Rich Dad Poor Dad is a personal finance book by Robert Kiyosaki in 1997. In this book, Robert Kiyosaki shared how he learned the 9 lessons of wealth from his friend's father (Rich Dad). He compares the difference between what his biological father (Poor Dad) and his friend's father (Rich Dad) taught him over the years. Robert believes that most people experience financial problems. This is because they need to learn how the rich acquire their wealth and continue to make it grow.

Reviews from Goodreads, Reddit, Amazon, YouTube, and Quora expressed mixed opinions. Goodreads and Amazon reviewers both give it high ratings. Many suggested that the book only offers some motivational value and basic financial concepts. Some viewed it as arrogant, misleading, and impractical today. For instance, Garrett Peters is not happy with Robert's portrayal of the poor as lazy. Most reviews also remind readers to approach the book with caution. Seek additional, more reliable sources of financial education and advice.

Robert advocated for investing in assets like real estate. While it has the potential to be profitable, it requires significant capital. It is also subject to market volatility and involves property maintenance and tenant management. High returns are possible for investors but often take longer to materialize.

This Rich Dad Poor Dad review covers its pros and cons, lessons, and reviews. We will also look at its author and the importance of Robert's advice about wealth accumulation. At the very end, we will look at another business model considered more convenient than real estate investing.

Rich Dad Poor Dad Review: Pros and Cons

Pros

The author of Rich Dad Poor Dad wrote it so easily and clearly that even a beginner can grasp the lessons.

Robert Kiyosaki uses anecdotes effectively to set up the complex idea he’s going to discuss.

It discusses the importance of assets versus liabilities well enough to change your mindset.

Rich Dad Poor Dad has a majority of positive reviews online.

Cons

Robert Kiyosaki’s financial education company Richdad will flood your email with a lot of offers as an offshoot of buying this book.

Investigations by enterprising journalists also reveal that the “rich dad” in this book might be fictional.

Robert’s book led to a lawsuit from his co-author because of a financial breach after he made a deal with the MLM firm Amway to market his book and make it required reading for its members.

Many financial experts criticized Robert's teachings, saying his advice was wrong and could lead to financial ruin if followed.

Price

Rich Dad Poor Dad cost $6.98 (Paperback).

Amazon Kindle Rank

Rich Dad Poor Dad ranked #4 in Top Personal Finance Books of All Time from Amazon Kindle.

Amazon Top Authors Rank

Robert Kiyosaki ranked #4 in the Business & Money Category from Amazon Top Authors Rank.

Bestsellers Lists

Rich Dad Poor Dad received bestseller status from Business Week, The New York Times, Wall Street Journal, and USA Today.

Copies Sold

Rich Dad Poor Dad sold over 35 million copies in 51 different languages.

Origin

The book, The Rich Dad Poor Dad, came out in 1997, 2011, and 2017 (20th Anniversary).

Reputation

Robert Kiyosaki has a good reputation as an author. His significant impact on the way people think about money and investing has earned him a good reputation as an author. This is despite some controversies surrounding his methods and advice. His emphasis on financial education and independence remains influential in the personal finance community.

9 Key Lessons For Financial Success

"The Poor and the Middle Class work for money, while the Rich have money work for them." (p.19)

The fear of going penniless motivates ordinary people to apply for jobs that enslave them to a life of working to pay bills. The only emotions that motivate them are fear and greed. With the false security of a job that pays them a salary every payday, these people will never try to get out of their comfort zone to start a business.

The Script of the Middle Class

Stay in school

Get good grades

Find a secure job

Retire with benefits

This is the old script most parents subscribe to all their lives. They force their kids to get good grades in school so they will also live the same. But if asked, these people may sometimes admit their discontent at such a mediocre existence. Before they followed the script, they might have had passions, artistic desires, plans to travel the world, and plans. But they themselves dashed it when the fear of an empty wallet grew bigger than their desire to pursue a life worth living. The better alternative is to seize opportunities to master the power of money. Use your emotions to think, not the other way around.

“Most people never see these opportunities because they're looking for money and security, so that's all they get.” (p. 62)

A job is only a short-term fix for a long-term problem. This is where the rich is a cut above others in the way they think about money: they set up opportunities to make money and have it work for them.

