Building a passive income can be a great way to generate extra cash flow. As a young adult, aiming to produce any form of passive income can help set you up for financial abundance as you move forward in your career.

Here are passive income ideas for young adults:

Keep in mind that achieving the items listed above is challenging, nor is it a quick fix for financial problems. It requires careful planning, smart investments, and consistent effort. Still, young adults don't have to focus solely on their careers and retirement plans. Instead, creating unique ways to generate passive income can give you a financial boost as you begin your adult life.

Passive Income Ideas for Young Adults

Generating Local Business Leads

Local lead generation is a business strategy that involves generating leads or potential customers for local businesses in a particular area or region. The lead generator uses various digital marketing techniques to connect local businesses with potential customers who are interested in their products or services. This can help the businesses increase their sales and revenue, while the lead generator earns a commission for every successful lead or sale.

Young adults can benefit from local lead generation as it can provide a source of passive income. By building a website that ranks high in Google search results or having an increased social media presence, they can attract prospective customers to the local businesses, and earn monthly commissions on every sale or lead generated.

Moreover, local lead generation does not require significant investment or overhead costs, making it an ideal business model for young adults who may have limited resources. With the right strategies and techniques, they can generate a steady stream of passive income while helping local businesses grow.

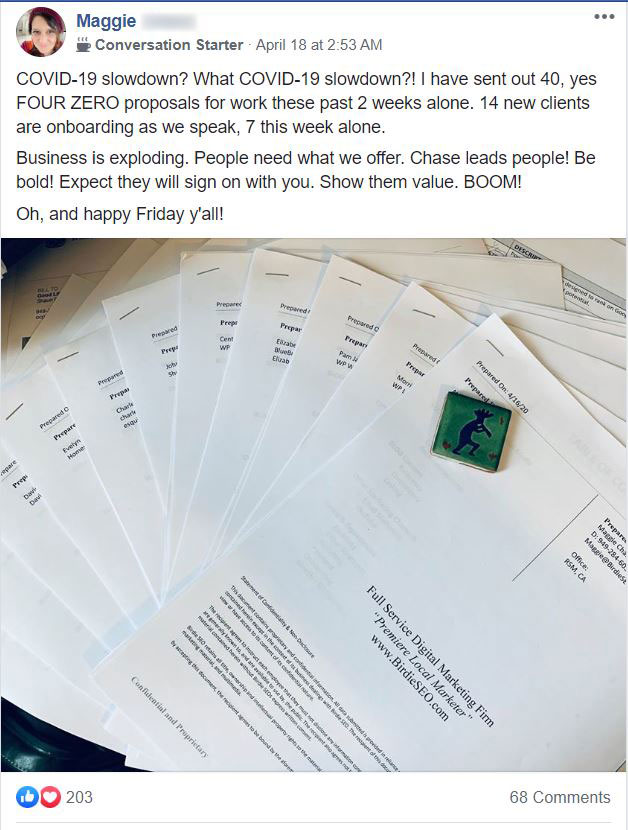

Success Story of an Entrepreneur Generating Leads

Jonathan Dane is a successful entrepreneur who is well-known in the digital marketing industry as the founder and CEO of KlientBoost, a California-based digital advertising agency that specializes in pay-per-click advertising, conversion rate optimization, and landing page design.

Dane started KlientBoost in 2015 with the goal of providing clients with a more personalized and results-driven approach to online advertising. Under his leadership, KlientBoost has grown rapidly and has been recognized as one of the fastest-growing companies in the US. The agency has also received many awards for its work, including a 2023 Google Premier Partner award.

Dane also emphasizes the importance of building relationships with his clients and understanding their specific goals and objectives. He takes a collaborative approach to working with his clients, ensuring that their input and feedback are integrated into his strategies.

Through his hard work, dedication, and innovative strategies, Jonathan Dane has become a highly successful lead generation expert. His agency, KlientBoost, has worked with plenty of clients in various industries, helping them achieve their lead generation goals and drive business growth.

