Wealth Builders Institute is an educational platform that aims to transform newbies into wealth-generating professional traders. WBI promises to be a reliable and repeatable system that helps traders go through the ups and downs of the business. Its focus is to teach students how to identify market reversals through the TSL strategy, TSL software (trading tool), and risk & reward ratio for long-lasting trading success. Inside the program is a 6-week course, weekly workshops, and direct interaction with trading coaches. Coaching calls and workshops are designed to help students adapt to changes in the market and stay profitable.

Todd Rampe teaches various trading strategies on future, stock options, and swing trading, including trading psychology, and risk management through the Wealth Builders Institute Platform.

In this Wealth Builders Institute course review, we’ll answer if the Wealth Builders Institute is legit, the Wealth Builders Institute cost, TSL strategy and software, Todd Rampe and his reputation in day trading, as well as Todd Rampe’s net worth, and some online reviews. We’ll also answer how effective the TSL strategy is, who the program is made for, the modules and lessons to expect, and the inclusions of the program.

Wealth Builders Institute Review: Pros and Cons

Wealth Builders Institute Pros

Years of Experience: Wealth Builders Institute has been in the business for over 20 years and has helped over 3,000 traders.

Many Online Community: Subscription to the course gives you access to an exclusive online community with 5,000+ members.

Good Reviews: Wealth Builders Institute has many good reviews and is rated 4.3 stars in Trustpilot.

No Hard-Selling: Interested students are explained what they will be getting into the course. They will also be given references with whom they can verify real, first-hand experience of WBI.

Wealth Builders Institute Cons

Students Learn at Different Paces: Students learn at different paces, and some moderators assume that the students absorb all the information in trading in just 8 weeks.

Limited System: The system taught in the course could work open some trades, but not in all of the trades.

Risky Business: Trading always has a substantial risk and only a few make consistent profits.

Price

WBI does not disclose the price of the course and the TSL software unless you book a 5-minute call with them. But, online reports say they charge $9K for beginners.

Refund Policy

No refund, all sales are final.

Origin

It’s not clear when WBI or TSL was launched, but Todd claims he had been trading for over 20 years.

Reputation

Wealth Builders Institute is a reputable company. It has been featured in big news outlets like CNBC and is accredited by the BBB with an A+ rating. It’s also a verified company on Trustpilot with a 4.3-star rating.

What is the Disclaimer Clause of Wealth Builders Institute?

The disclaimer clause of Wealth Builders Institute explains that each trade has a substantial risk and traders are responsible for assessing if the trade is a suitable investment (or not). It further explains that past performances shown in the system are not fully indicative of favorable future results. Information on the website is for educational purposes only and should not be considered as a financial or trading advice. Statements on income and profits from trade do not represent or guarantee profits. The trader is fully responsible for their actions, trade profits, and losses. Finally, by using the website, the user is accepting the terms and conditions stated in the user agreement.

Wealth Builders Institute's disclaimer clause in their Terms & Agreement page.

How Effective Is Wealth Builders Institute's TSL Strategy?

Todd Rampe’s Triple Sync Logic (TSL) strategy is an effective trading method for predicting a high win rate. It’s a blueprint for entering, managing, and exiting trades. The TSL strategy teaches what kind of stocks to trade, exactly when to enter the market, where to place your stops, profit target levels, and how to exit winning trades.The TSL strategy uses the TSL software, a charting tool for removing unnecessary and redundant indications in trading. Through the TSL software, the user gets clear rules of engagement, exit rules, risk capital, and money management. So, they wouldn't need to scroll around looking for information.

What is Triple Sync Logic?

Triple Sync Logic or TSL is proprietary software for Wealth Builder Institute members that contains recorded lessons where students can learn at their own pace plus 8 hours of live class instructions. The goal of this platform is to provide students with a learning center to keep them on the right track to success.The software uses algorithms to analyze market trends and find profitable trading opportunities. This software is designed to meet the needs of single traders and is compatible with many trading platforms. It is one of the most powerful trading tools that help traders make informed decisions by focusing on risk-management techniques. So how does the TSL software work? Users can see green buy indicators and red sell indicators on the screen. Inside the platform, the screen shows three charts that take up 1/3 of the screen. So users don’t have to click around and get lost when they’re studying a potential trade opportunity. Todd says he personally uses this platform and earns in his trades using this system.

