The best side hustles for accountants are;

- Starting local lead gen biz

- Become a virtual accountant

- Provide financial advice

- Offer tax preparation services

- Provide investment advice

- Offer accounting software solutions

- Provide startup assistance

- Engage in business development

- Online teaching or tutoring

- Become a CPA exam tutor

In the United States, almost 39% of adults have side hustles alongside their main jobs. This highlights the wide adoption of this trend, according to Bankrate. This shows many people seek extra income. They do so due to the challenges of inflation. Ted Rossman, a Senior Industry Analyst at Bankrate, says that side hustles are now a common way to secure essential income. They are not just for passion projects or financial advancement.

In 2021, accountants typically started at $66,504. This amount was much lower than data science and tech. They began at $97,562 and $101,401, respectively. This data is from the Burning Glass Institute. According to The U.S. Bureau of Labor Statistics, this wage gap caused a 17% drop in accounting industry employment. Over 300,000 accountants left their jobs in recent years. They face lower salaries. So, many accountants take side hustles to diversify their income. Or, they consider starting a business. The trend towards side hustles applies to more than just Gen Z. Accountants are also taking on extra work to make up for their low pay.

This article gives you a full list of side hustles for accountants. It shows both the opportunities you can tap into and the extra money you can make. It also covers four shocking reasons accountants have side hustles. Additionally, it answers frequently asked questions about these side hustles for accountants. At the end, we'll present a business model for accountants. It has low upfront costs, little competition, and high profits.

What Are Side Hustles For Accountants?

Accountants' side hustles are extra income-generating activities. They pursue their main accounting jobs alongside. These side gigs help accountants add to their salaries. This is important, since the median starting salary for accountants in 2021 was $66,504. This is much lower than other industries. For example, data science and tech. This is according to Burning Glass Institute. Accountants have common side hustles. They include freelance bookkeeping, tax consulting, and financial coaching.

Beyond their accounting profession, accountants can explore diverse opportunities to expand income sources. You can try engaging e-commerce ventures, freelance writing or blogging. Also, you can join the gig economy. You can do this through ride-sharing or food delivery platforms like Doordash and Grab. You can also do it through real estate investment or rental property management. These varied side hustles provide financial flexibility. They also enable accountants to explore interests beyond accounting. These side hustles let accountants earn extra and tackle low industry salaries. They also open doors to entrepreneurship.

35 Best Side Hustles For Accountants

1. Become A Virtual Accountant

Becoming a virtual accountant is a perfect side hustle for accountants. It serves a diverse clientele. They include small businesses and entrepreneurs who need financial expertise. To start, you can explore platforms like QuickBooks or FreshBooks. They help you connect with potential clients. Virtual accounting firm industry presents a notable opportunity. Over the past five years, it has grown at an impressive rate. The rate is 8.6% per year. This is according to data from FinModelsLab. You can seize this opportunity by leveraging your skills remotely. You can offer services such as bookkeeping, financial analysis, and tax preparation. This will meet the rising demand for online financial expertise.

When it comes to potential income, virtual accountants can earn lucratively. ZipRecruiter says the average monthly pay for a virtual accountant in the United States is $5,463. The income potential is attractive. It's for accountants seeking a side gig to add to their main earnings. If you manage clients well and offer quality virtual accounting services, you can secure a steady income. There are benefits, but a big disadvantage for accountants in the virtual world is the lack of in-person communication. This lack affects client relationships. According to a survey by Accounting Today, 65% of clients value in-person talks with their accountants. You may need to overcome this challenge. Perhaps, you can do this through regular video meetings or personalized communication. This will help you maintain strong client connections.

2. Provide Financial Advice

It's an ideal side hustle for accountants. This is especially true for someone with a unique skill set. That set aligns perfectly with the needs of clients seeking financial guidance. Accountants are well-equipped to help with tax planning, investing, and budgeting. They can help individuals and businesses. To kickstart this side hustle, explore platforms like Indeed, LinkedIn, and Glassdoor. The Bureau of Labor Statistics says that financial advising will grow 15.4% from 2021 to 2031. It resulted in approximately 50,900 new job openings. You can use this opportunity. Use your analytics and financial skills to offer personalized advice. Also, by staying informed about industry trends and networking on professional platforms. You can position yourself as a reliable financial advisor.

Accountants can make a good amount of money from financial advice. They can see it as a side hustle. The average annual salary for a financial advisor in the United States stands at $79,688. This figure shows that giving financial advice can be a good extra income for accountants. By building a solid client base and giving valuable insights, you can boost your earnings. You can also establish a reputation as trusted financial advisors. Despite the promising aspects, it's crucial to acknowledge potential disadvantages. The U.S. Bureau of Labor Statistics notes that the current number of financial advisors, at 330,300, is expected to increase by nearly 51,000 by 2031. This shows a growing market. But, it also shows the increasing competition in the industry. If you’re considering being a financial advisor, you must navigate this competitive landscape well. To beat strong competition, focus on three things. First, specialize in your field. Second, keep learning. Third, build good client relationships.

3. Offer Tax Preparation Services

Offering tax preparation services is a lucrative side hustle for accountants. Small companies seek expert help with taxes, so there is a big market. Small businesses have unique tax requirements and few resources. They often find it practical to outsource tax preparation. If you’re an accountant specializing in tax preparation, you can cater to this niche market. You can provide tailored solutions to meet the distinct needs of small businesses. To start your journey into tax preparation, try online platforms. These include TurboTax and H&R Block. It offers user-friendly interfaces for both accountants and clients. Also, joining professional networks is valuable. For example, the National Association of Tax Professionals (NATP) can provide resources. It also offers networking and access to clients.

