To double your $10k quickly:

- Local lead gen business.

- Retail arbitrage.

- Invest on Index Fund (SP500).

- Flipping and renting.

- Airbnb business.

- Peer-to-peer lending business.

- Invest in cryptocurrency (Bitcoin).

- Invest in real estate.

- Land flipping.

- Start a side hustle.

To double $10,000 quickly in 2024, you must choose opportunities that need a low initial investment. They must also offer high growth potential and face little competition. Focus on areas where demand is high and supply is low, and use digital tools to work efficiently. This means doing thorough market research. You should invest strategically in high-impact areas and keep optimizing your efforts. By planning carefully and executing well, you can turn a $10,000 investment into much more in a short time.

This article provides you with the top 10 ways to double your $10,000 quickly in 2024. It discusses some basic steps you can follow to double your investment. Additionally, we will share some success stories for each method to provide you with real-life insights on how they achieved it. At the end, we will reveal the quickest way to double your $10,000.

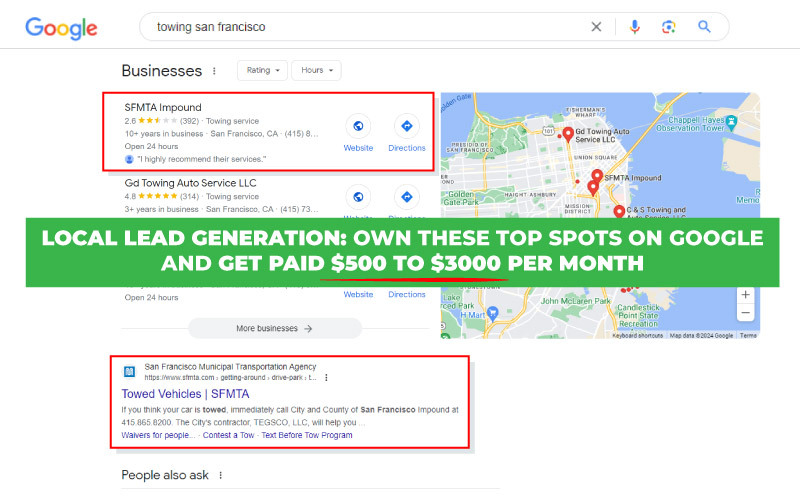

1. Start Local Lead Gen Biz

Local lead generation can double $10K quickly by focusing on profitable niches and low-competition locations. First, pick a high-value niche like plumbing, HVAC, or tree removal. For instance, plumbing leads can be worth $30 to $150 since plumbers charge $45 to $200 an hour. Consider whether the business needs a license, is seasonal, and if it's phone-driven. It means. local lead gen doesn't need a physical location, making it ideal for selling leads.

Next, find a location with low online competition. Aim for cities with populations between 75,000 and 250,000. Search for your niche plus the city name on Google. If you see listings without websites or with few reviews, you can likely outrank them. Check how many referring domains (RDs) competing sites have. Fewer RDs mean less competition. Create a website with an exact match domain like "springfieldtreeservicepros.com." Optimize it for local SEO with good content and backlinks. Partner with local businesses and offer a few free leads to show value. Scale by creating more websites in different niches and locations to grow your income.

2. Try Retail Arbitrage

Retail arbitrage is the practice of buying products at a lower price from retail stores and reselling them at a higher price. Typically, through online marketplaces, to profit from the price difference. To double your $10,000 quickly with retail arbitrage, start by researching products. Look for ones that are in high demand and have good profit margins. Look for clearance items, overstock items, or products with damaged packaging. You can find them at retailers like Walmart, Target, and Home Depot.

You can also find them online on Amazon and eBay. Use tools like Keepa to track prices and sales ranks, ensuring you are buying profitable items. Source products from multiple retailers to diversify your inventory and reduce risk. Be ready to handle returns quickly. Do this to keep your seller ratings high and maintain good customer relationships. Price your products competitively to attract buyers and ensure quick sales.

Retail Rogue has had a great success story in retail arbitrage. She achieved remarkable milestones in just over a year. Retail Rogue started as an Amazon seller and sold $40,000 worth of products in her first year. One standout month brought in $12,000 thanks to a lead from the BOLO Group. She reinvested her profits into tools like Inventory Lab and RevSeller. It's to streamline operations and boost her efficiency.

Despite working part-time, she has already hit two $1,000 sales days and aims for consistent $10,000 sales months. She plans to double her sales this year and reach $100,000. Retail Rogue's journey shows the power of smart investment and dedication in retail arbitrage. She went from a healthcare worker to an aspiring full-time Amazon seller.

3. Invest on Index Fund (SP500)

Investing in an index fund (S&P 500) involves buying shares in a mutual fund or ETF. The fund or ETF tracks the S&P 500 index, which represents 500 of the largest publicly traded U.S. companies. It provides broad market exposure and long-term growth potential. To double your $10,000 with an investment in the S&P 500 index fund, follow these clear steps. First, choose an index fund like the Vanguard S&P 500 ETF (VOO). Next, decide whether to invest through a brokerage account or a retirement account. Select a platform to buy your index fund, such as Robinhood or Fidelity. Regularly contribute to your investment, ideally $100 per month, to benefit from compound interest. Historically, the S&P 500 has returned about 8% annually. With consistent returns and no withdrawals, it would take around five years to double your initial $10,000 investment.

