The initial cost to start an ATM business ranges from $4,000 to $18,600. This includes the cost of the machine, initial cash refill, and set-up fees. You should also get a new internet connection and ATM insurance good for 1 year. Also prepare for the ATM business license fee, permits, and LLC set-up cost.

Here's a quick breakdown of how much is needed to start an atm business:

Cost Type | Estimated Cost |

|---|---|

Machines | $1,000 to $10,000 |

Cash Refill | $2K per unit per week |

Installation and Set-Up | $200 to $300 |

Internet Connection | $50 to $100 monthly |

ATM Insurance ATM Licensing and Permits LLC Set-Up Promotion Expenses | $400 to $700 annually $150 to $300 $100 to $200 $100 to $5,000 |

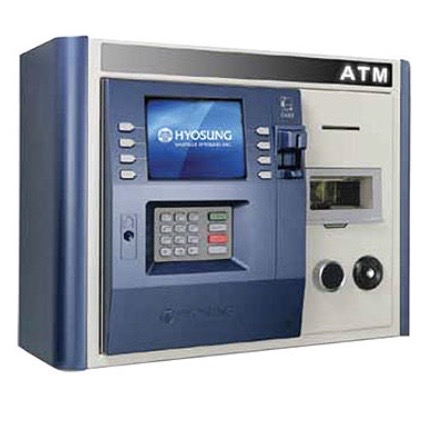

Other fees include maintenance and repair costs that range from $50 to $200. However, brand new units might be spared from this cost since they're covered by warranty. You can buy cheap brand new ones like Hyosung Halo II and Genmega Series. You also need backup cash to refill ATMs. Machines in high-traffic areas need at least $2K cash replenishment more than once a week. So, you need enough cash vault to refill ATM money machines.

This article breaks down the costs of starting an automated teller machine business. It covers the operational costs and the pros and cons of buying and renting an ATM. The costs of licenses and permits will also be discussed. I'll also share real-life examples from ex-ATM operators plus reasons why they quit.

Startup Cost of ATM Business: Detailed Breakdown

What are the ATM Business One-Time Costs?

Cost of the machines, delivery, and installation are the one-time fees in an ATM business. LLC formation and business set-up are also included. There are also fees for non-expiring licenses and permits (if applicable).

What are the Ongoing Expenses of an ATM Business?

Internet, rental fee, and lease cost are the common ongoing expenses of an ATM business. There's also maintenance and repairs if you're using old machines. Also account for utility and software updates. In some cases, a transaction fee to ATM networks may be applicable.

How Much Does a Brand New ATM Cost?

A brand new ATM range from $2,295 to $10,000. Price varies depending on the features, manufacturer, and ATM model. Machines with basic features are generally less expenses than the high-end ones. The basic ATM features include an LCD screen, EMV card reader, and electronic lock. They usually have a 1,000-note capacity cassette. High-end models offer advanced features. This includes a touchscreen interface, biometric verification, remote management, and customizable display. They also offer functionalities like fund transfers and coin dispensing. Some ATMs also let you choose wider denominations.

What is the Cheapest ATM Model?

Genmega G2500 is the cheapest ATM model. It costs $2,295 and has standard functionalities and features. This ATM has an 8-inch LCD display and a 1K cassette. This model is also compliant with EMV, ADA, and PCI standards.

Thomas Berkley's Top Three Recommended ATM Models for Business

The Hyosung Halo II is the flagship model in the ATM industry. It is EMV-compliant with a 10-inch color screen. It also has options for electronic locks and surge protection. This ATM has a large cassette capacity that can hold up to $4,000.

Price: Starts at $2,350

The Genmega Series has a slightly lower capacity than the Halo II. Its cassette can only hold around $2,000. It features a 10-inch upgradeable screen, electronic locks, and modern design. It has modern security features and is EMV compliant.

Price: Starts at $2,250

The Hyosung MX4000, the "big boy", can hold up to $6,000. It's the best choice for gentlemen's club, bars, and casinos that need large cash volumes. It is EMV-compliant with advanced features like customizable screen ads.

Price: 2,950

How Often are ATMs Refilled?

ATMs are refilled daily or weekly. The frequency depends on location, transaction volume, and the ATM cassette's capacity. Some ATMs can hold from $20,000 to $100,000. Basic ones can only hold around $2,000 to $6,000. ATMs with smaller cassette capacity might need to be refilled twice a week.

Pros and Cons of Buying VS. Renting ATM Units

Pros and Cons of Buying an ATM Unit

Pros of Buying ATM

Full ownership of the machine

No on-going rental fees

Cost-effective in the long run

Tax deductions on depreciation

Cons of Buying ATM

High upfront cost

Maintenance and repairs

If ATM becomes outdated, you need to buy again

Pros and Cons of Renting an ATM Unit

Pros

Lower upfront cost

No maintenance costs

You can upgrade ATM model more frequently

Less risky and you can leave the business any time

Cons

On-going rental fees

More expensive in the long run

Limited by a lease contract

No equity on the machine

Cost of Permits and Licenses in Starting an ATM Business

You'll spend from $260 to $2,300 for licenses and fees before starting an ATM business. This covers the cost of a general business permit and sales tax license. Zoning permits and ATM operator license are also included. You should also register the business with a DBA or "doing business as" so you can take a trade name.

