Bullish Bears is an educational platform, service, and online trading community for beginners and intermediate stock traders. It offers free and paid trading courses that cover day trading, futures, technical analysis, and more. Bullish Bears also highlight their trading room, including daily live streams by experts and providing real-world insights through their interactive community. Members can ask questions, share strategies, and engage with peers, making learning and trading more interactive and collaborative. There is also helpful tool for them to aid in their trading journey.

One Bullish Bear member is a college student and expressed how the program gave him the opportunity to earn while studying. Another testimonial is from a novice trader who has zero knowledge to becoming an expert. However, a Reddit review from a former member shared his/her experience regarding the website for not being user-friendly.

According to Investopedia, the financial markets have changed from a bear market to a bull market as of 2023. The S&P 500 shifted from a bear market to a bull market on June 8, 2023, after a 20% increase from its lows in October 2022. This transition shows a positive shift in the market and a general rise in stock prices during those specific periods.

In this article, we will dive into how Bullish Bears help stock traders, details on other offerings for the members, the cost of membership, and how effective their community engagements are. We also examine how local lead generation offers realistic passive income over day trading.

Bullish Bears Review: Pros & Cons

Pros

Bullish Bears offers a wide range of free and paid courses covering various aspects of stock trading, suitable for both beginners and intermediate traders.

The platform emphasizes community engagement, providing live streams, interactive forums, and real-world insights from experts.

The cost of membership is reasonably priced, offering monthly, annual, and lifetime subscription options, making it accessible to a wide range of traders.

Cons

The courses may not be applicable to all types of traders since different strategies are used depending on the external factors, such as liquidity, volume, and volatility in stock market.

Day trading involves risk and success is not guaranteed. Thus, learning the courses may forfeit the goal of steady income and profitability.

Price

The price for Bullish Bears membership costs $69.97 monthly subscription, 399 for 1 year access, and $597 for unlimited access.$69.97 monthly subscription; 399 for 1 year access; $597 for unlimited access.

Refund Policy

No refund available

Reputation

Bullish Bears earned 5.0 starts out of the 42 reviews. Most of the reviews are positive in terms of the cost of the services, courses offered, and support in their exclusive trading community. However, there was a former member who expressed his disappointment on the website not being user-friendly and no support was given regarding the problem.

How the Bullish Bears Platform Helps Stock Traders Succeed in the Market

Stock Traders can get knowledge and training from Bullish Bears course offerings. You can explore different trading styles, including day trading, swing trading, options trading, futures trading, and price action trading. Bullish Bears also offers trainings on the trading tools and apps used by traders.

What Free Training Courses Does Bullish Bears Offer?

The Stock Market Basics Course covers fundamental concepts for beginners. Participants learn about stocks, trading, and investing distinctions. Key topics include :

- Understanding ticker symbols

- Mastering day and swing trading timing

- Recognizing bullish and bearish trends

- Comprehending bid and ask prices

- Appreciating the significance of stock volume

- And more

The course guides individuals in discovering their trading style, developing a trading strategy, and creating an effective trading plan.

The Day Trading Basics Course covers essential elements for beginners. Topics include:

- Starting with penny stocks

- Knowing the PDT rule

- Mastering basic day trading strategies

- Understanding popular indicators

- Comprehending stock splits

- Knowing stock market hours

- Optimal trading times

- Mapping support and resistance

- Grasping the impact of float on price movement

- Exploring the pros and cons of short-selling

This course provides a comprehensive foundation for individuals entering the dynamic world of day trading.

In Swing Trading Basics, you'll discover:

- Distinctions between stocks and options

- Grasp purchasing stock shares and options contracts

- Comprehend bid-ask spreads

- Gain insight into blue-chip stocks

Additionally, the course covers fundamental swing trading strategies and indicators, highlighting the variances between cash and margin accounts.

This comprehensive learning experience equips you with essential knowledge to navigate the dynamic landscape of swing trading effectively.