Hypothetically, yes, triple sync logic offers a faster payback. Todd Rampe promises that Triple Sync Logic offers a faster payback. He says there’s no other software that could compete with TSL when it comes to recouping the initial investment in the course/software. Todd further explains that as users get more comfortable with the software, they overcome risk tolerance which helps them become more confident with their trades.

Can You Make Money Trading with Triple Sync Logic?

Yes, you can make money trading with Triple Sync Logic. But, you have to be ready to exert effort in learning the software and the trading business. Trading with stocks is always a game of chance and there’s no guarantee you’ll profit on every transaction. Triple Sync Logic is simply software that helps make trading decisions easier. It can never predict the outcome of the trade.

I found this Reddit comment from someone who claims to be using the TSL software.

Is Wealth Builders Institute Legit?

Yes, Wealth Builders Institute is legit. It is a Trustpilot-verified company with a 4.3-star rating as of writing (from 21 reviews given). The company has a physical headquarter at 2620 Regatta Dr Suite 102, 89128, Las Vegas, Nevada. The company has also been featured by the biggest news channels such as CNBC, TradeStation, and Investor Inspiration. Wealth Builders Institute is accredited by the Better Business Bureau with an A+ rating.Wealth Builders Institute is not the same as Wealth Builders International. Wealth Builders International is a pyramid scheme with a filed lawsuit whereas Wealth Builders Institute is a legitimate educational trading platform.

What are the 3 Common Indicators of Identifying Market Reversals?