The opportunity within tax preparation as a side hustle is noteworthy. The U.S. Bureau of Labor Statistics projects tax preparer jobs to grow by 4% from 2021 to 2031. Moreover, 71% of small companies outsource their tax preparation, as reported by 99firms. You can use this trend. Position yourself as a reliable tax expert. Emphasize your ability to remove the burden of tax rules for small businesses. You can expect steady and rewarding income from this side hustle. ZipRecruiter says the average hourly pay for an income tax preparer in the United States is $22.91.

But, IBISWorld says there are 265,460 people employed in U.S. tax preparation services as of 2022. This statistic highlights the competitive nature of the field. You should be ready to stand out. You can do this by specializing in certain industries or offering extra financial consulting. This will help you in a crowded market.

4. Provide Investment Advice

Giving investment advice is a great side job for accountants. The demand is growing from people seeking to invest, but lacking the knowledge to start. This side hustle lets you cater to this group. You offer guidance to those eager to invest. To start, you can check Robinhood, Acorns, or Stash. These apps can serve as valuable tools for you to guide clients. The opportunity in this side hustle is big. Stash's survey highlights this. It shows that 90% of Americans want to invest, but nearly half admit to being unsure about how to start. To meet the demand for investment advice, you need to teach your clients about investment strategies. This includes risk and long-term financial planning.

Providing investment advice can be a good way to generate extra income. This is when we talk about potential income. According to ZipRecruiter, the average annual pay for an investment advisor in the United States stands at $78,695. This figure shows the financial viability of this side hustle. To increase your income, build a client base. Then, offer valuable investment insights and group sessions. But, the Investment Adviser Association reported something. The number of investment advisors registered with the Securities and Exchange Commission rose by 2.2%. This increase happened from 2021 to 2022. It reached 15,114 advisors. Growing competition in investment advisory requires you to stand out. You must do this by honing expertise, building client relationships, and staying up on industry trends. This is what you need to do to succeed in this side hustle.

5. Offer Accounting Software Solutions

Offering accounting software is a great side hustle for accountants. Businesses want comprehensive software. It goes beyond basic accounting. This side hustle lets you serve businesses. They need software for tasks such as inventory, payroll, and invoicing. To begin, you can try popular accounting software. Options include QuickBooks, Xero, and FreshBooks. These applications are user-friendly and offer a range of features that appeal to businesses of varying sizes. In terms of opportunity, Software Connect revealed that over 20% of businesses need accounting software. They need it to do more than basic accounting. Also, Sage Practice of Now reports this. 58% of businesses use accounting software. They do this to meet the changing needs of their clients. You can use this chance. Position yourself as experts in picking, setting up, and improving accounting software. Tailor it to businesses' needs.

With regards to potential income, this side hustle can be an awesome way to earn side income. According to Indeed, the average salary for a software trainer is $61,537 per year in the United States. You can also boost your income by training and supporting clients. This will help them get the most from the software. But, the software industry is dynamic. It's shown by the rapid evolution of accounting software. Accountants face a challenge. They must keep up with software advances, features, and security. If you cannot keep pace with industry changes, it may cause you to provide outdated solutions. This will harm the accountant's credibility and market competitiveness.

6. Provide Startup Assistance

Startup assistance is a practical side hustle for accountants. There's constant demand for guidance in the growing world of new businesses. This side hustle allows accountants to cater entrepreneurs and startups. To start, explore platforms like Upwork and Fiverr. Also, check local business forums. They can be valuable places for you to connect with startups seeking help. According to the Economic Innovation Group, thousands of new startups are created every day. In the US alone, 3.2 million startups are started each year. There was a surge in 2021. About 5.4 million new startups were created. It shows that you can have huge potential customers to help in their starting line. You can offer financial planning, budgeting, and tax compliance to startups in need.

They can expect a competitive financial return from helping startups. According to ZipRecruiter, the average hourly pay for an executive assistant in a startup in the United States is $30.87. By offering expertise and support, you can become essential partners for startups. This helps them succeed financially and ensures you have a steady income. However, startups often operate on tight budgets. In that case, you will be forced to offer your service at a low price.

7. Engage In Business Development

Business development is a strategic side job for accountants. It meets the needs of growing businesses. This side hustle lets you help clients find and seize business opportunities. You also help them align with their financial expertise. To start this side hustle, target small and medium-sized businesses. They want to boost their market presence and increase revenue. You can use platforms like LinkedIn, Upwork, or local business forums. They are effective channels for you to connect with businesses. The businesses are seeking business development expertise.

Randstad predicts a 13.5% job growth for business development managers over the next five years. This shows a significant opportunity in the field. You can use this trend. Offer services that include financial planning, strategic analysis, and market research. These will help businesses make informed decisions that aid their growth. If you’re considering this side hustle, expect a varied but competitive financial return. As reported by Zippia, business development executives can earn anywhere from $65,000 to $143,000 annually. However, over 387,613 business development managers work in the United States, as per Zippia. So, the market is highly competitive.

