Is Airbnb arbitrage Profitable? Yes, Airbnb arbitrage is profitable. It involves renting properties from long-term owners and subleasing them on Airbnb for short-term stays. This allows you to earn rental income without owning properties. After recovering from losses from the coronavirus, the short-term rental industry saw a whopping increase of 289.2% in net income in 2021.

Having limited control over the property, a looming recession, and a volatile housing market are the problems in Airbnb arbitrage you need to deal with. You also need to invest time and effort to manage active tasks in Airbnb arbitrage. It includes responding to your guest inquiries and messages, coordinating check-ins and check-outs, and ensuring the property is clean.

Local lead generation is a better option than Airbnb arbitrage. Instead of renting physical properties, you rent websites that bring in leads for local businesses. This approach has several advantages. It lets you gain experience in different industries, not just hospitality like Airbnb. You can generate leads for multiple businesses, making it a scalable income source. It also eliminates the challenges of property management as maintenance and tenant satisfaction. You just need to focus on creating and ranking websites to generate leads. By that, you can create a digital asset that brings monthly passive income.

What Is Airbnb Arbitrage?

Airbnb Arbitrage is a business model that refers to renting a property for long-term from a landlord and then subletting on Airbnb to generate short-term rental income. It involves renting out properties on Airbnb at a higher rate than what is paid to the original landlord. It allows the arbitrageur to profit from the price difference.

7 Common Factors That Decrease Profits In Airbnb Arbitrage

1. Poor Market Research

Failing to conduct thorough market research is a common mistake that hinders beginners. They struggle to set competitive prices and attract guests because of a lack of understanding of the local market dynamics. Some beginners invest in a property in an over-saturated market with low demand. This results in low occupancy rates and insufficient returns.

2. Neglecting Property Preparation

Beginners sometimes forget to make their property guest-friendly. Also, they underestimate the importance of preparing their property for Airbnb guests. This means not providing basics like clean sheets, toiletries, or good internet. It can cause dissatisfied guests, poor reputation, and low rental income.

3. Pricing Errors

Setting the wrong rates for their Airbnb listings is another major mistake made by beginners. Overpricing can lead to low occupancy rates and potential loss of tenants to competitors. While underpricing may cause missed rental revenue opportunities. Beginners fail to consider factors like seasonal demand, local events, and market rates that lead them to struggle to maximize their profits.

4. Lack Of Marketing Strategies

Poor marketing efforts include using low-quality images, and generic descriptions, or not using social platforms can limit visibility and lessen the ability to attract guests. This can cause decreased booking and lower profitability.

5. Ignoring Customer Satisfaction

Beginners often forget that happy guests lead to positive reviews and repeat bookings. They don’t focus on good customer service or address guest concerns promptly. This can cause negative feedback, fewer bookings, and lower profits.

6. Poor Cost Management

Beginners may not manage their costs efficiently. They overspend on unnecessary expenses or don’t negotiate good deals with suppliers that eat into the revenue. It is hard to maintain profitability if you are not monitoring and controlling your costs effectively.

7. Finding Sublet-Friendly Landlords

After planning and preparing everything you need to start, the hardest part lies in securing a landlord who permits subletting. Some landlords explicitly prohibit subletting, while others take advantage and charge higher monthly rental fees.

What Are The Pros And Cons Of Airbnb Arbitrage?

Pros of Airbnb arbitrage

High-profit potential: Airbnb arbitrage can generate high income, as short-term rentals offer higher rates than long-term leases. For example, a property leased at $2,000 per month can earn $100 per night on Airbnb, then you can earn $3,000 per month or more.

Easy to scale: Airbnb arbitrage allows for quick scaling of the rental business. It is by leasing multiple properties and subletting to different short-term rental platforms.

Minimal Upfront Investment: Airbnb arbitrage typically involves lower costs since there's no need to purchase properties. Unlike traditional real estate investment, you need a huge capital to buy the property.

