Ben Alistor's Money Mindset Review: 10 Steps To Develop a Positive Money Mindset

Money Mindset by Ben Alistor aims to help you create a large net worth and generate passive income. The course comprises 135 videos, divided into 15 sections. Ben shares insights and concrete examples to foster a positive money mindset. Furthermore, he provides ideas on how to manage your finances effectively. This encompasses banking, credit, investing, negotiation, and many more. It offers mentorship and online learning programs geared towards your financial success.

Ben Alistor is a prominent e-commerce entrepreneur and Amazon FBA mentor. He is an expert in online business and personal finance. However, there are very few reviews about Ben Alistor and his Money Mindset course. Instead, you can find Ben’s Amazon FBA course, which receives positive reviews. Several websites recommend Ben Alistor’s courses in their reviews. It is also undeniable that Ben has a huge following, especially on TikTok.

Entrepreneurship courses like Ben’s Money Mindset can be beneficial for small business owners. They can provide knowledge of business planning, marketing, finance, and management. It can also offer practical skills and networking opportunities. However, the drawbacks to these courses are the cost and time commitment involved. Not all courses guarantee immediate and practical success, which can be frustrating. Some successful entrepreneurs argue that real-world experience and resilience are more valuable. These courses can be effective, but it depends on your learning style and business needs.

This Money Mindset review covers its pros and cons, contents, and curriculum. We will also look at whether the course is worth it for your time and money. In the end, we discuss why the right mindset is important for small business owners.

Money Mindset Review: Pros and Cons

Pros

Ben Alistor has a proven track record in online entrepreneurship and personal finance. He shares his firsthand experience.

The course is available on demand, so you can go through it at your own pace.

Ben has an excellent digital footprint. He earned positive feedback from other successful entrepreneurs.

Money Mindset offers unlimited lifetime access to 135 videos.

Cons

Money Mindset is not a personalized or tailored fit program. Some tools or strategies may not apply to your financial situation.

There is no direct interaction with the course creator. There are nothing but videos.

The videos are not downloadable. This means you need internet every time you log in to their portal.

There are no reviews or feedback from other students about the course.

Price

The Money Mindset course costs $299.

Training

The Money Mindset training has self-paced videos that you can access at any time.

Group

Ben has 139K subscribers on YouTube, 903K followers on TikTok, and 39.7K on Instagram.

Refund Policy

The Money Mindset course has no refund policy.

Origin

The Money Mindset course started in 2018.

Reputation

Ben Alistor’s reputation is good, especially in the Amazon FBA world. Most people find Ben’s tutorials and online learning materials helpful. Ben is also well-followed across different platforms.

July 10, 2024

So far, the Money Mindset course it’s not boring! Ben is an excellent speaker, making the lecture more fun and easier to understand. Ben is straightforward, and he gives you brutally honest insights about money-making ideas and other financial decisions and is also honest about his revenue streams, making the course more credible for his students. However, I can’t find testimonials from other students anywhere. But, there are a few online entrepreneurs who vouched for this program. I think he should add student reviews to his website to make it more credible.

Stacy

July 10, 2024

just got this course, hopeful for its effects esp in passive income… but we will see..

eric

4.0

4.0 out of 5 stars (based on 2 reviews)

Your review

Your overall rating Select a Rating5 Stars4 Stars3 Stars2 Stars1 Star

Your review

Your name

Your email

This review is based on my own experience and is my genuine opinion.

Submit Review

10 Steps To Develop a Positive Money Mindset

1. Recognize Your Beliefs and Attitudes About Money

The first step to a positive mindset is recognizing your attitudes about money. This includes money beliefs like “money is the root of all evil" or “I will never be one of those millionaires.” Once you have figured out these negative thoughts, it’s time to challenge them. Then, replace them with positive beliefs.

2. Learn and Move Away From Your “Stupid” Money Choices

Learn and move away from stupid money choices. Accept that we all made poor financial decisions in our lives. Whether you missed a credit card payment or bought expensive things you don’t need. It is time to acknowledge these mistakes and focus on moving forward. Forgive yourself for all the wrong decisions you’ve made in the past. Ben cited several strong points about this in part 3 of the course. He also gave concrete examples. This includes homeownership emotions, watches and jewelry, and other tricky money problems.