COST

FREQUENCY

Business Permit

$50 to $500

Annual

Sales Tax

License

Free to low fee (depending on state)

*Only applicable for states that require sales tax.

Per transaction

Zoning

Permit

$100 to $700

Every 3 years

DBA Registration

$10 to $100 (depending on state)

Usually every 5 years

ATM Operator

License

$100 to $1,000

Annual

How Many States Collect Sales Tax?

45 out of the 50 states in the U.S. collect sates tax. There are only 5 that don't: Alaska, Delaware, Montana, New Hampshire, and Oregon.

Real-Life Reviews on the ATM Business

Reddit Testimonials: What Ex-ATM Operators Say About the Business

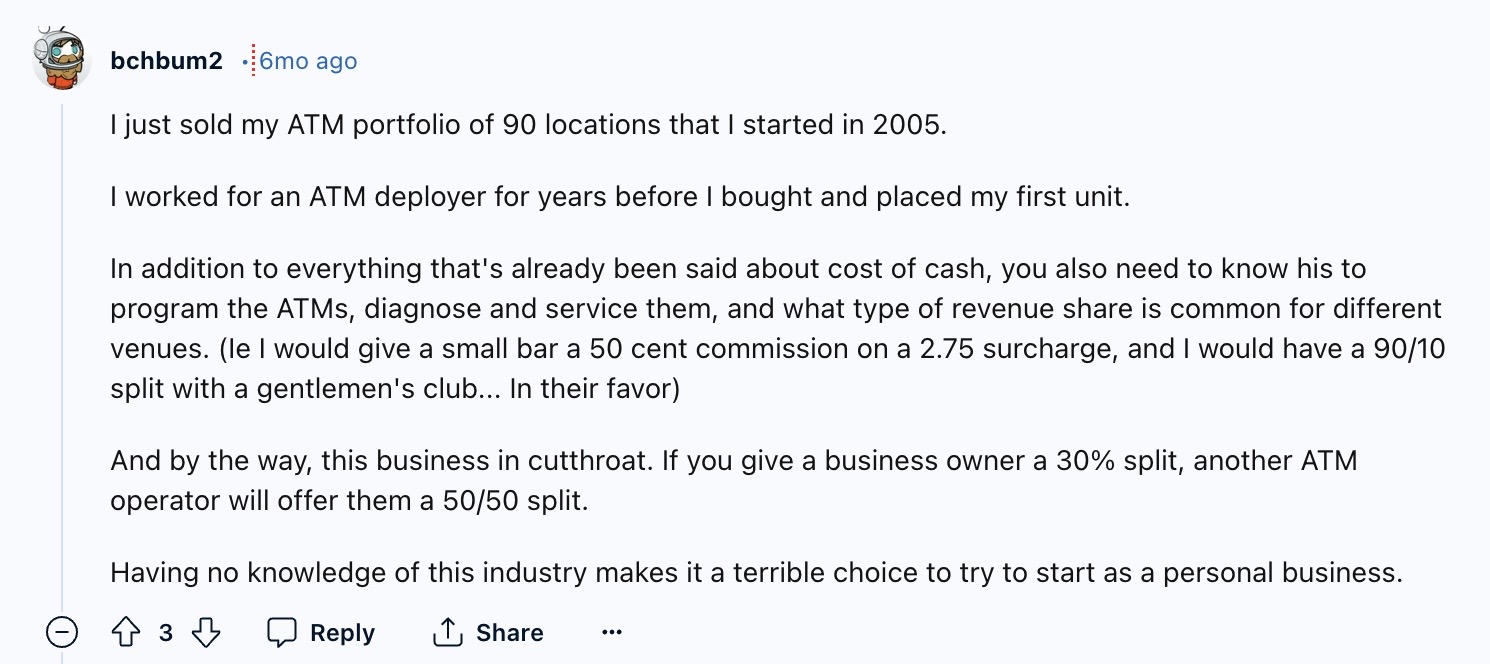

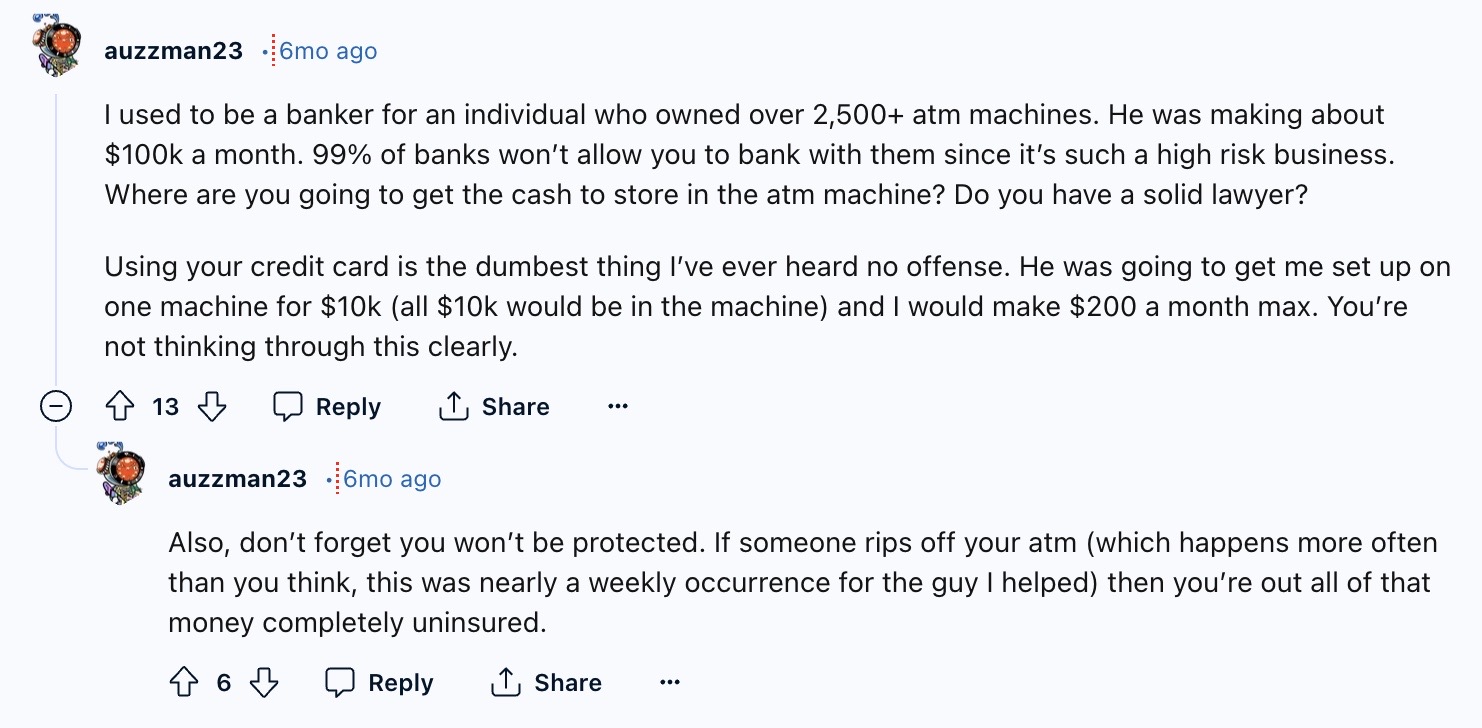

Ex-ATM operators warn about the downsides of the business. Independent ATM deployers should at least know how to program ATMs. They should also be able to diagnose basic issues and service the machines. ATM service operators must negotiate deals with business owners. It's a cutthroat business. Other operators will copy your ATM placement strategy. And, offer higher commissions to business owners.

This guy also warned that there are only very few banks that support ATM business. He also said that ATM rip-offs are very common. ATM owner's insurance won't fully cover the loss.

Paul Alex's ATM Journey: Growing From 0 to 30 Units

How Paul Alex Started His ATM Business

Paul Alex used to work in law enforcement for 7 years. He realized that the stressful environment wasn't for him. So he looked for other income opportunities. He started his business with one ATM unit in 2021. He found six more profitable locations for ATMs and expanded there.

How Paul Alex Grew From 0 To 30 Units

Paul Alex grew from 0 to 30 units by finding niche locations for his ATMs. He had a solid placement strategy. Paul deployed his units in marijuana dispensaries in the San Francisco Bay Area. It's an untapped market because banks don't cater to marijuana-related businesses. Dispensaries are on cash-only basis, so there's a huge demand for ATMs in the area.