8. Online Teaching Or Tutoring

Online teaching is a good side job for accountants. It lets you help individuals who want to better understand accounting. It involves giving valuable educational support. It is for students and professionals who want to excel in accounting. To start, you can visit platforms such as TeacherOn, LinkedIn, or The Princeton Review to connect with potential students. These platforms offer a space for accountants to show their expertise. They can also offer tutoring to a wide range of people. This includes students studying accounting and professionals seeking to improve their financial knowledge.

Online teaching offers a big opportunity for accountants. The US News ranks them 14th in Best Business Jobs and 75th in the 100 Best Jobs. This ranking shows the demand for professionals in the field. It also shows a pool of people seeking support in accounting. Accountants can tap into this demand by offering online tutoring. They address a misconception highlighted by Carolyn Green McNutt. She said accounting is seen as simple. But, it actually involves complex issues needing expert guidance.

Engaging in online teaching can be a great way to make extra money while doing your full-time accounting jobs. According to Salary.com, Tutor Inc should pay an online accounting tutor between $61,101 and $126,772. The average salary is $76,730. This shows that you could earn a lot. You could do so by sharing your knowledge and expertise through online teaching. However, you must stand out. You can do this by highlighting your experience, industry insights, and unique teaching style.

9. Become A CPA Exam Tutor

Many accountants become CPA exam tutors. It's a popular side job. Why? There's high demand. People need help with the CPA exam. It involves helping students that are aspiring to pass this challenging exam and attain their CPA certification. To start, you can position yourself as a CPA exam tutor. You can do this on platforms like Tutor.com, Chegg Tutors, or through local accounting associations. These platforms provide a direct avenue. It connects with aspiring CPAs seeking personalized guidance. The opportunity within this side hustle is significant, as highlighted by the data from Financial Times. Despite a 7% decrease in the number of candidates taking the CPA exam in 2022, the figure still stands at approximately 67,000 examinees. This large group of people is a big market for accountants. Accountants can help them prepare for the CPA exam. The exam is difficult. The national pass rate is 45-55% according to the AICPA. This shows the need for good tutoring.

In terms of potential income, Indeed reports that the average salary for a Test Preparation Tutor is $26.49 per hour in the United States. Accountants tutor for the CPA exam. They can earn a competitive income by offering their expertise to candidates who aim to excel in the exam. This role offers both money and the chance to help new accountants succeed. However, accountants entering this side hustle must stand out. They can do this by highlighting their pass rates, teaching approach, and personalized guidance.

10. Start Online Accounting Courses

Starting online accounting courses is a great side hustle for accountants. This is because there's a big demand for skill improvement in accounting. It involves offering online courses tailored to various aspects of accounting. They cover bookkeeping, taxation, auditing, and advanced Excel. You can join platforms like Udemy, Coursera, or LinkedIn Learning. They provide great ways to showcase and sell your courses. In 2022, the number of accountants and auditors in the United States reached a record high, exceeding 1.4 million individuals. This marked an increase of approximately 100,000 compared to the previous year. You can tap into this pool by offering online accounting courses. It has professionals and enthusiasts. You will provide useful knowledge to those looking to advance their careers.

In terms of how much money you can make, ZipRecruiter reports that the average annual pay for an online course creator in the United States is $82,499. This showcases the financial rewards associated with developing and delivering online accounting courses. You can use your expertise to make high-quality, in-demand content. It benefits learners and brings in a steady, attractive income. However, it's requiring accountants to differentiate their offerings effectively. You need to make sure that your course content is engaging, relevant, and meets the needs of your target audience. Also, staying updated on industry trends is key. So is refining course content based on feedback. This is essential for staying competitive in online education.

11. Produce Accounting Software Tutorials On YouTube Channel

Making accounting software tutorials on YouTube is a unique side hustle for accountants. This is because the customer base for this side hustle is vast. It encompasses individuals and businesses aiming to enhance their accounting software skills. To start, explore existing YouTube channels. They are dedicated to teaching accounting software, like "Accounting Stuff" and "BookkeepingMaster." These channels can give you insights. You can use these insights for effective content.

The opportunity in this die hustle lies in the widespread preference for tutorial videos on YouTube. Think with Google says users are 3 times more likely to choose tutorial videos. They pick them over reading product instructions. YouTube has an audience of over 2.70 billion. You can tap into this by making high-quality, educational content on accounting software. Furthermore, Sage Practice of Now reports that 58% of businesses use accounting software to meet client needs. It adds to the demand for proficient users in this field.

In terms of side income, ZipRecruiter reveals that the average annual salary for a YouTube channel in the United States is $29.05 per hour. It translates to over $100 per day for a 40-hour workweek. Accountants can earn good money from making accounting software tutorials for YouTube. This makes it a rewarding side hustle. However, Wyzowl highlights that there are over 114 million active YouTube channels. This shows that the landscape is highly competitive.

12. Start Accounting Podcast

Starting an accounting podcast is a rewarding side hustle for accountants. They want to share knowledge and insights within their field. The potential customers for this side hustle are people keen on growing their accounting knowledge. They also want to stay updated with accounting industry trends. To start your podcast, explore trusted accounting podcasts. For example, try PWC’s Accounting and Accounting Today Podcast. Also, try the Journal of Accountancy Podcast for inspiration. These podcasts can be your valuable references. They can help you craft engaging and informative content.