**3. **Set Financial Goals****

After moving away from poor financial decisions, the next step is to set your financial goals. Financial goal setting is all about knowing your priorities. Find out what matters to you the most. Apply the SMART (Specific, Measurable, Achievable, Relevant, and Timely) goal strategy. This ensures you’re always on track with your financial objectives. Having clear goals will help you drift away from a negative money mindset.

4. Optimize Your Money Habits for Happiness

Having a positive mindset towards money is not an easy feat. One way to make it easier is to optimize your budget for happiness. For example, if you like a gym membership or traveling, then include these things in your budget plan. If you’re not deprived, then creating a solid budget plan will feel less like a chore. Several money hacks in the course will help calibrate your budget for happiness. This includes scaling your finances, paying off debts, saving, and many more!

**5.**Stop Comparing Yourself To Others****

Comparing yourself to others can affect your mindset, including your money beliefs. Your financial situation will always differ from others. Making comparisons will only lead you to a losing end. As a result, you will feel discouraged and your goals may seem unreachable. These things will set you back and may cause you to make poor financial decisions along the way.

Ben also shared insightful learning materials about this in his course. He discussed different complexities and worst-case scenarios you may encounter. He also gave some valuable tips on what you can do to start over and stay focused on your goals.

**6. **Steer Away From Scarcity Mindset****

Focus on abundance rather than a scarcity mindset. A positive mindset comes from the belief that there is money that will come as you go on your financial journey. You will find more opportunities and be more likely to take risks.

**7. **Practice Gratitude****

Gratitude is one of the most powerful tools for developing the right money mindset. Take the time each day to pat yourself on the back. Express gratitude for the wealth you have and all the opportunities that lie ahead. This practice can shift your focus to your progress.

8. Invest in Yourself

Investing in yourself is the best investment you will make. Whether it’s through education, training, or personal development. All these things will pay off in the long run. By investing in yourself, you’re improving your skills and knowledge. You’re also making a statement to yourself that you’re worth investing in.

**9. **Surround Yourself With Positive Influences****

Surround yourself with positive influences and stay away from toxic people. They only instill negativity in your life. Choose the right people around you. Surround yourself with winners. Read books or find mentorship programs that offer support and guidance when you need it.

**10. **Focus On Solutions Rather Than Problems****

When you encounter financial challenges, focus on what you can do to overcome them. Rather than dwelling on the problem itself. This can help you stay motivated and proactive in achieving your financial goals.

What is a Money Mindset?

A money mindset is an individual’s beliefs and values about money and wealth. It often influences how people make financial decisions and manage their finances. The National Bureau of Economic Research said that small business owners with a positive money mindset are 30% more likely to succeed.

A positive mindset involves having a healthy relationship with money. It is believing in the abundance of opportunities. Also, it is feeling confident in one’s ability to make and manage money. It is feeling comfortable with wealth and financial success. This mindset can lead to responsible money habits. It enables you to pursue financial goals and have a sense of security and freedom.

A negative money mindset involves fear and scarcity thinking. It limits your beliefs about money. People with a negative money mindset may struggle with financial decisions. They feel anxious or stressed about money and struggle to achieve financial goals.

What is the Money Mindset Course?

The Money Mindset course is a comprehensive online course created by Ben Alistor. His goal is to help students build a huge net worth and generate passive income. This is regardless of what stage they are on their financial journey. Whether you’re building your wealth or are already on your way. It equips participants with the knowledge and tools needed to achieve financial independence. So that they can retire early and live the life they desire. The course offers valuable strategies that can apply to any financial situation.

The course is also available on demand. This allows participants to start and finish it at their convenience. The curriculum covers a wide range of essential topics. This includes passive income strategies, avoiding common money mistakes, and many more. It also covers understanding credit, as well as the fundamentals of investing. The course is broken down into 15 modules with 135 videos. Starting with an introduction that lays out the fundamental principles of financial success. It also explores the psychology of financial preparedness, budgeting, and more. The course also addresses common financial pitfalls.

What Will You Learn From the Money Mindset Course?

- Passive Income: Learn different ways to generate passive income.

- Money Management 101: It teaches effective ways to manage your money. The goals are to avoid financial obstacles and achieve your long-term goals.

- “Stupid” Money Choices: It gives tips on how to avoid making poor financial decisions.

- Credit: Find out how to pay off debts and use credit to your advantage.

- Laws of Banking: Learn how to apply the laws of banking to your financial life.