Creating a YouTube Channel

When you consider the number of searches, 2 billion monthly active users, and minutes spent on site, YouTube is the world’s second largest search engine. That is why creating a YouTube channel can be a fantastic way for young adults to generate passive income. It’s a powerful platform for building a brand, promoting products, and making extra money.

The first step towards a successful YouTube channel is to identify your niche and target audience. Choose a topic that aligns with your interests and expertise, and one that creates a sizable following. Know your competition and determine what makes your channel unique and what value you can bring to your YouTube viewers.

Once your niche has been established, start creating high-quality content that resonates with the theme of your channel and the appetite of your audience. Use keywords and tags to optimize your videos for search engines and consider collaborating with other YouTubers to expand your influence and reach.

As your channel grows, you can start monetizing your content through various means. The common means to earn through YouTube include YouTube ads, brand sponsorship deals, merchandise, and affiliate marketing. With sufficient hard work and dedication to your objectives, a successful YouTube channel can generate a significant amount of passive income.

The challenging part about this idea is that creating content and maintaining your YouTube channel can require immense time and commitment. The good news is that even if you're in school or working at your 9 to 5 job, you can still implement a strategy to earn passive income out of your channel, like YouTube automation.

Success Story of a Young Adult YouTuber

Safiya Nygaard is a YouTuber who first gained popularity as a video producer for BuzzFeed. In 2017, she started her personal YouTube channel and, at the time of writing this article, she has amassed a following of over 9.64 million subscribers. According to Yahoo, she earns an estimated $187,917 per YouTube post.

Safiya’s content is primarily focused on fashion, beauty, and lifestyle. She is loved for her quirky and creative video ideas, such as wearing only one color for a week and trying out different beauty products.

Her success on YouTube has led to various other opportunities, including a book deal and collaborations with major brands such as ColourPop. She was also featured in various media outlets, including The New York Times and Forbes.

Real Estate Investing

Similar to YouTube, real estate investing can be a powerful way to build passive income streams. These are the three ways you can build a passive income stream in real estate as a young adult:

Building a rental property portfolio

Investing in rental properties is an excellent strategy when your aim is building long-term wealth through rental income and real estate appreciation.

Pros and cons of building a rental property portfolio

Pros

Rental income

Real estate property appreciation

Tax benefits

Cons

Lack of liquidity

Huge upfront payment

Varying upkeep costs

Possibility of working with difficult tenants

Investing in real estate crowdfunding platforms

This idea will allow you to pool funds with other investors to purchase and manage real estate projects.

Pros and cons of investing in real estate crowdfunding

Pros

Asset diversification

Access to real estate market with smaller capital

Access to real estate projects

Cons

Lower returns

Lack of liquidity

Risk of default

Investing in real estate investment trusts (REITs)

These investable assets are publicly traded companies that own and manage income-generating real estate properties.

Pros and cons of investing in REITs

Pros

High dividend yields

Portfolio diversification

High asset liquidity

Cons

Dividends are taxed similarly with ordinary income

Sensitivity to fluctuating interest rates

Property-specific risks

While these opportunities may be lucrative and present you with multiple ways to earn passive income, it’s also important to do intensive research before investing in real estate, as this asset class can be complex and risky.

Conduct your study of the local market, evaluate potential real estate properties, and consider factors such as property management, maintenance, and vacancy rates. With a commitment to smart investing and consistent effort, you can take advantage of this passive income opportunity and build a firm foundation for your financial future.

Success Story of a Real Estate Investor

Brandon Turner is one of the successful young adults who focused on investing in the real estate industry.

He co-founded BiggerPockets, a real estate investing education platform and widely recognized as a leading expert in real estate investing.

Turner began his real estate investing journey in 2007 when he purchased his first rental property at 21. Since then, he began building his portfolio by purchasing rental properties in different markets.

Later on, he co-founded BiggerPockets, which has since become the leading online resource for real estate investing education. The platform provides plenty of information, including articles, podcasts, and online courses, and has an estimated community member of over 2 million.

Besides his work with BiggerPockets, Turner continues to invest in real estate. According to his LinkedIn Profile, he has built a portfolio of 7,400 rental units spread across the country.

