Bulls on Wall Street is a financial and trading education company by Kunal Desai that offers tools, lessons, and guidance on being a winning trader. It teaches day, swing, and options trading, covering trends, trading psychology, and risk analysis. Kunal's The "Free Trade" technique is a smart trading method that aims to make money while limiting the risk of big losses. However, Broker reports suggest that around 70% to 95% of day traders lose money. This still makes trading a risky business option out there.

Bulls on Wall Street have a lot of positive reviews online. It gained a 4.8 rating on Trustpilot, enforcing its legitimacy and effectivity. Users praise it for coaches' competence and the immediate benefits of membership. The course can cover all the tools for trading success. However, there are also negative comments on Trust Pilot. Most of these comments talk about the course being ineffective and the unresponsiveness of their team.

In this Bulls of Wall Street review, we'll provide you with the course's pros and cons. We'll also discuss its price, general information, and reviews. We'll also give information on Kunal Desai, Bulls on Wall Street founder. You'll have better understanding if the program, and trading as a business, is for you.

Bulls on Wall Street Pros and Cons

Pros

Bulls on Wall Street's website offer free materials in assessing whether the service is suitable for you.

The platform provides clear trade alerts for both swing and day trading services.

Bulls on Wall Street offers robust educational materials, making the site highly suitable for learning, especially for new traders.

Cons

Bulls on Wall Street's bootcamp are costly and financially inaccessible.

The program's chatroom has potential to become crowded.

Bulls on Wall Street don't have a trial period for you to test it out.

Price

Bulls on Wall Street's Live 60-day Bootcamp costs $2,850.

Refund Policy

Bulls on Wall Street don't offer any refunds.

Origin

Bulls on Wall Street started in 2008.

Reputation

Bulls on Wallstreet has a good reputation online.

What Is Kunal Desai's "Free Trade" Technique?

Kunal Desai's "Free Trade" technique is a management and trading strategy for balancing profit and minimizing risks. It begins with the trader establishing a position. A position in trading is the ownership or short selling of a security, asset, or property. Next, the trader targets a clear profit and risk point. In a favorable trade, selling some positions locks in early profits and reduces risk. This initial profit-taking transforms the remaining part of the trade into what's known as a "free trade." This term implies that the trade is risk-free. The profits already secured compensate for the potential loss of the remaining position. Even if the market were to shift, the trade could still be profitable or at least break even. But this depends on the size of the initial profit taken.

As a trader, imagine buying 100 shares of a stock at $10 each, costing you $1,000. When the stock price rises to $15, you sell 60 shares and earn $900. Now, with most of your initial investment recovered and 40 shares still in hand, these remaining shares become your "free trade." This means any profit from these shares is a bonus, as your initial investment is safe. This is regardless of future stock price movements.

The real advantage of this remaining position is the flexibility it affords. The trader can choose to hold it for potential gains and adjust stop-loss levels to safeguard against market reversals. Another option is adding it to the position if the market trends continue to be favorable. Beyond the financial benefits, this technique also offers a psychological edge. Securing early profits can ease emotional stress and reduce the pressure of decision-making. This allows for clearer thinking and more effective management of the remaining position.

However, recognize that the "Free Trade" technique is only for effective risk management. It's not a foolproof method and does not guarantee profits. Market conditions can change and what seems like a risk-free situation can still result in losses, if not managed. Additionally, this approach demands discipline. It also needs a solid understanding of market dynamics for successful execution.

What Does Bulls on Wall Street Teach?

Bulls on Wall Street teaches technical analysis, risk management, and trading psychology for beginner to expert-level trading skills. The platform offers specialized courses in day, swing, and options trading. It also has a Live 60-day Bootcamp that provides practical, real-world trading skills. These courses cover how to manage trading risks and identify high-probability trading opportunities. Daily market recaps, watchlists, and live mentorship sessions supplement it.

What Is the Live 60-Day Bootcamp?

The Live 60-Day Bootcamp is a complete trading program by Bulls on Wall Street. It provides the tools and knowledge necessary to succeed in the financial markets. The bootcamp has been running since 2008 and has taught over 5,000 students. It offers mentorship with trading simulators and live trading. This includes many well-known traders. The program offers lifetime access to all future bootcamps. It allows students to continue learning and staying updated with new strategies, news, tools, trends, tips, and tricks.

Additionally, the bootcamp includes access to trading plan templates and tools. These are TC2000, TraderVue, and Trading Sim. TC2000 is a real-time stock and options trading software. It provides advanced charting, scanning, and portfolio management tools. TraderVue is a trading platform that offers real-time streaming quotes, news, and charting tools. It also has a trading simulator for practice. Trading Sim lets students test trading strategies without using real money.

