The best income-producing assets to build wealth with are:

- Local lead generation websites

- Rental properties

- Real estate assets

- Storage

- Farm land

- Airbnb

- Real Estate Investment Trusts

- Real Estate Crowdfunding

- Bonds

- Stocks

Income-producing assets are valuable resources that companies and individuals can own to provide benefits in the future. Gallup Poll showed 58% of Americans invested in stock, but it rose up to 61% according to Statista in 2023. And 63% of US adults invested in real estate, according to the Census Bureau. There is a rising interest in investing in assets. But Forbes reported the average inflation rate is 3.8% per year. According to Bankrate, there is a steady decrease in interest rates from 15.32% of 1981 to 3.98% in 2022. Your money will only be profitable if you find assets with interest rates higher than the inflation rate.

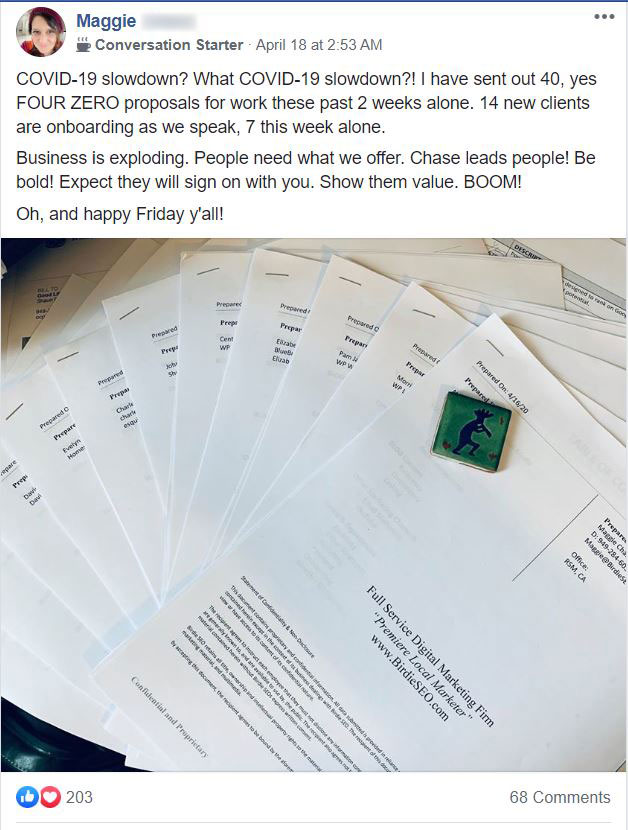

Redditors believe investing in an asset will always be a gamble. They emphasize a balanced portfolio and long-term investments. Redditor Sagetology’s on his way to retire after investing in Tesla. He’s tried other assets and only invested in Tesla after he’s sure of the company’s potential.

This article lists 29 income-producing assets you can invest in to build your wealth. We included the opportunities, interest rates, overhead costs and risks of each asset. Lastly, we introduced an asset that can generate $500 to $2000 passive income monthly.