He is also an author of the top-selling title, The Book on Rental Property Investing, which garnered over 700 five-star reviews and constantly ranked in the top 50 business books in the world on Amazon.

Investing in Dividend-Yielding Stocks

The easiest passive income stream is owning dividend stocks that yields high returns. It is also one of the most straightforward means of earning extra money for young adults.

Dividends are regular payments that companies make to their shareholders to distribute their profits. By investing in stocks that pay dividends, you get a passive income stream by earning a share of the company’s profits without having to actively manage the investment. The more shares you own, the higher your dividend payout.

To maximize your income in this type of income stream, you can consider:

The tricky part in this passive income idea is to select the right company in the stock market. While investing in dividend stocks poses a relatively low-risk way to earn passive income, it also involves market risk and requires intensive research and analysis.

Success Story of a Dividend Investor

One young adult who has achieved significant success through dividend investing is Joseph Carlson.

Carlson is a finance YouTuber who started his YouTube channel, ‘The Joseph Carlson Show,’ to share his journey towards financial independence.

He is a proponent of long-term investing and believes in building a portfolio of high-quality dividend-paying stocks. His disciplined approach to investing has allowed him to amass a diversified stock market portfolio of dividend-paying stocks that consistently generate passive income.

He emphasizes the importance of researching companies thoroughly before investing and stresses the need to focus on company fundamentals, such as earnings growth, dividend growth, and financial stability.

One thing that sets Carlson apart from other personal finance influencers is his transparency. He regularly shares his investment portfolio and provides updates on his financial progress. He is open about his successes and failures and encourages his audience to learn from his experience.

Building an Online Business

Another idea you can consider earning a passive income source is building an online business. Leverage the power of the internet and use your skills and passion to create a profitable business on platforms such as Amazon and Shopify or engage on profitable services such as Amazon FBA or Walmart Dropshipping. These ideas will generate income long after your initial effort is put in.

Here are a few ways building an online business can cause passive income:

E-commerce

One of the most popular ways to generate extra income is through the ecommerce space. You can create or source out the creation of an online store and sell products. You can also leverage social media to promote your products and employ services such as Amazon FBA or Walmart dropshipping to manage the shipping and handling of your goods.

Pros and cons of e-commerce

Pros

Low startup cost

Potential for higher income

Worldwide reach

Business scalability

Cons

Potential loss during site crash

Highly competitive

Potentially longer shipping times

Products can’t be tried and tested

Digital product

Creating and selling digital products such as an online course, ebooks, printables, and software can be an excellent source of passive income. When you create a specific product, it can be sold multiple times, requiring no additional effort on your part.

Pros and cons of creating and selling digital products

Pros

Inventory management is simpler

Delivery is easy

No sales limit for each product

Cons

Smaller payout per transaction

Highly competitive

Concerns for product piracy

Affiliate Marketing

Affiliate marketing is promoting other people’s products and earning an affiliate income through a respectable commission for each sale made through your referral or affiliate link. If you're unfamiliar with how affiliate marketing works, there are various affiliate marketing courses you can take online to help you succeed with this idea.

As a young adult, this can be a great way to earn extra money. All you have to do is attach your referral links to your social media and website platforms to increase visibility.

Pros and cons of affiliate marketing

Pros

Relatively low cost to set up

Minimal expertise needed to manage

Convenient and flexible

Work at your own pace

Cons

Can be highly competitive

A need to constantly generate leads

Revenue is not guaranteed

Approach can be perceived as spammy

Online Advertising

You can also monetize your website or blog through advertising. Display ads from Google AdSense or other advertising networks and earn another source of income stream for each click or impression.

Pros and cons of online advertising

Pros

Lower cost

Can target specific customers

Wide range of content format

Improved customer interaction

Cons

Limited ad space

Concerns for data privacy

Declining ad clicks

Site visitors can block ads

Online Membership

Some people have specialized knowledge or skills. If you’re one of them, you can monetize them by creating a membership site and offer exclusive content to paying members. You can charge a recurring subscription fee for unrestricted access to your content.