The bootcamp runs every 2 months and students have access to the material and tools for life. The Live 60-day Bootcamp curriculum includes live and on-demand training and ongoing education. It's a combination of live classes and on-demand learning modules. Participants can interact with instructors and connect with experienced traders. This approach enhances learning with resources and a peer community.

Phase 2 is Live Trading Classes, spanning over 30 days with live sessions. The live trading classes are on Tuesday, Wednesday, Thursday, and Sunday. You'll begin with the basics of trading and then move on to more complex strategies.

Following the instructional phase, you’ll engage in practical application. You can observe trades executed by instructors Kunal or Paul in a trading chatroom. It also includes reviewing their trades through daily recap videos. This phase emphasizes real-world application. It allows you to begin simulation trading to identify strategies that align with your trading personality.

Phase 3 is to Develop Trading Plan and Trade Simulator. This spans from days 31 to 60 and combines previous knowledge. Participants will study Kunal's daily live streams and attend mentorship classes. You will also refine and submit your trading plans for evaluation to Kunal and his team. This feedback loop helps identify areas of strength and improvement.

Additionally, the facilitators will introduce participants to a trading simulator during this phase. This simulator provides a safe environment to practice trading in real-life market conditions. It allows participants to apply their trading plans and strategies before entering the live markets. This phase emphasizes the importance of planning and practical application in trading success.

Phase 4 and the last phase is Trade LIVE, Continued Education & Development For Life. It covers days 31-60 and beyond. This phase involves implementing learned strategies. Participants will join Kunal's daily live trading sessions at 9:00 AM EST. This is where he shares his trading plans, executes trades, and shows patterns learned in class in real time.

This phase offers the opportunity to apply acquired knowledge in live trading situations. It has the added benefit of asking Kunal questions for immediate feedback during the trading day. Additionally, participants gain lifetime access to all future boot camp sessions. This ensures learning and adaptation to growing market conditions. This continuous access enables participants to stay up-to-date on new strategies. It also helps to navigate various market conditions, including bull and bear markets.

Day Trading Chatroom

The Day Trading Chatroom is a live trading community that provides access to real-time market commentary. Bull on Wall Street discord channel is their direct channel. It also includes daily screen shares and trade alerts from experienced traders. It helps traders navigate the stock market and learn about market trends and new stocks. The chatroom has been running for over 15 years, known for its informative and actionable value, with no spamming or fluff.

Lastly, the annual chatroom plus day trading accelerator course bundle is $997 per year. This plan includes both monthly and annual subscriptions and inclusions. It offers a significant discount for those who want to commit longer term to trading.

The chatroom also includes features like nightly watch lists and pre-market analysis. It also has a focus list before the market opens. Users can find out which stocks are being closely watched each day of the week and learn the reasons behind them. This helps them reverse engineer their unique trading watch list.

The chatroom uses a discord server to host the trading chat room. This chat technology keeps you engaged in the conversation. Members have access to educational resources, including courses on trading stocks and options.

Swing Trading Chatroom

The Swing Trading Chatroom is a live trading community that provides access to swing trading strategies and tools. Swing trading is a style of trading that aims to capture short- to medium-term gains in a financial instrument (stocks). Unlike day trading, swing traders hold positions for longer durations from days to weeks. The chat room provides real-time market commentary, daily screen shares, and trade alerts.

Paul Singh is the lead instructor in the Swing Trading Chatroom for swing traders. He shares insights on swing trading using his expertise and experience. A seasoned trader with over 18 years of experience, known for trading momentum stocks focusing on risk management. People also recognize Paul for his mentorship of Kunal Desai, the founder of Bulls on Wall Street.

The swing trading chatroom offers a Trade Alert Platform. It's where participants can connect with Paul. Paul provides live market navigation, trade calls, idea sharing, and reactions to market changes. Members get day trading ideas to stay on top of market movements. The platform offers live mentorship on strategies, market trends, and Q&As. Members can observe live trade adjustments made by experienced traders. The chatroom is where active traders share ideas and support each other.

Members also receive Market Speculator Reports detailing Paul’s open positions. It includes new entries, insights into macroeconomic conditions, and Market Pulse updates. It provides market movers and news with community perspectives.

Options Trading Chatroom

The Options Trading Chatroom is a live trading community that provides access to trading strategies and tools. Options trading is buying and selling contracts for assets at set prices within a specified timeframe. Call options offer the right to buy, while put options allow selling. Traders engage in options based on their market views and objectives.