29 Income Producing Assets to Build Your Wealth

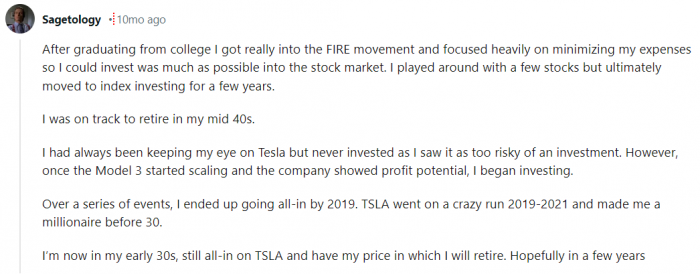

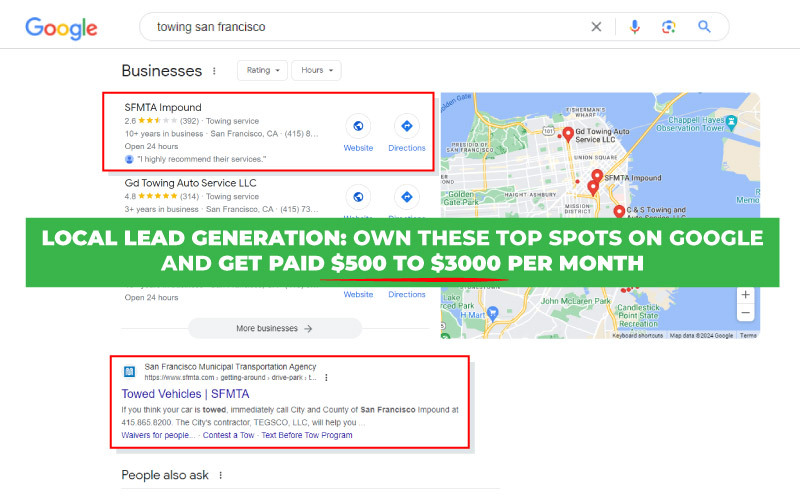

1. Local Lead Generation Websites

Local lead generation is the best asset to make money because it is passive and highly scalable with low startup cost. Local lead generation is the creation of websites for niche services and using SEO techniques to rank on search results. Once the websites are ranking, you can rent it out to local business owners.

It costs around $500 to start a local lead gen site for domain name, web hosting and call and payment processing. It can take 3 to 6 months or more to rank on Google search results, but once you start gaining traffic and leads, the income becomes passive.

Local lead gen is scalable because you can repeat the process for over 50 niche service providers. There are 41,683 ZIP codes in the USA and almost 8 million of them don't have a website. A local lead gen’s success rate is 35% but it increases the more websites you build. It’s an income producing asset with a lot of potential and carries low risk.

2. Rental Properties

Rental properties are the most common income producing asset. Rental units are residential or commercial properties for rent or for lease. According to JP Morgan Chase, there are 50 million residential rental units in the US. The property owner receives rental payment every month from the tenants. Doorloop reported that landlords earn $35k more per year than the average household. Especially since one and two-bedroom apartments increased rent by 24% in 2021-2022 during the pandemic.

Rental properties are typically used to build a large income-generating portfolio. Apartments, single-family houses, condominiums and duplex are some of residential property options for investors. There are also commercial properties including office spaces, industrial units and retail shops. Rental properties produce a steady monthly income and tax benefits. According to Investopedia, rental properties operated as sole proprietorship, limited liability company, S corporation or partnership can deduct 20% to their net rental income under the 2017 Tax Cuts and Jobs Act. As long as the total taxable income for the year is below $250k for singles and $500k for married couples even after the deductions.

However, according to Poplarhomes, landowners reported 50% of the monthly rent actually goes to maintenance, repairs, insurance and taxes. Rental units are also highly illiquid and require a large startup investment. According to Fortune Build, just the required appraisal fee for single family units is already $300-$500 while it's $500-$700 for multi-family property. So, while it can be lucrative, it can also demand high upfront, and your time and attention for management.

3. Real Estate Assets

Real estate assets are any property invested or loaned. These can be a house, a condo unit, an office building or an empty lot. According to Visual Capital, it makes up 32% of a millionaire's wealth. Real estate assets make the most millionaires because of rental income and price appreciation.

According to Fit Small Business, the median rent in the US in 2023 is $2,011. Rocket Homes also reported that buying and selling property for a living returns $124,000 per year. Real estate assets steadily increase in value throughout the years. That said, the federal government requires a 10% down payment for a $500,000 valued house. It’s also an income-producing asset that requires a huge capital upfront. Plus, the monthly property taxes.

4. Storage

Storage units are spaces rented to individuals and businesses for storage purposes. Self-storage is a rising industry predicted to reach $64 billion market value by 2026, according to Commercial Cash Buyers. Storage units produce passive income and require minimal maintenance so it’s an attractive asset. Currently, 9.4% of US households rent a self-storage as per Zipdo.

To tap into this income producing asset, you can either buy a storage unit or purchase shares in a storage facility. According to The Investment Real Estate and Secure Space, the annual income of a self-storage facility is $350,000 to $800,000. But as per Plan Buildr, the expenses of operating a storage facility costs $150,000 monthly. Anthony of Invest in Self Storage said at Quora that for a single storage unit owner, operating cost can be $4000 per month with $1600 on insurance and taxes.

5. Farmland

Farmland is one of the best income-producing assets because it’s not volatile and has a consistent demand. It is usually held for a long-term because its value appreciates. According to BTC Bank, in just a year, non-irrigated land’s value rose 2% at $5,555 per acre. Furthermore, the pasture land’s value jumped 6% at $3,374 per acre. Farmland’s income also comes in ancillary sources like billboard rents, timber sales and hunting leases.