Two Redditors shared their success stories with investing in the S&P 500. It shows the benefits of long-term investing and compound interest. The first Redditor, who started investing in the S&P 500 at age 26. He plans to invest consistently for 15 years and then let the investment sit for another 15 years without adding more funds. For him, it seems like a good plan.

creemeeseason, shared his experience of building wealth by regularly investing in index funds. He hasn't reached a million dollars yet, but feels confident that he's on the right track. Creemeeseason stressed that high returns take time and patience. He noticed the power of compound interest, which slowly increased his balance. His advice is to avoid checking the investment too often and to review annual statements instead. At a 7% annual return, an initial $100,000 investment could grow to $200,000 in 10 years, $400,000 in 20 years, and $800,000 in 30 years. This shows that you can double $10k with index funds.

4. Flipping and Renting

Flipping and renting involves purchasing properties, renovating them to increase their value, and then selling them for a profit (flipping). You can also rent them out to generate ongoing rental income. To double your $10,000 quickly by flipping and renting, consider these strategies. First, buy undervalued items like furniture, appliances, or sports memorabilia. Then, resell them online. For instance, purchase a chair at a yard sale for $5, refurbish it, and sell it for $25. Another option is to rent out assets such as a spare room or storage space. Platforms like Airbnb or Neighbor can help you find renters. If your space is nice or in a tourist area, you could earn over $1,000 per month. You can also flip houses by buying, renovating, and selling them for a profit.

A real estate investor in the Chicagoland area shared their success story of flipping a single-family home in Villa Park, Illinois. He purchased the property for $235,000, invested $60,000 in renovations, and held costs of $10,000. After listing the property for $425,000, they received an offer of $420,000 within four days of listing. The net profit was $90,000, which is a significant return on investment.

5. Start Airbnb Business

Starting an Airbnb business involves listing and renting out a property on Airbnb to travelers. start by using the $10,000 to cover the down payment on a small rental property. Allocate funds for four things. First is furnishings and decor. Second is upfront Airbnb fees. Third is marketing costs. Fourth is other expenses. Focus on cities with high tourism demand and limited hotel options to ensure high occupancy rates. By strategically pricing your rental and maintaining high occupancy, you can get $3,000 to $5,000 per month in profits. By managing well and booking consistently, you can double your initial investment. You can do this in six to twelve months.

Gary Fox is the founder of HostButlers. His company manages Airbnb properties and makes $420K per year. They have a small team of four people. HostButlers handles guest communications, cleaning, and maintenance. Gary uses technology and data to keep the properties competitive. This helps them have higher occupancy rates and more revenue. He focuses on great customer service, which leads to high guest satisfaction and positive reviews. This reputation is a key part of their success.

6. Peer-to-Peer Lending Business

Peer-to-peer lending is a financial practice where you lend money directly to borrowers via online platforms. It bypasses traditional financial institutions. To double your $10,000 quickly with peer-to-peer lending, invest in platforms like Lending Club or Prosper. These platforms let you lend money to individuals or small businesses and earn interest on your investment. Diversify your portfolio across many loans and borrowers. This minimizes risk and maximizes returns. For example, invest in a mix of short-term and long-term loans, targeting borrowers with strong credit profiles. The fund has an average annual return of 5-7%. You can double your initial investment in 2-3 years. This depends on interest rates and loan terms. This strategy leverages the power of interest income to grow your investment steadily.

Lending Loop is a Canadian peer-to-peer lending platform founded in 2015. It connects small businesses with individual investors. It provides cheap financing options and good returns. Lending Loop has helped with over $60 million in loans to small businesses. It has attracted thousands of investors with annual returns of 5% to 15%. The platform succeeds because of its strict credit assessment process. It ensures only creditworthy businesses get loans. This approach benefits both borrowers and lenders. It supports business growth and offers steady returns. Lending Loop's transparency and commitment have earned it a strong reputation in the industry.

7. Invest In Cryptocurrency (Bitcoin)

Investing in cryptocurrency (Bitcoin) involves buying and holding Bitcoin to profit from its price appreciation and market trends. To double your $10,000 quickly, invest in cryptocurrency (Bitcoin). But, you must understand market trends and sentiment. Start by researching Bitcoin's historical performance and market dynamics. Use tools to measure sentiment. You can find investor sentiment on platforms like Twitter, Reddit, and StockTwits. Positive sentiment often indicates rising prices, while negative sentiment can signal buying opportunities. Watch technical indicators, such as trading volume and market volatility. High volume can signal a market shift, and low volatility can indicate stability. Diversify your investment by setting stop-loss orders to protect against sudden market drops. By using these strategies, you can make good choices.