Levi AKA The Stock Hunter is the head of Options Trading Chatroom. He is a 35-year-old day trader with 11 years of experience. Levi specializes in trading stocks and options. He started trading with Kunal Desai at Bulls on Wall Street and has developed a tactical approach that works for all traders. People recognize him for delivering some of the best options trading education in the industry.

Day traders can use the chatroom to enhance strategies and stay informed on market movements. It includes a pre-market watch list that offers a detailed analysis of the market each day. It sets the stage for potential trading opportunities.

Additionally, members receive real-time options trade alerts through a dedicated Discord channel. This ensures they are well-positioned to act quickly on profitable trades. The chatroom provides continuous intraday market analysis for traders. Ongoing support helps traders stay ahead in trading.

SHT Options Course Syllabus

Risk Management covers techniques on how to roll profits and how to use options as insurance to hedge an equity portfolio. It also discusses the benefits and equity risks of trading options. Additionally, the lessons cover market strategies and emotional trading.

The trading Strategies lesson covers the five specific day trading strategies and application of Fibonacci retracements. It also has a detailed strategy for Day Trading using a 30-minute Opening Range Breakout. Additionally, it discusses how to use select moving averages for both day trading and swing trading. This part also covers the focus on trader mindset and psychology crucial for successful trading.

The SHT Custom Trading Indicator lesson covers the walkthrough of the SHT Indicator. It also covers the effective usage of the SHT Indicator in trades and instructions on how to install the SHT Indicator. Additionally, it discusses how to read an option chain and understand strike pricing and premium decay. It also has lessons on how to focus on profit rolling and hedging strategies with options.

Who Is Bulls on Wall Street For?

Bulls on Wall Street Trustpilot Reviews

Bulls on Wall Street receive a lot of positive reviews online. It gained a 4. rating on Trustpilot which shows its legitimacy and effectiveness. Users praise it for coaches' competence and the immediate benefits of membership including the tools for trading success. However, there are also negative comments on Trustpilot. Most comments talk about the course being ineffective and the unresponsiveness of their team.

John Gramse, Bulls on Wallstreet student, said that he found complete education in one place. BOWS provides a comprehensive trading education with a vast resource library. Trade educators support all skill levels for immediate benefits and a welcoming environment. He thanked Kunal, Paul, Levi, Kevin, and Josh for their commitment and guidance. He added that they significantly contribute to the success of many traders.

Shawn, another member, said that he learned a lot while having fun. He enjoyed the boot camp because Kunal is an actual expert in the field. Organized content made learning enjoyable and manageable. The community is both supportive and knowledgeable. He added that this program equips you to excel.

However, there are also negative reviews on Bulls on Wall Street. Es, a former student, said that there are better ways to learn instead of Bulls on Wall Street. The company could enhance its performance by improving customer service. Payment processing leads to a decline in customer support quality. There was a noticeable change in attitude. Additionally, there have been reports of issues with access permissions. Unauthorized deactivation of promised lifetime access services occurred. There was also poor customer service and biased benefit distribution.

Another complaint and a star rating came from Mathew, a former student. He said the Kunal had been trading like a drunken sailor. This occurred when he was still a member. It was a terrible experience for him. He added that it ruined him as a trader even after five years.

Are Students of Bulls on Wall Street Successful?

