What is Passive Income?

Passive income is money earned from online business models, royalties, rent collections, and investments that require little to no effort to manage. It differs from income received from a contractor or employer. Passive income is a form of "earned income".

Passive income means that you can receive money without working. But, all passive income will require some level of effort to set up.

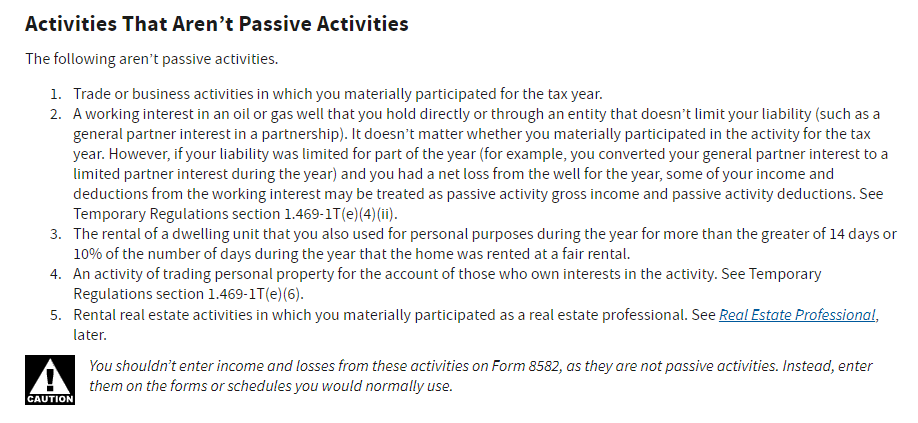

The IRS defines passive income as “two kinds of passive activities. Trade or business activities in which you don’t materially participate during the year. [Or] Rental activities, even if you do materially participate in them, unless you’re a real estate professional.”

Passive streams of income definition: The practice of having multiple businesses or assets earning money for you with little to no effort.

Passive category income definition: “Passive category income” has the same definition as passive income”.

Progressive passive income: Money earned with a little effort.Online Income Definition

Online income is money earned through the use of the internet. There are dozens of ways to make money online- all with no office, car, or even employees.

Other Definitions of Passive Income

Passive residual income definition: Money left over after taxes, expenses, and debts brought in from a passive income stream.

Form W-8BEN-E passive income definition: money from “dividends, interest, rents, royalties, annuities.” You must file this form if you’re a foreign company getting a withholdable payment or another payment that falls under chapter 3 withholding (Nonresidents/ foreign corporations). You’ll also need to fill out the form if you maintain an account with an FFI (foreign financial institutions).

PFIC passive income definition: Money from a foreign personal holding company that includes interest, dividends, royalties, annuities, rents, sale of property, and more. PFIC stands for Passive Foreign Investment Companies.Definitions of Passive Income Outside of the US

Passive income definition FATCA: The FATCA passive income definition includes dividends, interest, rents and royalties, annuities, net gains from transactions, foreign currency exchange gains, net income from notional principal contracts, cash value insurance contracts, and sales of assets. FATCA, or the Foreign Account Tax Compliance Act, dictates how foreign assets are reported.

Passive income definition Canada: Money earned from property, either physical or capital, with little to no effort from the owner. This is also the CRA passive income definition. CRA, or the Canada Revenue Agency, is like the IRS.

Passive income definition CRS: Money from cash value insurance contracts, swaps, foreign currency gains, dividends, interest, futures, forwards, options, rents, royalties, annuities, money from sale or exchange of financial assets. CRS stands for Common Reporting Standard for the HSBC, or the Hongkong and Shanghai Banking Corporation Limited.

Passive income definition ATO: Money from a trust, distributions, capital gains, royalties, rents, and interest. ATO stands for the Australian Taxation Office.

Base rate entity passive income definition: Money from non-portfolio dividends, partnerships, trust, franking credits, capital gains, interests, rents, royalties, or qualifying security. This is in line with the passive income definition in Australia.

Passive income definition OECD: Money earned when “the recipient does not participate in the business activity giving rise to the income, e.g. dividends, interest, rental income, royalties, etc.” OECD stands for Organisation for Economic Co-operation and Development.

Passive income definition NZ: In New Zealand, passive income typically comes from ETFs, stocks, and anything else that earns money with little to no effort.Passive Income Examples

The different types of passive income are asset building, asset sharing, and investments.

Asset Building Passive Income Ideas

Asset building passive income ideas involve time and effort upfront to start the business. Once set up, these assets may continue making money with no effort. Most asset building passive income business models include the creation, sales, and promotion of a product, service, or intellectual property. Some examples include:

Or, you can sell as a side hustle:

Asset Sharing Passive Income Ideas

Passive income through asset sharing involves boosting your personal finance by renting out assets you already own. For instance:

- Rental property- Rent is passive income.

- Rental real estate activities, like hosting an Airbnb- as long as you don’t spend any time managing it yourself.

- Digital real estate

Local Lead Generation is both Asset Building and Asset Sharing

Local lead generation involves owning your own digital asset- a website that features a phone number for a local business. Once this website is created and ranked organically to the top of Google’s front page, you rent this website out to real small businesses. They pay you a cut of the profits they receive off of your leads.

What are Good Passive Investments?