Discover the fundamentals of options trading, exploring the advantages and drawbacks. Gain insights into the following topics:

- Buying stocks and options contracts

- Comprehend bid-ask spread dynamics

- Understand call and put options

- Grasp the concepts of strike prices—covering at the money, in the money, and out of the money scenarios

- Learn the options chain and unravel intrinsic and extrinsic values

- Explore open interest's role

- Know the concept of implied volatility

- Distinguish between margin and cash account

- And more

Bullish Bears' Candlesticks eBook explores popular patterns and trading strategies, simplifying candlestick complexities for valuable trader insights. The eBook serves as a practical resource for those wanting to understand and capitalize on market trends using candlestick analysis.

What Are Bullish Bears' Paid Training Programs?

The Day Trading Course provides comprehensive training on key aspects of day trading, covering topics such as:

- Scanning for top gappers

- Identifying support and resistance

- Applying popular strategies in real-world scenarios

The course emphasizes daily preparation, teaching students to scan for gapping stocks in the premarket and create a watch list. It also teaches charting skills, focusing on mapping support and resistance levels and identifying potential entry and exit areas.

Students learn popular day trading strategies and gain insights into implementing them during live market action.

The course also covers the entire day trading process, from premarket activities to live trading, and provides access to custom day trading scanners and indicators.

This Swing Trading Course covers the essentials of swing trading, exploring the distinctions between stocks and options. Participants learn to interpret charts and implement popular strategies in real-world scenarios.

The course delves into the pros and cons of stocks and options, emphasizing effective charting with selected indicators. Multiple swing trading strategies are reviewed, with guidance on their application to both stocks and options.

The curriculum also outlines daily processes, including charting and stock scanning, while highlighting various swing trading styles. Participants also gain access to custom swing trading scanners and indicators provided by Bullish Bears.

The Options Trading Course teaches selling options, spread strategies (credit and debit), and common trading methods. The course focuses on spreads, like credit and debit spreads, for their safety compared to riskier buying and selling. It covers different strategies, including day trading and weekly contracts, with a practical approach.

The Futures Trading Course covers essential aspects of trading, focusing on emini and micro futures. It helps students understand tick and point values, reading futures charts, and proper chart setup. Topics include margin, buying power requirements, and the application of popular strategies.

Participants learn the trading processes for $NQ, indicators, tick charts, short calls, and interpreting the COT report. Strategies covered include cut n reverse, opening range breakouts, and 2fer. The course also addresses trading tools like the 20-bar EMA, breakout trading, position sizing, scalping, and futures order entry.

The Price Action Trading Course covers essential aspects of candlestick and reversal patterns, emphasizing practical application in real-world trading.

The course explores popular patterns like flags, pennants, and wedges, providing real-world examples. It common reversal patterns such as spinning tops, tweezers, engulfing, and star patterns with practical illustrations. Additionally, the course teaches mapping support and resistance levels, as well as buy and sell zones.

Included resources are an eBook and custom wallpapers for reference, making candlesticks the focal point for reliable trading signals. Real-world trading examples are extensively shown for both patterns and reversals.

The course offers over 7 hours of live day trades and 1+ hour of live options trades, providing practical insights into applying trading strategies. Access the Bullish Bears custom day and swing trading scanners to enhance market analysis.

The live trades library serves as a valuable resource for understanding real-world application of trading strategies. Witness live day and options trades, and utilize custom scanners for both day and swing trading. Additionally, gain access to the Bullish Bears' custom Trade Ideas link, providing a comprehensive approach to trading education.

Are Bullish Bear Students Getting Results?

Yes, Bullish Bear students are getting results after joining their program. Some of the students' success stories started from zero knowledge to getting results after taking the trading courses.

Mike, a new trader, initially hesitant, now feels on the right path with the structured approach.

Another one is Nicholas, a business owner, credits the flexibility and supportive community for making trading feasible alongside family and business responsibilities, even achieving profitable trades.

Sarah, a busy professional, praises the accessible 24/7 courses and supportive community, boosting her confidence and yielding returns on trades.