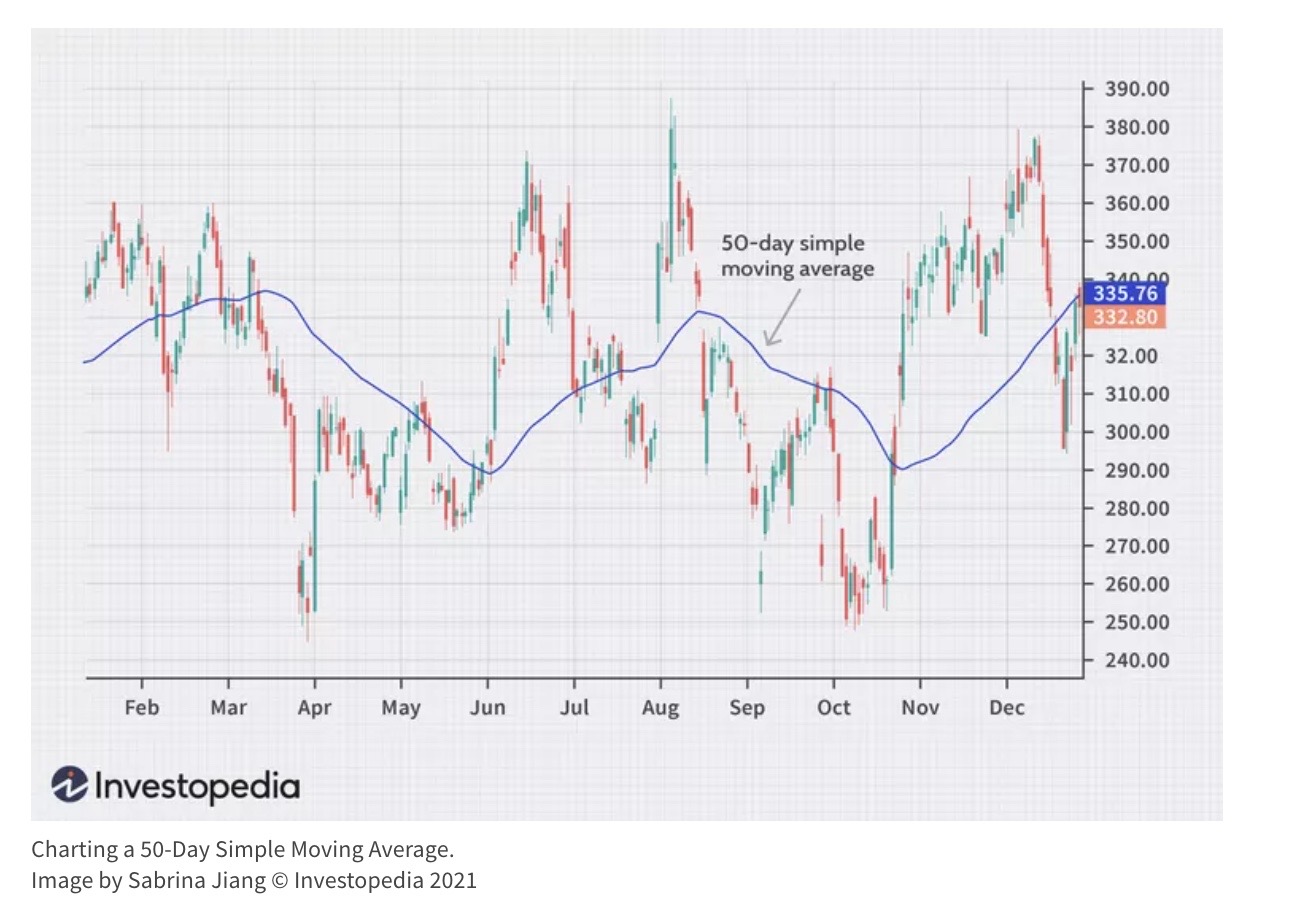

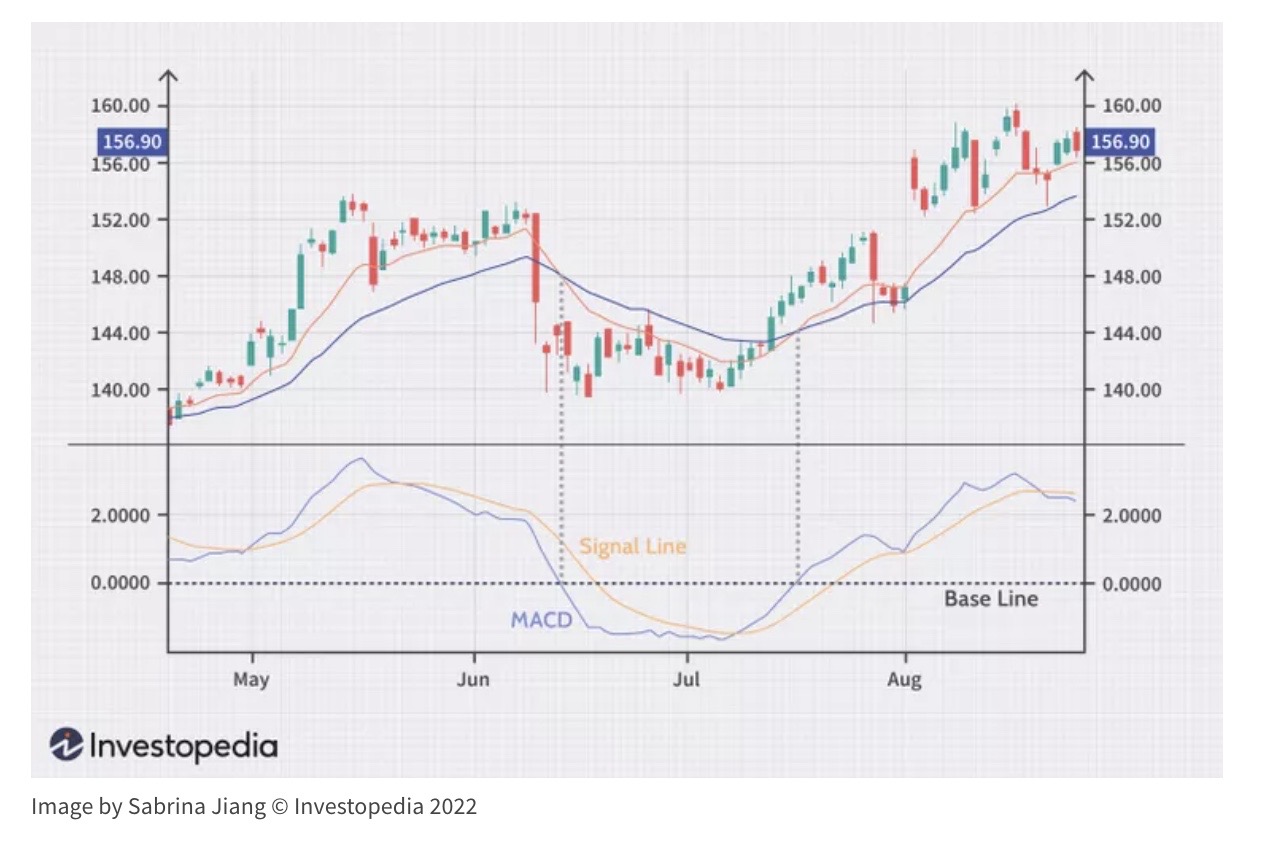

The three best indicators of identifying market reversals are moving averages, the moving average convergence and divergence (MACD), and the H pattern stocks (head and shoulders pattern).

Moving Averages: A rise in the moving average shows an upward trend, whereas a decrease in the moving average show a market reversal. By using the moving average as an indicator for a reversal, you can see if the markets are overbought or oversold. Below is an example of what it looks like.

Moving Average Convergence and Divergence (MACD): MACD shows the relationship between two moving averages. It identifies division in the market and it warns the traders of a possible reversal. This indicator works best with moving averages. Below is an example of what the MACD indicator looks like.

Head and Shoulders Pattern (h pattern stocks): A market trend that forms a pattern shaped like a lowercase letter “h”. This market reversal indicator shows a steep decline, which is then followed by a short-term rebound and a third decline that’s almost similar to the first one. It is one of the most reliable market reversal indicators.

Are There Alternatives to Triple Sync Logic Indicators?

Yes, there are other options trading software that can be alternatives to Triple Sync Logic. These are TradeStation, MooMoo, TD Ameritrade, and Interactive Brokers (IBKR).

How Much Does the Wealth Builders Institute Cost?

Wealth Builders Institute does not disclose the price of the course of TSL software on their website. But, some online reviews say it costs $9K (others say it's $7,500, but the most common answer is $9K). This price likely includes the Stock Options Workshop and access to the TSL software.

Who Is Wealth Builders Institute For?

Wealth Builders Institute is for new and experienced traders who struggle to succeed in the trading business. It is also suitable for new traders who don’t have prior trading experience because the lessons are taught in a clear, concise, and organized manner, which makes it easy for beginners to understand.