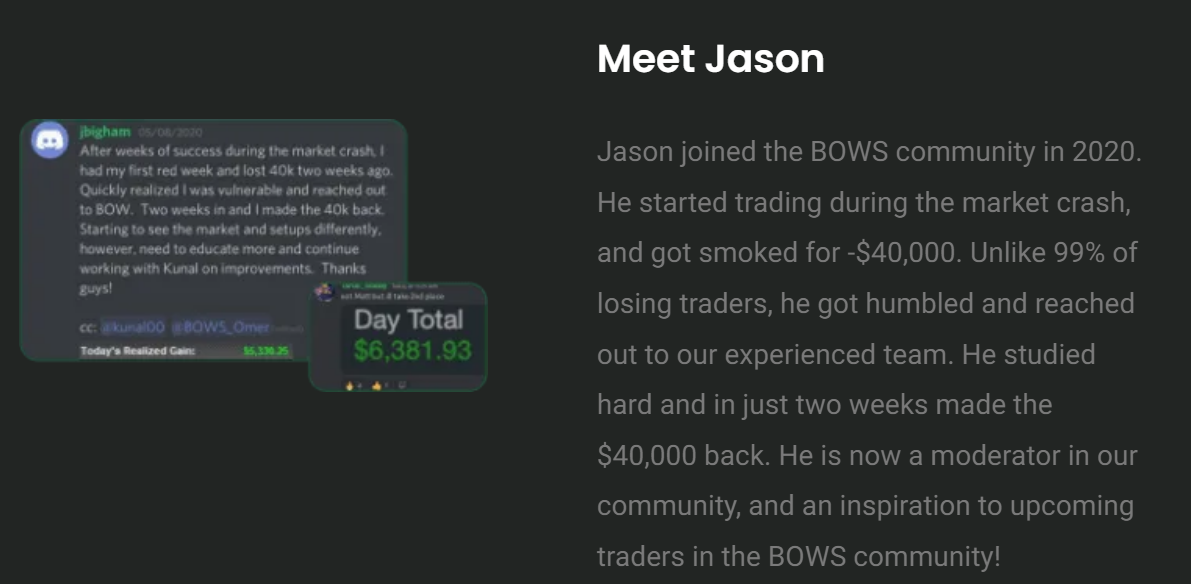

In 2020, Jason joined the Bulls on Wall Street community and started trading during the market crash. It's where he initially lost $40,000. He sought guidance from the experienced team at BOWS, and dedicated himself to learning. It took him only two weeks to make up for his losses. He earned $6k within a day. This success and commitment led to him becoming a moderator within the BOWS community. It's where he now serves as an inspiration to new traders.

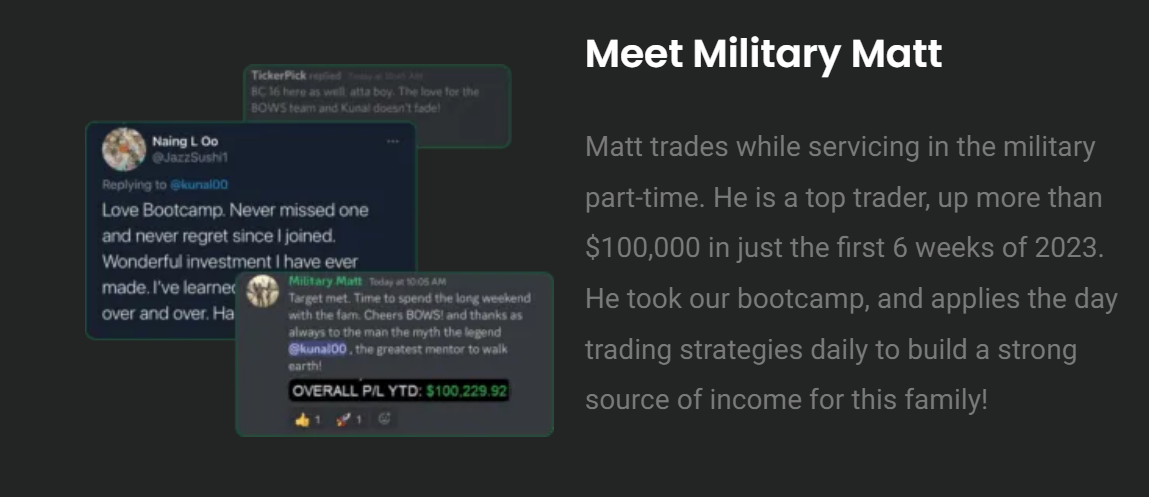

Matt, a former military, has also achieved significant success in trading. He earned over $100,000 in only the first six weeks of 2023. His accomplishments in trading came after participating in a bootcamp. It's where he learned various day trading strategies. He now applies these strategies daily, building an actual source of income for his family.

Trustpilot review also showed Bulls on Wall Street student success stories. Mathew, a student, said that Bulls on Wall Street is the key to trading success. He's been with the BOWS team since 2014, and they've been a key factor in his achieving six-figure gains for three consecutive years. The day trading education they provided has repeatedly proven its value. He wanted to recommend Kunal and his team.

However, there are also reviews that some students of Bulls on Wall Street are unsuccessful. Mark, a previous student, said that the platform teaches bad trading. He has over thirty years of experience and expressed dissatisfaction with Bulls on Wall Street's Swing Trader service. Despite his background and strong risk management skills, he faced significant losses. This is because of the high-risk trade recommendations from the service. He declared issues with poor risk management and bad timing on trades. He also warns other people about purchasing the program.

Who Is Kunal Desai?

Kunal Desai is the founder and CEO of Bulls on Wall Street. Desai, with a Communications degree from Michigan State University, has earned respect for finance. He started his trading journey during the Dotcom Boom. It's where he experienced the volatility of the market firsthand. Paul Singh's mentorship honed his skills and made him developed a trading system. It's tailored to his strengths and goals. This led to the founding of Bulls on Wall Street, where Desai aims to empower traders with the knowledge to navigate the market.

