Top 10 Digital Assets To Invest in for the Future | Websites, Crypto, and Apps

The top digital assets to invest in are:

- Local lead generation websites

- Cryptocurrency

- Digital products

- Tokenized real estate

- Mobile applications

- Social media accounts

- Web applications

- NFTs

- Directory websites

- Niche websites

Digital assets are assets that are created and stored digitally over the internet. Digital asset investing is creating or buying ownership of digital assets to realize profit through appreciation of the asset or the income the asset produces. Examples of digital assets are websites that generate income, Bitcoin, and Cryptopunks NFTs. You can make money with digital assets. For example, Bitcoin has generated a 49% annual return rate over the last 10 years, according to Etrade. Owning digital assets is important because it allows you to participate in the gains of the new economy.

Stocks are not considered digital assets. Although stocks are traded electronically, they represent ownership in a company. They don’t represent ownership in a standalone entity like digital assets do.

I’ve been making money with digital assets for a decade. Specifically, local lead generation websites. I’ve been able to consistently generate over $50K per month from these digital assets. In the following article, I discuss the top digital assets to invest in for the future and why it might be a good idea for you to invest now as well.

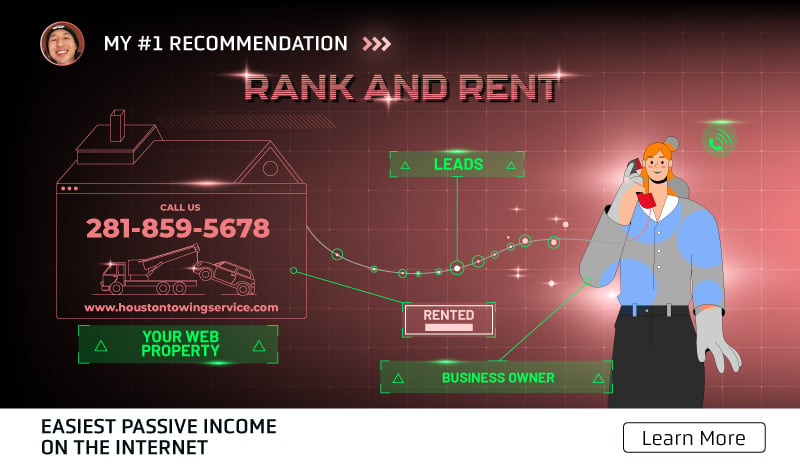

1. Local Lead Generation Websites

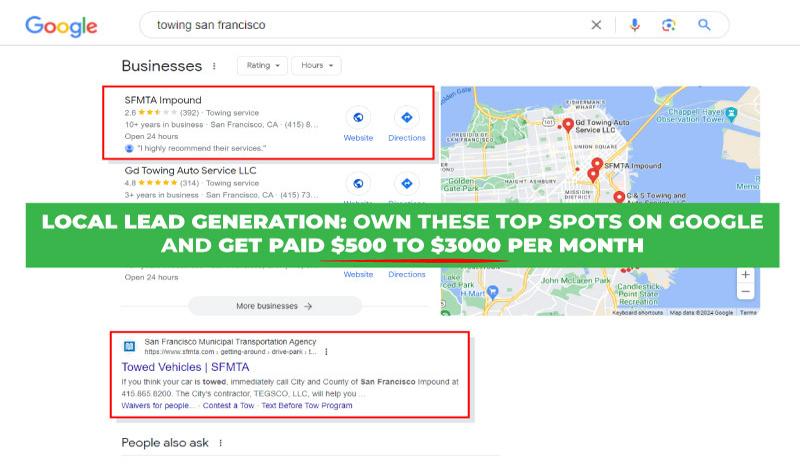

Local lead generation websites are digital assets that generate income by selling leads to business owners. Local lead generation websites cost a few hundred dollars to create. You can create these yourself or buy done for you lead generation websites from an SEO agency. Each website can generate $500 to $3,000 per month in recurring income online.

Lead generation websites are also known as rank and rent websites. The idea of investing into these assets is that if you rank a website on the first page of Google, you can rent it to a business owner. The first page of Google is valuable digital real estate that many businesses pay to access. They typically pay to access it by running Google Ad campaigns, sponsored posts on ranking web pages, and investing in SEO on their own websites. Renting a local lead generation website that is ranking on the first page of Google is an alternative option to access this online traffic.

