Joseph Hogue Review: Diversify Your Income Stream

Joseph Hogue, CFA, is a financial expert who focuses on personal finance, investment analysis, and wealth management. He educates his followers on stock trading, personal finance, and diversifying. Joseph does this through his Let’s Talk Money YouTube channel and courses. Joseph stands out from many of these personal finance and investment “gurus." He is professionally qualified and has a trove of experience.

Reviews for Joseph Hogue are very positive. Joseph is praised for his step-by-step guides and strategies. So is his practical approach to investing in divided stocks and real estate. Followers also praise his realistic approach when giving advice, especially with risk management. Being a Chartered Financial Analyst holder played a big part in attracting the trust of his audience.

In this review, you will learn all about who Joseph Hogue is, what his income streams are, his YouTube channel, and what courses he offers. You will also discover about options trading and my recommended cash flow business.

Joseph Hogue’s Diversified Income Stream

Joseph Hogue’s primary source of income comes from trading stocks. He also has several other income streams. He often promotes income stream diversification. This mitigates risks and provides a safety net to ensure you will always have an income source. Joseph’s income streams include stock trading, real estate, published books, affiliate marketing, course sales, virtual summits, YouTube AdSense, and blogging. Joseph Hogue’s net worth is estimated to be over $1.5 million from multiple income streams.

Who Is Joseph Hogue?

Joseph Hogue is a financial analyst, author, and entrepreneur known for his expertise in personal finance, investing, and online entrepreneurship. He is a Chartered Financial Analyst (CFA) holder as of 2011. Living in New York, he was born and raised in Iowa. Joseph served in the Marine Corps before taking a master’s degree in administration from Iowa State University - Ivy College of Business. He worked in corporate finance and real estate before starting a career in investment analysis. Joseph has appeared on Bloomberg and CNBC.

His last job was a director of institutional research at High Alert Capital Partners. There he got to work with managing blog commentaries. Following that, he created Efficient Alpha. This was a website that served as a platform for his financial analysis and investment research. It also helped him secure writing and analysis projects. He worked with small to medium-sized firms with analysis or reporting needs. After Efficient Alpha, Joseph moved into the educational industry. He created the Let’s Talk Money YouTube channel to help educate viewers on personal finance and investing.

History of Joseph Hogue’s Work Experience

- Senior Financial Reporting Analyst at Marsh (2003 - 2006) - Joseph spent almost 4 years analyzing data from various financial systems to reconcile receivables and payables. He was also working on his master’s degree during this time.

- Labor Market Research Economist at Iowa Workforce Development (2008 - 2013) - Joseph conducted comprehensive research on Iowa’s labor market, focusing on employment growth functions and related factors. He also spearheaded projects measuring job vacancies, retirement outlook, and payroll changes while also developing VBA macros to assess skills gaps among manufacturing workers.

- Director of Institutional Research at High Alert Capital Partners (2013 - 2015) - Joseph led a team of sell-side analysts, creating procedural documents and producing monthly reports with financial statement models and blended valuation models. He also managed weekly blog commentary to enhance site traffic.

Joseph Hogue’s Top 5 AI Stock Picks That Are Crushing The Market in 2024

1. One-Stop Systems (OSS)

One-Stop Systems (OSS) achieved a strong 59% return in early 2024. Over the last five years, OSS’s sales have grown by 21% annually, and has recently earned a contract with the US government and three others that would total around $8 million.

**Stock Valuation:**OSS is a penny stock. Its shares are trading at 1.1 times the sales. The total market value is roughly $74 million.

2. Nvidia Corporation (NVDA)

Nvidia Corporation saw a significant 73% increase in its performance in early 2024. The company, known for making advanced computing hardware for AI, cloud data centers, autonomous vehicles, and robotics, achieved a remarkable 125% growth in revenue and a 61% increase in profitability in 2024.

Nvidia expects continued strong demand in AI-related fields, indicating more growth ahead.

****Stock Valuation:****Quite expensive, trading at over 40 times its earnings and 21 times its sales.

**3.**Arm Holdings (ARM)

Arm Holdings has seen impressive growth, doubling in value since its IPO and jumping 47% after its recent third-quarter results. The company, known for its AI technology, has increased its revenue by 14% and its free cash flow by 63% over the last year.

**Stock Valuation:**This stock is quite price. It trades about 32 times the expected revenue and 81 times its earnings.

4. Big Bear AI (BBAI)

Big Bear AI saw a big 88% increase in early 2024, and it continues to grow compared to last year. The company, which turns large amounts of data into useful insights, has gained more customers and has a lot of pending orders. It recently secured exclusive deals with L3 Harris and contracts with the US Army.

Stock Valuation: In terms of stock value, it’s trading at around 2.2 times its sales.

5. SoundHound AI (SON)

SoundHound AI’s performance increased by 17% last year and then jumped 150% in early 2024. The company specializes in conversational AI for businesses and supports over 25 languages. Its technology that quickly picks up instructions from spoken language gives it a competitive advantage in the market.

After a brief dip in its stock value, the company is slowly recovering, thanks to Nvidia’s significant investment.

Stock Valuation: Significant price increase which was followed by a rebound after a post-earnings crash.

