Joseph Hogue Review: Diversified Income Through Stock Trading (Options & AI Stocks + Alternatives)

Updated On

Joseph Hogue, CFA, is a financial expert who focuses on personal finance, investment analysis, and wealth management. He educates his followers on stock trading, personal finance, and diversifying. Joseph does this through his Let’s Talk Money YouTube channel and courses. Joseph stands out from many of these personal finance and investment “gurus." He is professionally qualified and has a trove of experience.

Reviews for Joseph Hogue are very positive. Joseph is praised for his step-by-step guides and strategies. So is his practical approach to investing in divided stocks and real estate. Followers also praise his realistic approach when giving advice, especially with risk management. Being a Chartered Financial Analyst holder played a big part in attracting the trust of his audience.

In an interview with Ian Lopuch on YouTube, Joseph Hogue said: “That’s where I get to kind of use my skills as an analyst and look into individual stocks, pick the ones I think are going to outperform, beat the market, and really get a little bit bump onto the returns for the rest of my portfolio.” You see, it’s more manageable for analysts to determine patterns and potential wins in stock trading than beginners. In my opinion, investing in stocks, options, and other ETFs (Exchange-Traded Funds), as what Joseph Hogue teaches, is like entering the Chess Olympiad tournament where your opponent sees three moves ahead. The markets aren’t a fair fight because you’re up against hedge funds running AI-driven trading systems that react in microseconds. Retail traders think they’re analyzing patterns, but institutions are front-running orders and exploiting inefficiencies before you even click buy. To truly compete, you have to watch tickers, earnings releases, and Fed speeches like your life depends on it. Vacations, sleep, or missed alerts can cost you thousands. Plus, brokerage fees, slippage, spreads, and taxes quietly eat into every gain. Even “commission-free” platforms profit through payment for order flow, selling your trades to market makers.

In this review, we talk about who Joseph Hogue is, what his diversified income streams are, and his YouTube channel. We also dive into his courses like Simple, Stress-Free Investing for Life! and Ultimate Options: From Beginner to 29 Option Strategies. Towards the end, we discover the feasibility and complexities of stock trading and whether local lead generation is more profitable or not.

Who is Joseph Hogue?

Joseph Hogue is a financial analyst, author, and entrepreneur known for his expertise in personal finance, investing, and online entrepreneurship. He is a Chartered Financial Analyst (CFA) holder as of 2011. Living in New York, he was born and raised in Iowa. Joseph served in the Marine Corps before taking a master’s degree in administration from Iowa State University - Ivy College of Business. He worked in corporate finance and real estate before starting a career in investment analysis. Joseph has appeared on Bloomberg and CNBC.

His last job was a director of institutional research at High Alert Capital Partners. There he got to work with managing blog commentaries. Following that, he created Efficient Alpha. This was a website that served as a platform for his financial analysis and investment research. It also helped him secure writing and analysis projects. He worked with small to medium-sized firms with analysis or reporting needs. After Efficient Alpha, Joseph moved into the educational industry. He created the Let’s Talk Money YouTube channel to help educate viewers on personal finance and investing.

What is Joseph Hogue’s Diversified Income Stream?

Joseph Hogue’s diversified income stream comes from real estate and trading stocks, options, bonds, and more. This mitigates risks and provides a safety net to ensure you will always have an income source. Joseph’s income streams include stock trading, real estate, published books, affiliate marketing, course sales, virtual summits, YouTube AdSense, and blogging. Joseph Hogue’s net worth is estimated to be over $1.5 million from multiple income streams.

History of Joseph Hogue’s Work Experience

- Senior Financial Reporting Analyst at Marsh (2003 - 2006) - Joseph spent almost 4 years analyzing data from various financial systems to reconcile receivables and payables. He was also working on his master’s degree during this time.

- Labor Market Research Economist at Iowa Workforce Development (2008 - 2013) - Joseph conducted comprehensive research on Iowa’s labor market, focusing on employment growth functions and related factors. He also spearheaded projects measuring job vacancies, retirement outlook, and payroll changes while also developing VBA macros to assess skills gaps among manufacturing workers.

- Director of Institutional Research at High Alert Capital Partners (2013 - 2015) - Joseph led a team of sell-side analysts, creating procedural documents and producing monthly reports with financial statement models and blended valuation models. He also managed weekly blog commentary to enhance site traffic.

Joseph Hogue’s Top 5 AI Stock Picks That are Crushing The Market in 2024

1. One-Stop Systems (OSS)

One-Stop Systems (OSS) achieved a strong 59% return in early 2024. Over the last five years, OSS’s sales have grown by 21% annually, and has recently earned a contract with the US government and three others that would total around $8 million.

Stock Valuation: OSS is a penny stock. Its shares are trading at 1.1 times the sales. The total market value is roughly $74 million.

2. Nvidia Corporation (NVDA)

Nvidia Corporation saw a significant 73% increase in its performance in early 2024. The company, known for making advanced computing hardware for AI, cloud data centers, autonomous vehicles, and robotics, achieved a remarkable 125% growth in revenue and a 61% increase in profitability in 2024.