One way to profit from this asset is to purchase land and lease it to farmers. However, you must take note of the land location, soil conditions and climate. Another one is through Real Estate Investment Trusts (REITs) investing in farmlands. But be sure to look out for fees that can cut your potential income. With its rise in value, farmland’s overhead cost continues to rise too. In a study by University of Illinois Urbana, the average overhead cost in 2000 was $50 per acre but it rose to $100 per acre in 2024.

6. Airbnb

Airbnb produces an income by listing a property on its online marketplace. Travelers can book the place for a day to a maximum of 90 days. Airbnb or “Air Bed and Breakfast” is an online marketplace for travelers looking for accommodation and property owners who want to rent out their homes. It operates in 100,000 cities and towns in 220 countries with 7 million listings as per Airbnb’s latest data.

According to Rent to Retirement, Airbnb produces higher profit than traditional rentals. Awning’s report showed 8% profit in peak destinations and 4% for those in modest locations. So, it has high income potential but it depends on the location, the property size and amenities offered. Airbnb insurance expenses also vary so it can cost $1,500 to $3,000 and $9,000 on popular destinations like California.

7. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REIT) is a company that operates, owns or funds income producing real estate properties. REITs provide affordable investment opportunities for commercial properties and a dividend-based income. It enables people to dip into real estate without purchasing or managing the property.

REITs are an attractive asset because it reduces risk of diversifying your portfolio, and it has a 90% rule. Real Estate Investment Trusts must invest 75% of their assets in real estate and distribute 90% of their taxable income to investors. REITs will try to secure these criteria so it’ll be eligible for corporate tax exemption. According to Doorloop, REITs supported more than 3 million jobs and paid 92.3 billion in 2021.

Publicly traded REITs are available at stock exchange. Non-traded REITs are sold by financial advisors or brokers and have high upfront fees. According to the SEC, it can be 9% to 10% of the investment. But it can get as high as 15% in some cases. Streitwise also detailed other fees that may cut from your income like 3% acquisition fee and 6-8% developer fee.

8. Real Estate Crowdfunding

Real estate crowdfunding raises money online to purchase a property as a group. This enables people to tap into real estate with as little as $500 to $1000 capital, according to Investopedia. And according to My Frugal Business, a crowdfunding real estate investor earns between $200k to $500k. It’s a lucrative asset with low investment requirements.

Real estate crowdfunding is accessible through online platforms like Fundrise, Streitwise and EquityMultiple. Yieldstreet and RealtyMogul even accept non-accredited investors. However, Fin Models Lab reported annual maintenance of these platforms costs anywhere within $10k to $30k depending on its complexity. So, crowdfunding platforms charge fees for performance, maintenance, origination and management. These fees can be anywhere between 1% to 5% of the total investment amount and can cut on your income.

9. Bonds

Bonds represent loans of corporations and government entities that are paid through coupon rates within a specific time frame. Investors can purchase bonds directly from the issuing body or through brokers. These bonds can have a timeframe of 1 year to 30 years, and an average maturity rate of 4.5%.

Bonds are also known as fixed-income security. A $10,000 bond with a 10-year maturity date and 4.5% coupon rate will pay $450 a year for 10 years. And then the $10,000 face value is paid back to the investor too. But you should also take into account the fees like legal fees, accounting fees, underwriting fees and printing costs. Bonds are popular assets because they have steady returns and tax benefits.

10. Stocks

Stocks or equities are an investor’s share of ownership in a corporation. Stockholders are partial owners of the company and have a claim to its assets and profits. Some stocks are paid in dividends with an average return rate of 10% per year.

Stocks are available to buy and sell through stock exchanges. The two most popular stock exchanges are New York Stock Exchange (NYSE) and National Association of Securities Dealers Automated Quotations (NASDAQ). Some corporations also directly sell their stocks to investors.

Stocks is the asset that gives the highest return the longer you hold on it. According to New York University professor Aswath Damodaran, stock investments double every 7 years. So a $5,000 investment to an S&P 500 index fund in 2000 will double to $10,000 in 2007 and will become $20,000 in 2014. However, stocks are highly volatile so its value rises and falls with the business’s value. It’s a rule of thumb that stocks should only amount to 10% of your total portfolio.

It also comes with fees that can take a cut from your income. Securities transaction tax is 0.1% of the transaction value. Stamp duty fee is payment to the state government for the transfer of one security to another. GST is 9% of the brokerage charge and transaction charges for buying and selling set by the stock exchange.