Some good passive investments are:

Interest (capital gains), and self-charged interest (when lent to an S Corporation or partnership)

Cash dividends, dividend stocks, dividend index funds

Bonds

Private equity

High-yield savings accounts or certificate of deposit savings account

Peer-to-peer lending (amount earned changes according to your borrower's credit score)

Real estate investment trusts

Crypto staking

Limited partnership

Acting as a silent investor in a company

Owning a business, but having no active role

Dividend investing is generally the most profitable passive income. But, if you’re a beginner that wants to build their portfolio income, start with a high yield savings account.

How Much Do You Need to Invest for Passive Income?

To make passive income, you need to invest between $0 and $20K+, depending on the business model you decide to use. Here are some examples of appropriate initial investments for different passive income examples:

$10,000: Amazon FBA wholesale

$15,000 - $20,000: Amazon private label

$500: Local lead generation

$100 - $2000: Affiliate marketing

$350 - $400: Podcasting

$2,000 - $5,000: Dropshipping

How to Generate Passive Income with No Initial Funds

To generate passive income with no initial funds:

- Sell items you already own on Amazon with retail arbitrage

- Sell digital products you created

- Write and publish your own book on Amazon KDP

- Promote affiliate links on social media

However, it’s unlikely that any of these will be profitable enough to make passive income without some sort of initial investment.

What are the Benefits of Passive Income?

Increased cash flow for no or little exchange of your time

Financial freedom

Reduce stress with more income

After you have one source of passive income set up, scale to more streams of income. The benefit of having additional streams of income is that you can enjoy the entire list above two times over, or even ten or 50 times over.

Can Passive Income Make You Rich?

Yes, passive income can make you rich. You can make anywhere from $100 to millions of dollars from a single passive activity. It depends on the business models you choose, the skills you have, how much you scale, and how much initial investment capital you use to start your businesses. (Dropshipping isn't easier than affiliate marketing, and it's not passive). But it is a way to make a ton of money online in 2024.

You can make $1000/month by running a YouTube channel, selling an online course, or setting up a single local lead generation site (though typically these bring in more than just $1K).

You can also earn a living from a passive income opportunity- not just some extra cash. Some people can do this by scaling a single income stream. They might add more options to their private label brand on Amazon, or add3 or 4 more local lead generation websites.

You can earn $10K in passive income a month by following any of the passive income ideas listed. But, scale to multiple income streams so that you aren’t relying on just one. Also, you’ll need to invest more to make more. Check out these top 50 passive income streams while working full time.

How Can a Beginner Make Passive Income?

A beginner can make passive income by:

- Creating and selling digital products, like planners, journals, or low content ebooks

- Automating systems like lead generation in digital marketing

- Taking surveys

- Collecting rewards from a credit card

- Selling products you find on clearance online via Amazon online arbitrage

- Building a blog or faceless YouTube channel

- Build "rank and rent" websites

Beginner passive income will almost always be less than experts’ passive income. So, be wary of overnight success stories when it comes to online businesses, for example, PPC advertising or affiliate marketing. Often, these stories omit the costs that go into their successes- usually in the tens of thousands of dollars and most are not passive income.

Passive Income and Taxes

Do You Pay Tax on Passive Income?

Yes, you pay tax on passive income. There is no differentiation in tax rate between passive or active income; you'll always pay tax on your gross income. But taxes aren’t always the same, depending on the type of income you’re generating. For example, you’d owe no tax for capital gain if you make less than $80,800 and are filing as married, filing jointly. You also owe no taxes on interest payments from municipal bonds.

Which States Do Not Tax Passive Income?

The only states that do not tax passive income are those with no income tax at all. All other states tax all income, whether passive or active. States without an income tax are:

Wyoming

Washington

Texas

Tennessee

South Dakota

Nevada

Florida

Alaska

Does Passive Income Affect Social Security?

No, passive income will not affect social security benefits, as long as you do not need to physically work on the business at all. Even your rental property can continue to bring income, besides your benefits.

How Does the IRS Know If You Have Rental Income?

The Internal Revenue Service knows if you have rental income because of audits, public records, filed paperwork, and even neighbors. If you fail to report the income, they can fine you or even charge you. So, always report any income you have to the IRS.

How Does a Limited Liability Company Pay Income Tax?

A Limited Liability Company, or LLC, does not pay taxes. Instead, the members of the LLC receive funds from the LLC and they are taxed. So, if you are the sole owner of an LLC with a passive income stream, you will still pay income tax on whatever you bring in.

What is Considered Non Passive Income?

Wages, investment income, business income, retirement income, and any other income that you earn through active work is non passive income. The difference between active and passive income is that active income requires effort, while passive does not.

Passive portfolio income definition: Money from dividends, savings accounts, bonds, or unemployment benefits, fall under the definition of portfolio income rather than true passive income in this context. There are many definitions of income.

Passive investment income definition: All money collected from investments, like dividends, interest, and real estate investing.What is the Difference Between Passive Income and Unearned Income?

Unearned income can include money from child support or alimony. Passive income does not include these categories in a taxable year. So, while these incomes technically involve no effort to earn, they are not really in the same category.

Is Online Income the Best Way to Earn Passive Income?

Online income can be the best way to earn passive income, if you choose the right business model. Even investment type passive income, which is generally considered the best passive income, runs a higher risk than a business model like local lead generation. Local lead generation requires a small investment, which you use to build a digital asset that you own. You won’t run out of stock, because there is no end to the leads you can generate for small businesses. You remain in control of this asset, with no larger platform dictating your next move.