"It is not how much money you make. It's how much money you keep." (p.75)

Acquiring money without sound financial knowledge is a bankruptcy waiting to happen. Without being taught how to budget and manage $3,000, a person won't be able to manage $3,000,000. Hence the stories about broke lottery winners. Who burned through millions of dollars of their winnings by buying stupid stuff and not planning.

Set aside time to learn how to make money, how to tend it, and water it to where it grows deep enough roots that it won’t need you anymore someday. Part of this is learning about accounting, investing, markets, taxes, inflation, and the law. The more you grasp complex financial concepts, the more successful you’ll be in your business. A strong financial foundation needs the following: solid knowledge of the difference between an asset and a liability.

An asset puts money in your bank account.

A liability takes that money out.

" The rich focus on their asset columns while everyone else focuses on their income statements." (p.129)

Employed people work for everyone but themselves. They enrich their employers or the owners of their company. Then, they pay their taxes to the government, then they pay the bank where they mortgaged their house. When you see a financially struggling family, they didn’t get into that situation overnight. Being financially poor is the culmination of a lifetime of making poor financial decisions.

You are likely to be financially poor if you are:

working every day to make somebody else’s dreams come true

reporting every month to a boss whose only goal in life is to wring out one more drop of productivity out of your lifeblood to turn a profit for the company.

Professionals have only their jobs as a source of income. Rich people have their assets as sources of multiple income streams.

Types of Real Assets

Businesses run by other people (managers)

Mutual funds

Bonds

Stocks

Notes (IOUs)

Real Estate

Royalties from Music, Books, & Patents

Any Income-Producing Item (#cashflowisking)

Companies use all kinds of feel-good type of slogans to foster a sense of community among their employees. But the goal is for them to overwork you. Until the workweek spits you out, drained and exhausted, to a parking lot of similarly miserable souls. Grateful for two days’ freedom from the grind of work. Do not climb the corporate ladder to get a pay raise so you can increase your income column. Focus on building up your asset column instead.

Key Takeaway

Mind your business

Scope in on your assets

Don’t waste time making your boss richer and your company turn more profit, they won’t lift a finger when you’re hurt and need another way to pay off your bills. Be smart about it though. Keep your day job, but continue to increase your asset column. Refrain from spending money on liabilities. A lot of young couples get buried in debt because they use credit cards to buy items they don’t need to live up to a standard of life they can’t afford.

And this is where most schools fail their graduates. An overhaul of the education curriculum is necessary to address the yawning financial education gap. This turns kids into credit-hungry consumers.

"Why not own the ladder?" (p.158)

The lawmakers originally voted taxes into law only for wealthy citizens. But as government bureaucracies grew bigger and needed more funding, they levied taxes on the middle class. But the rich found ready loopholes and created corporations to limit their risks. Knowledge of how a corporation works gives the rich an unfair playing field to lord it over the middle class.

Benefits of Corporation

Taxed Less than Personal

More Tax Deductions Available

Protection from Lawsuits

Corporations protect the rich because they’re taxed less than an individual worker gets taxed. Corporations can also write off certain expenses as tax deductible, saving even more money for the company. Make sure each dollar in your asset column multiplies and gives birth to more dollars. So that you can quit your 9-5 job and focus on nurturing your own business.

Read up and become very well-versed in business law. Specifically, "corporate compliance" and "maintaining the corporate veil" to protect yourself from lawsuits. A corporation can be an attractive target for lawsuit-happy individuals. People perceive corporations to have deep pockets, which is why this perception exists.

“It is the knowledge of the legal corporate structure that really gives the rich a vast advantage over the poor and the middle class.” (p. 154)

It’s only prudent to use several layers of legal protection. This is to make yourself immune from the litigious in our society to keep the hard-earned income you’ve worked so hard for.

"Often in the real world. it's not the smart who get ahead , but the bold." (p.217)

Each person naturally holds massive potential inside. Each individual has a skill or talent that surpasses others. But self-doubt and insecurity impede our “becoming” that we settle for safe, unfulfilling jobs that won’t rock the boat too much. Once out of the safety of the academic gates, a person needs to rely on more than just his scholastic degrees to make it big.