11. Savings Accounts

Savings accounts are the most straightforward income-producing asset since you earn through the interest accumulated on your own money. Typical interest rates in traditional banks are .01% to .30% while high-yield savings accounts can get as high as 5%. But according to Bankrate’s April 2024 survey, the national average yield of savings accounts is 0.57%.

Savings accounts are easy to open at any local bank with small to no minimum investment requirement. It’s also a safe income producing asset since savings accounts are FDIC insured up to $250k. Although compared to other assets, it has lower returns and is not inflation-proof.

12. Money Market Accounts

Money market accounts or money market deposit accounts (MMDAs) combine the benefits of savings accounts and checking accounts. These accounts earn higher interest rates, FDIC insured and are different from money market funds. According to CNN, MMDAs earn 0.65% interest while savings accounts pay at 0.46% and checking accounts at 0.07%.

Money market accounts are highly liquid too. MMDA funds are accessible through debit cards. But banks typically require a large opening deposit and charge fees. According to SmartAsset, it can get around $5000 to $10000 and if you fail to maintain this balance, you’ll get monthly fees up to $15. For example, PNC’s basic checking account has a monthly fee of $7 while money market accounts’s service fee is $12 per month. So money market accounts offer higher interest but the fees can stack if you don’t meet the required maintaining balance.

13. Money Market Mutual Funds

Money market mutual funds pool investors money to invest in debt securities that are short-term and with low credit risk. It includes banker’s acceptances, treasury bills, commercial paper and certificate of deposits. Investors must understand these money market securities to be in the loop of their investment. It is also known as one of the assets with the lowest volatility.

According to Fortune, MMF investment rate can get as high as 5.45% APY. The current inflation rate is 3.5% as per Nerdwallet. So, money market mutual funds are an inflation-beating asset. But it also incurs chargers like the expense ratio. Vanguard’s expense ratio range is 0.09% to 0.16% so for every $10,000 investment, you’ll be charged $9 to $16.

Mutual fund companies can also charge 2% per redemption if the fund’s liquid assets go below 30% as per SEC. Money market mutual funds can be lucrative and are inflation-beating, but charges can affect your profit.

14. Certificates of Deposits (CDs)

Certificates of Deposits (CDs) produce income through fixed interest rates. It’s also called time deposit because you’ll have to lock in your money for a set period of time or you’ll face penalties. So, it’s not easy to liquidate. But CDs are risk-free, FDIC insured up to $250,000 and the longer term-length you chose, the more interest you accumulate.

Certificates of Deposits are easy to open, like savings accounts. And they don’t charge user fees. According to Nerdwallet, the national interest rate as of January 2024 is 1.86% for 1-year CDs and 1.41% for 5-year CDs. But Time reported there are banks that offer 5% interest for special CDs. It’s not as profitable as other assets and is difficult to liquidate.

15. Dividend Stocks

Dividend stocks are attractive assets because of its regular income and price appreciation. Dividend stocks pay dividends to shareholders annually, quarterly or monthly like bonds. But the income isn’t fixed like bond coupons because it can rise in value like stocks.

Dividend stocks are less volatile than stocks and are typically associated with stable companies. The Dividend Aristocrats are made up of corporations paying their shareholders consistent dividends for over 25 years. Dividends vary but according to Investopedia, it generally pays 2% to 5% annually.

To know which companies are paying dividends, you can check the “dividend yield” line on stock listings. It’s worth noting that dividends are taxable. Its rate will depend on whether you own the dividend stock 60 days before the ex-dividend date or not.

16. Index Funds

Index funds are investment funds that mirror a market index to gain the same profit. The pooled money is used to invest in the same companies as the index it’s tracking. This method provides investors with exposure to a broad market, minimal operating costs, and low portfolio turnover.

Investing in index funds is a great solution for new investors or individuals with minimal capital to get in on the action with diversified risks. According to Investopedia, index funds crossed 50% assets in 2023. Index funds also have a low expense ratio compared to money market mutual funds. CNBC reported it is 0.02% so for every $10k investment, investors are only charged $2. Bankrate even mentioned there are index funds with no expense ratio, like Fidelity ZERO Large Cap.

17. Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) pool investor’s money to buy securities. It works like index funds, but are bought and sold like stocks. ETFs are accessible for starting investors because of the low minimum investment requirement. It is also less risky because of the diversified investment.