With the surging popularity of podcasts, you can already have potential customers for your content. The Infinite Dial 2023 by Edison Research says that 90 million Americans listen to podcasts weekly. Specifically, 74% of podcast listeners tune in to learn. This is a prime chance for you to share your accounting knowledge. You can use this large audience. You can share well-made podcast content. Share personal experiences, tips, hacks, and host guests from the accounting community.

Regarding the profitability, various revenue streams can contribute to your podcast's financial success. Descript says podcast sponsorships can earn $18 to $25 per 1,000 listeners. Affiliate marketing offers commissions of 5% to 30%. Book sales provide royalties of 35% to 70%. And, merchandise and physical products can net about 9%. Also, email ads present an additional avenue, offering between $25 and $50 per 1,000 sends. However, it's essential to note that not all podcasters achieve the massive income levels of top-tier figures like Joe Rogan. With many podcasts out there, you need three things to stand out. These are top-quality content, effective marketing, and a unique perspective.

13. Start An Accounting Niche Blog

Starting an accounting niche blog is a valuable side hustle. It lets accountants connect with a targeted audience and share insights within their field. This side hustle is for people who want to gain deep knowledge about accounting. They will learn about industry trends and financial insights.

You can start blogging by using user-friendly platforms, such as WordPress or Blogger. Also, explore apps like Grammarly for writing help. With regards to the opportunity, it lies in the substantial readership of blogs. According to Social Media Today, a remarkable 77% of internet users engage with blogs. Moreover, Statista highlights that nearly 26% of individuals aged 5–18 in the U.K. actively read blogs. It means, you can have a vast audience base for your blogs.

You can also leverage your accounting niche blog to generate revenue. According to ZipRecruiter, the average hourly pay for a blogger in the United States is $29.94. This income can be diversified. You can do this through various channels. They include sponsored content, affiliate marketing, and Google AdSense. By adding these money-making methods, you can boost your income. You'll still share valuable content.

However, gaining many readers takes consistent effort. This effort must last a long time, often 1-2 years. According to the Web Tribunal, blogging is highly saturated, with more than 600 million blogs among 1.9 billion websites worldwide. This shows the importance of dedication and perseverance. You need them to build a successful accounting niche blog.

14. Sell Spreadsheets

Selling spreadsheets is a good side hustle for accountants. It offers a simple and cheap way to make extra money. You can consider platforms like Payhip, which demands no upfront costs or monthly fees—just a modest 5% commission on each sale. Using Payhip is easy. First, create an account and add a new product. Then, upload your Excel file and set your price. And, all this without financial commitments.

The opportunity in selling spreadsheets lies in the widespread use of these tools in professional settings. Matt Robinson of Spreadsheet.com revealed this. Over 90% of respondents use spreadsheets in their daily work. With such high reliance on these tools, you already possess a substantial pool of potential customers. Google's G Suite, including Google Sheets, had over 2 billion active monthly users by the end of 2019. Javier Soltero from G Suite mentioned this in a March 2020 Axios interview.

Moving on to potential income. Sellfy reports that making just a couple of spreadsheets, a task done only once, can earn an average passive income of $300 to $800 monthly. This highlights the viability of spreadsheet selling as a source of consistent and lucrative earnings. Selling spreadsheets is a simple and free entry. But, getting seen and finding clients may take time. Also, getting customers and increasing sales could be hard. Doing so needs patience and persistence.

15. Become A Virtual/ Fractional CFO

Becoming a virtual or fractional CFO is a nice side hustle for accountants. It opens up opportunities to give financial advice to small and mid-sized businesses. They are seeking guidance. Many startups and companies have seen the advantages of outsourcing roles like CEO, CMO, and CFO. This is especially true in the tech hub of Silicon Valley.

Many companies are hiring fractional CFOs. They do so to navigate complex finances without a full-time, in-house CFO. By being a virtual CFO, you can offer valued financial insights. You can also help with strategic planning for these enterprises. You can consider platforms like The Finance Story for guidance and insights into the evolving landscape of virtual CFO roles.

ZipRecruiter says accountants in virtual or fractional CFO roles can make a lot of money. They earn an average of $151,302 per year in the United States. This offers big earning potential. It's for accountants who want to diversify their income. Virtual or fractional CFO roles can be unstable. They often lack the job security of full-time roles. You should be prepared for potential fluctuations in workload and client demands.

16. Become A Freelance Writer

Becoming a freelance writer is a famous side hustle for accountants because they can serve diverse clients. These include financial publications, blogs, and businesses that need financial content. As an accountant, you can start your freelance writing journey. You can do this by exploring platforms like Upwork, Fiverr, or Freelancer. They connect you with clients who need your expertise.

The Bureau of Labor Statistics forecasts a 4% increase in employment for writers and authors from 2021 to 2031. It translates to around 5,900 new writing jobs. You can benefit from this job outlook. Offer your financial insights and expertise by writing. Moving on to the potential income, Indeed reports that the average salary for a freelance writer in the United States is $22.69 per hour.

You can earn extra income by writing about finance. You can share your knowledge and write for many publications. This offers a flexible way for accountants to boost their earnings. It also lets them showcase their expertise in finance. However, Zippia says 82% of US freelancers are writers. This shows competition. It means creating a strong portfolio. You should also showcase accounting expertise and target niche markets. These steps can help you stand out in this tough freelance writing world.

