Stedman Waiters Review: Funding Business With the Prove It Method?

Stedman Waiters teaches people to start their own funding businesses. He teaches his “Prove It” method in his Wealth Builders Academy program. A funding business helps entrepreneurs and business owners access capital by connecting them with lenders. You earn commissions from successful funding placements.

Stedman Waiters reviews are positive based on testimonials from his students and clients across multiple industries. His funding company, Waiters Capital, has a 4.2/5 star rating on Trustpilot. Clients like its speed and professionalism.

In a July 2025 Sy Ari Not Sorry Show interview, Stedman Waiters describes his business as such: “I’m a middleman. We’re brokers. We get paid from the lenders directly. So on the alternative private money side, we’re the middleman. We basically secure the clients, qualify them, and basically take them through the client journey, but we’re not the actual ones lending the money at that time.” In my experience, being a middleman is the way to consistently make money online throughout the decades. It’s like how New York City will always need the subway system - people will alays need help getting to where they need to go. For Stedman Waiters, he helps young entrepreneurs get the funding they want for new businesses. But, for Stedman, there’s a major downside. This is not a passive business for him. As a funding middleman, every day is like being a traffic controller at O’Hare Airport in Chicago - you’re taking calls, talking customers through their next steps, for hours a day under extreme pressure. If a customer decides against funding with you, you don’t get paid. And, getting lenders to use you as a middleman sounds an awful lot like trying to get hired at a traditional 9-5 job. The lender is in control of the success of your business, as they could choose to not use you at any time. Just like a director of a movie like One Battle After Another has the ultimate control over actors brought in by a casting agent, the lenders have control over the investors final choices - and your employment.

I’ve built multiple 6-figure online businesses with little starting capital. This article reviews Stedman Waiters and his “Prove It” method of operating a funding business. It covers Stedman’s background, all the way back to his first college-age investment. We also weigh his claims about the funding business against the realities of doing this in 2025."

Stedman Waiters: Pros and Cons

Pros

- Stedman is actively handling deals with Waiters Capital

- His training programs cover multiple funding types and credit repair

- Stedman offers a Skool community for support and coaching calls

Cons

- Stedman does not disclose the pricing of his programs

- You do not get paid with the “Prove It” model if you do not close

- Stedman’s strategy is long-term and may be challenging at the start

What Is Stedman Waiters’ Prove It Method?

Stedman’s “Prove It” method only charges the clients when the loan is received. It removes all financial risk for the borrower. Most funding businesses require upfront payments ranging from $2,000 to over $10,000. Stedman’s team handles the entire process from analyzing the client’s financial situation and credit to negotiating with lenders. When the client receives the loan, Waiters Capital takes 2% to 6% of the funded amount.

The “Prove It” approach forces accountability that other funding businesses avoid. Since Stedman doesn’t get paid unless he delivers actual funding, he must maintain strong relationships with multiple lenders. This makes his work easier and quicker in the long-run. However, this relationship with lenders means that only qualified businesses can work with him.

Who Is Stedman Waiters?

Stedman Waiters is an entrepreneur from Las Vegas, Nevada. He is the founder of the business funding company Waiters Capital. Stedman has an interesting background in athletics, engineering, and entrepreneurship. Originally from Snellville, Georgia, he played D1 football as a linebacker at Georgia Southern University while majoring in electrical engineering. After a short professional football career, he worked as an electrical engineer for 4 years.

Stedman started a credit repair business while maintaining his engineering job. He took advice from a teammate and invested $25K in a funding business mentorship. He founded Waiters Capital in 2021 and grew it for 1.5 years before resigning from his engineering job. It has facilitated over $40 million in business funding and connected over 200 entrepreneurs and business owners with direct lenders. Waiters Capital clients include restaurants, auto dealerships, medical practices, and ecommerce businesses. Many of these clients were looking for starting capital, while others sought expansion funding.

What Are Stedman Waiters Claims About a Funding Business?

- Earn over $10,000 with only 2 monthly “high-ticket transactions” ranging from $50,000 to over $500,000 per deal.

- Earn commission rates between 2% and 6% of funded amounts.

- The business requires only minimal time investment.

- Scale income exponentially by increasing deal size rather than client volume.

- Stedman’s “Prove It” model uses exclusive lender relationships to gain competitive advantage.

- Create multiple revenue streams through funding commissions, credit repair services, and referral partnerships in a recession-proof business model

- Achieve six-figure annual income within 12-18 months.

The Realities of Funding Brokering

- The National Association of Commercial Finance Brokers reports that only 15% to 20% of brokers earn over $100K annually. The Commercial Finance Association found that 340% more brokers entered the market since 2019, making high-ticket deals extremely competitive. New brokers typically secure deals under one hundred thousand dollars, not the five hundred thousand dollar transactions Stedman suggests.

