Business Lending Blueprint is a 6-module online course by Oz (Oguz) Konar that teaches entrepreneurs and business loan brokers effective ways to start and grow their lending businesses. This comprehensive business training system aims to help you scale your monthly revenue to 6-7 figures while working part-time or full-time. It focuses on the core components of a lending business, such as loan application, credit history checking, business funding, alternative lending options, and projected interest rates.

According to the Forbes Advisor April 2025 Survey, 42.4% of business loan applications in the U.S. are mainly for business expansion. This means that the industry will continue to grow as most small businesses recover from the COVID-19 pandemic. But because banks are getting stricter with the loan application process, many business owners are switching to alternative financing options like peer-to-peer lending and crowdfunding. However, this industry entails a meticulous startup process, financial proficiency, and in-depth knowledge of local laws and regulations.

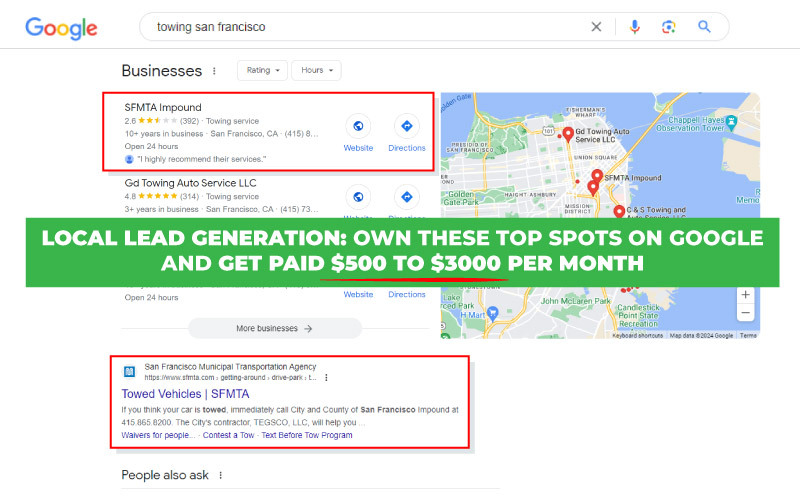

Unlike the lending business industry, local lead generation is easy to set up and scale. You don’t need to search for interested individuals to make significant monthly income because your target audience is ready to buy. By creating local service sites that are organically ranked high on Google, you drive a sizable volume of leads. And forwarding these leads to local business owners can make you 5 to 6 figures in passive income with this online business model.

Business Lending Blueprint Review: Pros and Cons

Pros

You can find numerous reviews and student testimonials about the Business Lending Blueprint course.

Oz (Oguz) Konar has a huge following on social media.

The course has flexible payment terms.

Oz’s company is listed in the Inc. 5000, which features the fastest-growing companies in the U.S.

Cons

Business Lending Blueprint doesn’t offer an overview of its modules.

Oz showcases free workshops about his course offerings but doesn’t disclose the actual prices.

This business model is complex and requires legal and financial proficiency.

Price

Business Lending Blueprint costs $2,197. You can also pay in 3 monthly installments of $845 per month.

Training

Business Lending Blueprint is self-paced.

Group

Oz offers free access to his Business Loan Broker Blueprint Facebook group (2.5K members).

Refund Policy

The course has a 90-day refund policy but is subject to specific conditions.

Origin

Business Lending Blueprint started in February 2018.

Following

Oz (Oguz) Konar has 35K YouTube subscribers, 45.3K Instagram followers, and 3.4K Facebook followers.

Any time you have to put up over 2k for the program before you even know how the program operates should tell you the company preys on those who are desparate to make a dollar. Key words that will tell you there is a significant investment are: funnels, Google and fb ads.

I don’t recommend this course to beginners! it takes over a month to finish the entire course. If you’re short on time and have only a few hours to spare, then don’t expect for a refund. The coaching was not worth it for me.

What Do You Get With Business Lending Blueprint?

You get access to a 6-module online course, weekly one-on-one Zoom calls with your business coach, U.S.-based customer service, and weekly Q&A calls with Oz Konar with Business Lending Blueprint. They also give exclusive access to a community of learners, reputable lenders, and a board of mentors through your Business Lending Blueprint login to the website.

Business Lending Blueprint will show you how to:

- Earn up to $25,000+ per month

- Start and grow your lending business

- Set up an LLC

- Properly check credit scores, credit history, loan portfolio, and business credit

- Manage financial institutions or lenders and borrowers

Who is Business Lending Blueprint for?

Business Lending Blueprint is for entrepreneurs and aspiring business loan brokers with or without experience and expertise. It is also perfect for individuals who want to quit their 9-5 job or want another income source as a part-time or full-time employee. Yes, you can make money with Business Lending Blueprint as an online business. This course will help potential students build their online business loan brokerage and make money through the alternative lending industry.

Is Business Lending Blueprint Worth It?

Business Lending Blueprint is worth it if you can acquire the necessary skills, strategies, and foundational knowledge for starting a successful and compliant lending business through the course. You also get access to Business Lending Blueprint downloads on the website. According to Step By Step Business, this industry has a revenue potential of $72K-$300K yearly.

Oz (Oguz) Konar also claims that the lending business is resilient to recessions. This fact is also supported by David Mashian in his LinkedIn article. While this business model is lucrative even in economic difficulties, there are still many recession-proof businesses out there.

Is Business Lending Blueprint Legit?