17. Freelance Remote Bookkeeping Jobs

Exploring freelance remote bookkeeping jobs is a great side hustle for accountants. This is due to the jobs' potential to serve the financial needs of small businesses. Small businesses make up 21% of the highest financial roles in the United States. They often rely on bookkeepers to keep accurate financial records and ensure compliance. Imed Bouchrika emphasizes that bookkeeping is a highly regarded profession. It gives individuals a sense of meaning and significance in their work.

Are you looking to do freelance remote bookkeeping? You can start by exploring platforms like Upwork. Businesses post their bookkeeping needs there. You can also check platforms like QuickBooks or FreshBooks. They can be valuable tools for you. You use them in freelance remote bookkeeping. They let you streamline tasks and provide great services to clients.

For profitability, ZipRecruiter reports that the average hourly pay for a freelance bookkeeper in the United States is $24.31. This makes freelance remote bookkeeping rewarding. It is a side hustle for accountants seeking extra income. But, freelance remote bookkeeping has one challenge. It requires strong organization and communication. You should be good at managing tasks alone. You should also be good at talking with clients. This is to ensure accuracy in financial records.

18. Freelance Data Entry Job

Freelance data entry jobs are a beneficial side hustle because it allows you to cater to various businesses and industries. Small businesses often need accurate and quick data entry. It helps them manage their information well. Accountants can begin freelancing in data entry by using platforms like Upwork or Fiverr. Businesses often post their data entry jobs there. Also, apps such as Trello or Asana can help you organize your tasks efficiently, ensuring a smooth start to your freelance data entry side hustle.

For the demand, The U.S. Bureau of Labor Statistics predicts a significant growth of at least 31% in jobs related to data and data entry. You can leverage your attention to detail and organizational skills to capitalize on this expanding field. Businesses are digitizing more. This is increasing the demand for skilled data entry professionals. It provides a lucrative opportunity for accountants seeking a side hustle.

In terms of potential income, Indeed reports that the average salary for a data entry clerk is $18.19 per hour in the United States. You can benefit from this additional income stream by offering data entry services to businesses on a freelance basis. Set competitive rates. Deliver accurate and timely results. This way, you can create a reliable source of income through freelance data entry. However, Vault reports that there are approximately 187,300 data entry workers in the United States. While this indicates a demand for data entry services, it also highlights the competitive nature of the field.

19. Freelance Virtual Assistant

Freelance virtual assistant (VA) is a promising side hustle for accountants because of the opportunity to cater to a diverse range of companies. Notably, 49% of companies hiring VAs have more than 1,000 employees, as reported by Zippia. This gives accountants a chance to offer their skills to large, established businesses. They can tap into a customer base that values professional support. To start as a freelance VA, you can explore platforms like Fiverr, Upwork, and Indeed. They often have many virtual assistant job postings.

Freelance virtual assistance involves providing administrative and support services to businesses. It is done from a remote location. You can use your organization and attention to detail to excel in tasks. These include email management, scheduling, and data entry. Also, you can use apps like Toggl or Trello to help you efficiently manage your tasks and deadlines. It ensures a seamless start to their freelance virtual assistant side hustle.

Delving into the opportunity, the demand for virtual assistants is evident in the job market. ZipRecruiter reports that there are more than 150,000 virtual assistant jobs posted in the United States alone. Accountants can use this demand. They can do this by positioning themselves as capable virtual assistants. They should showcase their ability to boost efficiency for businesses in many industries. This is a practical opportunity for accountants. They are seeking a side hustle that aligns with their expertise.

In terms of potential side income you can make, freelance virtual assistants can earn a competitive salary. According to ZipRecruiter, the average hourly pay for a work from home virtual assistant in the United States is $33.84. However, freelance virtual assistance offers flexibility and many opportunities. But, you should be ready for its competition. The growing popularity of remote work has led to an increase in individuals seeking virtual assistant roles.

20. Self Publishing on Amazon KDP

Self-publishing on Amazon KDP is another side hustle for accountants because it can tap into the substantial market of over 115 million active customers on Amazon KDP, as reported by Amazon in 2021. The potential customers are avid readers and those looking for financial insights. This creates a niche for accountants to apply their experience.

You can start journey into self-publishing by using user-friendly platforms. For example, Kindle Direct Publishing. Self-publishing on Amazon KDP involves independently publishing books and reaching a global audience. You can share your financial knowledge, tips, or even delve into writing fiction with financial themes. Platforms like Scrivener or Reedsy will help you in starting into self-publishing. It provides you with resources like formatting and designing your books effectively.

For the opportunity, the statistics speak for themselves. Amazon KDP facilitated the sale of over 200 million books in 2021. It shows you the chance to make money by publishing a book on Amazon KDP. Also, Zonguru reports that self-published Kindle writers earn between $150 to over $20,000 per month.. By consistently publishing valuable content, you can build a steady income through royalties and sales.

But, Wordsrated reveals something else: Amazon publishes over 1.4 million self-published books each year. They do this through Kindle Direct Publishing. These show the platform's popularity. They also stress the need for accountants to position their books strategically and do effective marketing. This is to stand out in a crowded market.

21. Offer Career Consulting

Offering career consulting is an awesome side hustle for accountants because it caters to a specific audience—individuals seeking guidance in their career paths. Accountants have a lot of financial and business knowledge. You can use it to give helpful advice to people navigating their careers. You can check platforms like LinkedIn that can serve as your starting points to connect with potential clients.