The Trustpilot review for Bullish Bears praises the team for guiding a member with no day trading knowledge, helping them transition from struggling to trade to gaining a solid understanding of the stock market.

Despite ongoing challenges, the reviewer values the team's continuous support. representing Bullish Bears as a helpful resource for improving day trading skills.

However, a former member expressed dissatisfaction and labeled their service nonfunctional.

How Does Bullish Bears Help You Make Money?

Bullish Bears help you make money through realistic, and affordable stock trading education, fostering a fun trading environment. The community employs a three-step teaching model:

Bullish Bears aims to empower members, providing valuable insights and support for profitable trading experiences.

What Type Of Trader Is Bullish Bears Best For?

Bullish Bears is best for independent traders. Through trading community and educational services, Bullish Bears aims to teach individuals how to become expert day traders. The reality of day trading differs from get-rich-quick schemes, as independent traders use their own money and their income relies on their trading performance.

Unlike institutional traders, independent traders may have fewer market and platform choices, and limited resources to stay updated on news and price changes.

Best Trading Course For Beginners

The best trading course for beginners within the Bullish Bear's platform is the Stock Market Basics. This course introduces novice traders about the fundamentals of stock trading. The free course provides a comprehensive overview of stock market trading, helping participants understand the market, trading styles, investment strategies, and the creation of a trading plan. The key learnings include:

Requirements for the course include registering for a free Bullish Bears account, a strong motivation for trading, a desire to discover one's trading style, and a commitment to completing the course.

Like other best trading course for beginners, the content addresses essential factors like market workings, trading goals, and equipment considerations, offering insights into various trading strategies such as day trading, swing trading, futures, and options.

Who is Lucien Bechard?

Lucien Bechard is the creator of Bullish Bears, established in 2016. He is an entrepreneur with over 25 years of experience. Lucian is dedicated to educating individuals not only about the stock market but also about life and psychology.

The company, based in Connecticut, was co-founded by Tim Davis and Daniel Adams, with Rose Boye contributing as a futures specialist. The mission of Bullish Bears LLC is to offer an straight-forward, realistic, and affordable educational journey in a supportive environment and catering to beginner traders.

Lucien aspires to transform the community into a free service, driven by authenticity and a sense of purpose.

Is Lucien Bechard Legit?

Yes. Lucien Bechard is legit because he has established his online presence after getting Bullish Bears listed as one of the best trading courses in Investopedia, Business Insider, and Benzinga.

Bullish Bears also got tons of positive Google reviews expressing their wins in day trading and other trading styles.

Bullish Bears receives an excellent Google rating of 5.0 based on 42 reviews. Most traders praise the platform as an exceptional learning environment for both novices and experienced investors. The community extends to the Discord room where members assist each other.

Bullish Bears is commended for its affordability offering a comprehensive educational resource for different trading types. Traders also appreciate the interactive approach with the team, ensuring members understand concepts thoroughly. The platform fosters diverse learning, empowering traders to develop their personalized strategies.

What Is Day Trading?

Day trading is a trading strategy where individuals buy and sell financial instruments within the same trading day, attempting to profit from short-term price movements. Day traders rarely hold positions overnight, and they aim to capitalize on various markets, such as stocks, currencies, commodities, or futures contracts.

According to Gitnux, 40% of traders quit within a month and only 13% persist after three years. For the demographics, most day traders are 90.5% male. In 2020, the NYSE had a daily average trading volume of 6.3 billion shares. Day traders rarely make substantial profits.

In 2020, the NYSE saw 6.3 billion daily shares traded. Though winners are sold 50% more often than losers, the average day trader struggles to generate significant income.

How To Start Day Trading

Start trading using the following tips below.

Starting day trading requires careful planning and dedication. Unlike other business models, such as lead generation and affiliate marketing, day trading involves understanding stock markets and quick decision-making. Success isn't guaranteed, but logical decisions and effective risk management are essential for profitability.

