The Advanced 11 Hour Options is a trading course created by Dave Aquino, one of the seasoned traders of Base Camp Trading. This workshop aims to help traders generate a weekly paycheck (11 hours per week) by using Dave's exact options trading framework. The course has eight lectures with three bonus videos. it also comes with detailed checklists, tip sheet and worksheets.

Before jumping to options trading, keep in mind that it’s a high-risk-high-reward investment. According to a report published by Forbes, 90% of traders fail and most of them had huge financial losses. Even Cory Michael of Vantage Point Trading had a notable remark about the trading industry. In one of his interviews, he said that only 1% of traders are successful or make money. That’s why it’s imperative to measure your risk tolerance to avoid financial hiccups in the long run.

Let’s find out if Dave Aquino is a trusted educator and if his Advanced 11 Hour Options trading course is worth your time and money. We will break down the coverage of his workshop and show you reviews from other sources to help you decide if this is the right course for you.

What is Options Trading?

Options trading is a popular trading method because it provides traders with more flexibility compared to other types of trading. This trading strategy involves buying and selling financial contracts (also known as options) at a specific price (strike price) and predetermined date (expiration date).

With options trading, you’re not really obligated to trade an underlying asset. Traders may exercise their options. However, you need to fulfill the contract when selling assets or options. Your assets are worthless when they reach the expiration date. And this is where things get more complicated. Timing is a crucial factor when trading options. That’s why it’s important to keep track of the trading market to mitigate potential risks.

Advantages of Options Trading

Disadvantages of Options Trading

Pros and Cons of Dave Aquino's Advanced 11 Hour Options Trading Course

Pros

Base Camp Trading Membership Access: Purchasing the course will give you one month of Base Camp Trading membership access, including 2 trading room access, extra learning sessions and more.

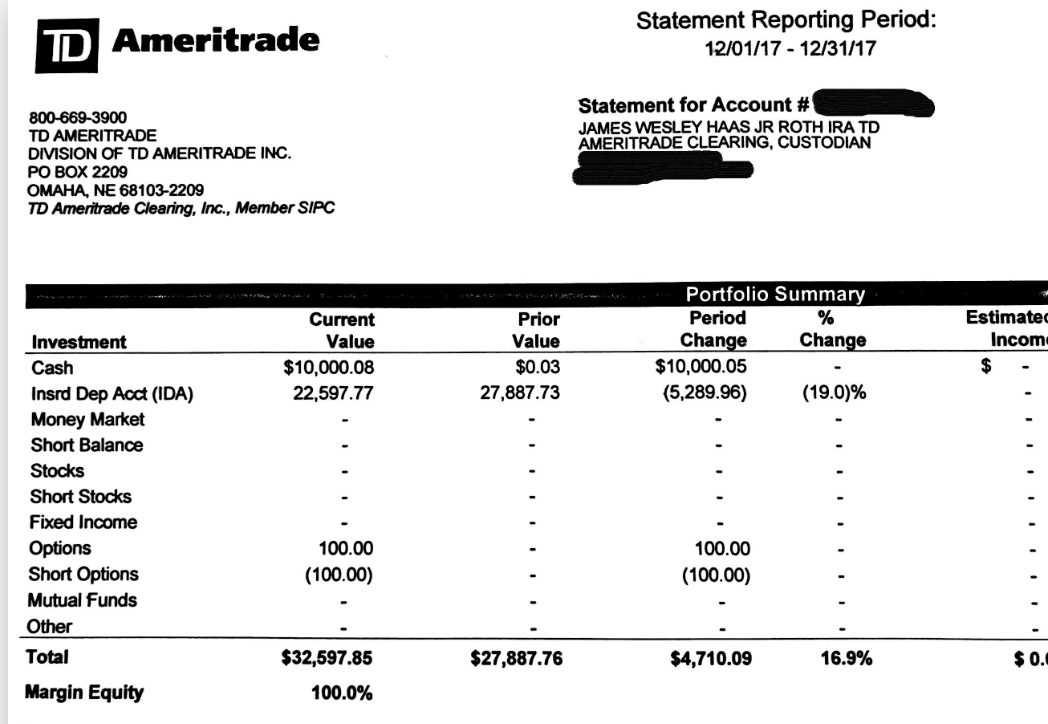

Detailed Case Study: There’s a success story posted on the site that includes transaction documents from TD Ameritrade.

Experienced and Successful Instructor: The site claims that Dave Aquino is a successful trader with years of experience under his belt.

Cons

Base Camp Trading Negative Reviews: There are a lot of negative reviews on Base Camp Trading, where Dave Aquino is affiliated to. Some people even call them the “Drew Day” scammers.