The platform is also open to anyone who wants to learn about the stock market through an education program. There is no skill requirement to join the Wealth Builders Institute's program. It is open to beginners who have zero knowledge and experience in trading. However, prior trading knowledge helps you understand the lessons and the TSL software faster. Experienced traders can also sign up to learn trading strategies that could help grow profits and minimize losses.

Does Wealth Builders Institute Have a Free Course?

Yes, Wealth Builders Institute has a free course. The classes are scheduled and have a limited seating capacity (only 320 students per class). It's a 60-minute live webinar where Todd promises to reveal his three key rules for trading. In this free class, students will learn how to master trading, increase their chances of winning, manage trading risks so they can trade anytime and anywhere. Todd will discuss his 3 insider secrets for successful trading, which include the Magic Formula, 5 Stocks & 3 Rules, and Maximize Your Wins.

What Do You Get With Wealth Builders Institute?

Wealth Builders Institute includes an initial 6-week course, the Triple Sync Logic software, weekly workshops, direct interaction with the coaches, and updates on market developments to increase your chance of landing profitable trades.

The Stock Options Workshop is an online course that helps students achieve consistent profits and trading advantages through proven strategies. Lessons taught in this course are based on Todd’s over 20 years of experience as a day trader. It also includes exclusive access to the Triple Sync Logic software, an online member’s area, and 8 hours of live class.

Live Coaching Classes ensure that students are on track with their learning. It’s an 8-week program where students can ask questions directly to the mentors to address questions they have in trading.

Triple Sync Logic Software is a trading tool that clears the rules of engagement, money market exit strategies, and money engagement regulations. Todd designed the platform to fit all the data you need on just one screen.

Who Is Todd Rampe?