Pros and cons of creating a membership site business

Pros

Highly flexible

Highly scalable

No overhead costs

Income potential is limitless

Cons

Highly competitive

Development process may be complex

Site maintenance and upkeep

Longer sales process

Success Story of an Online Entrepreneur

Pat Flynn is one of the young adults who achieved a stable passive income stream by building several online businesses and affecting millions of people worldwide.

He was one worker who was laid off in the 2008 financial crisis. To get back on track and earn money to help support his family, he turned to online business ventures. In his projects, he discovered that he had the passion for teaching others how to achieve the same success.

One project he developed is The Smart Passive Income Podcast because he believed podcasts are essential tools to learn about business strategies and management. Through his show, he revealed his online business and blogging strategies, marketing tips, income sources, and best practices to achieve financial freedom.

Since 2010, Flynn’s show has earned multiple awards and has been featured in The New York Times. Because people realized the immense value that his podcast brings to the table, it garnered about 60 million downloads!

Investing in High Yield Savings Account

If you seek the best passive income idea for young adults, consider investing in a savings account or certificate of deposit (CD) that gives a higher interest rate.

The best thing about this income source is that you won’t have to do anything besides selecting the nation’s top savings accounts and CD rates. With high yield savings, it’s best to transact with an online bank because it will allow you to gain access to the top rates across the country. If you’re going to a local bank, your options might be limited.

Another advantageous factor that this high yield savings account has is that your principal money is covered by the Federal Deposit Insurance Corporation (FDIC) up to a maximum limit of $250,000 if your banking institution is insured.

Pros and cons of creating a membership site business

Pros

Higher interest rates

Principal is FDIC insured up to $250,000

Compounding interest

Funds are easily accessible

Returns are not correlated to market fluctuations

Cons

Interest rates may change

Potential fees

Account subject to withdrawal restrictions

Inflation may hurt returns over time

The risky part about these savings accounts is inflation. It will play a big part in determining the purchasing power of your money in this account.

Nevertheless, having a savings account that gives a higher interest rate is still a great passive income option over holding your money in cash or in a non-interest yielding checking account where you’ll get nothing.

Success Story of a High Yield Savings Account Investor

One young adult who has achieved success with a high yield savings account is Michelle Schroeder-Gardner.

She is the founder of the personal finance blog Making Sense of Cents, where she shares tips on budgeting, saving money, and investing.

Michelle started her blog in August 2011 when she was in her early 20s and before she finished her finance MBA. One strategy she used to achieve financial independence was to maximize her savings in a high yield savings account.

As her blog grew in popularity, Schroeder-Gardner monetized it through various means, including affiliate marketing and sponsored content. However, it was her creation of an affiliate marketing online course that really propelled her business forward, help pay for her student loan debts, and maximized her cash flow.

Through her success, Schroeder-Gardner has become a sought-after speaker and has been featured in major media outlets such as Forbes and CNBC. She is a powerful advocate for financial education and encourages others, especially young adults, to save money early and often to achieve financial freedom. Her success is a testament to the power of disciplined saving and smart investing.

Taking Part in Peer-to-Peer Lending

Peer-to-peer (P2P) lending allows investors to lend money to individuals or businesses for interest payments. As a young adult, you can earn passive cash flow through P2P lending by investing your money in loans offered on these platforms.

The process in P2P lending involves selecting a P2P lending platform, also known as ‘marketplace lending platforms,’ like Lending Club or Prosper, creating an account, and then browsing available loans to determine which offering matches your investing objectives. Once you select a loan, you need to transfer funds from your bank account to the platform, which will then lend the money to the designated borrower.

As the borrower makes repayments on the loan, you’ll receive a portion of the interest payments as passive income. The amount of money you earn from this setup will depend on the interest rate of the loan and the amount you initially invested.

One benefit of P2P lending is that it’s one of the passive income streams that offers relatively high returns compared to traditional savings accounts or bonds. However, there is also a higher level of risk involved, like the possibility that the borrower will default on the loan, resulting in a loss on your part.

