The United Tax Liens is a real estate program by Jay Drexel that teaches how to make money in real estate through tax lien investing. Jay guides you from how you can buy tax liens online to the crucial things you need to check when evaluating a tax lien deal. United Tax Liens also reveals some secrets to avoid beginner's traps in tax liens.

Tax lien investing can be profitable, but it has some drawbacks. While it has the potential for high returns, it's important to understand the complexities involved. For beginners, buying tax liens and dealing with legal procedures can be challenging. There's also a risk that property owners may not repay the debt, which could lead to losses. Before diving into tax lien investing, it's crucial to do thorough research of the rules and processes in your area. Is Jay Drexel's United Tax Liens the best option to start tax lien investing?

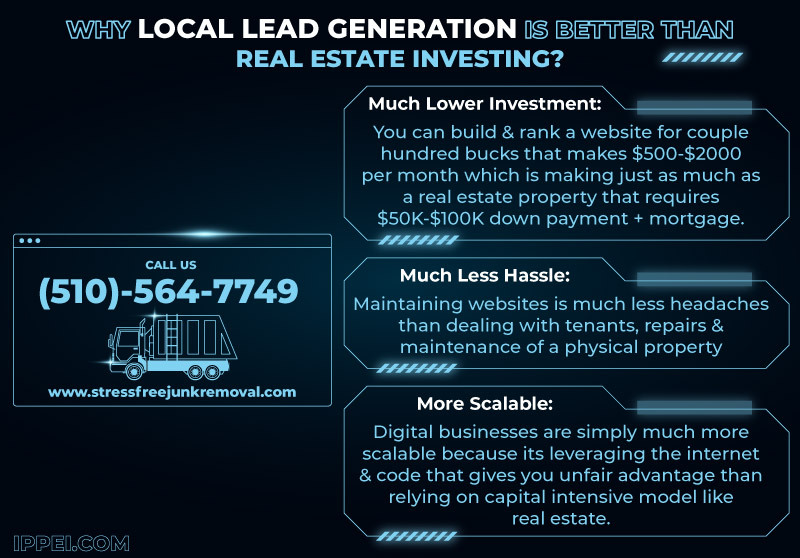

If you're new to investing, local lead generation is a better choice than tax lien investing. Being a digital landlord through local lead generation has clear advantages over real estate investment. With local lead generation, you create websites that bring customers to local businesses. It requires less money, has fewer risks, and offers more growth potential than real estate.

United Tax Liens Pros And Cons

Pros

Jay Drexel is a successful and active real estate investor.

The program has an excellent reputation.

It received 265 5-star reviews in Trustpilot.

United Tax Liens has coaching and consulting.

Cons

Tax Lien investing is not for everyone.

Tax Lien and Deed investing is difficult to get into.

It receives negative feedback on Trustpilot.

There are no testimonials available on their website.

Price

The price of United Tax Liens is not available on the website.

Refund Policy

The refund policy is not stated.

Origin

United Tax Liens started in 2020.

Reputation

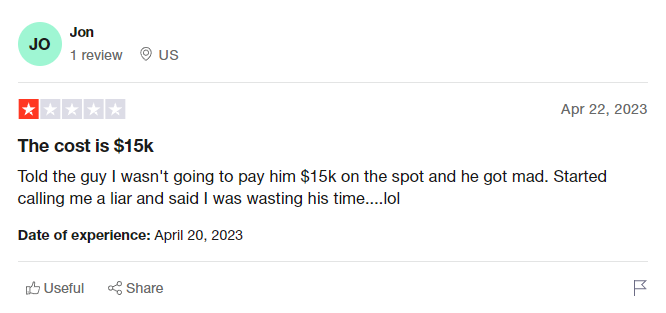

United Tax Liens is the #1 Property Investment category on Trustpilot with a 4.7-star rating.

What Do You Get In United Tax Liens?

With United Tax Liens, you will get access to its training courses. You can also use their very own Marketplace Pro Software. Jay Drexel and his team offer coaching and consulting.

It offers straightforward training to help you kick-start their Tax Lien investing journey. You'll learn about the states that have Tax Liens and Tax Deeds. You will know how to avoid common beginner mistakes and discover the secrets to achieving favorable returns. By their courses, you can gain the knowledge and insights necessary to navigate the world of Tax Lien investing with confidence.

This software offers a hassle-free way to begin your investment journey. With this tool, all you have to do is choose a property, and the software will provide you with all the information to make a profitable decision. It's as simple as pointing, clicking, and investing.

Their coaching and consulting program provides expert guidance from experienced investors in Tax Lien and Deed investments. Their extensive knowledge helps beginners bypass the learning curve and achieve profitability faster. Take advantage of this program to receive the support you need for successful tax lien investing.

Who Is The Founder Of United Tax Liens?

The founder of United Tax Liens Jay Drexel, an experienced investor in the real estate industry. With over 10 years of successful tax lien and deed investments, he has accumulated a wealth of expertise. Jay shares his secrets and helps others achieve profitability in tax lien investing.

