Wealth Builders Academy Review: What Is Stedman Waiters' DBA Hack?

Stedman Waiters’ Wealth Builders Academy is a funding business training platform. It teaches students to start, grow, and scale their own funding businesses. One of their main methods is their DBA hack, or “Doing Business As” hack. Wealth Builders Academy’s lessons cover multiple funding types, including business term loans, equipment financing, and merchant cash advances. Students learn to connect business owners with lenders and earn commissions from successful funding placements with Stedman’s “Prove It” method.

Wealth Builders Academy reviews are positive based on testimonials from students and clients. Students appreciate the step-by-step training and ongoing support. I found no complaints about the program.

In my experience of over a decade in online business, becoming a business loan broker like Wealth Builders Academy teaches is like trying to dropship a blender for $100 when someone can buy the same product on Amazon for just $90. You really add no unique value to the product, but you’re able to make some money because not all prospects look at alternatives. Furthermore, you’ll need to cold call and pitch hundreds of businesses to find just a few interested ones that don’t already have a direct connection with an established bank for business loans or business credit cards. This is like Will Smith in the Pursuit of Happyness, where his character Chris Gardner must persist through rejection after rejection to sell medical equipment. Once you do find some interested prospects, you’ll need to evaluate their financial history to determine if any of your lending partners would be interested in financing their business venture. That requires the collection of documents like bank statements and tax returns, which businesses can be slow or even reluctant to provide. It’s like trying to encourage an old horse with a bail of hay when they’re contemplating whether to live or die.

This article reviews Wealth Builders Academy and its unique DBA hack to a funding business. It includes what you get with the program, such as direct lender access and automation tools. I also briefly discuss how a funding business works and what skills do you need to be successful.

Wealth Builders Academy Pros and Cons

Pros

- Strong community support on Skool

- Direct lender relationships and insider access

Cons

- No pricing publicly disclosed

- Overoptimistic claims

- Success depends on your sales and networking skills

Price: Wealth Builders Academy pricing is not publicly disclosed.

Refund Policy: Wealth Builders Academy does not display any refund policy

Origin: Wealth Builders Academy was founded by Stedman Waiters alongside Waiters Capital in 2021.

What Is Wealth Builders Academy’s DBA Hack?

Wealth Builders Academy’s DBA Hack is a business structuring strategy that helps funding brokers secure approvals for clients in “high-risk” industries. Here’s how the DBA hack works:

- Consultation process: The broker advises clients to form a new LLC with a neutral name like “Precision Services LLC” or “Summit Solutions LLC” instead of “Mike’s Auto Repair LLC.” The client then registers their original business name as a DBA under the new entity.

- Application submission: The broker submits the funding application using the generic legal entity name rather than the industry-specific DBA. This allows the application to bypass automated screening systems that flag high-risk industry keywords.

- Favorable classification: The broker selects neutral NAICS codes like “All Other Support Services” instead of industry-specific codes that trigger automatic rejections. The business description focuses on general services rather than specific industry activities.

Stedman teaches brokers to restructure their clients’ businesses using generic legal entity names while maintaining industry-specific DBA (Doing Business As) registrations. By advising clients to separate their legal business entity from their marketing identity, they can bypass automated lender screening systems that reject certain industry names.

Most funding brokers struggle with clients in industries like auto repair, restaurants, construction, and beauty services because lenders automatically reject applications containing these keywords.

For instance, a client who was rejected three times as “Premium Auto Detailing LLC” might get approved for $75,000 when restructured as “Precision Services LLC” with a DBA registration. Wealth Builders Academy’s DBA hack helps students successfully fund clients that other brokers cannot help.

What Do You Get With Wealth Builders Academy?

- The full funding broker training curriculum

- Access to direct lender relationships and banker connections

- Templates for sales scripts, contracts, and client onboarding

- Live coaching calls with industry experts

- Private Skool community with over 170 active members

- Credit repair training for additional revenue streams

- Automation tools and plug-and-play website systems

- Optional paid 1-on-1 support for students who need individual guidance

How Does a Funding Business Work?

A funding business involves acting as a middleman between business owners needing capital and lenders. The business can be broken down into several steps:

- Lead generation: Find business owners who need funding through networking, referrals, or marketing campaigns.