In exploring the opportunity, it's crucial to understand the demand. The Bureau of Labor Statistics projects a 5 percent growth in employment for school and career counselors and advisors from 2022 to 2032. The rate of growth is faster than the average for all jobs. There will be about 26,600 openings each year for the next decade. You meet this demand by offering career consulting. You use your financial expertise to guide people in making smart career choices.

With the potential extra income, ZipRecruiter reports that the average hourly pay for a Career Consultant in the United States is $25.11. By offering a consultancy service, accountants can offer one-on-one sessions or career workshops. They can also develop online courses to reach a broad audience. This will increase their earning potential.

However, building a client base and establishing credibility in the career consulting field may take time. You should be ready to work hard to market their services. You must also build a good reputation to attract clients. It's important to stay updated on industry trends and career strategies. This ensures advice is valuable and relevant.

22. Sell Printables On Etsy

Selling printables on Etsy is an artistic and profitable side hustle for accountants because of the broad audience looking for various printables on Etsy. You can take advantage of this by making and selling printables. They should be about budgeting, financial planning, or business organization. They benefit from financial tracking and planning tools. You can check the success stories of Rachel Jiminez, who earned nearly $160,000 in passive income from selling printables on Etsy in 2021. Her diverse range of printables are from planners to trackers. It showcases the vast market demand.

For how much extra cash you can make, Growing Your Craft suggests that, initially, one can expect to earn about $10-100 a week. As the shop gets stable and attracts regular sales. The potential income rises a lot. Also, a well-structured Etsy shop with quality financial printables in the right niche can make daily sales. It could eventually earn an income of $1,000 or more per week. This income can serve as a profitable addition to an accountant's overall earnings.

However, according to CNBC, Etsy charges a seller fee of 20 cents for each listed item, along with a 6.5% transaction fee on every sale. You should consider these fees when pricing your printables. They ensure a balance between profit and competitiveness on Etsy.

23. Start Affiliate Marketing

Starting affiliate marketing is a straightforward side hustle for accountants because you can target individuals interested in financial planning, investment tools, or accounting software. You can join platforms like ClickBank or Amazon Associates. They can serve as your starting point to explore and join affiliate programs relevant to your expertise.

Authority Hacker states that 81% of brands use affiliate programs to boost brand awareness and drive sales. This implies a substantial demand for affiliate marketers including the financial sector. You can partner with trusted brands and banks to promote their products or services. You do this through affiliate links on your blogs, websites, or social media.

For income, ZipRecruiter indicates that the average annual pay for affiliate marketing in the United States is $72,969. For accountants, this income can serve as a significant supplement to their primary earnings. You can optimize your income potential in affiliate marketing. Do this by choosing high-paying affiliate programs and marketing financial products well. However, some niches are saturated. The need for effective marketing to stand out can pose challenges. Accountants must invest time to understand their target audience. They should refine their marketing to maximize success in affiliate marketing.

24. Online Arbitrage

Online arbitrage offers accountants a promising side hustle opportunity because it leverages the potential to start with minimal capital and achieve attractive profit margins. To start, this side hustle serves a diverse customer base. It focuses on those interested in e-commerce and retail arbitrage. You can enter this market by exploring platforms like Amazon. Many online retailers started their arbitrage ventures with under $500 on Amazon. This is according to JungleScout.

You can take advantage of the opportunity. About 54% of online arbitrage sellers make profits of 16% or more. This highlights the lucrative potential of the venture. By researching and choosing the right products, accountants can boost their profit margins. They can also navigate the competitive landscape well. The statistics from Seller Assistant App show that over 50% of online arbitrage sellers earn about $5,000 per month. They have profit margins of 16% and up. It showcases the substantial income potential of this side hustle.

However, according to Seller App, around 17% of Amazon sellers are engaged in online arbitrage. This side hustle is gaining popularity. But, as more sellers join, competition and finding profitable products get harder.

25. Sell On Amazon FBA

Selling on Amazon FBA is a wise side hustle for accountants because it offers a chance to tap into a vast customer base involved in e-commerce. To begin, this side hustle is for people in online retail. It's especially for those who use Amazon's Fulfillment by Amazon (FBA) service. You can target this customer segment, as it comprises a substantial portion of online sellers. Also, apps like TrueProfit and Gitnux can help accountants. They are valuable resources for accountants starting their Amazon FBA journey.

According to TrueProfit, 46% of Amazon sellers achieve a success rate of 11-25%. This shows that it's feasible to start a profitable FBA business. Also, 64% of Amazon sellers become profitable within 12 months. This indicates a quick turnaround for those venturing into FBA. For accountants, this is a chance to diversify income streams. They can enter a thriving e-commerce market.

Discussing the potential income, Gitnux highlights that in 2018, about 30% of Amazon FBA sellers reported earning over $100,000 per year. This showcases the income potential that you can tap into by effectively managing and growing your FBA business. However, you should know the competitive nature of the Amazon marketplace. Also, you need to stay informed. You must continuously adjust strategies and explore niche markets. This will help reduce potential disadvantages.

26. Flip Items

Flipping items is a good side hustle for accountants. It appeals to a broad audience, including 82% of Americans, or 272 million people, who buy or sell used items. The statistics from OfferUp show that recommerce is big. This is especially true for clothing resale. It is a dominant force, with projections suggesting 80% growth over the next five years. This would bring it to a huge $289 billion. This presents accountants an opportunity. They can enter a growing market. Use your financial expertise. It will help you make informed decisions about the products to flip.