- Commercial Finance Online and the Business Finance Association reveal that average broker commissions range from 0.5% to 2% for standard deals. 4% to 6% commission rates are only available in high-risk loans requiring 3-5 years of niche expertise.

- The Small Business Finance Association and American Commercial Finance Association report that successful brokers work 50-60 hours weekly and require 12-18 months of full-time networking to establish sufficient lender relationships.

- Federal Reserve data shows commercial funding approval rates drop 45-60% during economic downturns. Commission-based financial services experienced 3x more income volatility. The National Federation of Independent Business found that 73% of small businesses prefer working directly with banks, while successful brokers must contact 75-100 prospects to generate one qualified lead.

- The Conference of State Bank Supervisors reports that 23 states now require specific licensing for commercial finance brokers, while the Consumer Financial Protection Bureau has increased scrutiny, requiring enhanced documentation and disclosure procedures that add administrative overhead.

Stedman’s claims represent the top 5% to 10% of funding brokers under ideal market conditions. It does not reflect the typical experience of newcomers entering a saturated market. A successful funding business involves extensive relationship building and 18 to 24 months of consistent effort before achieving meaningful income levels.

What Is Stedman Waiters’ Wealth Builders Academy?

Wealth Builders Academy is Stedman’s training platform that teaches people to start, grow, and scale a funding business. It offers recorded training modules, live coaching calls, and community support. Both the free and paid versions are available through Skool.

The Academy covers multiple funding types, such as 0% interest funding and personal loans, and business term loans and lines of credit. Stedman teaches both the technical aspects of funding and the business development skills needed to attract and retain clients. Students learn how to create automated marketing systems so they can focus on building relationships with direct lenders.

How I Earn $52K Passively As a Middleman

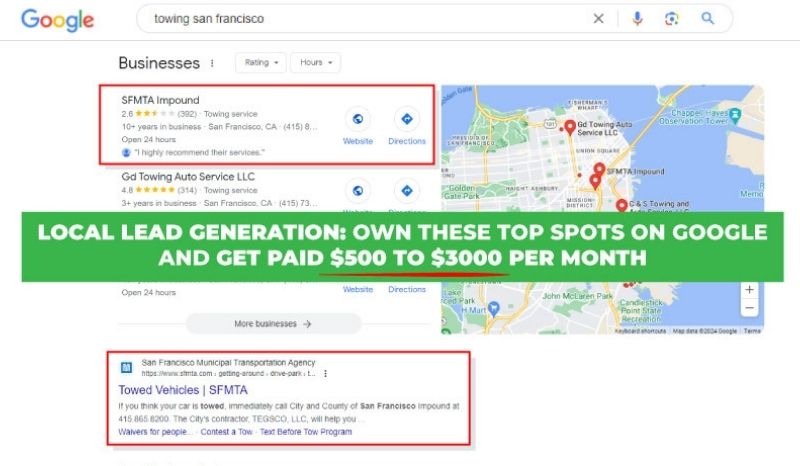

I earn over $52K a month by renting out lead generation websites to local businesses. I connect customers with local service-based businesses like HVAC, plumbing, and tree care. Customers search on Google for local services. By ranking my websites on Google using SEO, the sites attract organic traffic. I then sell these leads to local businesses or rent out the sites for a monthly fee. When a site is ranked and rented, it earns $500 to $3,000 a month passively.

My site Glendale Elite Hardwood Flooring 1106 S Central Avenue Glendale, California 91204 818-732-4711 https://www.glendaleeliteflooring.com/ regularly brings in about $42,394 per month in business for my client. This is a 10% commission of $4,239 for me that I didn’t have to work for. Instead of clocking in every day as an air traffic controller, I am more like master puppeteer Geppetto, with many valuable digital assets under my total control. My websites are like Pinocchio when he comes to life, except my sites need much less guidance. The difference from Stedman Waiters’ funding business is that I can leave the puppets and they continue to work. I do a bit of maintenance on them from time to time, but they bring in leads consistently. If a client decides they want to go another route with their marketing, I simply offer my asset to someone else. It’s as simple as owning a boat rental company on the St. Croix River in Stillwater, Minnesota. When my clients don’t want to rent a pontoon, they don’t take my business with them. I keep the pontoons, speedboats, and sailboats in my fleet, and just rent them to the next customer. And, just like Midwesterners on a 90 degree, humid day who want to cool off in the river, many small businesses are interested in jumping into my ranked site. In my opinion, it’s much better to rely on this passive income than try to essentially land at least 1 sale per day.

With a funding business, you need to constantly find deals. This means competing with older funding businesses with more connections and longer track records. Alternatively, renting out a local lead generation website earns a stable income every month. You can focus on scaling instead of running marketing campaigns and outreach. You don’t even have to worry about saturation as you can choose your market from hundreds of niches and thousands of local areas. Check out our local lead generation program to learn how it works. You can even earn while learning by generating leads for my client for over 8 years.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.