How to invest in digital real estate:

- Decide on the digital asset you wish to own.

- Do market research and find a digital real estate platform.

- Develop a digital real estate monetization plan.

- Execute your strategy and increase your digital assets’ value.

Investing in digital real estate in the 21st century's highly competitive online landscape entails beginners and experts to be proficient in digital asset management, the newest trends in online marketplaces, and strategic reputation management. They must know how to utilize modern audience engagement tactics like video content, affiliate marketing, and carousel ads. According to Gallup's research, businesses can expect a 23% improvement in revenue and customer satisfaction by fully engaging their audience. This leads to brand growth that will increase your digital real estate's value in the long run.

Digital real estate is any property on the Internet that you own. It can be websites, social media accounts, domain names, cryptocurrency, NFTs, or digital products like mobile apps. Unlike the traditional real estate industry, digital assets don't have tangible properties. You can't see or touch them, but they take up space online. Some examples of virtual worlds include Crypto Voxels and Decentraland. According to Bankless Times, the smallest imaginable lot in Crypto Voxels is valued at 0.20 ETH or around $1,799. When you purchase online real estate, you are given a deed. The deed is proof that you own the property that "lives" on the blockchain as an NFT or virtual property.

Jordan, also known as Millionaire Millennial on YouTube, revealed how he makes a sizable income from digital real estate In June 2023, he said that he'd made around 15-16 sites from scratch. These websites cost about $0-$100 to build and set up. On average, a single site generates $622 monthly. He even mentioned an RV niche site that sells for $18k and makes $700 in passive income per month.

The goal in investing in digital real estate is to make your virtual assets valuable by driving high-quality traffic and promoting a good online presence. Some Reddit comments focus on the intangible nature of digital real estate and saying its "fake" estate. Most people are so accustomed to traditional real estate that they're not seeing the profitable trends in 2024 and beyond. Redditor Ricketybang mentioned how he makes $2K monthly for each of his seven lead gen sites. Some online entrepreneurs even buy websites on platforms like Flippa to optimize the site and sell for around $100K-$200K in profit.

While digital real estate is lucrative, you still need to invest time and money to build your assets' value and presence. The more value your digital assets have, the more profit you can earn. But what specific digital real estate assets is the best one to invest in in 2024? This article will talk about the steps in digital asset investment, proven methods for securing virtual real estate, the business model's profitability, and the costs involved.

How To Invest in Digital Real Estate

1. Decide on the Digital Asset You Wish To Own.

You need to decide on the type of digital real estate assets you want to own and sell. The most popular ones include websites, domain names, blogs, mobile apps, cryptocurrency, and Metaverse land. As with any investment, there are risks and associated costs. Consider how much you want to spend investing in digital real estate and the profit margin you hope to generate. Will this be a long-term investment, or do you want a quick turnover? You also need to consider your competitors, industry trends, and your target market.

Talk to an expert or other people who have invested in the digital assets you're interested in pursuing. Then weigh the pros and cons before making a decision. It's also best to learn as much as you can about the type of digital real estate you wish to own. This includes their cost, how long it takes to reach certain revenue gains, and their long-term potential. That's why local lead generation is the best digital real estate asset to invest in in 2024. It has low startup costs (only web hosting and domain name), high profit margins (80%-95%), and long-term demand. This is because of its localized niches. You have less competitors than on a global scale. And your target market is always ready to buy.

2. Do Market Research and Find a Digital Real Estate Platform.

It's crucial to conduct in-depth market research to find the niche and digital real estate platform that fits your interest and goals. This way, you also choose the right target audience based on market demand, trends, profitability, and sustainability. You can use third-party tools like Google Trends, Yahoo Finance, or SEMRush to assess things like:

- How does this digital asset make money?

- What are the current market trends?

- How high is the level of competition?

- What are the experts saying?

Then, you can decide on the platform that best meets your budget and goals. You also need to consider the platform fees and regulations and how much time you need to commit. When investing in digital real estate, do your research. Use a trusted site to avoid getting ripped off or losing capital. Finally, you must determine your competitors' capabilities. This includes their market presence and competitive advantage.

3. Develop a Digital Real Estate Monetization Plan.

After you've picked the type of digital real estate you want to invest in, you need to develop an actionable real estate monetization plan. For example, if you buy and flip websites, consider the rank and rent business model. Build and rank generic websites that produce leads you can sell to a local business owner for profit margins as high as 85%-90%. You can start a blog and leverage affiliate links, sponsored content, or paid ads. Other methods include things like:

The key is to develop an online asset that gets attention or offers something unique.

