Philip F Smith's Loan Broker Network Review: Is a Done-For-You Loan Brokerage Business Legit?

Updated On

The Loan Broker Network is a done-for-you mortgage and loan broker business program by partners Philip K Smith and Kevin Harrington. The program comes with lead generation training and will partner you with a team that will run every aspect of your business. This is just one of the services offered at philipfsmith.com.

In my experience of running an online business for over a decade, paying for a done-for-you loan broker business like Loan Broker Network offers is like buying a Mazda MX-5 Miata without knowing how to drive stick shift. You aren’t likely to make it very far if you don’t know how to manage it. Although they provide a lot of support, you still need to generate leads and close customers, which is the hardest part of the job. The home buyers or small businesses you’re pitching loans to can typically go directly to a legitimate financial institution themselves and get a similar rate to what you can offer. That’s like trying to sell a $5 coffee from a street stand in front of a Starbucks. Most people will choose to go with the more reputable source. There’s high pressure to convince people to take on debt because you only get paid through commissions, just like selling timeshares for the Marriott Vacation Club.

In this Loan Broker Network review, I discuss the pros and cons of the program, uncover the lawsuit, and highlight student testimonials.

Philip F Smith’s Loan Broker Network Review: Pros and Cons

Pros

- Philip Smith has been working in lead generation and marketing since 1998.

- Comes with lead generation lessons.

- Access to the private Facebook group.

Cons

- Kevin Harrington has an ongoing lawsuit.

- No refund policy has created several unresolved complaints.

Can You Trust the Loan Broker Network?

The Loan Broker Network is technically not a scam. However, there have been some issues that you need to be aware of before deciding if this program is for you. Phil Smith has been in the lead generation business for over 2 decades now, which means his services are most likely legit. While there have been some complaints about his programs and services, you could attribute this to the performance of his teams. His partner, Kevin Harrington, has been involved in a legal issue.

Kevin Harrington Lawsuit

In August 2021, Shark Tank co-stars Kevin Harrington and Kevin O’Leary were involved in a 102-page lawsuit filed with over 20 plaintiffs. The lawsuit was highly publicized and is on various news publications like Fox , USA Today , and NewsNation . The Shark Tank co-stars were sued for their alleged involvement with the crowdfunding companies InventureX and Ideazon, which used “fictional executives, false promises of financial success, and even illusions of being on the show ‘Shark Tank’ itself” to lure start-up businesses into working with them. These 2 scam businesses used “facades designed to lure in unsuspecting victims, extract their money, and then virtually disappear under the guise of delays, minimal to no performance, and no results.”

While O’Leary denied his involvement with the companies, claiming that he never worked with any of the plaintiffs, video evidence showed him discussing the companies in question. As for Harrington, he was “prominently featured as a partner on the IventureX website,” with plaintiffs receiving a personalized video in which Harrington would state that he was informed of their business and wanted to invest in them. Harrington claimed that he was only paid to do videos for the company and does not own a piece of the company, nor has he taken any principal role in them.

Who Is Loan Broker Network For?

The Loan Broker Network is for anyone who wants to create their own done-for-you mortgage and loan brokerage business and have it automated by a team of professionals. This is for beginners who have a zero idea of the business model, or experienced loan brokers who want to scale.

What Do You Get With Loan Broker Network?

With Loan Broker Network, you will learn how to generate leads and how to sell them to businesses for a profit. The program also comes with a complete, done-for-you service.

The Loan Broker Network Package Includes

- Done-for-you service where a team of about 100 members takes care of every aspect of your business, from the creation of sales funnels to managing your marketing campaigns and closing your deals.

- Access to the Facebook support group, where you’ll be able to find 24/7 help and learn new tricks and tactics.

- Lead generation training by Philip Smith so you can understand how your business works.

- Ability to be invited to attend a mastermind virtually or in person.

Are Clients of Loan Broker Network Successful?

There are tons of video testimonials from clients who have attended several of Philip’s live mastermind. In these testimonials, they mostly talk about the mastermind events and the community with the lack of any real world success examples.