Too Good To Be True: Some claims seem too good to be true, especially in the trading industry. The 93% to 94%win rate is hard to verify, as it lacks proof to support it. The big discount also makes the actual value of the course.

Price

It costs $497 but they also have seasonal promos and offer the course for only $47.

Origin

The first version of 11 hours options trading was created in 2014. The creator modified it in 2017.

Refund Policy

They offer a full refund for a period of 1 month.

Reputation

The course creator, Dave Aquino, lacks an individual online presence. However, he is more visible on Base Camp Trading’s online channels. It has 32.3k YouTube subscribers, 169 Instagram followers, 1.6k Facebook followers and 6k Twitter followers.

Dave Aquino’s Advanced 11 Hour Options Review: Quick Overview

Dave Aquino created the advanced 11-hour options trading strategy for specific short-duration, high-probability credit spreads. According to Dave, it’s a common method used by Base Camp Trading members to develop consistent weekly credit spreads. He also mentioned that they have been using this technique for many years and have been providing them with consistent results with 95% wins and 5% profits per week.

Basic Principles of 11-Hour Options

In one of Base Camp Trading’s webinars, Dave emphasized that you don’t need to apply high-level math equations in 11-hour options trading. This makes it a lot easier to understand and execute when trading options.

He explained that the biggest factor in this strategy is identifying the “theta”, which refers to the option’s sensitivity to time. This amount increases rapidly as the option approaches expiration. For monthly options, the biggest rate of loss to time decay is in the last month. For weekly options, the biggest rate of loss to time decay is in the last 1 or 2 days. So, traders can use this market behavior to their advantage.

11 Hour Trading Options Key Notes

The 11-hour trading options encourage traders to:

Make high-quality or high-probability trades, succeeding 80% of the time or more.