You can make money from flipping. The Flipping Ninja has insights on income you can expect. By investing 10 to 20 hours weekly in flipping, you can earn a steady side income. This ranges from $500 to $3,000 a month or more. This income potential is flexible. It allows you to scale your efforts based on your availability and preferences. It provides an avenue for accountants to supplement their income without the constraints of a rigid schedule. Yet, you should mind the time commitment. Also, watch for price changes in the second-hand market. Flipping success relies on identifying valuable items, and market trends can change.

27. Home Baking

Home baking is an excellent side hustle for accountants because the recent nationwide survey conducted by The Harris Poll reveals that 28% of Americans have increased their consumption of baked goods in the past six months because of the pandemic. Additionally, 26% express a heightened craving for baked items. The statistics show a big change in consumer behavior. More people turn to baked goods for comfort and satisfaction. This presents an obvious opportunity for accountants to tap into a growing market of potential customers. To start this side hustle, you can promote your baked goods well on popular social media. Use platforms like Facebook, Instagram, and Twitter.

In terms of income, home baking offers accountants rewards. The rewards match their skills and dedication. According to Salary.com, the income range for a home bakery owner in the U.S is from $63,419 to $89,598 per year. While home baking presents a promising side hustle, one notable challenge is the time commitment required for baking. Especially when handling a growing number of orders. You should be mindful of balancing your primary profession and the demands of a home baking business.

28. Vacation Rental Property

Vacation rental property is a promising side hustle for accountants due to the ever-growing market of international visitors to the United States. The ITA's National Travel and Tourism Office (NTTO) forecasts that international visits will increase to 62.8 million in 2023. It reflects a much growth of 21.2% from the previous year. The increase in international travel offers accountants a big opportunity. You can now enter the vacation rental property business.

You can use this growing trend in international travel. You can do it by investing in vacation rental properties. More people are visiting the United States. They want alternative accommodation, like vacation rentals. You need to pick great locations. You also need to improve listings. And, you need to offer top service. The statistics from NTTO further reinforce the vast potential for success in this side hustle.

When it comes to potential income, you can rely on valuable insights provided by industry experts. John Banczak is the executive chairman of TurnKey Vacation Rentals. He suggests a rule of thumb for estimating annual rental income from property. For every $100,000 invested, accountants should aim for an annual rental income of about $10,000. Moreover, data collected by Airbnb and Vrbo indicates a wide income range for vacation rental owners, spanning from $11,000 to as much as $33,000 per year. This income potential makes vacation rental property a lucrative side hustle. It is for accountants seeking extra money.

To start this side hustle, you can begin by exploring popular platforms Airbnb and Vrbo. Managing vacation rentals includes property maintenance, guest communication, and obeying local regulations. You must be prepared for the time and effort required to effectively manage these aspects.

29. Real Estate Investing

Real estate investing is a smart side hustle for accountants because it offers a multitude of opportunities in the dynamic property market. To start this side hustle, begin by using easy apps and websites like Zillow, Redfin, or Realtor.com. It provides valuable insights into property listings, market trends, and investment opportunities. Accountants can use the growing interest in real estate investment. Gitnux's 2021 research highlights this. A significant 48% of real estate investors expressed plans to acquire more properties. It indicates a substantial opportunity for those entering this venture.

When considering potential income, the S&P 500 says that residential real estate in the United States has an average annual return of 10.6 percent. This statistic underscores the income potential for accountants engaging in real estate investment. However, real estate investing has inherent risks. These include market fluctuations, property management challenges, and economic uncertainties. You must be ready for the unpredictable real estate market. You must also consider factors that may affect investment returns.

30. Deliver Food With Doordash

Delivering food with Doordash is a fun and accessible side hustle for accountants due to individuals and families who rely on food delivery services, particularly the 112 million Americans who utilized such services in 2020, according to Statista. You can easily start by downloading the Doordash app and signing up as a delivery driver. Accountants can choose flexible hours. They can also choose areas for food deliveries on this user-friendly platform. It's a convenient and adaptable option for those seeking extra income. You can benefit from the trend in food delivery. 60% of Americans order takeout or delivery weekly, according to Nation's Restaurant News. This creates a steady demand for food delivery services.

It gives you a reliable stream of potential customers. Indeed's data shows DoorDash drivers in the US earn about $19.31 per hour. This figure, surpassing the national average by 14%. It shows a good pay structure for accountants. The pay is competitive and fair. They work in food delivery. However, a notable drawback is the wear on personal vehicles. You should consider this when evaluating the side hustle's profitability. The pay is good. But, you must include vehicle maintenance costs and gas expenses. These costs can affect the net income from food delivery.

31. Social Media Management Fo A Small Business

Social media management for small businesses is a promising side hustle for accountants because owners are looking to establish a robust online presence. hese businesses often lack the time or expertise to manage their social media well. This creates an opportunity for you to fill this gap. To get started, you can explore tools such as Hootsuite or Buffer. These apps simplify social media management. You can schedule posts, monitor engagement, and manage small businesses' online presence. The gig's opportunity is in social media marketing. Gitnux's report highlights this. It says 63% of small business owners find it effective. They can do this by offering their expertise to businesses. The businesses want to improve their online visibility.