- Investing: It offers tips on how to invest your money wisely and grow your wealth.

What is the Money Mindset Curriculum?

Introduction

This module comprises three sections. It covers the foundational concepts and basic principles essential for the course. Additionally, it discusses the ultimate goals of the course.

Getting Started With Psychology

The second module includes fourteen sections. It explores how to cope with starting anew and encourages you to define key terms personally. The course prompts you to observe your environment. Additionally, it covers essential budgeting principles and delves into understanding losses.

This course discusses your views on investing. It also uses gaming analogies for learning and emphasizes gradual progress. Furthermore, it discusses prioritizing tasks and offers tips on managing expenses.

Stupid Choices of Money

This module comprises thirteen sections. It discusses the financial implications of relocating. It also explores strategies for achieving early retirement and financial independence. Also, it covers the risks of indecisive financial commitments. The module also differentiates between essential and nonessential possessions.

Moreover, it examines the financial pitfalls associated with car ownership. It also looks into complex financial issues, such as the costs of clothing and luxury items. The course discusses the emotional and financial aspects of buying a home. It also offers tips for financially savvy gifting. Lastly, it delves into the intersection of romantic relationships and financial management.

Money vs No Money

This module includes eleven sections. First, it explores the differences between having a financial mentality and a mindset. Then it discusses the financial impact of one-time purchases or events. It also covers the strategic use of discounts in saving money and financial dealings.

Furthermore, Ben delves into the art of negotiating for better financial outcomes. He also highlights the importance of understanding financial terms and agreements. The course also covers issues related to compulsive shopping. And it evaluates the cost-effectiveness of entertainment options.

Productivity

The Productivity module includes eight sections. The course shows how altering your environment can boost productivity. Its Workout video highlights the benefits of physical exercise in productivity. Also, it examines why notifications can affect focus and productivity. Ben also covers the importance of checklists in staying organized and productive. Plus, it has one video that explores how chaos and disorder can affect productivity.

Investing Beliefs

Module 6 has eight sections that include how to evaluate investment returns. It explores the importance of asset valuation versus the quantity of investments. This module also covers the implications of cashing in on investment gains. Ben also explains this fundamental investment strategy. The course also examines harmful mindsets that can negatively impact investing. Lastly, it explores trends and popular investments and how they should be approached.

No More Paycheck To Paycheck

This module includes seven sections. The Tough Love video shares an approach to financial discipline and managing money. It provides strategies for effectively reducing debt and discusses how to handle debt. Ben also emphasizes building resilience and discipline in financial management. Furthermore, it covers steps to take when resetting your financial situation. It outlines methods to prevent falling back into a paycheck-to-paycheck cycle. Also, it reflects on past financial decisions to improve future financial behavior.

Negotiating a Raise

This module includes eight sections that discuss understanding the employer’s perspective during negotiations. Ben covers aggressive negotiation tactics and deal-making strategies. Moreover, it highlights the significance of persistence in negotiations. Additionally, it explains how to show your value to your company. It covers alternative approaches if initial negotiations fail and promotes a professional mindset.

Laws of Banking

The Laws of Banking module includes fifteen sections. It discusses the role and management of cash. The Checking Accounts video covers the essentials of maintaining and using checking accounts. It also emphasizes the importance of setting up certain key accounts. Also, it addresses the challenges faced by individuals without bank accounts.

Moreover, it compares trading strategies and explores how bank fees affect finances. It also explains the importance of spreading investments. This module also identifies situations where diversification may not be crucial. Ben also advises on accounts to avoid and warns against certain banking services. He also discusses overdraft policies and their implications. Additionally, he examines the effects of interest and debt on different socioeconomic groups.

Lastly, Ben compares loan types and offers strategies to avoid overdrafts. He also guides contesting incorrect charges and outlines measures to ensure banking security.

Practical Economics To Make You Money

This module includes eleven sections on how negative compounding can erode wealth. Ben explores distractions that hinder financial growth. Additionally, it examines the tendency to choose middle options by default. He also covers the cost-effectiveness of bulk purchasing.

Moreover, it explains the concept of sunk costs and how to avoid related fallacies. It also highlights the hidden costs of free offers. The course teaches critical thinking using basic accounting principles. It discusses gift cards and the psychological effects of spending.