According to Oliver Wyman, there are $6.7 trillion of ETF assets under management across US and Europe. ETF has a compound growth rate of 15% per year since 2010. There is an upward trend with this income producing asset. Although it also has fees that can stack with every trade. Investopedia reported the average management cost for every $1000 investment is $3.70. EFTs brokerage commission rate is charged at $20 or less. And an expense ratio of 0.75%.

18. Annuities

Annuities are investments you can pay with a large sum of money and get back with interest after 59 ½ years old. Annuities are typically available in insurance companies, but they can also be bought in banks and brokerage firms. It can be a reliable source of income, popular for retirees.

The average ROI of Annuities is 4% to 6%. And as per US News, a $2 million annuity can likely pay $10,000 to $20,000 a month for the rest of your life. Annuities are complex but there is an upward demand on it. Annuities sales rose 22% to $77.5 billion in 2022 alone.

Annuities can be a promising asset, but it also has sizable fees. If you withdraw your annuities before 59 ½ years old, you’ll be charged a 10% penalty by the IRS. Although this drops the longer you hold the annuity. Aside from that, there’s an administrative fee which is 0.3% of the annuity and annual maintenance fee of less than $50. Insurance companies also impose the mortality risk and expense charge (M&E charge) which is 1% to 1.5% of the annuity.

19. Peer-to-Peer Lending (P2P)

Peer-to-peer lending (P2P) is an alternative investment trend that cuts intermediary institutions. Borrowers get the loan directly from lenders through P2P online platforms. P2P started in 2005 and is also called “social lending” or “crowd lending.”

P2P lending annual rate is 5% to 10% so it’s a lucrative investment. But it also comes with risk since P2P borrowers typically have poor credit scores and are inadmissible for bank loans. P2P platforms also charge service fees to lenders for payment processing, loan monitoring and customer support. Servicing fee is 0.5% to 1.5% of the interest earned.

20. Investment Trusts

Investment trusts are companies pooling investors money to invest in different companies. Investment trusts are public limited companies with a fixed number of shares. Thus, the value of each unit, or share, depends on the value of the underlying security and the supply and demand. Investment trusts are assets mostly in the United Kingdom and Japan.

Investment trusts are mandated to pay 85% of their profit to their shareholders. They’re also allowed to keep the 15% of the income so they can consistently pay dividends to shareholders even through challenging markets. However, according to Money.Co, dividends over £1,000 are subjected to tax. The tax rate range is 8.75% to 39.35%, depending on your income tax band.

21. High-Yield Savings Accounts

High-yield savings accounts are savings accounts with higher interest rates. According to CNBC, the national average for a savings account in 2024 is 0.4%, while high-yield savings accounts offer 4% or more. It’s a passive income producing asset with high liquidity. A high-yield savings account offering 6% return annually can earn you anywhere between $60 to $1500.

Forbes listed BrioDirect and Ivy bank as the best banks offering high-yield savings accounts in 2024. BrioDirect offers 5.36% interest rate while Ivy Bank offers 5.30%. High yield savings accounts are typically offered by digital banks. Some of them charge a maintenance fee as high as $25 per month, according to Experian. It offers high return but you should have a large enough deposit to still profit even after the maintenance fee deductions.

22. Private Equity

Private equity is an alternative investment with potential high returns but also considerable risk. It is usually available to accredited investors who meet certain net worth or income requirements. Private equity firms pool money to invest in private companies. These companies are usually in early stages of development. It’s promising if you find the next successful startup.

According to the Investment Council, PE funds have increased 60% in the last 5 years and have $4.4 trillion assets under management, $1 trillion is uninvested capital. Private equities are long term investments and may require your capital locked in for years. According to Investopedia, private equity firms charge management fees around 1.5% to 2% of your committed capital.

23. Cryptocurrency

Cryptocurrency is a digital currency monitored by a peer-to-peer network called blockchain. Cryptocurrencies are stored in crypto wallets which can be cloud-based or hardware. Cryptocurrencies can be used to purchase goods and services like fiat or government issued currencies. Although it is banned in 10 countries and now widely used as a method of payment.

According to Bankrate, 255 of US high-income earned are crypto investors. However, cryptocurrency is known for its volatility like the rise and fall of Bitcoin in 2021 and 2022. Additionally, it takes $5000 to $70,000 to create a crypto coin. Every cryptocurrency also has built-in transaction fees. Bitcoin’s network fee is BTC 1.43%, Etheruem’s gas fee is ETH 0.66% and Solana’s processing costs is SOL 3.44%.