Cameron and Tyler Winklevoss are known for their Olympic rowing careers. They also had a legal battle with Mark Zuckerberg over Facebook. Now, they are major players in the cryptocurrency world. They settled with Facebook for $65 million. Then, the Harvard-educated twins bet big on Bitcoin. In 2015, they launched Gemini, a top cryptocurrency exchange known for its security and reputation. The Winklevoss twins have made over $1 billion from their Bitcoin holdings. They did this thanks to their determination and smart investments. They show the potential of new financial technologies.

8. Invest in Real Estate

Investing in real estate involves buying, managing, and selling properties. It's to make money from rental income, property growth, or other gains. To quickly double your $10,000 by investing in real estate, use these strategies. Pool your money with other investors to take part in bigger deals, like renovating commercial property. Use platforms like Fundrise. It averages 12% annual returns. Put your $10,000 towards a down payment on a $50,000 rental property. You will earn rental income and benefit from property appreciation. Or, you can pursue real estate wholesaling by finding undervalued properties. Secure them under contract, and assign the contract to an investor for a fee.

RealWealth shared some success stories of their members. One of them is Claudia. She turned a tough situation into a real estate success story. She did it by turning her $10K investment into a big monthly income. Claudia received an all-cash offer of $1.45 million for the run-down home in San Francisco that she inherited, which she listed for $1.3 million. She closed the deal within 10 days. They had 45 days to reinvest or face big taxes. Claudia and her husband used insights from RealWealth events and market updates.

9. Land Flipping

Land flipping is buying undervalued land, making strategic improvements, and selling it at a higher price for a profit. Buy undervalued properties, make strategic improvements, and sell them for a profit. Start with thorough market research to identify ideal properties and understand local laws. Find cheap land with potential to gain value and get financing if needed. Invest in upgrades, like clearing and landscaping. For example, purchase a plot for $8,000, spend $2,000 on improvements, and sell it for $20,000. This strategy leverages low renovation costs and high returns to quickly double your investment.

Adam Harrison from Los Angeles, CA, shared his land flipping success story on BiggerPockets. He encountered a motivated elderly couple selling ten 5-acre properties in Colorado with back taxes. Adam bought all ten properties for under $10,000 and assumed the back taxes. He sold two properties on a payment plan for $700 down and $250 per month, totaling $10,000, with the buyer assuming the back taxes. The remaining eight properties were sold for cash at two to three times their purchase price, with buyers also assuming the back taxes. This deal earned Adam an additional $25,000 in cash and equity and $250 per month in cash flow, showcasing the potential of land flipping.

10. Start Side Hustle

Starting a side hustle involves creating and managing an additional source of income outside of your primary job. To double your $10,000 quickly by starting a side hustle, focus on creative and income-generating ideas. One approach is to use your initial $10,000 to finish a spare room or basement space and rent it out on Airbnb. If you rent the space for $100 a night and secure 10 bookings a month, that's $1,000 in revenue before Airbnb fees. Another option is to buy a car and rent it out on platforms like HyreCar or Turo. You could also sell handcrafted items on Etsy, turning a hobby into a profitable business. Additionally, consider offering freelance services like graphic design, writing, or consulting.

Rodney Melton, featured in CNBC Make It’s Six-Figure Side Hustle series. He built a six-figure side hustle in just over a year by creating and selling pet memorial headstones on Etsy. In March 2021, Melton used his $15,000 engraver and self-built workshop in Alma, Arkansas, to mold and engrave headstones. At first, it took several days to produce each piece. But, as his business grew, he put $51,500 into new tools like a sandblaster and laser engraver to work faster.

By May 2022, his Etsy shop was bringing in nearly $20,000 monthly, allowing him to leave his full-time job and hire family members. In 2022, his business generated over $207,000, with two-thirds of that as profit. Melton credits his success to passion and hard work. He thinks others can copy it with an initial investment of $10,000 for equipment and a real dedication to the craft.

Final Verdict: Why Local Lead Gen Biz Is the Quickest Path to Double $10K in 2024?

Local lead generation is one of the quickest paths to double your $10,000 investment in 2024 because of its low initial investment, less competition, and potential for passive income. You can create lead generation websites with an initial investment as low as $500. The websites target local niches like house cleaning, property maintenance, or custom holiday lighting. After ranking it on Google, it can generate a monthly passive income ranging from $500 to $3,000. The local lead gen market is less saturated and faces just 10-15 competitors. This makes it easier to capture and keep market share. By scaling up and creating more lead generation websites, you can quickly multiply your initial investment. This could double your $10,000 within a short time.

Compared to stocks, real estate and Airbnb require much more money up front. This is often in the tens of thousands. They also have more risk and ongoing costs. Retail arbitrage can be profitable. But, it demands constant effort and time for sourcing, listing, and shipping products. Local lead generation is different. It offers a simple, cheap, and scalable business model. Once you set up and optimize the lead generation websites, they require minimal maintenance. It allows you to enjoy a steady stream of passive income with relatively low effort.

Local lead gen biz is a highly efficient and effective way to double your $10k quickly and achieve substantial returns.