Ross Cameron of Warrior Trading shares his knowledge on his YouTube channel about how to start with Day Trading for beginners. He emphasizes day trading relies on volatility, and the most volatile market time is in the morning, especially from 9:30 to 10:30 am. He also added that volume is crucial for liquidity, allowing traders to easily enter and exit positions.

Ross also focuses on trading at the market open, aiming to achieve his daily goal within the first 30 minutes with one to two trades. He identifies stocks with low-risk entry points is a challenge for every trader.

He encourages discipline and emotional control in day trading, requiring quick decisions based on a predefined strategy.

Ross emphasizes the importance of finding patterns and having a specific strategy to trade successfully. The strategy involves focusing on stocks with high retail interest, often gapping up on earnings or having significant news. He also mentions candlestick patterns, such as flags and pullbacks, are crucial in identifying potential trade opportunities.

Day Trading FAQs

Yes, $1000 a day trading is possible. The choice of trading strategy influences the capital required to make $1000 daily in forex. Strategies include day trading, swing trading, and position trading, each with its own risk-reward ratio. Risk management is also crucial for forex trading success. The level of risk accepted affects the amount of capital needed to achieve a $1000 daily profit.

The biggest mistake day traders make is setting unrealistic expectations. Setting unrealistic expectations is indeed a common mistake that day traders often make. Unrealistic expectations can lead to poor decision-making, emotional stress, and ultimately, losses in the financial markets.

95% of the day traders lose money is because of these 3 reasons based on Angel One:

- Traders often make the mistake of becoming too obsessed with indicators, relying on them blindly without understanding the market structure. Indicators should be used as tools, not considered as signals for trading decisions.

- Many traders enter the stock market to make quick profits rather than focusing on long-term growth.

- Some traders, especially newcomers, take positions that exceed their risk capacity, potentially risking their entire capital in a single trade.

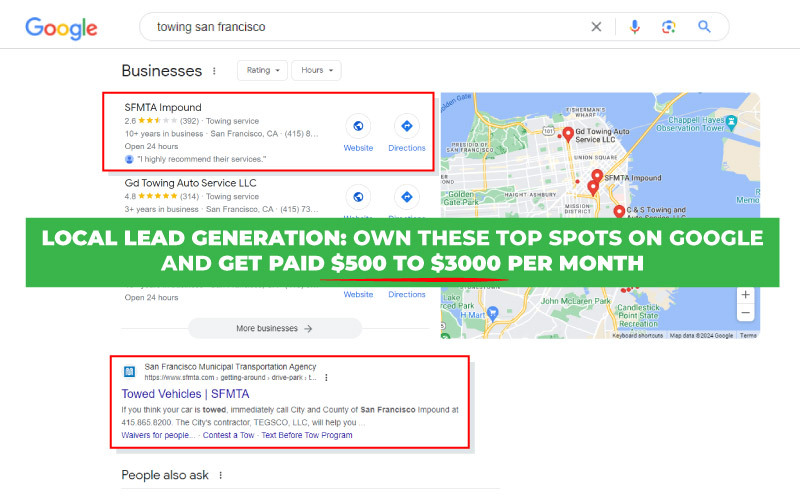

How Does Local Lead Generation Compare To Day Trading?

Local lead generation and day trading differ in their nature and goals. Day trading involves short-term buying and selling of financial instruments to capitalize on market fluctuations. It requires a deep understanding of financial markets, risk management, and quick decision-making.

On Karson Gaule's YouTube channel, she questions day trading, saying it's often risky and pushed by gurus who makes more money selling courses than trading. Day trading gurus are accused of being deceptive about their profits.

Investopedia reveals about 80% failure rate among day traders, debunking the idea of making a consistent one percent daily profit, proving its impractical.

In contrast, local lead generation involves creating and nurturing leads for businesses within a specific geographic area. This focus on long-term client relationships with low to no risk involved. Most importantly, it provides is more steady growth and helps you earn passive income.

No complex trading charts or tools needed to be profitable and experience gain. You don't even have to sit whole day at your desk and interpret if it's time to buy or sell. With local lead generation, you just have to invest in an organically ranked website that generates high-quality leads and sees realistic results.