Credit

The Credit module includes fifteen sections. One video explains the significance of credit scores. It also discusses the characteristics of preferred customers by banks to get approved. Furthermore, it identifies the primary factor influencing and improving credit scores. The course also offers crucial advice for maintaining good credit.

It also provides strategies for establishing credit without a credit card. Another video discusses the importance of credit for businesses. It highlights a key advantage of good credit and examines the impact of annual fees on credit. It also compares secured and unsecured credit lines. Ben also recommends additional credit line options.

Money Hacks

The Money Hacks module includes seven sections. It shows how the concept of economies of scale applies to personal finance. The module also explores the use of marginal analysis in making financial decisions.

Ben introduces a personal finance rule aimed at improving money management. It focuses on strategies for saving a specific percentage of one’s income. He also highlights the financial benefits of cooking at home versus eating out. The course explains how to take advantage of price-matching policies to save money.

Happiness And Efficiency Hacks

This module includes eight sections and shows ways to balance happiness and efficiency. It explores the impact of setting and environment on productivity and happiness. Ben also shares the benefits of physical activity for both efficiency and well-being. He also examines how diet affects mood and productivity. Additionally, the course explains the practical application of these hacks in daily life.

Progressing

Module 14 includes ten sections that cover strategies for an early waking habit. It also emphasizes the importance of establishing a consistent daily routine. Ben guides the creation of an effective daily schedule. He also offers a specific tip or hack related to productivity. Additionally, he shares personal anecdotes about poor financial habits. The course also teaches the importance of setting personal and professional boundaries.

Passive Income

The last module includes thirteen sections. The lessons cover the principles of generating passive income and building wealth. It emphasizes creating income streams tailored to your needs. Ben also addresses common misconceptions about passive income. He also shares how to maximize passive income. The course explains the role of collateral and defaults in passive income strategies.

Also, it shares the risks with certain types of debt and shares safer debt options. Ben helps you identify the most beneficial types of debt for building wealth. He also addresses issues related to quantity and price in passive income strategies. Moreover, it shares about stock investments and the benefits of earning dividends.

Is Money Mindset Worth Your Time and Money?

Yes, the Money Mindset course is worth your time and money. Ben did a terrific job of making the learning materials a lot easier to understand. This makes it ideal for anyone who is struggling with their financial situation. This course will help you start over and make better decisions in your financial future. He also shares practical strategies you can directly apply in your situation. He also advises against bad financial decisions, which can make you reflect on your own.

As emphasized in this course, always look for opportunities for financial growth. Amazon FBA is one of Ben Alistor’s strongest suits. This platform presents many opportunities to grow your income. He also shares some passive income strategies and ways to manage your finances.

However, there are no reviews available online about the Money Mindset course. Even his website has no testimonials from students. Although there are some about his Amazon FBA Mentorship.

Who is Ben Alistor?

Ben Alistor is a 7-figure Amazon FBA seller. He is also a motivational speaker and finance coach. Currently, he is taking TikTok and the YouTube platform by storm. His videos are mostly motivational tips and online business tutorials. E-commerce is one of his suits. He has established himself as a leader in the world of online entrepreneurship. For the past few years, he has carved out a part as a personal finance mentor. His recent success has led him to offer mentorship programs to aspiring entrepreneurs. Or anyone seeking financial freedom.

Ben started his Amazon FBA journey in June 2018 after hearing about the business model. He was convinced by the low involvement in inventory management. His first product, charcoal toothpaste, launched three months later. He has proven that the model was successful. Ben also said that he had no prior business experience. He added that his first significant investment in stock was £1,200. This is equivalent to a month’s salary, which was scary, but he deemed it as a necessary risk.

He shared that his experience was a steep learning curve. It involves finance management and dealing with stress and setbacks. His first year saw £25,000 in revenue and £8,000 in profit. In 2019, his revenue jumped to £207,000 with £80,000 in profit. Ben has a wealth of experience. Including dealing with drawbacks and challenges. After buying his first house, he took charge and decided that the next 40 years of a 9-to-5 job were over. With this, he created the Money Mindset course. The goal is to help his students break free from their 8-hour jobs. So they retire early and take full control of their financial lives.

Why is a Positive Mindset Important for Small Business Owners?

A positive mindset is important for small business owners because it affects success. It helps them stay resilient and bounce back from setbacks. Also, a flexible attitude allows them to adapt to changes in the market. Thus, a combination of both can bring small business owners a long way. It encourages creativity and innovation. This leads to unique products and services that stand out from competitors.