They help people get double-digit paychecks from real estate by finding tax liens for free through a public records search. Through this, they uncover off-the-books income in any city of your choice. Then, connect you with the original property owner, who will sell you the property at a significant discount. This process typically takes less than two weeks and saves you thousands of dollars on legal fees and months of stress. Investing in tax liens is like buying houses in bulk with no effort.

Is United Tax Liens Worth It?

United Tax Liens can not be worth it. But it can be a good course if you want to invest through a tax lien. The course offers expertise from multiple real estate experts, not just Jay.. It has a good reputation in Trustpilot, making it the #1 out of 3 programs in the Property Investment category. But there is no actual feedback on their official website. The program has 264 5-star ratings, and there is not even one testimonial available on their website. Also, there is no information about how much it is and someone in Trustpilot says that it costs $15,000. Which is expensive. Additionally, there are a few negative reviews, showing some risk for beginners considering this course. If you want some alternatives, you can check my top real estate wholesaling courses in 2023.

United Tax Liens Social Media Presence

Despite receiving over 260 feedbacks from different students on Trustpilot, United Tax Liens has a relatively small social media presence. Their Facebook page has only 183 followers, their Instagram account has 1,036 followers, and their LinkedIn page has 50 followers. Furthermore, their YouTube channel is outdated, with their latest video being a year old. It is surprising that despite the positive feedback on Trustpilot, their social media following is not as strong. You can check Dealmaker Wealth Society if you want another option.

Is Tax Lien Investing Really Profitable?

Yes, tax lien investing can be profitable. When you invest in tax liens, you are purchasing the debt owed to the government by property owners who have fallen behind on their taxes. By paying these delinquent taxes, you become the lien holder and gain the right to collect the debt along with interest from the property owner. If the property owner cannot repay the debt within a specified period, you may even get the property. Florida is the best state for tax lien investing, according to The Balance. Florida offers the largest interest rate of 18%, which is higher than Arizona's highest rate of 16%. So, if done correctly, investing in tax lien certificates in Florida can be a favorable choice for investors.

While tax lien investing can be profitable, there are a few drawbacks to consider. First, not all properties with tax liens will cause acquiring the property itself. Property owners may redeem the debt, meaning you only receive the interest on your investment. The process can be time consuming and requires thorough research on properties and local regulations. Last, the potential return on investment may vary. Also, there is a possibility of encountering properties with significant issues or low market value.

What Is Tax Lien Investing?

Tax lien investing is an investment strategy where individuals purchase unpaid property tax debts from property owners. It involves attending auctions, bidding on tax liens, and paying delinquent taxes to get a certificate. By doing so, you can earn interest in the amount owed. If the property owner cannot repay the taxes within a specified period, the investor may foreclose on the property and gain ownership. Tax lien investing offers a potential way to earn returns and possibly own properties. If you are not into this kind of method and want to try digital real estate, you check the different ways you can make money investing in digital real estate.

What Is A Tax Lien Used For?

It is used by the government to secure the payment of outstanding tax debts. When a property owner cannot pay their taxes, the government can place a tax lien on the property. It gives them the right to collect the debt by selling the property or through other means. The purpose of a tax lien is to ensure that the government can recover the unpaid taxes owed to them.

How Does Tax Lien Investing Work?

Tax lien investing is a process that involves these steps:

What Are The Benefits And Risk Of Tax Lien Investing?

Benefits

Potential High Returns: Tax lien investing can provide attractive interest rates. Potentially higher than other traditional investments, offering the opportunity for significant returns.

Secured Investment: Tax liens are backed by the property itself, which provides some level of security for investors in case of non-payment.

Potential Property Acquisition: If the property owner cannot redeem the tax lien, investors may get the property at a discounted price.

Potential For Passive Investment: Once the tax lien is purchased, investors can earn interest without actively managing the property.

Risks

Uncertain Redemption: Property owners may not redeem their tax liens within the designated redemption period. It leads to a loss of investment opportunity.

Property Condition: Acquiring properties through foreclosure may involve unforeseen expenses for repairs or renovation.

Legal Complexity: Tax lien investing involves navigating complex legal processes and foreclosure proceedings. It can be time-consuming and require expertise.

Limited Liquidity: Tax lien investments can be illiquid, meaning it may take time to sell or recoup the investment if desired.

Lack of Control: You have limited control over the property during the redemption period. Also, the property values may fluctuate, affecting potential returns.

How Is Tax Lien Different From Tax Deed Investing?

Tax lien investing and tax deed investing differ in their approach and outcomes. With tax lien investing, you buy unpaid tax liens on properties and earn interest in the delinquent taxes paid by the property owner.

In tax deed investing, you buy properties from the government when owners don't pay their taxes, giving you full ownership of the property. Tax lien investing earns your interest, while tax deed investing lets you acquire properties. It's essential to understand these distinctions and associated risks before deciding which strategy suits your real estate investment goals.

United Tax Liens Alternatives

What Is My Top Recommendation In Making Money Online In 2023?

My top recommendation for making money online in 2023 is local lead generation through the rank and rent model. This method involves creating websites that generate leads for local businesses. Once it is ranked, you will rent out those websites to the businesses for a monthly fee. Compared to tax lien investing, local lead generation offers a more passive income stream. As a digital landlord, you can earn a consistent monthly income with no active management or dealing with property-related issues.