4. Execute Your Strategy and Increase Your Digital Assets’ Value.

Executing your planned strategies lets you increase your digital assets' value by more than 2x-5x or more. In fact, Sujan Patel's article on HubSpot recommends creating a business strategy by diversifying into new locations, markets, and assets. To make money with digital real estate, you need to increase its worth. Create something that people are interested in, like a blog, or that solves a problem, such as a digital course. The goal is to own digital real estate that has value. Then you can generate positive cash flow with your monetization techniques. You can rent your assets for a fee and act like a digital landlord. Or you can sell your investment for profit.

8 Methods To Secure a Virtual Asset in 2024

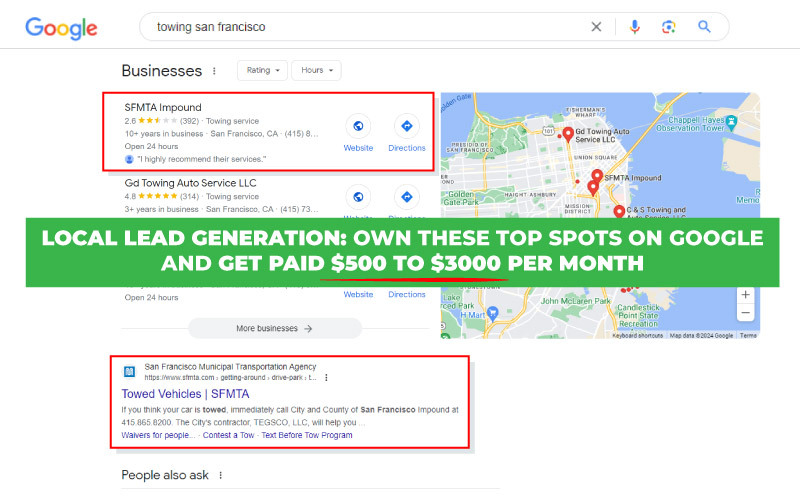

1. Create Local Lead Generation Websites.

Creating local lead generation websites and landing pages is the most profitable way to secure digital real estate assets in 2024. It doesn't break the bank or take months of grinding to get results. Instead, you can own premium digital real estate in just 5-15 hours. Plus, ranking them organically on search engines like Google takes around 3-6 months. Sometimes it even takes less than 3 months. You can use platforms like WordPress, Wix, and Squarespace to build your websites with zero coding skills needed. These site builders have drag-and-drop functions that streamlines your site development journey.

With local lead gen, you own the sites, tracking number, and leads. Thus, you generate free, unlimited leads without the hassle of strict third-party platforms. Plus, there's no cap on how many lead generation properties you can create. And they don't need much maintenance after that. Your lead gen sites are like a resource. One that people are searching for and will go to repeatedly. All that's left to do is find a local business owner interested in expanding. Then, you can sell your leads and start making some real money on a monthly basis. This digital real estate asset lets you earn up to $1K per lead or $10,000 for every site you make.

2. Buy and Flip Websites and Domains.

Buying and flipping websites and domains is a lucrative way to earn money using virtual assets. According to Medium, most website and domain flippers generate around 30% to 150% of ROI. You can find used websites on platforms like Flippa for $500-$5,000+. Then, check out the link profile using a tool like Spamzilla or Ahrefs. You want a site with a clean profile that you can monetize with strategies like affiliate marketing, a blog, or earn a monthly rental income by leveraging the local lead generation business model.

You can also build your own website on a platform like GoDaddy for around $15 monthly and host it on a site like Namecheap for $8 per month. Hosting Tribunal reports that there are approximately 2 billion websites on the Internet. But there are only three spots at the top of the SERPs. The key is to rank your site and drive online traffic. Then you can make money with your monetization methods.

Similarly, you can find used domains and URLs on sites like Hostinger or Sedo. The domain name is like your license and gives you the right to use the platform. Look for URLs that are short and easy to remember with a city name. Then check for a clean backlink profile with a tool like SEMRush. Pick domains with a favored extension like .com or .io. However, site rules must be adhered to. Failure to comply with the policies could result in you forfeiting your right to ownership. Used domains can cost upwards of $10-$10,000. Data suggests that in 2023 there was an increase of 3.5 million domain name registrations. So do some research before you find one that meets your criteria.