Synonyms of Financial IQ

inner resolve

guts

bravado

sixth sense

This something extra, when called forth and used liberally in everyday dealings, makes an outstanding one. Develop your financial IQ to open up more options in your future. The world is constantly changing. Automatons or younger, hungrier graduates will take secure careers of yesterday over.

Kiyosaki developed and launched a financial education game called Cashflow 101. This helps his students familiarize themselves with investment and complex financial concepts. Kiyosaki released the game called Cashflow 101 in 1996, and it became popular that year.

"I recommend young people to seek work for what they learn, more than what they will earn." (p.225)

Learn salesmanship and awesome negotiating skills. This allows you to persuade other people to see the value of any product you’re offering. It is one more tool you can use and deploy from your arsenal of high-value skills.

In the 6th lesson, Robert stresses the importance of developing Life Skills in addition to School Skills.

School Skills:

Writing

Accounting

Typing

Investing

History

Life Skills:

Selling

Leadership

Public Relations

Managing People

Flexibility

Great talent isn’t enough to succeed, unfortunately. The world has talented underpaid people. You also need to augment your skills and the most important upgrade is how to market. Another important skill to learn is public relations.

Even such soft skills as learning how to write exciting ad copy are very helpful. Especially to those who want to grow a business that needs the attention of other people. Learn a little bit of everything so you have an idea of how to solve a wide variety of problems. Seek work that offers a lot of learning opportunities, not just rote assembly-line duties.

- Fear of Losing Money and Taking Risks: Many people avoid taking necessary financial risks because of the fear of losing money. Kiyosaki argues that while it's important to avoid unnecessary risks, some risk-taking is essential for wealth building.

- Listening to Naysayers: Doubt and criticism from others can lead to inaction. Kiyosaki emphasizes the importance of analyzing opportunities for oneself rather than succumbing to cynicism.

- Laziness and Procrastination: Laziness often disguises itself as busyness. To combat this, Kiyosaki suggests harnessing a bit of "greed" or desire for something more, which can drive one to take necessary actions.

- Bad Money Habits: Kiyosaki highlights the importance of paying oneself first, even before paying bills. This habit forces creativity and effort to meet financial obligations, ultimately leading to financial strength.

- Arrogance About Money: Arrogance can mask ignorance. Kiyosaki advises continual learning and humility for managing finances.

"I offer you the following 10 steps as a process to awaken your financial genius." (p.279-280)

Each person has a financial genius of him. Some are just asleep. Robert shares his 10-step process to develop your ability to recognize God-given opportunities.

Robert's 10 Steps:

Find a reason greater than reality (Power of Inspiration)

Practice your power of choice daily (Power of Decisions)

Choose your friends carefully (Power of Association)

Learn a formula then master it (Power of Association)

Pay Yourself First (Power of Self-Discipline)

Pay Experts to Guide You (The Power of Good Advice)

Be Mindful of the Long-Term Return

Use Assets to Buy Luxuries (The Power of Focus)

Study People You Admire (The Power of Myth)

Pass on What You're Learning (The Power of Giving)

"Action always beats inaction." (p. 329)

In the final chapter of Rich Dad, Robert Kiyosaki lays out his five-step process for continual growth.

Robert's Cycle for Continual Growth

Monitor What's Working and What's Not

Explore New Ideas, Strategies, and Tactics

Get Guidance From Experienced Experts

Take in Educational Opportunities

Put New Education into Action

Since writing the original Rich Dad Poor Dad in 1997, Robert Kiyosaki has continued to build his wealth through both real estate deals and constructing digital assets.

What is Rich Dad Poor Dad?

Rich Dad Poor Dad is a personal finance book by Robert Kiyosaki. He originally published it in April 1997. This bestselling book, Rich Dad Poor Dad, became a cult phenomenon. It attracted fans from all over who wanted financial education explained in layperson’s terms.