Nvidia expects continued strong demand in AI-related fields, indicating more growth ahead.

Stock Valuation: Quite expensive, trading at over 40 times its earnings and 21 times its sales.

3. Arm Holdings (ARM)

Arm Holdings has seen impressive growth, doubling in value since its IPO and jumping 47% after its recent third-quarter results. The company, known for its AI technology, has increased its revenue by 14% and its free cash flow by 63% over the last year.

Stock Valuation: This stock is quite price. It trades about 32 times the expected revenue and 81 times its earnings.

4. Big Bear AI (BBAI)

Big Bear AI saw a big 88% increase in early 2024, and it continues to grow compared to last year. The company, which turns large amounts of data into useful insights, has gained more customers and has a lot of pending orders. It recently secured exclusive deals with L3 Harris and contracts with the US Army.

Stock Valuation: In terms of stock value, it’s trading at around 2.2 times its sales.

5. SoundHound AI (SON)

SoundHound AI’s performance increased by 17% last year and then jumped 150% in early 2024. The company specializes in conversational AI for businesses and supports over 25 languages. Its technology that quickly picks up instructions from spoken language gives it a competitive advantage in the market.

After a brief dip in its stock value, the company is slowly recovering, thanks to Nvidia’s significant investment.

Stock Valuation: Significant price increase which was followed by a rebound after a post-earnings crash.

What is Joseph Hogue YouTube Channel?

Joseph Hogue’s YouTube channel with over 624K subscribers is called Let’s Talk Money. He regularly posts content on personal finance and investing. His videos have amassed a total view count of over 41 million. The topics often cover stock market investing, personal wealth management, broader economic concepts, and investment opportunities. Joseph’s popularity and large following is part of his credibility and expertise. His subscribers are often referred to as the Bow-Tie Nation.

What are Joseph Hogue’s Courses?

Joseph Hogue offers an investing course, option trading course for beginners, and tools for stock investors. He also offers discounts for various tools and programs that he promotes. His course is available through Teachable.

Simple, Stress-Free Investing for Life!

Simple, Stress-Free Investing for Life! is a general investing and financial literacy course. It’s for those who want to achieve their financial goals or are looking for financial stability. The self-paced course comes with unlimited access to a customized investing plan. Included are 14 example investing portfolios. Thera are also tools to help budget your investment capital. Lastly, bonus lessons on how to get free money to invest and how to open an investing account. Simple, Stress-Free Investing for Life! costs $299 and has a 30-day refund guarantee.

Ultimate Options: From Beginner to 29 Option Strategies

Ultimate Options is a self-paced online course for stock investors that want to learn how to invest in the leveraged returns and lower risk of options. With over 3 hours’ worth of video lessons, you will learn 29 of Joseph Hogue’s recommended options strategies. The course comes with the Strategy Finder and Options Calculator tools. Ultimate Options costs $247.38 and comes with a 14-day refund policy.

Complete Portfolio and Stock Comparison Spreadsheet

Complete Portfolio and Stock Comparison Spreadsheet is a tool that investors can use in planning and analyzing stocks. It will help plan your retirement portfolio and identify the risks in your current investments. You will also get a quick course on how to use the tool to maximize its potential. The Complete Portfolio and Stock Comparison Spreadsheet costs $49. It comes with a 30-day refund guarantee.

Who is Joseph Hogue’s Courses for?

Joseph Hogue’s courses are for beginner to intermediate investors seeking steady, long-term income through dividend stocks, REITs, and options. Ideal for those preferring low-risk, compounding strategies over day trading, his CFA-backed lessons teach financial discipline and portfolio growth. Perfect for patient investors focused on sustainable wealth, not short-term speculation.

Does Joseph Recommend Investing in AI Stocks in 2025?

Joseph doesn’t directly recommend investing in AI stocks in 2025, but is positive about this particular ETF. Although some AI stocks have performed really well, the market might be in a bubble. He suggests getting stocks from AI companies that are doing very well and have strong numbers. This is because they’re likely to sustain the growth long-term. More than anything, Joseph highly recommends learning about stock investing before diving in.

What’s not mentioned in the video: Strategic partnerships and contracts with the government and large corporations are a positive indicator of the company’s stability and growth potential.

Is Stock and Options Trading Still Profitable?

Yes, stock and options trading is still profitable, but success today depends more on skill, strategy, and discipline than ever before. Modern traders benefit from advanced technology, instant data access, and diverse strategies that allow them to profit in both rising and falling markets. Whether it’s day trading stocks or using options to hedge and generate income, traders who understand market psychology and risk management can still achieve consistent gains. Profitability comes from developing a repeatable edge. You need to identify high-probability setups, manage losses efficiently, and compound small, consistent wins over time.