Today, Desai is fully involved in trading, teaching, and speaking engagements worldwide. He has shared his expertise at renowned events like the Trader and Investor Summit. He also actively took part in the Traders4ACause gala and received features in the Huffington Post and Inc.com. Additionally, he engaged in Forex, Cryptocurrency, and Commodity trading. Desai's teaching dedication and trading expertise have solidified his status in finance.

What Is Kunal Desai's Claim?

Debunking Kunal's Claim

Kunal's claim of becoming a pro trader in 60 days or fewer is enticing but needs critical evaluation. The boot camp offers a solid foundation in trading fundamentals and practical skills. However, his claim of guaranteeing proficiency and profitability quickly is potentially misleading.

The program may be a valuable educational tool for those new to trading. However, future traders should approach such programs as part of a longer-term educational journey. It is not a quick route to success.

Is Trading Worth the Risk in 2024?

Trading is worth the risk in 2024, according to this Warrior Trading review. It's worth it if you have advanced strategies, discipline, and risk management skills. However, statistics reveal that success in trading is rare and not the norm. Around 40% of day traders quit within a month, and 87% give up within three years. This is why experts do not encourage beginners to trade.

After considering costs, experts expect that only about 1% of day traders will be profitable. Trading offers quick gains but is risky and unlikely to be consistently profitable. Also, the average trader stops trading after six months of losses. 97% of day traders also lose money consistently.

Additionally, you can learn about the stock market for free (and how to trade) through online courses on platforms like Investopedia and Udemy. You can also check YouTube video tutorials on stock market trading. Trading forums such as Reddit's r/StockMarket is also a good source of trading knowledge. In libraries, you can find trading books like "Reminiscences of a Stock Operator" and they are often available for free online. Online brokers provide demo accounts for practicing trading with virtual money. Stay informed by free financial news websites like Bloomberg and CNBC. These resources provide valuable knowledge and insights in trading without spending money.

Trading is potentially lucrative, but the data points to a significant risk and a low success rate. To trade successfully, learn an effective style and manage your risks.

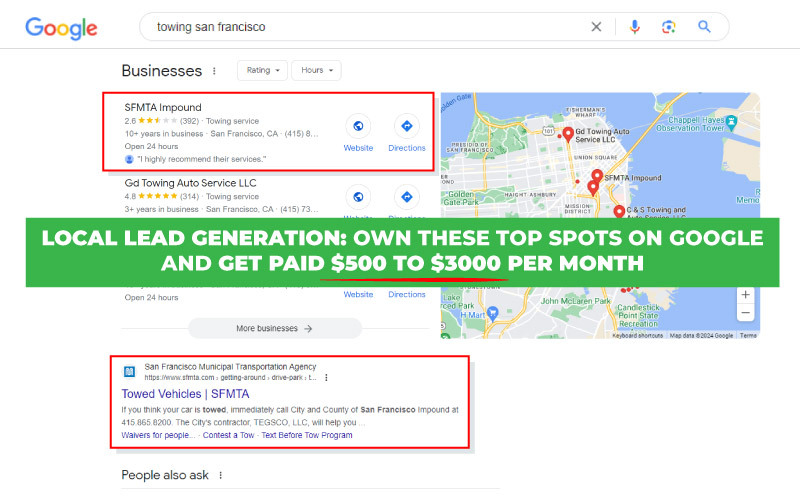

Create Low-Cost Passive Income With Local Lead Generation

Local lead generation is a better business opportunity for passive income with lower risks compared to trading. Lead generation tools, website development, and marketing are the initial costs for this business. These passive opportunities can generate modest income, which is lower compared to the capital required for trading. Additionally, local lead generation offers the potential for high-profit margins. With recurring revenue models, such as monthly retainers from clients. Competition exists in the local lead generation space. However, specialization, marketing, and exceptional service can handle it.

In contrast, trading involves higher costs, including brokerage fees, trading platform subscriptions. There is also potential for significant losses from trades. Profit margins in trading can vary and are subject to market fluctuations. This makes it more challenging to predict and manage compared to the stable income streams of local lead generation. The stressfulness of trading is also great, as it involves navigating market volatility. It involves quick decision-making and emotional management of financial difficulties. While trading can offer high returns, it also carries higher risks. This includes intense competition from other traders, institutional investors, and algorithmic trading systems.

Try local lead generation biz as a better alternative to trading. It offers stable income, scalability, and lower stress levels compared to trading. With predictable revenue streams and manageable risks, it's a less risky venture. It also has a better potential to provide financial stability and growth opportunities.