- Qualification: Assess the business’s credit score, revenue, and funding needs to match them with appropriate lenders.

- Lender matching: Connect qualified businesses with direct lenders, banks, or alternative funding sources based on their specific requirements.

- Deal facilitation: Guide both parties through the application process, documentation, and approval procedures.

- Commission earning: Receive payment from the lender upon successful funding.

The business model requires no inventory, minimal overhead, and can be operated remotely. Success depends on building relationships with both business owners and lenders.

What Skills Do You Need to Succeed as a Funding Broker?

- Sales and communication: Ability to build rapport with business owners and present funding solutions effectively.

- Relationship building: Networking skills to develop connections with both clients and lenders.

- Industry knowledge: Understanding of credit, lending requirements, and various funding types.

- Persistence: Handling rejection and maintaining consistent outreach efforts.

- Professional presentation: Credibility and trustworthiness when dealing with high-value transactions.

- Time management: Balancing multiple deals and maintaining organized follow-up systems.

Success typically requires 6-12 months of consistent effort to reach significant monthly income levels. Jumping as a beginner with no connections will be very difficult. The business demands patience and long-term relationship building.

Who Is Stedman Waiters?

Stedman Waiters is funding broker from Las Vegas, Nevada. He graduated from Georgia Southern University with a degree in electrical engineering and played D1 football as a linebacker. Before entrepreneurship, Stedman worked as an electrical engineer for 4 years. He founded Waiters Capital in 2021 using his systematic “Prove It” approach to business funding. Stedman has connected more than 200 entrepreneurs with over $40 million in business funding.

What is my top remote business model?

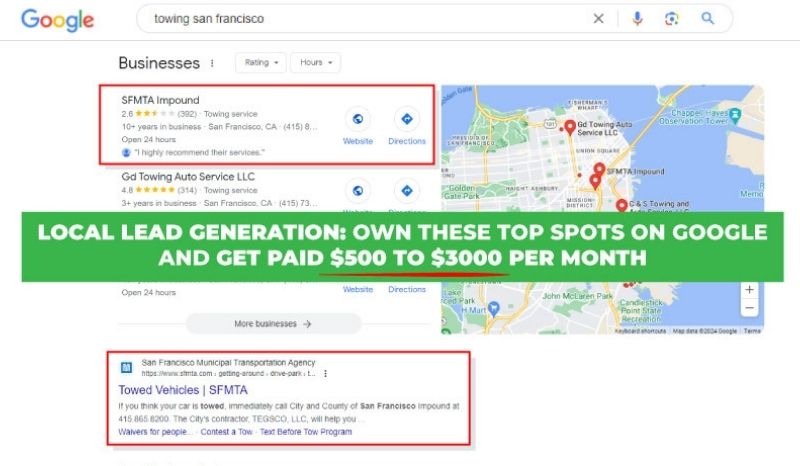

My top remote business model is local lead generation because you set up digital assets that can generate long-term passive income.

One of my local lead gen sites is Pasadena Elite Concrete Solutions 2849 East Foothill Boulevard, Pasadena, California 91107, 626-628-1311 https://pasadenaeliteconcrete.com/. Last month, it generated 43 leads and the business owner closed $33,278 of new business. We have a 10% commission deal in place, so they paid me $3,328 for the month.

In my opinion, an online funding business is like chasing fish underwater when you could just throw some bread in the water and catch all the fish with a net. You need to spend considerable time prospecting and contacting leads, when you could just let the leads come to you like local lead generation does. Why chase money when you can just attract it? That’s the beauty of local lead generation websites. You’re building assets that consistently bring prospects to you through Google and selling those prospects to others, instead of buying prospect lists and spending energy hunting them down one by one like a loan broker does.

You can scale a local lead gen business by replicating the rank-and-rent process across hundreds of niches and thousands of local markets. This approach earned me $52,000 a month in passive income. Check out our local lead generation program to learn more. You can even earn while learning by selling leads to one of my long-term clients.

Follow Me

Ippei Kanehara

Founder/CEO

$52K per month providing lead generation services to small businesses

Ippei.com is for digital hustlers, industry leaders and online business owners.

His #1 online business recommendation in 2024, is to build your own lead generation business.