It banks on the comical relief and drama made from receiving contrasting advice from two differing authority figures. One is an educated biological father who made poor financial decisions. The other is “adoptive dad,” the rich father of his school friend who became his mentor. Robert explored and researched common beliefs about money that usually encumber people as they grow up.

Robert examined the common misconceptions about jobs and careers. He also unmasked the myth of job security versus the massive rewards of building a business. Contrary to prevailing beliefs, he demonstrated that one does not need a lot of capital to succeed in a business. He also resisted outdated middle-class mindsets about asset acquisition. Instead, he shows that liabilities are what you’ve been collecting all this time. It teaches you the right way to think about money so that you can enjoy a financially rich life.

What is Rich Dad Poor Dad's Summary?

Rich Dad Poor Dad by Robert Kiyosaki is a personal finance book that contrasts the differing financial philosophies of his two "dads". His biological father (the Poor Dad) and the father of his best friend (the Rich Dad). Robert learned from the Rich Dad that rich people don't work for money. They work to learn. The rich don't simply monetize their time like employees do. Rich people invest in the future.

The Poor Dad believes in traditional education, job security, and saving money. Poor Dad advised Kiyosaki to study hard, get a good job, and save diligently. In contrast, the Rich Dad emphasizes financial education, entrepreneurship, and investing. Rich dad advocated for making money work for you rather than the other way around. Rich people develop a broad skill set, especially in sales and marketing. They don't just aim for job security; their goal is financial independence.

Rich Dad teaches that an asset is something that puts money in your pocket, while a liability takes money out. Building wealth involves accumulating assets. This includes real estate, stocks, and businesses, and minimizing liabilities like debt. Financial intelligence is crucial for success, especially when it comes to your purchases. It is important to understand the difference between assets and liabilities. Focus on your asset column, not your income column. As for Robert, the key is to invest in assets you're passionate about. The rich create money through innovative ideas and investments. Financially intelligent people see opportunities, whereas others see challenges.

Kiyosaki argues that the traditional education system cannot teach financial literacy. This leaves individuals unprepared to handle money wisely. He stresses the importance of understanding financial principles. This includes reading financial statements and knowing how money works. The book describes poor people as those who work hard but remain stuck in a cycle of earning and spending. Rich Dad's approach focuses on breaking free from this cycle by creating passive income streams.

What is Robert Kiyosaki's Opinion on Why the Rich are Getting Richer?

What are the Mindset Differences Between Rich Dad and Poor Dad?

The mindset differences between Rich Dad and Poor Dad highlight contrasting attitudes toward money, education, and financial independence.

Rich Dad:

- Believes lack of money is the root of all evil.

- Asks, "How can I afford it?"

- Studies to find a good company to buy or invest in.

- Wants to be rich to support his kids.

- Manages financial risks.

- Thinks being broke is temporary, but being poor is eternal.

- Views money as power.

- Pays bills last.

- Emphasizes financial self-reliance and opposes entitlement mentality.

- Teaches creating strong business and financial plans to create jobs.

- Sees graduation as the start of learning.

Poor Dad:

- Believes love of money is the root of all evil.

- Says, "I can't afford it."

- Studies to find a good company to work for.

- Wants to be rich to support his kids.

- Avoids financial risks.

- Thinks he will never be rich.

- Believes money doesn't matter.

- Considers his home the largest investment and asset.

- Pays bills first.

- Trusts the government to take care of his needs.

- Focuses on writing an impressive resume for a good job.

- Stresses studying hard for a stable job.

Who is Robert's Rich Dad?

Robert's Rich Dad was the father of Robert's best friend, Mike. Rich Dad owned a chain of superettes (convenience shops), a construction company, and several restaurants. He hired Robert to work for him at ten cents an hour working in his grocery stores. Robert was cleaning and completing errands. This exposed Robert to the entrepreneurial aspect of making a living when he was only nine. Robert complained about the unfairness of getting paid only a dime for every hour worked. His rich dad then asked him to work for free for a business education.

Who is Robert's Poor Dad?

Robert's Poor Dad is his biological father. He is a highly educated teacher who earned a PhD from Stanford University on a full-ride scholarship. Despite not earning a lot of money, he had a passion for teaching. He gives his son solid advice about finances to make Robert grow up and taste the same life he built.