Todd Rampe is the founder of Wealth Builders Institute headquartered in Las Vegas, Nevada, United States. He is a successful 7-figure day trader, financial advisor, entrepreneur and Todd is the creator of the proprietary trading software Triple Sync Logic (TSL). TSL is a trading tool that spots market reversals, which Todd claims to be the best time to enter the market.

He was a fighter pilot before he started trading. Todd entered the trading world as a stockbroker and financial analyst after learning about the business in 1998. In 2013, he launched Wealth Builder’s Institute and has helped over 3,000 aspiring traders since.

Todd is also the author of the trading and investing books “Trading by Numbers”, “How to Profit in the Forex Market,” and “High-Performance Trading.” In his books, Todd covers important trading topics, such as technical analysis, trading psychology, and risk management.

What Is Todd Rampe’s Net Worth?

Todd Rampe’s net worth as of writing (2023) is estimated to be around $4 million. He built his wealth through day trading and by giving financial advice through coaching in the Wealth Builder’s Institute. He is also a speaker and a consultant. Overall, Todd is a respected figure in the trading and investing business.

Todd Rampe Interview: How To Make Big Money with Stock and Options Trading

Todd's Background and Current Business Status

Todd Rampe started stock trading after he sold his first business when he was 34 years old. He was enticed to trading because of its promising returns after he met a trading coach at a seminar. Backed by 2 decades of trading experience, Todd created his own software called Triple Sync Logic. He uses this tool to determine when to enter and exit markets.

Biggest Trading Misconception According To Todd

The biggest misconception in trading (according to Todd), is that it's often perceived as gambling. He justifies that trading is a calculated risk, and it follows specific rules, so it shouldn't be considered as gambling.

Biggest Lessons on Challenges Faced

Knowledge is Power: Todd emphasized the importance of learning and understanding the market. He advises beginners to find a mentor who can guide them, like what he did when he first started.

Risk Management: He said it's crucial to effectively manage risks. He emphasized the importance of setting a hard stop to mitigate risks and losses.

Avoid Emotions in Trading: Keep emotions like fear and greed out of trading decisions. He tells beginners to stay disciplined and follow the established rules.

Consistency is Key: Be consistent in your trading approach. Don’t chase unrealistic profit targets and take in what the market offers you.

Learn from Losses: If losing becomes a pattern, stop and ask for help. Seeking advice from experienced traders helps prevent further losses, so you understand what went wrong in the trade.

What's not mentioned in the interview: Stock and options trading have high failure rates. According to statistics, 90% of options traders lose money. The failure rate is quite lower (but still relatively high) with stock trading at 70% to 90%.

Todd Rampe Reviews

There are mixed reviews on Todd Rampe, TSL, and Wealth Builders Institute online. Overall, Todd is a great teacher, and he's very knowledgeable about options trading. His offers are legitimate and verified services, and there are no published cases on him for fraud.