Minimal property ownership responsibilities: You can avoid the usual obligations, such as maintenance and repairs. With Airbnb arbitrage, landlords typically take care of these responsibilities.

Diversify income streams: By doing Airbnb arbitrage, you can generate additional sources of revenue. It helps you to reduce the risks of relying solely on one income stream.

Cons of Airbnb arbitrage

Legal and regulatory challenges: Airbnb arbitrage can be subject to location-specific legal and regulatory restrictions. Some cities impose limitations on short-term rentals. It requires permits, licenses, and taxes that can affect your profitability and operations. In New York, it's illegal to rent out an entire apartment for less than 30 days without the owner.

Operational complexities: If you want to scale, managing multiple short-term rentals is time-consuming and demanding. You may need to do some guest communication, property maintenance, and coordinating booking. It requires hands-on systems that can lead to hiring staff or outsourcing services.

Unpredictable market: The short-term rental market can change rapidly because of seasonality, local events, and economic conditions. Also, economic downturns, changing travel trends, and unforeseen events like pandemics can affect your cash flow.

Tough competition: Airbnb arbitrage increased its popularity because of low capital to start. The increased competition can affect occupancy rates and pricing strategies.

Limited control over the property: You need to follow the decisions and rules of the property owners. Landlords may impose restrictions, and lease agreements, and raise rents that can affect your income.

How Much Would It Cost To Start An Airbnb Arbitrage?

$6,000 is the average cost to start an Airbnb arbitrage business. According to SixFiguresUnder, PassiveAirbnb, and BiggerPockets, the minimum Airbnb startup cost is $3,900 and the maximum startup costs are $30,000.

These are the several expenses you need to consider in starting Airbnb arbitrage.

How Much Money Can You Make In Airbnb Arbitrage?

$100,000 per month is the money that you can make in Airbnb arbitrage if you scale. With proper strategies, it's possible to reach a six-figure income within 12 months or fewer. Also, the minimum earnings in Airbnb arbitrage are between $1,00 - $2,500 per month. But, it can vary on several factors, like location, property type, market demand, and operational costs.

How to Calculate Profit In Airbnb Arbitrage?

You can calculate your profit in Airbnb arbitrage by using this formula:

Weighted average rate (A) =

(average weekday rental rate from Airbnb x5 + average weekend Airbnb rate x2) / 7

(B) = All monthly costs are / 30 for the daily cost of property expenses

A / B x10 = Percentage of days per month you will need to rent out your Airbnb property

For example:

$100 = average weekday rental rate

$150 = average weekend rental rate

$3000/month costs

($100 x 5 weekdays) + ($150 x 2 weekend days) = 800 / 7 days =

@ $115 = Weighted average rate

$3000 / 30 days = $100 / day expense

$115 / $100 = $15/day profit

To improve your success in Airbnb arbitrage, aim for a ratio of 2 or higher. You can achieve that by charging $200+ per night to generate $100 profit each day from short-term rentals.

What Are The Profitable Cities For Airbnb Arbitrage?

The best cities for Airbnb arbitrage are:

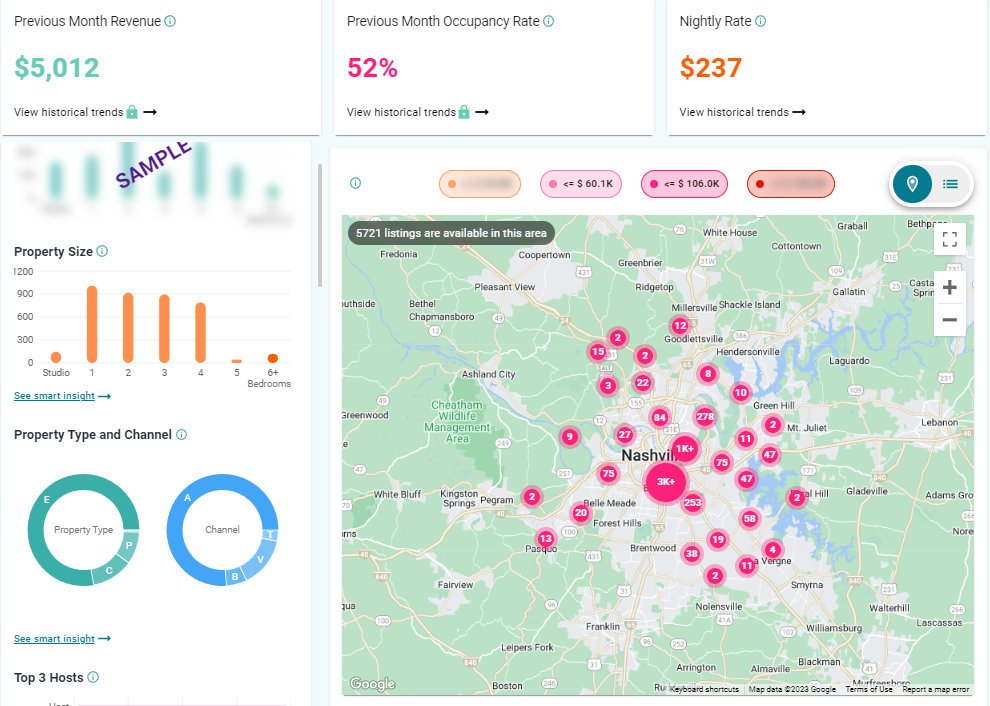

1. Nashville, TN

Nashville, Tennessee, is an ideal choice for Airbnb arbitrage. It is a highly desired domestic destination with a 200% increase in travelers. According to AirDNA, it has an occupancy rate of 51.9%.

Previous Month Revenue: $5,012

Previous Month Occupancy Rate: 52%

Nightly Rate: $237

Total Listings: 5721 (76% are listed on Airbnb)

2. Charleston, SC

Charleston, South Carolina, is an excellent choice for Airbnb arbitrage. It ranks among the top 5 cities in the US for rental arbitrage, according to AirDNA. In 2021, Charleston boasts an effective rent of $1,326, a strong STR premium of 223.6%, and it takes only 5.5 nights to cover rent.

Previous Month Revenue: $7,013

Previous Month Occupancy Rate: 62%

Nightly Rate: $275

Total Listings: 1204 (100% are listed on Airbnb)

3. Boston, MA

Boston, Massachusetts is a great option for Airbnb arbitrage. In 2021, it is the 9th best real estate market in the US, according to the Urban Land Institute. With a population of nearly 695,000 residents, it offers a strong economy and a promising market for rental arbitrage.

Previous Month Revenue: $3,452

Previous Month Occupancy Rate: 52%

Nightly Rate: $162

Total Listings: 2087 (83% are listed on Airbnb)

4. Savannah, GA

Home values in Savannah have increased by 18.8% in the past year, showing a strong market. The West Savannah neighborhood offers affordable investment opportunities, with a median listing price of $75,000.

Previous Month Revenue: $6,137

Previous Month Occupancy Rate: 59%

Night Rate: $210

Total Listings: 2378 (68% are listed on Airbnb)

5. San Diego, CA

In 2022, San Diego, California ranks 7th in the largest markets with multifamily STR listings. It has effective rents of $2,622, monthly STR revenue of $5,331, and 10.2 nights to cover rent.

Previous Month Revenue: $5,001

Previous Month Occupancy Rate: 62%

Night Rate: $195

Total Listings: 9696 (74% are listed on Airbnb)

How To Increase Profitability With Airbnb Rental Arbitrage?

It is essential to conduct market research to identify profitable locations with high demand for short-term rentals. Analyze factors like tourism, business opportunities, and local events to determine your potential income.

PRO TIP:

Nashville, TN, Charleston, SC, Boston, MA, Savannah, GA, and San Diego, CA are the best cities for Airbnb arbitrage. These cities have a high demand for short-term rentals. It is because of their popularity among tourists and business travelers. In Nashville, TN, you can make $96/day profit and $77/day profit for Charleston, SC.

