Index Fund Pro is a trading program by Andrew Giancola that teaches how to build wealth with index funds. It has over 30 video lessons that cover every step of investing in index funds. This program guides you from the start, through the basics of trading, and how much you need to invest to have a retirement plan.

Investing in index funds can offer an opportunity to earn significant income in the long run. It tracks market indexes like S&P 500 that provide diversification and steady returns. Also, some experts recommend index funds for beginners because it is cost-effective with low expenses. But, there are drawbacks to consider. Index funds can't beat the market and you have limited control over the individual stocks in the fund.

If you're looking for a better alternative than investing in index funds or ETFs, check local lead generation. It provides higher returns and more control. With this business model, you create websites that rank well in search engines that attract valuable leads. You then rent these out to local businesses that pay you a monthly fee between $500 - $2,000. Unlike index funds, it is more hands-off with greater potential for a passive income stream.

Index Fund Pro Pros And Cons

Pros

Index Fund Pro has good inclusions.

It's not expensive, which is good for beginners.

Index Fund Pro offers a great refund policy.

Investing in index funds is a good start.

Cons

The one-hour coaching session with Andrew is not for everyone.

Index funds are not a quick money scheme.

Index Fund Pro doesn't have student reviews, unlike Andrew's podcast.

Price

Index Fund Pro costs $99.00.

Refund Policy

Andrew Giancola offers a no-question-asked refund within 60 days.

Origin

Index Fund Pro started in 2015.

Reputation

Master Money has a solid online following online. Andrew has 150.3K followers on TikTok alone, 12.6K followers on Instagram, and 2,439 on Twitter.

What Do You Get In Index Fund Pro?

With Index Fund Pro, you get access to over 30 video lessons that have 7 sections to guide you on how to invest in index funds and ETFs. Also, you will receive the Investor's Checklist, Best Brokerage Accounts for Index Funds, and a chance to win a monthly 1-hour coaching session with Andrew. Index Fund Pro gives you access to future bonuses and updates.

In this section, you will learn why you need to invest your money. It reveals that you can build wealth by investing your money in index funds. Andrew teaches you how to conduct research before entering this business.

This section covers the basics of trading in index funds and ETFs. It teaches you also what stock, bond, index fund, and ETF is.

Section 3 will show you the reasons why index funds and ETF are the better stocks to build wealth.

In section 4, you will learn what % of index funds you should have in your portfolio for each type.

Andrew focuses on helping you to save tons of dollars in this section to reduce taxes in your venture.

Section 6 covers the step-by-step of buying your first index funds. Also, it talks about what accounts to open and in what order.

The last section of the program helps you to set your goals which is enough to retire from your job. Andrews provides tips and tricks on how to retire early through index funds and ETFs.

Who Is The Creator Of Index Fund Pro?

Andrew Giancola is the creator of Index Fund Pro. Andrew is the founder and CEO of Master Money, which offers two programs; Index Fund Pro and Debt course. His main goal is to teach people to build their own wealth. Giancola shares his personal experience in finance, money, investing, business, income sources, stocks, and even in real estate. Andrew reveals his failures and success in his finance venture to people since 2013.

Andrew Giancola runs the Personal Finance Podcast. It is a well-known finance podcast that teaches strategies to save more money and have good habits in budgeting. The Personal Finance Podcast has 4.8 ratings and a good reputation online for its listeners. Andrew receives tons of great reviews from his audience, which shows how helpful his content is.

What Is Andrew Giancola's Net Worth?

Andrew Giancola has a net worth of $1.5 million by the age of 34. After reaching this mark, he focuses on helping investors, entrepreneurs, and traders to reach their goals. He still hosts his podcast and offers his programs.

Who Is Index Fund Pro For?

Index Fund Pro is for:

Is Index Fund Pro Worth It?

Yes, Index Fund Pro is worth it. It costs only $99.00 to access the course that teaches the ins and outs of index fund investing. Also, you will receive bonuses and access to future updates of the course with no additional fee. Index Fund Pro offers a 60-day money-back guarantee which is great for beginners. You can contact their customer support if you find the course doesn't fit you and they will refund your payment with no-question-asked.

Andrew Giancola has a good record online for being one of the best mentors in finance and investing in index funds. He receives positive reviews from his audiences on the Personal Finance Podcast. However, Index Fund Pro doesn't have feedback online. The review section on its website is also for his podcast. But, for its price and great refund policy, Index Fund Pro can be worth it.

Aside from Index Fund Pro, you can try his Debt course. It is a free course by Andrew Giancola that helps you to get out of your debt. Debt course provides a clear plan on what debts to pay first. This course has 7 videos that walk you through the fastest way to have freedom in your debts, which you can finish in less than an hour.

What Is An Index Fund?

An index fund is a type of investment fund that aims to replicate the performance of a specific market index, such as the S&P 500. It allows multiple investors to pool together and uses it to buy a diversified portfolio of stocks. An index fund is a good investment and one of the top ways to double $10K quickly in 2025. It offers a simple and cheap method to diversify your portfolio by mimicking a market index. Index funds reduce the risk of individual stocks and are higher upfront than other funds.

What Are Index Funds' Pros And Cons?

Pros

Diversification: Index funds offer ways to invest in broad market indices.

Low costs: It can be cost-effective because of its lower expense ratios than actively managed funds.

Simplicity: These kinds of funds are more straightforward and easy to manage than other methods.

Cons

Can't beat the market: Index funds have lack of potential to outperform the market because it aims to match the performance of the index.

Not immune to loss: It is also prone to market downturns. Index funds' value can decrease when the market declines.

Lower return potential: Index funds have lower return potential because you have limited control over the stock selection, unlike actively managed funds.

Are Index Funds Safe for the Long Term?

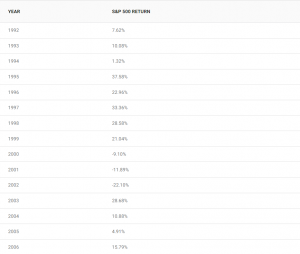

Index funds are safe for the long term. It has consistent growth potential and data supports this notion. For example, a market index like S&P 500 has had an average annual return of 10.7% per year over 30 years. The data below reveals that investing in the S&P index can be profitable in the long run. But, the past performance for the last 10 years decreased its average return than before.

Index Fund Pro Alternatives

Conclusion: Is Investing In Index Funds Still A Good Idea?

Yes, investing in index funds is still a good idea. It has low fees, is easy to understand, and can provide consistent returns. Index funds outperform actively managed funds because of its low costs and can be a passive investment. It can be a good idea also if you are planning to hold your investments for the long term.

Local lead generation through rank and rent is a better idea than investing in index funds. You create websites, then by using SEO strategies you rank them higher in search results. After that, you can earn monthly passive income by renting it out to local businesses in need of leads. Also, it allows you to have more control over your income and scale to as many websites as you want.