To mitigate the risk, you can do:

Success Story of a Peer-to-Peer Lending Investor

Peter Renton is a successful individual who has made a name for himself in the world of peer-to-peer lending. He is the founder of Lend Academy, which is a leading educational resource for investors interested in peer-to-peer lending.

Renton moved to Denver, Colorado, in 1991 to expand his family’s printing business. He became interested in alternative investment options such as peer-to-peer lending, and in 2009, he started investing in this lending practice through various platforms.

After researching and investing in various peer-to-peer lending platforms, Renton saw the need for an educational resource to help investors navigate this new investment landscape. He founded Lend Academy in October 2010 to provide investors with the knowledge and tools they need to succeed in peer-to-peer lending.

Through Lend Academy, Renton has shared his knowledge and experiences with thousands of investors worldwide. He has become a leader in the industry, and he is often featured in financial media outlets such as Bloomberg and Forbes.

Creating an App

The financial reward of creating an app is like creating an online course. Both of them require a huge amount of initial investment of time and then you get to reap its benefits upon completion and as time passes. As a young adult, creating an app gives you the potential to generate another passive income source.

Unlike a traditional 9 to 5 job that requires trading time for money, passive income from an app can be earned 24/7 with no constant supervision. The global app market is booming and there’s a constant demand for innovative and useful apps that can impact people's lives.

If you can identify a gap in the market and develop an app that solves a problem or provide a valuable service, it might attract a large user base and generate significant income.

Here are some ways you can achieve a passive income source through app creation:

Success Story of a Young Adult App Creator

Ben Silbermann is a young adult who has achieved outstanding success in the tech industry by co-founding and creating Pinterest, a social media platform with mobile app availability that allows users to discover and save ideas for projects and interests. Silbermann had previously worked at Google and had experience in designing user-friendly products.

Silbermann and his co-founders worked tirelessly to develop a unique and user-friendly interface for Pinterest, which allowed users to easily save and organize images and content from around the web. They also focused on building a strong community around the platform, which included features like the ability to follow other users and create collaborative boards.

One of the key factors in Pinterest's success was its ability to tap into a previously underserved market: women. By offering a platform that allowed users to easily discover and organize content related to fashion, home decor, and other topics that were popular among women, Pinterest quickly gained a devoted following.

Over the years, Silbermann has continued to lead Pinterest through many challenges and opportunities. He has overseen the development of new features and products, such as the ‘buyable pins’ feature that allows users to purchase products directly from the platform.

Through his leadership and vision, Ben Silbermann has created one of the most popular and influential social media platforms in the world. His success with Pinterest serves as an inspiration to other young adults who are looking to create innovative and impactful products in the tech industry.

Writing blogs

As a young adult, you can earn extra cash by creating a blog because it can be a platform that provides knowledge, ideas, and experiences with a larger audience. As you build an audience and establish yourself as an authority in your niche, you can monetize your blog through various strategies, such as affiliate marketing, display advertising, sponsored posts, digital products, membership sites, and consulting or coaching services.

Once you have created content and implemented your monetization strategies, your blog can continue generating income and improving your finance with minimal effort.

Writing blogs can also provide a platform for networking and building relationships with other bloggers and industry experts in your niche. This can lead to collaborations, guest posts, and other opportunities to expand your reach and grow your dedicated audience base.

Blogging can be done and started by anyone. It is also one of the passive income ideas for stay-at-home moms that can help them earn extra profit.

Also, if you want to start a blog business, you can check my article about the blog course of My Freedom Empire and The WordPress Studio.

Success Story of a Young Adult Blogger

One successful young adult who became successful in the world of blogging is Ella Mills, also known as Deliciously Ella.

Mills started her blog in 2012 while she was studying at university, as a way to share her journey towards healthier eating habits after being diagnosed with a rare illness.

Her blog, which features plant-based recipes and lifestyle tips, quickly gained a large following and has since expanded into a successful brand. She has authored several cookbooks, opened multiple delis and cafes in London, and launched a podcast.