There are several complaints from clients on the BBB. All complaints have so far gone unanswered and unresolved. Here are some of those shorter complaints:

Keep in mind that the products and services of philipfsmith.com do not have a refund guarantee. Take that into account before deciding if this service is right for you.

Conclusion: Do I Recommend the Loan Broker Network?

I recommend joining the Loan Broker Network if you want to take advantage of the done-for-you service model. However, if you are looking for just a course on lead generation, I suggest taking a dedicated course or mentorship program.

What I found most fascinating about the Loan Broker Network is that both of the partners’ expertise benefit them well with this program. Phil is a lead generation expert who finds leads and recommends them to Kevin’s loan services.

Who Is Philip K Smith?

Philip F. Smith is a digital marketing consultant and founder of philipfsmith.com. He has consulted for over 40 companies with the likes of IBM, Intel, AT&T, and HP. Phil has built and sold 4 digital marketing companies since 1998. He started his marketing career by learning how to broker leads, finding them, then selling them to lead buyers. by running advertisements and marketing campaigns. He has been featured in several publications like Inc , and Forbes .

Phil Smith founded his advertising and marketing agency, PJP Marketing, in 2013. PJP Marketing delivered online lead generation services, specializing in the financial services market, providing business loan leads and credit repair leads. His company made the Inc. 5000 list of fastest growing private companies for 4 years in a row in 2018–2022, with the first 3 as a one-man company.

Who Is Kevin Harrington?

Kevin Harrington is considered the “infomercial godfather” for airing the first ever infomercial in 1985. Kevin has launched has invested in nearly two dozen companies and launched over 500 products. His net worth is estimated at $400 million.

By 1994, 90% of all stations were airing infomercials. Since the start of infomercials, the question of getting celebrities and known people to market the product has also been considered. While experts are used for their endorsement value, the “name” of a famous person adds marketing value. Using his own name as a successful investor, Kevin has added marketing value to various products and services.

Is A Loan Brokerage Business Worth It in 2025?

A local brokerage business is worth it in 2025. There will always be businesses looking for funding and investors looking to invest their capital. The purpose of a loan broker is to act as an intermediary between the borrower and the lender. Loan brokers are popular because most applications for loans, about 80%, are denied by banks. Working with loan brokers also has its own distinct advantages.

Advantages and Disadvantages of Using Loan Brokers

Pros

Saves time - Loan brokers are knowledgeable in their field and can know a wide variety of lenders and policies. Their expertise can help you find the best loan terms that suit your situation.

Lower rates - Brokers usually have a lot of connections. Successful brokers may get lower fees from lenders because of the many leads they bring in. They may even get the lenders to waive miscellaneous fees such as origination fees, application fees, and appraisal fees.

Easy, quick, and convenient - Brokers usually handle their own time, so it’s easy to book an appointment. As brokers are after their commission, be assured that they speed up the loan process and make it as easy for you as possible to secure loans.

Cons

Bigger loans can be more expensive - Make sure to do the math before agreeing to the deal. Brokers usually take a percentage commission relative to the loan. The larger the loan, the higher the broker’s fee.

Estimates aren’t guaranteed - Brokers usually make an offer based on a “good faith estimate”. This means that this is just an optimistic figure, as the offer hasn’t been finalized yet. The lender may decline the initial offer and change the figures.

Not all lenders work with brokers - Since 2008, there has been a decline in the number of lenders working with brokers because of the high percentage of broker-originated loans going into default. This means some lenders who may have better deals are not accessible through a broker.

Loan brokers can make a lot of money if they constantly receive leads and close deals. They make money from either an upfront commission fee or ongoing commissions that span the life of the loan. Loan brokers charge 0.50 percent to 2.75 percent of the loan principal. Broker fees are capped at 3% by federal law.

With all the available lead generation tools and software, finding leads has never been easier. Automation is a big factor in making lead generation easier and more scalable. Tools can automate your marketing campaigns, such as email marketing, and outsourcing can automate other aspects like cold calling. For many years, Phil was able to scale his lead generation business without even hiring any employees.