3. Trade, Stack, or Sell NFTs.

Trading, stacking, or selling Non-Fungible Tokens (NFTs) is convenient because its fairly simple to confirm ownership of these digital real estate assets. NFTs can cost a few thousand dollars. But studies report that revenue in the NFT market is set to hit $1,601.00 million in 2023. You can buy NFTs from a platform like OpenSea. Then generate income with NFTs by trading, renting, leveraging play-to-earn games, or minting and selling your own. Increase their value by building or developing intricate artwork. You can store them long-term and earn interest. Data suggests that some NFTs can make $75+ daily in interest.

4. Buy or Rent Out Metaverse Land.

Buying or renting out land in the Metaverse is a $660-$2,000+ investment. You can buy land on sites like The Sandbox or Decentraland. Purchase parcels of land in the Metaverse through a marketplace like OpenSea NFT for a ground price of 1 ETH ($1,300). Research suggests that the market is predicted to increase to $1.5 trillion by 2030.

To increase the worth of your land, develop it by building a virtual store or amusement park. The key to making money in the Metaverse is to own property where people hang out—the more popular the area, the more valuable your digital asset.

5. Invest in Cryptocurrency.

Investing in cryptocurrency is a profitable digital real estate investment. However, it requires constant monitoring whenever the economy experiences surges in crypto movements. You can purchase cryptocurrency on an exchange site like eToro for a few dollars. eToro is monitored and supports exchanges from debit/credit cards, bank account transfers, or e-wallets like PayPal. You can also buy cryptocurrency on a site like Coinbase with a minimum investment of $2 plus trading fees. Data says that over 4,000 cryptocurrencies are traded worldwide.

Bitcoin alone has gained 75% in 2023, and Ethereum prices are up 55%. Cryptocurrency prices rise and fall, much like the stock market. The idea is to buy when the market is low. Then hold until market prices increase to make a profit on your investment.

6. Create and Sell Digital Products.

Digital products like eBooks, audiobooks, or PDFs take time to create, but they're a low-cost way to invest in digital real estate. The idea is to develop a product that solves a problem or focuses on an unserved market.

You pay with your time but can then sell your product over and over to generate passive income. You can sell digital products on sites like Sellfy. Automate the process with tools like FastSpring; you can make hundreds of dollars each month.

7. Develop and Monetize Mobile Apps.

If you're tech-savvy, you can build and monetize mobile apps on sites like App Builder for minimal costs. But to outsource the process, have a budget of at least $5,000-$25,000. The secret to making money with mobile apps is creating one people want to use. Data reports that 21% of Millennials open an app 50+ times per day.

Decide on your target market. Then learn everything you can about their wants and pain points. Monetize your app with ads, real estate crowdfunding options, sponsorships, or subscriptions. Or you can sell it to the highest bidder for a one-time profit.

8. Grow and Capitalize Social Media Accounts & YouTube Channels.

Creating a social media account or YouTube channel and growing its followers and audience base can be a profitable digital asset to sell. You can also buy active social media accounts or YouTube channels for a specific target audience on sites like FameSwap for $100-$1,000+ or SocialTradia and EazysSMM for $439 with zero copyright or community strikes. Look for ones that offer 1,000+ real subscribers and 4,000+ watch hours. Then post high-quality content that answers questions people are asking online. The goal is to build your following. Then you can monetize your assets with things like banner ads.

You can also sell merch, ask for viewer donations, or use influencer marketing. But if you can drive online traffic to your site, you can earn $1,000+ a month. Data states that Internet users spend 151 minutes a day on social media. And 52% of Internet users worldwide access YouTube at least once a month.

What are the Pros & Cons of Investing in Digital Real Estate?

Pros of Investing in Digital Real Estate

Investing in digital real estate is less expensive than traditional real estate investing like commercial real estate or buying a short term rental property.

The digital real estate industry is now experiencing an increase in acceptance and a shift of wealth trends that are shaping the future.

Digital real estate investing has a high online demand. Assets in the digital space are also expanding like wildfire.

This business model offers a massive opportunity to diversify your income stream, even if you have no prior experience as a digital real estate investor.

Cons of Investing in Digital Real Estate

Digital real estate investing has a volatile market, which could result in a loss of investment capital.

As this industry evolves, security and regulatory risks increase. These include fraud, cyber theft, or technological issues.

In digital real estate, it's not easy to determine how to effectively market your assets to increase their value and get ample online engagement.