Mills' success can be attributed to her relatable and engaging writing style, as well as her passion for healthy living. Her blog offers a wealth of resources for those looking to change their diet and lifestyle, and her honest and transparent approach has earned her a loyal following.

In addition to her success as a blogger, Mills is also a successful entrepreneur and philanthropist. She has used her platform to raise awareness of various causes, including mental health and sustainability.

Selling Photos and Videos Online

Selling photos and videos online is a great passive income idea because it allows you to monetize your skills in photography and videography. As a young adult, you may have a natural talent for capturing high-quality images or producing engaging videos that can appeal to a wider audience.

There are several platforms and marketplaces available that allow you to sell your photos and videos online. You can use stock photo websites like Shutterstock, iStockPhoto, and Adobe Stock to upload and sell your photos around the world. For video assets, you can sell them on marketplaces like Pond5, VideoHive, and Shutterstock.

What’s best about this passive income idea is that once you upload your digital assets, they can be sold or downloaded repeatedly with no ongoing effort on your end.

Each photo or video you sell on these marketplaces entitles you to royalties and would make up the entire passive income for this idea. As an Adobe Stock Contributor, your earnings will depend on how your assets are downloaded. Platform users can buy them with varying options, such as subscriptions, on-demand, or extended licenses.

You’ll earn a 33% commission per image download. So for subscription-based downloads, you’ll earn between $0.33 and $3.30. It’s higher for each extended license download—$21.12 to $26.40.

It’s also a higher figure for video assets. You’ll get a 35% commission for each video download. This makes up a subscription-based download earning of around $2.80 to $7.84 and an on-demand download earning of $22.40 to $70.00.

The key here is to upload as much high-quality digital assets as you can. This idea may require substantial effort, but since these marketplaces have a wide user base, it’ll be easier to increase your sales potential and capitalize on this passive income opportunity.

Success Story of a Young Adult Selling Photos Online

One young adult who has achieved outstanding success in selling stock photos online is Ryan Longnecker. Longnecker began his photography journey in high school when he joined an after-school photography club where he learned about the darkroom process. In his senior year, he took up the responsibility of becoming the yearbook photographer.

As his skills and portfolio grew, he tried selling his work online through various online platforms such as Adobe Stock.

Through careful research and trial and error, Longnecker learned how to optimize his photos and videos for successful sales on stock photography platforms. He pays close attention to market trends and creates content that is in high demand, such as lifestyle and travel niche.

Over the years, Longnecker has built a successful business selling his photos and videos online. His work has been purchased and used by various clients for advertising, marketing, and editorial purposes.

Longnecker's success in selling photos and videos online is a testament to the power of passion, hard work, and a keen understanding of the market demand for high-quality visual content. With the rise of digital media, the demand for quality images and videos is constantly increasing, creating opportunities for young adults like Longnecker to succeed in the stock photography industry.

Why Is It Important To Start Thinking About Passive Income Early On?

It’s important to think about passive income early for four reasons: investment growth, financial security, learning experiences, and more time to pursue your passion.

What Skills Can You as a Teenager Learn To Earn Money at an Early Age?

As a teenager, these are the various skills you can learn to earn money at an early age:

By learning these skills early on, you can start building a portfolio and establishing your brand, which can help you earn passive income in the future. Additionally, by starting early, you have more time to hone your skills, build a network, and create a firm foundation for your future career.

Final Thoughts: Turning Your Money on Autopilot

Turning your money on autopilot refers to generating passive income. As a young adult, there are various ways to create passive income streams that require upfront effort and investment, but then generate ongoing cash flow with minimal effort.

By building passive income streams, young adults can set themselves up for financial abundance as they move forward in their careers. It's important to note that generating passive income isn't a quick fix for financial problems and requires careful planning, smart investments, and consistent effort.

If you’re looking for a unique passive income opportunity, consider local lead generation. It’s a growing industry that allows you to generate consistent income by helping businesses generate more leads and sales. You can also check out these top 50 passive income streams while working full time.