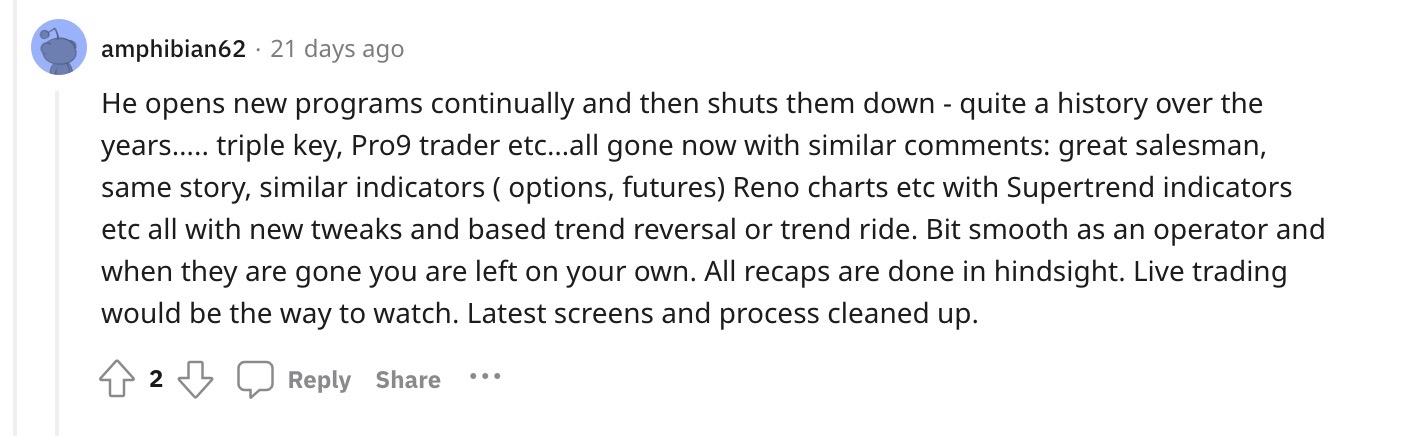

But there's an issue I found while digging about him online. Prior TSL, Todd has launched two other trading tools, Triple Key and Pro9 Trader. This made people speculate that he makes money by creating new tools and programs, overselling them, and then abandons them (and the students) later on.

I researched triple key and the Pro9 trader. I found that Pro9 trader is oddly similar to Triple Sync Logic. It was launched in 2015 and there's no update on what happened to it and why Todd is not using the system anymore.

Todd Rampe discusses how the Pro9 Trader works. In essence, it works the same way as TSL.

Triple Sync Logic Review Reddit

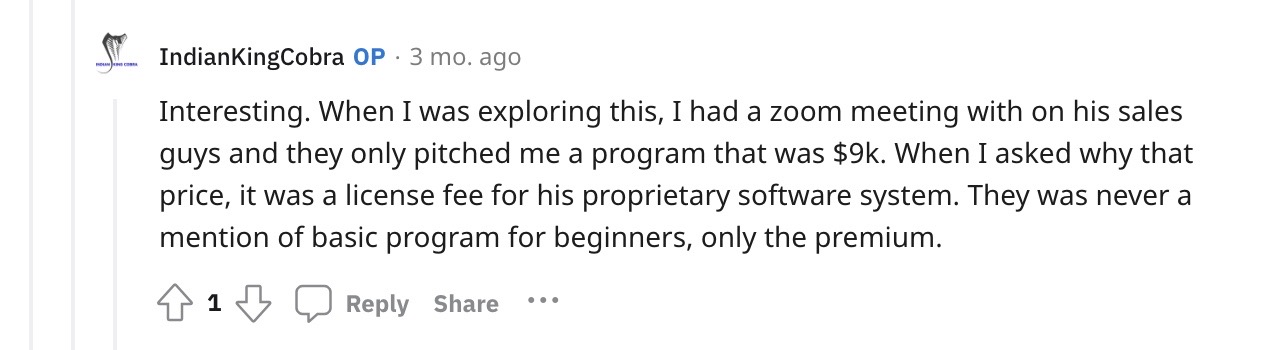

These Reddit commenters say TSL is not worth paying $9K for and new traders are better off learning on their own.

Wealth Builders Institute Reddit

This Reddit commenter shares his experience booking a call with the WBI team and claims that they practice unethical marketing strategies.

Wealth Builders Institute Trustpilot

Todd Rampe's Claim

Todd Rampe claims that he developed a repeatable system and trading formula that works every time.

But, does it?

Can traders really rely on a system to make consistent profits in options trading?