Top Skills You Need to Be a Successful Business Loan Broker

- Research - Good research skills will help you find the best deals with low interest rates for your clients that suit their needs. You need to keep on top of the industry and be updated on the news.

- Marketing - You need to have skills in marketing if you are to run effective campaigns to attract more clients. Running ineffective paid ad campaigns can make your cash flow negative.

- Interpersonal - Having good people skills is paramount in this business. You need to be able to build rapport and effectively negotiate loan terms.

- Communication - Effective communication is the key to closing deals. You need to be able to explain complex financial offers and create concise proposals.

- Time management - It is important to manage your schedule and workload in order to meet your clients’ needs. Time management is very important when working with tight deadlines.

FAQs

- How are loan brokers and direct lenders different? Loan brokers do the legwork in securing you a loan, while direct lenders do the qualification and process the loan application. Direct lenders are banks and other financial institutions.

- How can a business loan broker benefit your business? Working with a business loan broker can benefit your business by connecting you with lenders that suit your needs. Brokers usually have the expertise and knowledge and the proper connections.

- **Will working with a small business loan broker hurt your credit score?**Working with a business loan broker will not hurt your credit score. There are a lot of benefits to working with a broker for your small business without affecting your credit score.

- How much does it cost to hire a business loan broker? It costs anywhere from 1% to 6% of your loan amount to hire a business loan broker. Many reputable brokers charge the lender instead. Commission rates are neither standardized nor controlled, so the prices fluctuate from case to case.

- What is a personal guarantee for a business loan? A personal guarantee for a business loan is an agreement between the business and lender that if the business is unable to pay, the individual who signed will take responsibility for the repayment. Business loans do not require a personal guarantee, but most lenders will require one.

Is Starting a Loan Broker Business a Good Idea for Most People?

Starting a loan broker business is not a good idea for most people because it requires advanced skills in lead generation and sales. Furthermore, loan brokers operate in a highly competitive industry with minimal leverage.

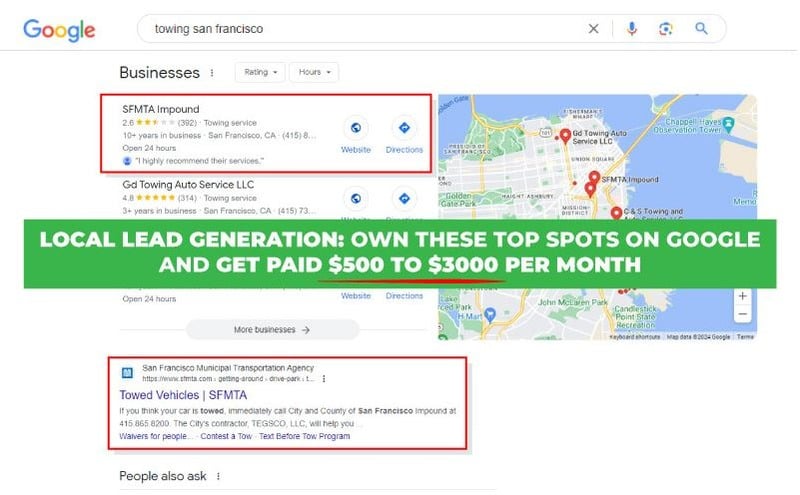

In my opinion, local lead generation is a more reliable way to make money online than being a loan broker. Local lead generation entails setting up websites that generate leads for small business owners. You’re like Zillow, but instead of connecting home buyers with home sellers, you connect local businesses with paying customers. These websites cost a few hundred to a few thousand dollars to set up, but they can generate $500-$3,000+/month in long-term recurring revenue. It’s like investing in US Treasury Bonds, you can get a reliable return month after month. The goal is to create a portfolio of these websites to scale your income to over 5 figures per month in passive income.

One of my local lead generation websites is Garden Grove Elite Roofing, 14096 Brookhurst Street, Garden Grove, California 92843, 714-699-9737, https://www.gardengroveeliteroofing.com/. Last month, it generated 28 leads, and my client closed $45,690 in new business. We have a 5% commission deal, so I got paid $2,285 for my leads.

Learn more about making recurring, passive income online with local lead generation.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.