How Rich Dad Impacted Robert's Mindset?

Robert's Poor Dad is his biological father. He is a highly educated teacher who earned a PhD from Stanford University on a full-ride scholarship. Despite not earning a lot of money, he had a passion for teaching. He gives his son solid advice about finances to make Robert grow up and taste the same life he built.

What People are Saying About Rich Dad Poor Dad?

Rich Dad Poor Dad Reviews From Goodreads

People from Goodreads have very contrasting views about Rich Dad Poor Dad. It has a rating of 4.12 out of 5.0 stars from over 624,604 ratings and 23,839 reviews. The 5-star reviews emphasize the book's impact on the readers' perspectives about money and finances. Some reviewers appreciate how the book challenges conventional wisdom. It urges people to rethink how they view wealth, education, and financial independence.

One reviewer, Abby, shares that the book changed her life, prompting her and her husband to invest in properties. Will Thomas considers Rich Dad Poor Dad one of his most re-read books. He believes the book's message has the potential to significantly improve the world's economy if widely adopted. Audrey said the book offers a fresh perspective on personal finance and breaking the conventional cycle of working for money. Eric Dubay finds Kiyosaki's books essential for entrepreneurs. It inspired him to seek financial freedom.

The one-star reviews highlight several criticisms of the book. Troy finds discomfort with Robert's attitude towards educated individuals and the working poor. He notes it is repetitive and lacks specific. Dan said the book offers false information and misleading advice. He it is for those who have failed in conventional terms, like higher education and stable jobs. He added that Robert dismisses the high correlation between education and wealth. Garrett Peters criticized the poor writing style of the book. He criticized Kiyosaki's portrayal of the poor as lazy. Garret also finds Kiyosaki's advice unrealistic. It dismisses the role of privilege in wealth accumulation.

Rich Dad Poor Dad Reviews From Quora

Rich Dad Poor Dad reviews on Quora are mixed. Some appreciate the book for its basic financial lessons and motivational aspects. Others criticize it for its inconsistencies, simplistic advice, and potential to mislead readers. The consensus is that the book can be useful for beginners in personal finance. Tom Lee said the book is just a rehash of basic financial concepts. He also noted Kiyosaki's inconsistent stories about his financial success. Omar Bessa also finds the book "faux enlightening", simplistic, and offers little substance.

Mansi Tayal finds the book helpful. Especially for understanding personal finance and recommends it for its practical lessons. Suhrid Sukumar acknowledges that the book may not work wonders for everyone. However, it offers useful knowledge that can benefit individuals if applied correctly. Amanda Huntington finds value in its discussion of assets and liabilities. But she criticizes Kiyosaki's misleading advice on taxes and business expenses.

Rich Dad Poor Dad Reviews From Reddit

Rich Dad Poor Dad reviews from Reddit express negative views of the book. Many users criticized the book's content, Kiyosaki's credibility, and the practicality of his advice. Redditor, patr8354, felt the book was arrogant. He found it dismissive of educated people and provided confusing and unrealistic advice. Tiedtomythoughts said that it focused solely on making money. This could be off-putting despite some useful advice.

Uptons_BJs and Similar_Hold_746 have observed that Kiyosaki's theories frequently receive criticism.Robert has changed his story about "Rich Dad" multiple times, with evidence suggesting that "Rich Dad" is fictional. RevolutionaryTie8481 and Eternal_Revolution said that Kiyosaki's backstory appears fabricated. They also said that Robert makes money through selling books and seminars rather than practicing what he preaches. Vito-53 argued that Robert's ideas were more about marketing than about actual financial wisdom. However, Bubbagumpredditor said that for those unfamiliar with business concepts, the book might be a good start. Although, it still promotes get-rich-quick schemes.

Rich Dad Poor Dad Reviews From Amazon

Rich Dad Poor Dad customer reviews from Amazon are positive. It has a rating of 4.7 out of 5.0 stars from over 97,450 ratings. For instance, Gordon Andrews said that the book is very helpful and appreciates its perspective on assets and liabilities. Bluesky recommends it as a great beginner book, though finds it boring and repetitive. James Nginya said that the book is a valuable source of knowledge. Reginaldo Rodrigues Andrade praises the book for making readers reflect on financial stability. Though it doesn't give direct instructions on becoming rich.