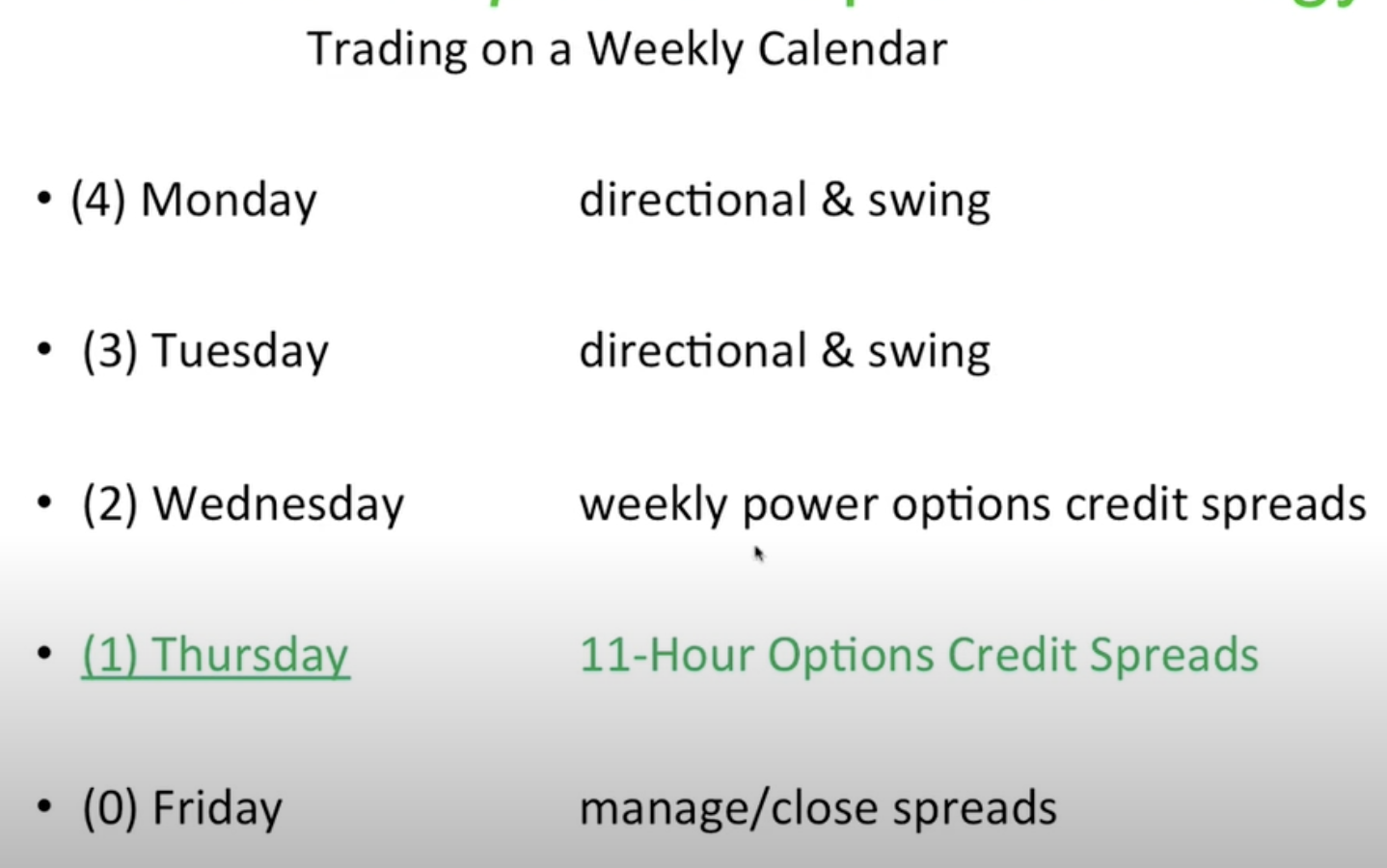

To aim for overnight trading focus (noon/afternoon on Thursday to 4 PM close on Friday. This timeframe is where Dave named his strategy the 11-hour options.

To consistently make a trade based on the Daily & 60-Minute Chart that you can access when you purchase the course.

Side Note: You can evaluate the quality 11-hour option trade by looking into the momentum strength and direction. Other factors you should check include the support and resistance, as well as the Fibonacci and extension levels.

What Do You Get From Dave Aquino’s Advanced 11 Hour Options Workshop?

Dave Aquino’s Advanced 11 Hour Options Workshop Coverage

Dave gives a short introduction about himself, including his personal background, work credentials and trading career. He will also discuss the basic principles of his trading strategy.

This module explains how 11-hour options trading works. This includes the key factors when applying the strategy, including recommended peak hours of the trade, collecting time decay, power of compounding, how to measure trading success and much more.

This module focuses on theta or the option’s sensitivity to time. In this module, Dave explains how traders can use theta to their advantage and how it can help minimize losses.

In this module, Dave will walk you through the step-by-step trading process using his 11-hour options strategy.

Dave answers some of the most asked questions about his trading strategy.

Focus on one or a few trading strategies that align with your personality, risk tolerance and trading style. This is one reason Maurice Kenny wanted to introduce his trading methods first before you can proceed to his VIP Trader Program. It’s advisable to practice your chosen strategies until you become proficient in executing them effectively.

Dave highlights the key factors to achieve high-quality trades and consistent results.

The final video includes actionable steps to help you get started with actual trading. Dave also teaches how to use his recommended trading tools, including their advanced features.

In this bonus video, you will learn how to evaluate the quality of your trades, so you can improve your strategies in the long run.

This module covers more detailed lectures on how to make your first trade, manage stop-losses and control trade positions to your advantage.

This video will teach you some fundamental trading techniques for TradeStation.

Who is Dave Aquino’s Advanced 11 Hour Options Workshop for?

Dave Aquino’s Advanced 11 Hour Options Review: Testimonials and Negative Feedback

There are only a handful of reviews on Dave Aquino’s Advanced 11-hour options trading workshop. And it’s hard to validate if these are genuine feedback from actual students since they are posted on their website. Unfortunately, I cannot find reviews from other reliable review sources.

11 Hour Options Success Story

Jim Hass

According to Basecamp Trading, Jim was a beginner when he started using Dave’s 11-hour options trading strategy. His initial plan was to use the 11-hour options strategy, but he changed his mind and went on SPX (S&P500). Jim was only aiming for a 4% to 6% return on every trade. He was also going for consistency over big gains. So, Dave recommended using the same strategy he showed in the trading room to get better results.

Jim mentioned that the biggest challenge he had with 11-Hour Options was finding the best way to cut his losses to exit the trade. But after watching Dave’s methods, he was curious about how they were getting 94% to 95% wins. He began using the exact strategy in November 2017 and noticed some huge changes.

In his interview, he mentioned that he took 7 trades with no losses the entire month. The following month, Jim made 10 more trades with no losses again. He did the same thing in December and still took a clean sweep. Overall, he had 100% wins in 27 trades and grew his account in just three months.

Negative Reviews on Base Camp Trading and Dave Aquino

As mentioned, Dave Aquino is affiliated with Base Camp Trading. While the organization has earned an excellent rating of 4.5 stars (based on 89 reviews) in Trustpilot, there are still negative reviews about them all over the internet. Some people are even calling them scam artists and all their workshops and trading tools are useless.