Does Joseph Recommend Investing in AI Stocks in 2024?

Joseph is positive about investing in AI stocks in 2024, but doesn’t directly recommend it. Although some AI stocks have performed really well, the market might be in a bubble. He suggests getting stocks from AI companies that are doing very well and have strong numbers. This is because they’re likely to sustain the growth long-term. More than anything, Joseph highly recommends learning about stock investing before diving in.

**What’s not mentioned in the video:**Strategic partnerships and contracts with the government and large corporations are a positive indicator of the company’s stability and growth potential.

What Is Joseph Hogue YouTube Channel?

Joseph Hogue’s YouTube channel with over 624K subscribers is called Let’s Talk Money. He regularly posts content on personal finance and investing. His videos have amassed a total view count of over 41 million. The topics often cover stock market investing, personal wealth management, broader economic concepts, and investment opportunities. Joseph’s popularity and large following is part of his credibility and expertise. His subscribers are often referred to as the Bow-Tie Nation.

What Are Joseph Hogue’s Courses?

Joseph offers an investing course, option trading course for beginners, and tools for stock investors. He also offers discounts for various tools and programs that he promotes. His course is available through Teachable.

Simple, Stress-Free Investing for Life!

Simple, Stress-Free Investing for Life! is a general investing and financial literacy course. It’s for those who want to achieve their financial goals or are looking for financial stability. The self-paced course comes with unlimited access to a customized investing plan. Included are 14 example investing portfolios. Thera are also tools to help budget your investment capital. Lastly, bonus lessons on how to get free money to invest and how to open an investing account. Simple, Stress-Free Investing for Life! costs $299 and has a 30-day refund guarantee.

Ultimate Options: From Beginner to 29 Option Strategies

Ultimate Options is a self-paced online course for stock investors that want to learn how to invest in the leveraged returns and lower risk of options. With over 3 hours’ worth of video lessons, you will learn 29 of Joseph Hogue’s recommended options strategies. The course comes with the Strategy Finder and Options Calculator tools. Ultimate Options costs $247.38 and comes with a 14-day refund policy.

Complete Portfolio and Stock Comparison Spreadsheet

Complete Portfolio and Stock Comparison Spreadsheet is a tool that investors can use in planning and analyzing stocks. It will help plan your retirement portfolio and identify the risks in your current investments. You will also get a quick course on how to use the tool to maximize its potential. The Complete Portfolio and Stock Comparison Spreadsheet costs $49. It comes with a 30-day refund guarantee.

Is Options Trading Worth It?

Option trading is worth it if you can apply an effective strategy that mitigates the risks. The large majority of individual traders will lose money from trading options. This very risky investment will require a lot of skills and experience if you are to make any profits. Options trading is preferred by beginners and investors with low capital, as it is a way to enter the industry without putting a lot of money down. However, it comes with its unique risks and challenges.

You should only trade with money you can afford to lose. Investing into multiple cash flow streams will lessen the risks of trading in stock options. It can even provide a source of trading capital. Investing in passive income cash flow assets is the best way to secure your finances.

Create a Low-Risk Passive Income Stream with Local Lead Generation

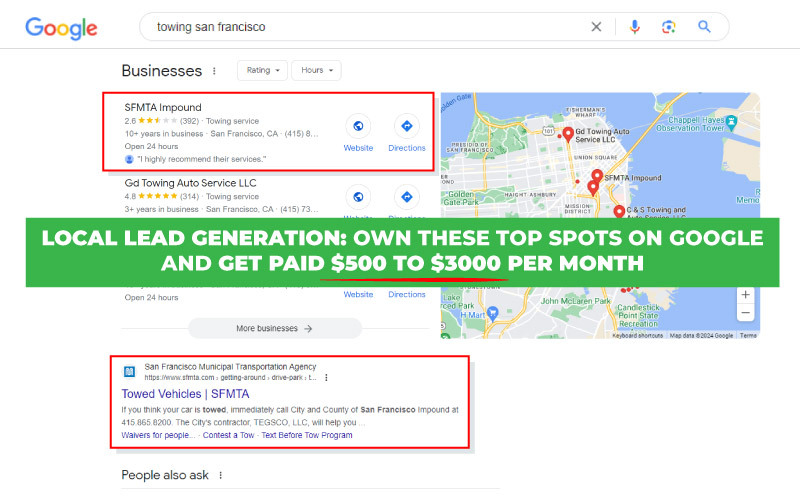

Local lead generation is a digital real estate business model that creates a passive income stream through the rank and rent method. You create and rank a site on Google using SEO tactics, then rent it out to local business for the leads it generates. A rented site creates predictable and passive monthly income with no added risks.

You compete with hundreds of professional big money traders when investing in stocks. With local lead generation, you only have to outrank a handful of sites. To scale when trading stocks or investing in real estate, you have to increase your spending. This leads to added risks. With local lead generation, you only need to repeat the rank and rent process. There is no limit on how many sites you can have. It only costs as low as $500 in initial investment and as low as $30 a month in operating costs. Once a site is rented, you can earn as much as $500 to $3,000. This makes local lead generation the best cash flow asset that has the potential to create time and financial freedom.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.