24. Small Business/Franchise/Angel Investing

Investing in small business, franchise or startups comes with potential high return but also significant risk. The Angel Capital Association’s survey revealed only 11% of angel investing have positive results. And Investopedia shared franchise owners earn less than $50,000 per year.

Investing can be lucrative if there’s a large market opportunity for the business. According to TechCrunch, angel investors can receive 2.5x of their investment. Franchisees can earn 4% to 12% of their gross revenue. Although to get a franchise license, the initial start-up fee is ranging from $20k to $50k. These are income producing assets that will demand hard work for a positive return. Bankrate even mentioned angel investors are also mentors of startup entrepreneurs.

25. Starting/Buying a Business

Starting or buying a business will ensure you a business asset. According to Payscale, US small business owners generate $70,000+ on average. And 36% of small businesses are getting leads online. So, that’s less overhead costs too.

However, starting a business is more risky with a 10% to 35% success rate, according to Lenza. It has huge overhead costs. Brick and mortar stores typically rent a space. It’s a fixed monthly expense regardless if you turn in profit for the month or not. On top of that, equipment is expensive. Depending on your business and industry, they can range between $11,000 to $125,000 as per Bankrate.

Meanwhile, buying a business poses less risk since the initial planning, launching and operations are already done. Most of them already have a market. Lenza’s research revealed 9 out of 10 businesses bought by entrepreneurs are still in business after 5 years. Buying or starting a business will require a lump sum of capital, with no guarantee of a return.

26. Online Business

An online business sells goods and services through the internet. Its rise in popularity in recent years resulted in 20% of all retail purchases being done online. According to NASDAQ, by 2040, it’s expected that 95% of purchases are online. Ziprecruiter reported the average annual income for an e-commerce business in the US is $111,230 per year. It’s approximately $10,000 per month.

Since all commercial transactions are done online, ecommerce stores set up websites. Web hosting and domain names are recurring expenses of around $100 per month. It has a lower overhead cost than traditional stores, but you’ll also have to work on your website optimization and content creation.

27. A Business

A business sells, exchanges, purchases or creates goods and services for profit. According to Scottmax, 66% of small businesses in the US reported they’re profitable. And entrepreneurs increased 15% in the last 2 years. There is an increased interest in this income producing asset.

Any business comes with an overhead expense which varies on the industry. According to Clover, restaurants' overhead cost is 35% of sales. Retailers enjoy the lower 20% to 25%, while professional services’ overhead cost can get as high as 50% of sales.

28. Your Own Products

Creating your own product for income takes a lot of hard work upfront, but can be very rewarding. It also has a potential to be a passive income source. Selling your own products will give you 100% control as the owner. Creative Flow Collective advises entrepreneurs to set their profit margin at 60%.

Some products you can sell online are books, online courses, printable designs and art and crafts. Because of ecommerce, your products are open for the global market. However, according to Click Post, logistics cost of ecommerce stores range from 5% to 15% of sales while brick and mortar stores typically reach 5% only.

29. Royalties

Royalties are the percentage of sales from an intellectual property you own but distributed by other parties. Typically, sales from books, music, artworks, copyrights, franchise and patents pay royalties. In Royalty Exchange, you can buy and sell royalties on music, films and trademarks.

Investors use this to diversify their portfolio and earn steady income unrelated to the volatile financial market. According to Royalty Exchange’s data, music royalties earn consistent 10% returns to investors. Meanwhile, Self-Publishing School reported traditionally published authors receive an advance of $100,000 and 10% of royalties for every book sold. So royalties can be a lucrative passive income option.

How To Build Assets That Generate Income?

Conclusion: Start Building Your Wealth With Local Lead Gen Assets

Local lead generation is the best income-producing asset to build your wealth because you can start it with your 9-5 job. The tree care site I created in 2015 took me 15 hours at max to set up and it still generates me $2000 passive income per month. It requires minimal attention.

In terms of risks and competition, local lead generation websites also win. It’s like real estate but digital so the more people rely on the internet to get the services they need, the more your local lead gen sites get valuable. And there are 5.9 million searches per minute. But you’re not competing worldwide so you’re not up against giant corporations with money for ads.

So if you’re looking for an income-producing asset to prepare for your retirement or start your journey to financial freedom, creating local lead generation websites is the best way to start. It’s passive with low maintenance required. And it carries low risk with high income potential.