The first page of Google provides value to businesses because internet users search for specific keywords. The more people that search for a product or service with a specific keyword, the more valuable that keyword is for a business.

Consider the example of a website that ranks #1 on the first page of Google for the keyword “plumber Dallas”. This keyword gets an estimated 8,800 searches per month according to SEO tool Keywords Everywhere data. Data from SEO company Backlinko shows that the first result on Google has an average click-through rate of 27.6%. As such, a website ranking #1 for plumber Dallas can expect to generate approximately 2,429 clicks per month from the position. A study by Ruler Analytics found that the conversion rate of organic leads for professional services like plumbing is 12.3%. In our example, that’s approximately 299 conversions per month. The average homeowner spends $336 for calling a plumber, according to Angi. When multiplying conversions by average cost per job, the business value of the website ranking #1 for plumber Dallas is $100,464 per month!

Business owners are typically willing to pay between 25% to 50% of the business value of a lead generation website in monthly rent. This allows them to make a good profit on their service. It allows you to earn a solid income from your digital asset.

2. Cryptocurrency

Cryptocurrency is a digital asset that is maintained by a decentralized system. It uses cryptography to maintain itself rather than being controlled by a central authority. Bitcoin, Ethereum, Ripple, and Cardano are some of the most popular cryptocurrency.

Cryptocurrency is an asset class because of supply and demand economics. Each cryptocurrency has a specific amount of available coins that investors can buy. When there are more investors that want to buy a cryptocurrency than want to sell, the price increases. Investors that hold the coin gain more value on their investment. You can sell your investment at a higher rate than you bought it to earn capital gains.

Besides capital gains, you can also make money with cryptocurrency through staking. Staking is earning interest on your cryptocurrency. It’s earned for allowing it to be locked up for a limited period to the support blockchain network.

Cryptocurrency can be bought and sold directly on online exchanges like Coinbase and Binance. These platforms also offer the ability to store your cryptocurrency in a hot wallet that is always connected to the internet. Many cryptocurrency investors choose to transfer their assets off exchange for better security. This is accomplished with a cold wallet, like a Tresor or Ledger. These cold wallets are less susceptible to hacking.

Bitcoin is the best digital asset to buy because it has a fixed supply and large-scale adoption. While other cryptocurrency like Ethereum can increase supply over time, Bitcoin has a fixed supply cap of 21 million coins. Unlike most other cryptos, Bitcoin can be traded by investors on stock exchanges through ETFs. The Fidelity Wise Origin Bitcoin Fund (FBTC) is one example of a Bitcoin ETF. Many governments, like the United States, China, and El Salvador, hold vast sums of Bitcoin. These factors help give Bitcoin much more stability and potential to increase in value compared to other digital assets.

Some cryptocurrency are not digital assets because they are not meant to grow in value. They are just digital currency. These are called stablecoins. Stablecoins like Tether, USDC, and Dai are typically pegged to a fiat currency like the US dollar. They are meant to provide stability for trading cryptocurrency positions. They are also useful for everyday transactions.

3. Digital Products

Digital products are goods that exist in digital format. They are purchased online and accessed by the customer through download or an online portal hosted in the cloud. Examples of digital products include:

- Online courses

- eBooks

- PDFs

- Printables

- Music

- Digital artwork

- Templates

- Presets

Digital products are digital assets because by investing time and money into creating them, you can earn a return on the sales of the product. You create the product once, and can sell it unlimited times for a profit.

Molly Keyser earns over $46,365 per month by investing in her own digital products. She originally offered in-person coaching and workshops but transitioned to digital products. She realized her customers preferred the flexibility of this learning method. Molly started writing eBooks and creating online courses. One of her eBooks earned over $500,000 while one of her courses generated over $70,000 in just the first 7 days. Overall, Molly claims to have earned over $8 million from her digital product sales.

A Reddit user sells digital products on Etsy to earn $50 to $60 per month from 65 listings. The digital products they sell include Canva presentations, Instagram templates, and gradient backgrounds.