How is Paul Alex's Business Doing Today?

Paul has over 30 ATM units today. He runs a successful ATM business that makes $12,000 to $15,000 monthly passive income. He was smart enough to leverage opportunities in the ATM business. Paul also launched an online course called ATM Together. This program teaches the ATM biz to beginners.

What's not mentioned in the video: Paul did not mention how much he spent to start his ATM business. It's probably around $4,000 (conservative), since he started with just one unit. With 6 units post-expansion, he would have spent $12K more.

How Much Profit Does an ATM Business Make?

$300 profit per machine. Assuming you make 200 transactions monthly and charge $2.50, your gross income is $500. Deduct operating cost of around $200, the net profit is $300. These values vary depending on traffic volume and location. ATM transaction fees also vary, as well as the number of monthly transactions.

My Low-Risk Alternative To the ATM Business

My low-risk alternative to the ATM business is local lead generation. It builds simple websites for local service providers and ranking them on Google. The goal is to build many of these simple websites and rent them out to business owners. Ranked sites place you in front of a global pool of potential customers. They generate leads you can sell to local entrepreneurs at 85% margins. It's like owning prime real estate in a virtual setting.

The ATM business is burdensome and time-consuming. Local lead generation is more hands-off, giving you more time freedom. Income with local lead gen is consistent and stable. You don't depend on surcharges for income. You create your wealth by owning digital assets. So, you have full control of the business.