However, some reviews of the book are not as promising. For instance, William J. Bauman said the book is repetitive and lacks clear advice on acquiring wealth.One reviewer, draco_cj, expressed disappointment after having high expectations from recommendations. He found the book lacking practical financial education. He described it as more like an introduction to multilevel marketing. JR believes the story to be fabricated. He added that the book lacks of actionable advice and the author lacks empathy.

Rich Dad Poor Dad Reviews From YouTube

Edrina Calderon expresses her preference for the Rich Dad Poor Dad paperback books because of their portability and ease of use. She recommends that everyone should read it at least once. Edrina said that Kiyosaki's idea of creating wealth, particularly through real estate and investments, is valuable. She encourages readers to create personal financial statements. Edrina said that she learned from the book the dangers of living in fear, being controlled by money, and the false sense of security from a paycheck.

Noelle Randall said that Rich Dad Poor Dad is a popular yet controversial book on personal finance published over 25 years ago. She highlights five key lessons from the book that can help anyone become wealthy. Noel agreed with Robert that you should not focus on working for others. But creating multiple income streams through assets. She also points out a critical yet often overlooked piece of advice from the book. It is the strategy of buying real estate and selling it every two to five years to maximize profit and reinvest in more properties.

Who is Robert Kiyosaki?

Robert Toru Kiyosaki is a prominent author, entrepreneur, and financial educator best known for his book Rich Dad Poor Dad. Born on April 8, 1947, in Hilo, Hawaii, Robert Kiyosaki attended Hilo High School and graduated from the U.S. Merchant Marine Academy in New York in 1969. He later attended the University of Hawaii at Hilo. Robert grew up in a strict middle-class home to a father who became a high-ranking government official in Hawaii’s Board of Education. His mother was a nurse. The family belonged to a fourth-generation Japanese immigrant group. Robert grew up with three other siblings and immediately signed up to join the U.S. Naval Academy after high school.

After leaving the Marine Corps, Kiyosaki worked for Xerox Corporation. Then, he started his first business, Rippers, which produced nylon and Velcro wallets. Despite initial success, the business eventually failed. In the 1980s, he started a business licensing T-shirts for heavy metal bands. This business also faced financial difficulties, leading to insolvency. He became a motivational speaker for a personal growth seminar business called Money and You. This is where he taught the principles of Buckminster Fuller.

He published his Rich Dad Poor Dad in 1997, advocating for financial independence. He later founded the Rich Dad Company with his wife. The company provides financial education through books, seminars, and the CASHFLOW board game. The company emphasizes the importance of financial literacy and entrepreneurial thinking. Kiyosaki has co-authored books with notable figures. This includes two with Donald Trump before he became President of the United States. Kiyosaki continues to write books, host the Rich Dad Radio Show podcast, and speak globally on financial education. He filed for bankruptcy through Rich Global LLC in 2012 and faced a class action lawsuit from seminar attendees. He was inducted into the Amazon.com Hall of Fame in 2005 as one of the Top 25 Authors. Aside from Rich Dad Poor Dad, he also wrote other books.

- Rich Dad Series:

- Rich Dad Poor Dad

- Rich Dad's CASHFLOW Quadrant: Guide to Financial Freedom

- Rich Dad's Guide to Investing: What the Rich Invest in That the Poor and Middle Class Do Not!

- Rich Dad's Increase Your Financial IQ: Get Smarter with Your Money

- Rich Dad's Conspiracy of the Rich: The 8 New Rules of Money

- Books on Financial Education:

- Why 'A' Students Work for 'C' Students and 'B' Students Work for the Government: Rich Dad's Guide to Financial Education for Parents"

- Rich Dad's Prophecy: Why the Biggest Stock Market Crash in History Is Still Coming...And How You Can Prepare Yourself and Profit from It!

- The Real Book of Real Estate: Real Experts. Real Stories. Real Life.