Besides creating your own digital products, you can also invest into already created versions of these digital assets. This is done through master resell rights (MRR) and private label rights (PLR). MRR on a digital product allows you to purchase the digital product and resell it to others unlimited times as it comes. PLR on a digital product allows you to purchase the product and rebrand it as your own to resell it. For example, Passive Income Lab offers many MRR and PLR that can be bought and resold for a profit.

4. Tokenized Real Estate

Tokenized real estate is real estate that is represented as a token on the blockchain. Real estate tokenization makes real estate investing accessible to a larger audience. This digital asset breaks real estate projects into fractional pieces, or tokens. Instead of needing a large amount of capital to acquire an entire piece of real estate, investors can participate in real estate capital gains by acquiring a small piece of the property through ownership of these blockchain tokens.

St. Regis Aspen Ski Resort is one example of a tokenized real estate project. The asset management company Elevated Returns raised $18 million in funding for the project. They did so by issuing tokens on SolidBlock’s blockchain technology in 2018. The token was called AspenCoin. In 2020 AspenCoin was allowed to trade on a secondary market, tZero. The token increased in value by 30% within just 18 months.

Sabai Ecoverse offers live tokenized real estate investment opportunities in Phuket, Thailand. The minimum investment amount on these projects is just $50 per token. Sabai Ecoverse tokenized real estate investors make money through rental income and appreciation.

5. Mobile Applications

Mobile applications are downloadable software. They are available through mobile platforms like Google Play Store and Apple App Store. Mobile applications are highly demanded and generate considerable revenue. Mobile applications can earn money through paid downloads, in-app purchases, subscriptions, and ad revenue. For reference, the Apple App Store generated $24.6 billion in consumer spending in just Q2 of 2024, according to Statista. Google Play generated $11.2 billion in the same period.

The average mobile app costs $30,000 to $350,000 to develop, according to software development company Acropolium. Although costly, these digital assets can generate considerable earnings. The top 200 mobile apps produce an average of $82,500 daily, according to APPWRK. The top 800 still produce a considerable $3,500 daily on average.

Consider the mobile app Flappy Bird. Vietnamese game developer Dong Nguyen created this simple game in 2013. At the peak of the game’s popularity, Flappy Bird was generating $50,000 per day.

7. Web Applications

Web applications are software that are accessed through a network and run in a web browser like Google Chrome. Although smaller than the market for mobile apps, web applications generate considerable revenue. The global web application market size is estimated at $1.46 billion, as of 2023 data from Grand View Research. Ahrefs for SEO and Jungle Scout for Amazon FBA are some examples of popular web applications.

Web applications can cost between $5,000 to $250,000 to develop, according to Cleveroad. Development costs depend on the app’s complexity. These digital assets can generate income through methods like paid subscriptions and ad revenue. According to Fin Models Lab, 86% of web applications are profitable and owners typically earn $75,000 to $250,000 yearly on average.

Marc Lou earns considerable income by investing in the creation of web applications. As of September 2024, Mark claims to be making $63,247 per month from upwards of 24 web applications. One of his web apps, Habits Garden, generated over $400 in September. He charges a subscription for the habit tracking web application of either $5 per month or $50 lifetime.

8. NFTs

Non-fungible tokens (NFTs) are blockchain-based digital assets like artwork, content, and video. These assets get a unique identification code that is stored on the blockchain to validate ownership of the asset. NFT platforms like OpenSea and Axie Marketplace allow investors to buy and sell these assets. You can make money by creating and selling your own NFT, or buying an NFT and reselling it at a higher price.

NFTs reached their peak in 2021 when trading volume reached $23 billion, according to Forbes. The most expensive NFT sold has been a digital artwork called “The Merge” by Pak. This digital asset sold for $91.8 million in December 2021. Although NFT prices have since dropped dramatically and many have exited the space, many believe there is still potential with NFT investing.

One NFT investor on Reddit with a multi-million dollar portfolio says the NFT space is doing well for artists and builders. They make the point that NFTs can experience periods of depressive bear markets. That’s similar to their cryptocurrency counterparts.