Additionally, a constructive mindset helps entrepreneurs solve problems and make better decisions. This mindset also fosters strong leadership. It enables them to inspire and motivate their teams. Therefore, creating a positive work environment. Furthermore, a customer-focused mindset helps build strong relationships with clients. Thus, increasing satisfaction and loyalty.

A determined and growth-oriented mindset drives persistence, goal-setting, and continuous improvement. Other benefits of a positive mindset are self-confidence and a healthy work-life balance. This ensures the overall well-being and sustainability of the business. So, a positive mindset can be the difference between a struggling business and a thriving one.

Are Entrepreneurship Courses Worth It?

Yes, entrepreneurship courses are worth it if you want to learn essential concepts. This can include business planning, marketing, and even the entrepreneurial mindset. These courses can help you gain practical skills and expand your network. In addition, it may also help you find inspiration for new ventures or scale your current ones. For instance, Ben Alistor’s Money Mindset course may give you ideas on how to manage your finances.

Many courses online offer mentorship on scaling an e-commerce business or starting one. An example is the For Good Profits by Andrej Morgan and Darryl Ephraums. It operates on the core value that “profit and purpose must coexist”. A success story from this course includes Bronson and Makaela Bragg. They saw an enormous boost in their sales, leading them to earn a monthly income of almost $40,000.

The value of entrepreneurship courses depends on your individual needs and learning style. They can be beneficial for those who need structured lessons and guidance. But, it may not be necessary for those who prefer learning through hands-on experience.

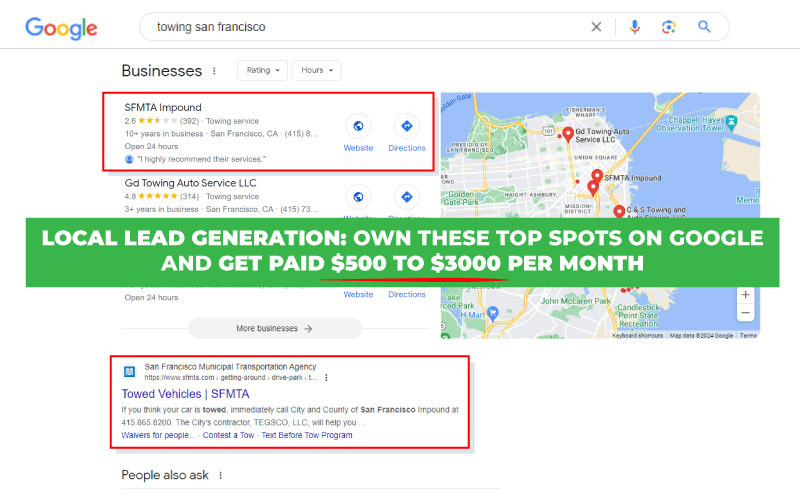

Why is the Right Mindset Important in a Local Lead Generation Business?

The right mindset is important in local lead-generation businesses because it affects motivation. If paired with the right actions, it will lead to success. Local lead generation involves creating digital assets to attract leads for local businesses. These digital assets can include websites, landing pages, blogs, and many more. The primary goal is to generate interest and inquiries from local prospects. Especially those seeking products or services in their area.

BrightLocal stated that 93% use the internet to find a local business, with 34% searching every day. A well-designed website optimized for local SEO can attract these consumers. Moz said that businesses on the top three local search results on Google receive 70% of the clicks. This shows that local lead generation services are crucial. Small Business Trends reported that it can yield a return on investment (ROI) of up to 800%.HubSpot found that 63% of marketers see generating traffic and leads as a challenge.

Local lead generation requires consistent effort and time. A positive mindset helps you stay resilient in your strategies and overcome challenges. A growth-oriented mindset allows you to adapt to changes in the digital landscape. This helps you implement new strategies as necessary. One good example is ranking well in Google. Search Engine Journal said that 75% of users never scroll past the first page of search results. A customer-focused mindset helps you create content that resonates with the local audience. This leads to higher engagement and conversion rates. Therefore, combining effective digital strategies with a positive mindset helps lead generation efforts.

With the right mindset and the business model’s proven success, you can earn a passive income in no time. So, if you’re into a low-risk, high-return investment, try local lead generation .

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.