- Collaborations:

- Why We Want You to Be Rich: Two Men, One Message" (co-authored with Donald Trump)

- Midas Touch: Why Some Entrepreneurs Get Rich - and Why Most Don't (co-authored with Donald Trump)

- Other Notable Works:

- Second Chance: For Your Money, Your Life and Our World

- Unfair Advantage: The Power of Financial Education

- FAKE: Fake Money, Fake Teachers, Fake Assets: How Lies Are Making the Poor and Middle-Class Poorer

- Who Stole My Pension?: How You Can Stop the Looting

Is Rich Dad Poor Dad Good For Beginners?

Yes, Rich Dad Poor Dad is good for beginners who are just figuring out their finances. This is because of the simplified explanations of fundamental concepts like assets and liabilities. Amrutha from Quora said that the language used it super simple and easy to understand.

The book encourages a shift in mindset. it promotes financial education and the importance of acquiring income-generating assets over liabilities. It is valuable for its motivational aspects and basic financial principles. However, individuals should supplement it with more comprehensive resources to gain a well-rounded financial understanding.

Is Rich Dad Poor Dad Still Valid?

Yes, Rich Dad Poor Dad remains a valid and influential book in personal finance. However, its applicability depends on the reader's context and goals. The book continues to be praised for its emphasis on the importance of financial education, investing, and entrepreneurship. Many readers appreciate its unconventional advice that challenges traditional financial thinking. This includes viewing a house as a liability rather than an asset.

However, there are criticisms that the book lacks detailed, actionable financial advice. Many said that its principles may not suit everyone. Especially those not inclined towards entrepreneurship or real estate investment. Critics also highlight that the book's examples and advice can sometimes be simplistic or outdated in today's economic environment.

Is Real Estate Investing Profitable in 2024?

Yes, real estate investing can still be profitable in 2024. However, success depends on several factors as location, market conditions, and investment strategy. The real estate market is still in the expansion phase, where prices and sales are rising. This makes investing more profitable. Good locations with low crime rates, good schools, and exceptional amenities usually offer better returns. For instance, Thomas Vargeletis, a realtor, said that the market you are in will dictate your return. Some markets can yield 15% or higher, while highly competitive markets will only give you 5%. Multifamily properties like apartment buildings continue to be a solid investment choice. This is because of the consistent demand for rental housing.

Using leverage is a major advantage in real estate. A down payment can help you control a larger asset, leading to significant returns. There are various investment types like rental properties, house flipping, and pre-construction properties. Each of these comes with its risks and potential returns. Rental properties provide steady income while flipping houses can offer quick profits. However, for someone who has done it, they often say it is not as passive as you think.

It's important to understand all costs upfront, including repairs, closing costs, and insurance. Miscalculating these can turn profits into losses. Keeping a cash reserve can help manage risks and avoid selling at a loss. Robert Kiyosaki's book emphasized the importance of investing in real estate. Reading it might get you motivated but, if you want to invest, try to look at some of the top real estate investing courses to gain a thorough understanding of this opportunity.

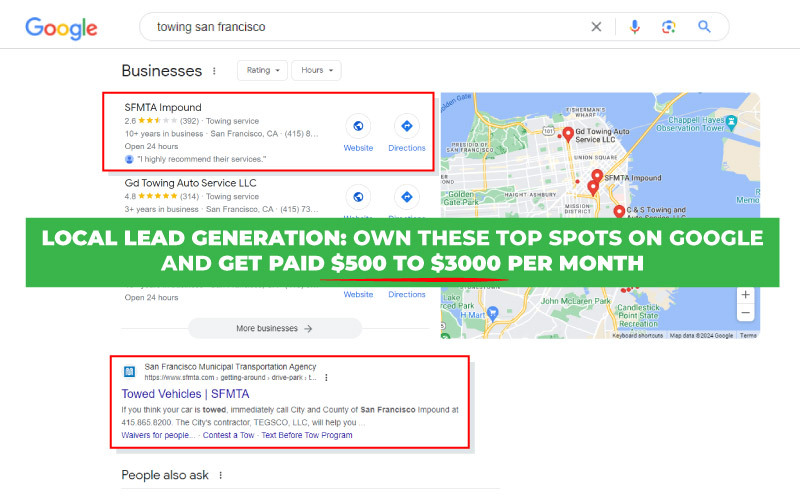

Why Local Lead Generation is More Convenient Than Real Estate Investing?