9. Directory Websites

A directory website is a platform that lists information about businesses and services within specific locations or categories. For example, Clutch is a directory website. It’s for B2B service businesses like marketing agencies to list their services for discovery by companies. These digital assets generate online income through a variety of methods, including:

- Paid listings - Charging businesses to list on the platform

- Memberships - Charging businesses a fee to use the platform

- Featured listings - Charging businesses for better visibility through higher listing position

- Display ads - Allowing ad networks to run ads on website pages

- Referral commissions - Earning a percentage of the revenue from referred customers

A business directory website costs around $37,500 on average to build, according to Crowdbotics. Successful directory websites can earn between $1K - $40K per month.

10. Niche Websites

Niches websites are websites that publish content around a specific niche to attract that niche’s audience. These digital assets make money by selling products and services related to the niche, affiliate marketing, sponsored posts, and paid advertising.

Epic Garden (epicgardening.com) is an example of a niche website. This website publishes high-quality content on gardening topics. The website generates income by selling products like live plants, garden beds, seeds, and soil.

Niche websites can cost between $500 - $10,000+ to set up. The primary cost depends on how much of the content creation is outsourced. These sites can generate $0 - $10,000+ per month in income. You can also outright sell these websites for a huge fee. For example, Mike Futia of Stupid Simple Blogging has taken 3 niche websites to over $10,000 per month in earnings. He has sold one of his niche sites for over $100,000 when he was ready to move on from it.

Recent Google algorithm updates have made it much more difficult to realize success with niche websites. However, by choosing the right niche and content strategy, it’s still possible to earn income with this type of digital asset.

Why is Investing in Digital Assets a Good Idea for the Future?

- Increasing participation in the digital space - The amount of internet users has doubled over the last decade, from 2.7B in 2014 to 5.52B in 2024.

- Expanding digital economy - Data from Forrester predicts that the digital economy will hit $16.5 trillion by 2028 and represent 17% of the global GDP.

- Investment portfolio diversification -A diversified investment portfolio provides more stable gains over the long term. Digital real estate can provide solid returns during periods where stocks, bonds, and real estate are down.

- Access to global markets - Digital assets inhabit the internet, so they allow you to take advantage of opportunities beyond your home country.

- Enhanced security and transparency - Digital assets like cryptocurrency are believed to offer superior security compared to banks because they use anonymous ID numbers in transactions.

- Capitalize on emerging trends - Owning and understanding digital assets puts you at the forefront of new business and investment opportunities before they become saturated.

- Growing adoption among institutions and governments - Regulation around digital assets like Bitcoin has been uncertain. Now more governments and institutions are accepting and adopting digital assets.

How To Invest in Digital Real Estate

The simple steps on how to invest in digital real estate are:

- Decide which digital asset you want to own

- Perform market research on the digital asset

- Develop a plan to make money with the digital asset

- Execute your strategy and work to increase the digital asset’s value

Is Renting Digital Assets a Good Way To Make Passive Income Online?

Renting digital assets can be a good way to make passive income online. For example, renting out a local lead generation website can generate you $500 to $3,000 per month online passively. “Renting” your crypto for staking purposes can generate 2% to 10% in interest passively, according to Nasdaq.

Are Digital Assets a Good Investment?

Digital assets can be a good investment if you choose the right opportunities and time your exits properly.

Look at the experience of Glauber Contessoto who invested in the DogeCoin cryptocurrency. Glauber went from being broke to accumulating a net worth of $3 million in May 2021. He used his life savings and credit cards to accumulate a large amount of Dogecoin. He didn’t sell his holdings and his investment quickly fell to just $200,000 in the following months as the Dogecoin price crashed. Although the Dogecoin price is climbing once again, it might have been a good idea for him to lock in some profits when his investments were doing well.

Many digital assets like cryptocurrency and NFTs can be highly volatile. I prefer digital assets that offer more stability. Specifically, local lead generation websites. Local lead generation websites are a good investment because these website owners commonly earn a return on investment of 90%. These investments can also continue paying dividends long term. I have local lead generation websites I set up nearly a decade ago that are still paying me an income of $2,000 per month.

If you want to learn how to create these digital assets yourself, I help teach the local lead generation business model to a community of over 7K students. We offer bi-weekly live coaching to equip you with the latest strategies to succeed with these digital assets.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.