Yes, Business Lending Blueprint is legit. It is registered under the business name Massive Action Consulting Co, Inc. Business Lending Blueprint is also listed in the Inc. 5000.

What Do Business Lending Blueprint Students Say?

Business Lending Blueprint students say lots of positive reviews about the course. While there are no Business Lending Blueprint Reddit reviews, the course has a 4.4-star rating on Trustpilot (27 reviews) and a 4.9-star rating on SoTellUs (740 reviews).

These screenshots from the Business Lending Blueprint website show how one student closed a $105K funding deal, and another student made a $1,200 commission for a single deal. Some of Oz Konar’s students were also into other passive income streams while working full-time.

While some students gave 5 stars for gaining valuable knowledge on starting a lending business, there were still some who thought the course was a waste of time and money.

Who is the Founder of Business Lending Blueprint?

Oz (Oguz) Konar

Oz (Oguz) Konar is the founder of Business Lending Blueprint and the President of Local Marketing Stars. He is a multiple 7-figure business owner and business consultant living in New York City. Oz is also an established business loan broker and coach. He authored The Ultimate Guide to Online Marketing For Small Businesses and Start-Ups and 10 Ways To Grow Your Practice In The New Age Of Marketing. Oz has also been featured in well-known publications like Huffington Post and Entrepreneur.

Oz started his career as a Territory Manager in Heartland Payment Systems shortly after graduating from Montclair State University in 2009. He went from one sales job to another before realizing that he wanted his own business. In March 2013, Oz founded his first marketing agency called Local Marketing Stars. Five years after getting hundreds of inquiries about the alternative lending industry, he began the Business Lending Blueprint. Now he has members from across 11 different countries. According to various online sources, Oz Konar’s net worth is estimated to be in the millions.

What Other Programs Does Oz Konar Offer?

4 Lending Business Mistakes of Business Loan Brokers

1. Targeting the Wrong Customers

As a business loan broker, you need to specify your target market to avoid creating unsuitable services or business terms. For example, a small business owner potentially has bigger loan needs than an individual borrower. Investopedia states that the average amount for personal loan borrowers is $8,018, while small business loans are at $663,000 as per the Federal Reserve’s latest data. You also need to screen your borrowers strictly by checking their credit scores, credit history, and loan portfolios.

2. Improper Business Management

The alternative lending industry is complex as it needs to balance the needs of the lender (creditor) and borrower (debtor). If you lean towards one party, the other party could easily lose trust in your lending business and cancel the transaction. Consider proper legal advice when drafting and finalizing business fees, contracts, and loan conditions. You should also consider numerous factors when granting loans. Watch out for bad credit, high debt-to-income ratio, and negative cash flow.

3. Creating Unrealistic Revenue Goals

Some business loan brokers focus only on big deals. While this is profitable, it’s not sustainable in the long term. Your borrowers will vary from small and large businesses to individual debtors. The types of loans you offer are also essential in creating your revenue goals. For example, a term loan like the Small Business Administration loan (SBA loan) has a longer repayment term (5-25 years) than a business line of credit (2-10 years).

Another thing to consider is the collective amount of loans in your target market. According to LendingTree, personal loans in the U.S. are at $222 billion in 2025, while business loans are at $645 billion in 2019 per the Small Business Administration. Thus, you must take into account all types of loans.

4. Restricting Your Growth

Most loan brokers stop when they reach their business goals. But to be a successful business loan broker, you must continuously learn and grow your business. One way is to diversify your business by expanding your loan services to more groups of people. Understand the market’s loan behavior and originate strategic offerings based on it. Just be sure to check personal credit scores and business credits to prevent unsecured loans. You can also partner with more financial institutions or creditors to have more loan options when matching lenders and borrowers.

Joining a comprehensive course like the Business Lending Blueprint is a great way to seek guidance from an expert. These coaching programs allow you to create your business blueprint or success roadmap.

What are the Common Practices of Successful Business Loan Brokers?

Is It Profitable To Be a Business Loan Broker?

Yes, it is profitable to be a business loan broker. Oz Kunar’s team claims that their students make around $15K-$25K within their first 30-60 days. And Step By Step Business also states that the annual profit potential for the alternative lending industry is $58,000 to $120,000.

However, this amount depends on factors like economic stability, foreign exchange, citizens’ buying power, inflation, and many more. Pandemics and other major global crises also affect the profitability of this industry. That’s why some entrepreneurs and aspiring business owners dive into various online businesses. You can also earn from digital assets like websites and blogs. These platforms offer significant digital real estate passive income of up to 7 figures.

Related Articles on Starting a Business

Local Lead Generation is Simpler and More Profitable Than Lending Businesses

The alternative lending business model can make you sizable monthly revenue. It can offer a positive cash flow without using your own money. However, this industry is unstable. In fact, in the Federal Reserve Banks' 2021 Small Business Credit Survey, 43% of small business owners still borrow money from large banks and 36% from small banks. Only 23% apply for loans from alternative online lenders. These values declined from a higher rate back in 2019.

While being a business loan broker gives you big commissions, local lead generation offers a simpler, more stable, and more profitable way to make money online in 2025. You don’t need to be legally and financially proficient to succeed with this business model. Plus, it doesn’t require you to do stringent credit history checking and debtor screening. All you need is to build local microsites and rank them high on search engine results. This will push local leads to contact you. And by selling these high-quality leads to local businesses, you make up to $52,000 in passive income monthly.

I was a member here, does that give me access to the website

Based on the course details, yes. You can check out more information about Oz Konar’s online groups on his website.