Local lead generation is more convenient than real estate investing. This is because it can give you a more consistent income every month with less investment. The idea is very simple; you rank a website to capture high-quality leads. Once your website generates leads, local businesses will pay you $500-$3000 per month. By owning and renting digital assets to local businesses, you create a win-win situation. When businesses get quality leads, you earn consistent monthly income. The profit margin for local lead generation is from 85%-90%. Real estate investing can go as high as 15%.

Real estate investing can be volatile and subject to market fluctuations. Local lead generation income is less susceptible to economic downturns and real estate market cycles. Most local businesses need customers all the time and they will partner with anyone who can provide them with leads that convert. In addition, building a lead generation website requires less upfront investment. Real estate investing needs some capital, some renovation or repair work, and may demand a property manager. This cost can be high even before you earn.

Once you have a successful lead generation website, you can replicate it in different niches and locations without extra investment. The opposite happens with real estate investing. Maintaining a properly is costly, labor-intensive, and stressful when dealing with tenants. One thing that makes lead generation more convenient is that it is digital. Real estate can suffer from physical deterioration or natural disasters.So, if you want to master relevant skills to create life changing passive income much faster than trying to invest in real estate, try local lead generation.

What Up Ippei,

Bro, to be honest your content is sick. I know Robert Kiyosaki I really follow the teachings of the man zealously myself…

I think I stumbled upon rich dad poor dad 3 years ago, it was a video interview of him. He was being interviewed & when he said "Keep them poor" that hit me right there…

So we're living in a world were the elite are plotting against us, to keep us in the middles class or poor. However I'm intrigued by the fact that he offers solutions to how to get around these pitfalls.

He became a real estate mogul doing exactly what he lays out in his book, so it's proven, actionable & really lifts the fog around the different ways the rich play the system and how the system cripples the poor – a vicious cycle.

Great article man, couldn't have chosen a better book to summarize. 😉

I've heard his book mentioned many times over the years. The summary you've given here and, more crucially, the way you've demonstrated applying the learnings, has made me finally order it. Thanks, dude. and well done

I hope you enjoyed reading it!

I loved this post, so compelling and clear. I understand now why this is a classic book for rich people how it explains in such a fun way how the rich people look at money totally different as poor people look at it

thanku for providing this

This book is one of my favorites. It is a must have for anybody who wants to achieve more by working smartly.

There is an amazing difference between the way people think about creating wealth. Most of the people in the world are stuck with the poor dad's mindset and are unable to change their minds and explore new ideas.

On the other hand people who have the rich dad's mindset look for new ideas and opportunities and acquire knowledge regularly which helps them to stay ahead and make more money than most of the people in the world.

There are opportunities everywhere in the world and having the right mindset is what separates those who take advantage and those who don't.

This is a great summary of the book and helps to take the main points from the book.

Like I am the only one person who don't read this book uptil now.

But the way you outline the detail of the book I was curious so I will definitely read this book in this week.

Thanks for this post ippei

glad you liked it

Thank you for posting this, ippei. After reading this i'm gonig to exercise my mind to be more aware of the assets and liabilities in my life. This should make my spending more concious and help me to think of ways to identify the assets around me that I can build or collect for myself.

glad u liked it

While I was reading about Robert's lessons, specifically about being able to "see" the gold around you, I immediately thought of you and Dan selling face masks during this pandemic. And the part of building your asset column, specifically real estate, I immediately thought of your digital "real estate." Thank you for the article, I need to make a plan and work on adding more to my asset column. Thank you Ippei!

100%

the more assets you have that’s valuable to the marketplace, the more mailbox money you earn!

Thanks for sharing this summary of the book! I read it like 1 year ago and reading this refreshes my mind and open my eyes to read it again! This summary is so detailed it is really amazing! What I like too was the summary of the pros and cons in the end it helps to develop a better understanding why this book is great and what kind of negative aspect it has as well!

glad you liked it