The biggest con of investing in digital real estate is not understanding the needs and wants of your target audience.

Can You Make Money Investing in Digital Real Estate?

Yes, you can make money investing in digital real estate if you can create assets online that are in-demand, have value, and are profitable in the long term. Data Reportal says that global Internet users spend over 12.5 trillion hours connected to devices and online services in 2024. This means that there is a massive user base out there that can help you boost your digital asset's value. Plus, there are lots of digital assets you can invest in. Reddit users Goingwiththeflowofit and Wgcole01 even commented on the how well they managed their cryptocurrency and NFT investments a few years back. One Redditor has assets to sell at 2x his initial investment in 2021. Another one was able to be financially stable and paid all his debts from trading crypto.

Like physical property in the real world, your digital assets appreciate over time. So digital real estate can be a profitable venture. But like all investments-when the returns are high, so are the risks. The idea is to buy low. Then increase the value of your virtual assets and resell them for gains.

How Much Does It Cost To Invest in Digital Real Estate?

It costs around $0 to $300 yearly on average to invest in digital real estate, depending on the type of online asset you want to pursue. For example, building and ranking a website like the lead generation business model costs around $500. This includes a monthly overhead of around $25 to cover the cost of hosting, your domain, and your tracking number.

Quora user Rahul Ashok reveals that some SEO companies or freelancers charge $1,000 for helping you rank your websites on Google. That's why it's beneficial to upskill constantly and try to do most of the expensive work yourself.

Another great example is creating a following on YouTube or social media. If you know how to drive traffic and engagement, then it can cost you nothing. In a YouTube video by Think Media, Sean Cannell talked about how creating quality content, sticking to a publishing schedule, and using interesting topics can help you build a following quickly. It only costs you your time and effort.

Is Digital Real Estate a Wise Investment in 2024?

Yes, digital real estate is a wise investment in 2024 because of the high internet usage of 66.2% of the world's total population, as stated in DataReportal's Global Digital Insights. This means that billions of people are using the digital space daily. It's a great opportunity to build your virtual real estate by choosing highly active, profitable, and sustainable niches and markets. According to Mike Vestil, beginners in this space can easily create a long-term passive income. This is due to the rise of AI, machine learning platforms, course creation websites, and many more. These technologies streamlines content creation, photo and video editing, monetization, etc.

Two Redditors shared their money-making journey in digital real estate selling digital products like e-books and online courses. Molvich made $3,000 monthly in sales, while ShellOfNutShell hit the $25,000 revenue in February 2024. Many other Redditors posted and expressed their positive experience with digital real estate investments in 2024.

Digital real estate is valuable because it appreciates over time and has scarcity. So if you invest in the resources to get online attention with your virtual land, you own digital assets people want to check out. Then you can rent your online space or sell for more than you paid for and earn capital gains on your investment. Digital real estate platforms can also alter people's interest. Trends or market upheavals could change the current demand or popularity of a virtual asset, so it's important to diversify your portfolio. The key is to invest in several digital real estate ventures. Then you mitigate risk, and you don't rely on governed mandates from only one third-party platform.

The Best Digital Real Estate Investment in 2024: Local Lead Generation

Local lead generation is the best digital real estate investment in 2024 because it focuses on local markets and service niches. In fact, there are 41,705 unique zip codes in the U.S. alone. Each one represents a local market with untapped potential.

Digital real estate passive income is money your virtual property earns even when you're not actively working on them. This business model works a lot like the traditional real estate market. But instead of buying physical property, you're investing in online assets. Digital real estate offers an alternate investment option that is profitable, scalable, and easy-to-start. You just need to build demand and drive traffic to your virtual properties to generate significant profits.

First, you need to build and rank microsites that attract attention and produce leads. Then, you can sell those leads to local business owners. You own the website, the tracking number, and the leads. Your lead gen properties act like digital billboards. At the top of the search engines, they get in front of a ton of eyeballs. And because lead generation is a learned skill set, there's less competition.

Once you understand the process, you can scale fast. You can build a single site in around 10 hours or less. Plus, it doesn't cost much to actualize a website. In local lead generation, you generate 85%-95% profit margins. That's about $10,000 per month on every site you make. Let's say you build 10 microsites that are performing well and bringing in leads. You can make over $100,000 monthly.

Venture into modern digital real estate investments that have a high-income potential in 2024 and beyond. Create sustained business growth and financial stability with local lead gen.