You must negotiate favorable lease terms with the property owner. Aim for a long-term lease at a discounted rate. Make sure that the lease agreement allows subletting and short-term rentals while complying with local laws and regulations

PRO TIP:

Try to negotiate a three-year lease for the apartment at $1,500 per month and secure a lower rate compared to the market average.

You can consider investing in quality furniture, comfortable beds, essential appliances, and attractive decorations to create a good ambiance for your guests.

PRO TIP:

Furnish the apartment with modern furniture, a fully equipped kitchen, and high-speed internet.

You may need to create an interesting listing on Airbnb. It should highlight the property's unique features, amenities, and location. You need to use high-quality images, engaging descriptions, and relevant keywords to improve your visibility.

PRO TIP:

Use professional photographs to showcase the interior of the property. Also, show its proximity to popular attractions. You can mention nearby amenities like restaurants, shopping centers, and public transportation.

You must set competitive prices based on location, property size, seasonality, and local market rates. Also, monitor and adjust the prices to maximize occupancy and income regularly.

PRO TIP:

You can set a daily rate for the apartment at $150. Analyze similar listings in the area, then adjust it slightly higher during peak seasons or special events.

Provide exceptional customer service and resolve guests' inquiries, concerns, and requests. You should offer a seamless check-in and check-out process, and make sure that the property is well-maintained and clean.

PRO TIP:

Respond to your guest messages within a few hours and provide clear and complete instructions for self-check-in. You can also partner with a cleaning service to maintain the cleanliness of the property.

You must use various marketing channels to promote the property. This includes social media, online travel agencies, and your personal networks. Ask for feedback from your guests to build trust and attract more bookings.

PRO TIP:

You can start creating social media pages for the property to engage with potential tenants. You can use that also to offer exclusive offers or discounts.

Always monitor your income and expenses. Track your rental payments, maintenance costs, furnishing and other expenses to keep your profitability performance accurate.

PRO TIP:

Use accounting software to monitor your finances such as QuickBooks Online, Xero, and Zoho Books.

Airbnb Arbitrage Profit vs Different Ways To Make Money With Airbnb Without Owning Property

Is Airbnb Arbitrage Worth It?

Yes, Airbnb Arbitrage is worth it because it allows you to rent properties on Airbnb and make a profit by subletting them at a higher price. This can be especially worth it in popular tourist destinations with high demand. For example, in cities like Miami and New York, some Airbnb owners report monthly revenues of $5,000 or more after expenses. Also, you need to find landlords that will offer generous lease agreements that will work for the long term. However, you need to consider the pros and cons of Airbnb arbitrage and be aware of local regulations and laws. Property management can be time-consuming, and market conditions can fluctuate, which can affect your Airbnb rental arbitrage business.

Airbnb Arbitrage Related Article

Conclusion: Is Airbnb Arbitrage Profitable?

Yes, Airbnb arbitrage is profitable because of its growing valuation at over $70 billion as of August 2022. You have access to a vast customer base of Airbnb, with over 150 million users worldwide that booked over one billion stays. In 2021, the average earning of an Airbnb host is $13,800. It highlights the potential profitability of this business model. Also, in the second quarter of 2022, Airbnb's revenue reached $2.1 billion, which further shows the huge opportunity for Airbnb arbitrage.

However, with over 6 million listings worldwide from 4 million hosts, competition can be fierce. You need to differentiate your properties and invest in effective marketing strategies to attract guests and maintain profitability. Additionally, the seasonal nature of demand can affect your booking rates and earnings.

Local lead generation through the rank and rent model is a better option compared to Airbnb arbitrage. Instead of renting physical properties, you rent websites that generate leads for local businesses, like digital real estate. The advantage is that you compete with only 20-30 companies or fewer, not millions of Airbnb hosts. This reduces competition. Additionally, the profit margin is high, which is around 80% - 90%. You can potentially earn $500 - $2,000 per website each month. It's a simpler and more profitable way to make money online.