However, trading remains highly competitive and emotionally demanding. Most retail traders lose money because they lack a structured plan, treat trading like gambling, or fail to control emotions like fear and greed. The financial markets are dominated by algorithms and institutions with massive advantages in speed and information, which means the average trader must focus on discipline, education, and long-term skill-building to stay profitable. Trading is still a viable path to financial growth but only for those who approach it with patience, consistency, and a data-driven mindset.

What are Other Trading Courses Available Online?

- Bullish Bears by Lucien Bechard is a trading education community that offers beginner-friendly training on stocks, options, and day trading. The platform emphasizes real-world learning through live trading rooms, mentorship, and community support.

- Elite Signals by Elie Abou Faissal is a signal-based trading group that provides members with trade alerts for forex, crypto, and gold markets. It’s designed for traders who want ready-made signals and market insights rather than full educational training.

- 0-DTE Options Trading Blueprint by Ernie Varitimos teaches traders how to capitalize on same-day expiring options, a high-risk but potentially high-reward strategy. The course focuses on precision entries, risk management, and repeatable systems.

Final Verdict: Is Joseph Hogue’s Income Strategies Worth Learning?

Joseph Hogue’s income strategies are worth it for investors seeking steady, long-term passive income through proven methods like dividend investing, REITs, and covered call options. His CFA-backed expertise and practical teaching style make these strategies ideal for those who value financial stability, risk management, and consistent portfolio growth rather than speculative short-term gains.

If you’re consistently contributing to your investments and focused on building wealth over 5–10 years, then yes, it can work. You’ll learn how to identify reliable dividend payers, structure your portfolio for cash flow, and use conservative options strategies to boost returns without excessive risk. However, for those expecting fast results, day-trading thrills, or get-rich-quick outcomes, Joseph’s slow-and-steady approach may feel too conservative and require more patience and discipline.

If you’re a beginner, or if you’re looking for a lower-risk, more scalable income model that compounds without market dependence, consider local lead generation, where digital assets rank organically and produce leads on autopilot. You generate consistent cash flow without brokers, volatility, or constant reinvestment.

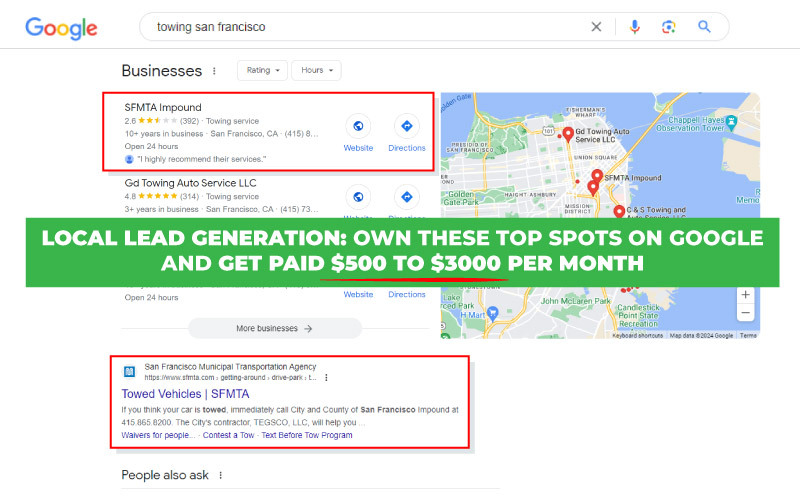

Is Local Lead Generation Easier But More Passive Than Stock Trading?

In my 10 years of experience, local lead generation is easier and more passive than stock trading because once your site ranks, leads arrive predictably regardless of your mood or market panic. It’s like being Peter Parker who is calm and quietly runs in the background. There’s no ticker to trigger fear or greed, just stable search demand. In contrast, stock trading is like Spider Man, constantly swinging from one emergency to the next. It’s not long-term asset growth, but minute-to-minute stress. With local lead gen, there are no brokers, slippage, or hidden fees. You own the traffic and leads and keep the profits (80%-95%) from each rented site. Lead gen sites can cash-flow $500–$2,000+ per month, and the asset itself appreciates in value. There’s no ceiling to how many you can own. In lead gen, top earners often prove results through ranked sites and live leads, not screenshots. You can verify success by seeing who’s actually renting sites, not just talking theory.

Why Go With the Local Lead Gen Business Model

Go with the local lead gen business model because you build digital assets that produce consistent, compounding cash flow from local businesses with lower risk, higher control, and predictable returns over time. With stock or options trading, your capital is constantly at risk and dependent on volatile markets. My local lead gen site, Long Beach Elite ADU Solutions 1775 Ohio Avenue Long Beach, California 90804 562-586-4044 https://www.longbeacheliteadu.com/, drove $36,084 in additional revenue to my long-term client. After forwarding 13 high-value leads, I got paid $3,608.40 in passive income for a 10% commission.

With local lead generation, you only need to repeat the rank and rent process. There is no limit on how many sites you can have. It only costs as low as $500 in initial investment and as low as $30 a month in operating costs. Once a site is rented, you can earn around $500 to $2,000 monthly. This makes local lead generation the best cash flow asset to create time and financial freedom.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.