1. Gripeo

3. High-Income Source Review

4. Medium

Who is the Creator of the Advanced 11 Hour Options Trading Workshop?

The creator of the Advanced 11-Hour Options trading workshop is Dave Aquino. He graduated from Vanderbilt University in Nashville, Tennessee and is now a Managing Partner at Base Camp Trading. According to his bio, he has over 20 years of experience as a professional trader and portfolio manager. Base Camp Trading also claims that Dave began his career at Merrill Lynch and worked his way up the ladder to manage over $650 million in assets.

In one of his podcasts, Dave mentioned that he specializes in creating options income strategies for Vanguard Asset Trading. And today, he focuses on creating workshops to help individuals learn how to trade options for consistent results.

The Verdict: Is Dave Aquino’s Advanced 11 Hour Options Worth it?

Dave Aquino’s Advanced 11-Hour Options is not worth it. It’s just hard to recommend a workshop or a course creator with so many negative online reviews. Many researchers also said that the screenshots that were supposed to be proof of their students’ profits were not verified or audited by a third party. Options trading can still be a great option for those looking for the flexibility to make money anywhere in the world. However, if you want to learn more about options trading or day trading, it’s better to look for more reliable educators and successful traders.

7 Common Mistakes to Avoid in Options Trading

While options trading offers flexibility, it still requires a solid strategy. For example, how can you evaluate the quality of your trades? What indicators do you need to look for? Is there a specific timeframe you want to follow? These are some basic questions you should ask yourself before diving into options trading.

If you trade with no objectives or plans, you’ll just end up losing your money instantly. So, increase your chances of trading successfully by doing your research and understanding market behavior. Devise your entry and exit strategies by setting profit goals and measuring stop-loss levels. Be sure to stick to your plan to avoid hasty or impulsive trading.

Like day trading or any financial investment, It’s important to understand its basic principles. Some basic concepts you need to study in options trading include call and put options, strike price, expiration dates and the Greek payout (Theta, Delta, Vega and Gamma).

Over-leveraging is another common mistake when trading. While it can be tempting, avoid using too much of your capital on a single options trade. Set a profit benchmark and know your limitations. Avoid spending what you cannot afford to prevent a significant loss on a single trade.

Trading illiquid options can put you in a bad position. This can make it more challenging for you to enter or exit trades at fair prices. Take note that options trading is not as simple as selling shares at a specific market price. As an options trader, you should always be prepared to deal with the bid-ask spread. Stick to options with sufficient trading volume and open interest to ensure smooth execution.

This is another common mistake by both beginners and experienced traders. Don’t be deceived by the prospect of quick and massive gains. Remember, the higher the potential return is, the higher the risk. Stop chasing unrealistic profits and stick to your profit benchmark. Chasing high returns often leads to substantial financial losses.

Having a solid risk management strategy is vital in options trading. Find out how much you can risk on each trade. Set the maximum percentage of your trading capital and be sure to stick to your numbers. You can also try using risk calculator tools for options trading. The most recommended tools today are:

Option Finder

Options Profit Calculator

Options Industry Council (OIC)

OptionStrat

Unusual Whales

CBOE

Many experienced traders have been successful because they use stop-loss orders to protect their trading positions. A stop-loss order is like a price indicator that tells you when to buy or sell specific assets. This can help you prevent substantial losses when trading options.

Avoid putting all your money in a single options trade. Diversification is one way to mitigate risks. Explore your opportunities in other trading markets or asset classes, including mutual funds, ETFs, stocks and so on.

11 Hour Options Trading Course Alternatives

Final Thoughts: Local Lead Generation is a More Profitable and Safer Investment Option than Options Trading

If you’re looking for a more profitable and safer investment option than trading or options trading, local lead generation remains my top 1 online business recommendation. In options trading, the average return per trade is only 4.9%. The average profit margin per winning trade is 8.7%, while the average per losing trade can go up to 10.2%. So, even if you have the trading tools you need, the risks are always higher when trading.

The profit margin you can earn from local lead generation can range from 85% to 90%. Your cash flow is also more predictable compared to trading options. The goal of local lead generation is to drive high-quality leads to local businesses.

To attain this, you need to build, rank and rent service sites. So, the more high-ranking sites you build, the more potential earnings you can generate. Building and maintaining local lead generation sites are also not that expensive, making it a lot easier to upscale and maximize your profits. On average, you can earn $2,000 monthly per site. And the best thing about it is you can easily automate the operations, making it a lucrative passive income stream!