lead generation, you have more control over your business operations. In contrast, crypto investing is largely influenced by external factors beyond your control. These are market trends and regulatory changes.

Why Local Lead Generation is My Best Pick for a Passive Business Model

Local lead generation is my best pick for a passive business model because it delivers predictable, real-world cash flow with low volatility and minimal risk. For instance, my site Los Angeles Automatic Gate Repair Elite 137 East 3rd Street Los Angeles, California 90013 424-422-6002 https://www.laautogaterepair.com/ brought in $32,795 in additional revenue to my client’s business. After forwarding 14 high-intent leads, I earned $3,279.50 in passive income for a 10% commission.

If you are looking for a business that allows for sustainable growth, operates in a more stable regulatory environment, and creates recurring revenue streams through long-term client relationships, I highly suggest local lead generation.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.