Todd Rampe's Claim Debunked

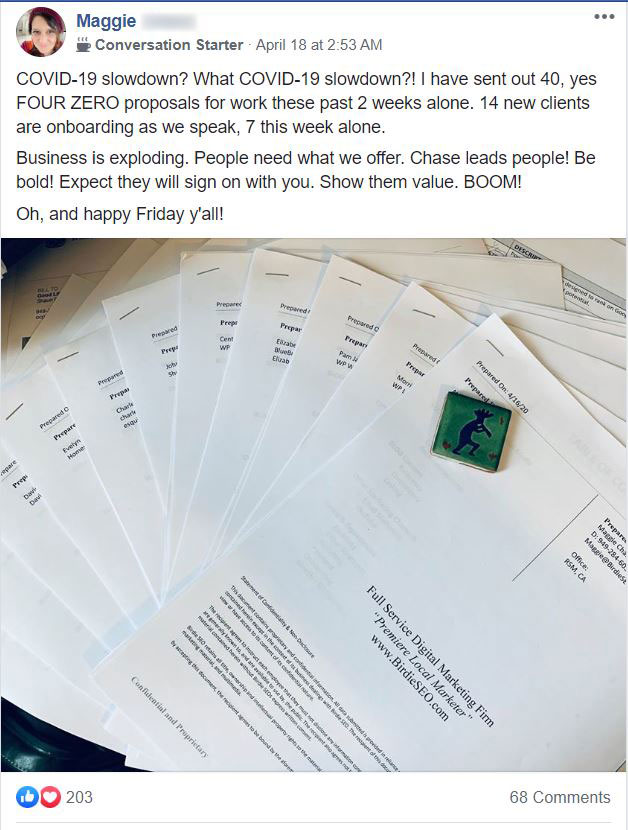

No matter how perfect and exceptional the system Todd claims to be, there's always substantial risk in every trade. WBI even includes a disclaimer on their sales page saying results are "not typical" and can vary from one trader to another.

They further explain that the result of every trade is affected by many factors, including the trader's effort, education (or level of knowledge), the business model used, and external market factors that affect the outcome of the trade.

Is Stock Options Trading Worth It?

Stock options are worth it if you’re looking for a less-risky alternative. Compared to traditional stocks and bonds trading, they’re easier to manage, safer, and cheaper. Although options are safer, there’s still a substantial risk to it and trading educators cannot guarantee consistent profits. Option traders have a 75% success rate. But, if you’re looking for a lucrative income opportunity, options can be a great way to play the financial markets.

4 Challenges of Stock Options Trading

The 4 common challenges of Stock Options Trading are time decay, bid-ask spread, implied volatility, and emotional discipline.

Time Decay refers to the rate of decline in an options contract as time passes. It can be calculated by deducting the stock price from the strike price and then the value is divided by the number of days before the contract expires.

Bid-Ask Spread refers to the variance between the price of the highest buyers and the asking price. Usually, high-demand assets have a narrow bid-ask spread. S&P 500 stocks have an average bid-ask spread of 13% to 18%.

Implied Volatility is the predicted movement in the security’s price. IV can be used in pricing options contracts and in determining if the market is bullish or bearish. To compute for implied volatility, take the market price (of the option) and enter the value in the Black-Scholes formula. From there, you can use the value to back-solve for the IV.

Emotional Discipline refers to the risk management strategies of the trader. Lack of emotional discipline leads to impulsive decisions that can cause significant losses.

Related Articles on Stock Options Trading

Why Local Lead Generation Is More Sustainable Than Stock Options Trading

Options trading can be a profitable way of making money online. With options, traders can make anywhere from 10% to 50% on every trade. To be a good and profitable trader, you need to understand the ins and outs of the trading world and develop strategies for entering/exiting the financial markets and managing your trades.

Wealth Builders Institute is a legit platform for learning options trading. Todd Rampe is a trading veteran with over two decades of experience. The TSL strategy and TSL software aid traders in finding the most profitable trades while avoiding potential losses. However, trading is not for everyone. Statistics show that 90% of traders lose money, and only a small percentage of traders make consistent profits. So, it’s really not a reliable income source after all. If you’re a new trader or a struggling one, enrolling in an options trading course is not your key to financial freedom.

My number 1 business recommendation, and the profiting business model I can vouch for, is local lead generation. Trading can make you lose money at any second. There’s no security and stability in trading, every trade is a gamble, and there’s always substantial risk involved. But, local lead generation is stable, reliable, and long-term. Learning the local lead gen business is also easier than learning how to trade options. You don’t need a special strategy or a new software to know the right deals to enter. All you need is to do is build websites, organically rank them, and you’ll be earning consistent passive income in just 3 months or even less.

I built a tree care site 6 years ago and it has been profiting $2K monthly since.

Learn the best business model for making conistent passive income online.

Get lead gen coaching!

Interested in learning more

Hey, Pat. You can check out https://ippei.com/best/ to learn more about local lead gen.

$4 million net worth? That's hardly enough to boast that you're a successful wealth creator. Not in 2024.