About the potential income, according to Payscale data, the average salary for social media managers is $53,060. This figure provides a benchmark. But, you can set your side hustle rates based on your experience and the scope of services you offer. However, Revelio Labs reported that in April 2022, there were over 64,000 social media managers in the United States. The high number shows competition. You should stand out by showing your unique skills and financial expertise in social media strategy.

32. Online Transcription

Online transcription is a compelling side hustle for accountants because it caters to various professionals and industries, from businesses, researchers, and content creators who require accurate and accessible written records. To start, you can explore transcription platforms. Examples include Rev, TranscribeMe, and GoTranscript. These platforms are easy to use. They let you upload audio files and get transcriptions. According to Type Whizz, the audio transcription industry is booming in 2023. It is driven by the growing demand for accessibility, SEO, and research.

Moving on to the potential income for accountants in online transcription. Data from the Transcription Certification Institute shows that a transcriptionist's salary is $19.02 to $30 per hour. By dedicating 2.5 hours per day for 24 days a month, accountants can earn an average of $1141.2. This income is flexible and allows you to manage your time while earning a steady supplementary income. However, meeting deadlines with a high rate of accuracy and efficiency is a constant requirement. Accountants entering this side hustle should be prepared for a dynamic and fast-paced environment. Also, staying updated with the latest transcription technology is crucial. It is needed to remain

33. Virtual Event Planning Or Coordination

Virtual event planning is an exciting side hustle for accountants because businesses and organizations increasingly rely on virtual events for various purposes. It creates a demand for skilled professionals who can coordinate and plan these events seamlessly. You can explore platforms such as Hopin, Remo, or Zoom Events. These platforms empower you to plan and coordinate virtual events effortlessly. In terms of the opportunity, according to the U.S. Bureau of Labor Statistics, the job outlook for event planners is expected to grow by 8% from 2019 to 2029. This growth signifies an increasing demand for professionals with event planning expertise. Accountants are well-positioned to excel in this growing field. They have organizational and detail-oriented skills.

Data from ZipRecruiter shows how much you can make. The average weekly pay for a virtual event planner in the United States is $1,168. This figure shows the earnings potential for accountants. They work on virtual event coordination. However, Market Reading reveals the biggest annoyance at virtual events. It is a bad connection (38%). This is followed by issues with microphones (30%) and cameras (20%). You should be ready to face these technical challenges. They are key to smooth and successful virtual events for clients.

34. Dog-Walking

Dog-walking is a fun side hustle for accountants due to the substantial customer base like pet owners, specifically those who struggle to find time to regularly walk their dogs. To start, consider signing up on platforms like Rover or Wag!, which connect pet owners with dog walkers. These apps provide a convenient way for you to initiate your journey into dog-walking as a side hustle. Also, the Bureau of Labor Statistics predicts a notable 22% growth in the dog-walking field between 2016 and 2026. The growth in demand for professional dog walkers is clear. This trend also benefits accountants looking for a side job.

For potential income, according to Care.com, the average monthly pay for a dog walker in the United States is $2,878. This figure shows the financial potential. It is for accountants who dedicate their time to walking dogs regularly. They can walk dogs when it suits them. This lets them earn extra money. However, Econlife reveals that there are about 29,000 dog-walking businesses. They employ an estimated 51,000 walkers. This shows a strong market. But, it also highlights the need to stand out to attract clients.

35. Freelance Graphic Design

Freelance graphic design is a promising side hustle for accountants because it offers you to cater to small businesses and entrepreneurs that often require design services for branding and marketing materials. To start, you can explore platforms like Upwork or Fiverr. They connect freelancers with clients who need graphic design.

The U.S. Bureau of Labor Statistics projects 3 percent employment growth for graphic designers from 2022 to 2032. They expect about 22,800 job openings. This growth signals an increasing demand for graphic design services. It provides you the chance to leverage your creativity and contribute to various projects. Small businesses are realizing the importance of visual communication. You can position yourself to meet this rising demand.

In terms of potential income, freelance graphic designers can expect substantial earnings. According to Creatibly, income for freelance graphic designers varies, ranging from $6,000 to $60,000 per year. This flexibility allows accountants to set their prices. They base them on their skills and experience. By delivering quality designs and building a strong portfolio. You can attract clients who will pay well for their graphic design services.

However, it's crucial to consider the competitive landscape of freelance graphic design. Zippia reports that over 122,236 freelance graphic designers are currently employed in the United States. This high number emphasizes the importance of differentiation and specialization.

Recommendation:

If you're a daddy and wanting to explore side gig opportunities outside your CPA profession, you can check my ultimate list of side hustles for men.

4 Shocking Reasons Accountants Start Side Hustle

1.Challenges with Low Pay and Limited Career Growth

Low pay and limited career growth underscores the struggles accountants encounter in their professional journey and holds significant importance for those seeking financial stability and career advancement. A key statistic from Salary.com shows that accountants with a graduate degree earn only 4% more than those with an associate degree. The small difference in pay based on education highlights a stark reality in accounting. Advanced degrees don't always mean big pay raises. This shocking reason is important.

It is clear in the 35% dissatisfaction expressed by accountants. They are unhappy with their career growth prospects, as reported by Accounting Today. The limited avenues for advancement within the field contribute to a sense of slow growth among accountants. It leads them to seek extra paths for professional development and financial improvement.

2. Coping with Rapid Inflation

As inflation rates soar, the cost-of-living surges. In response to this economic shock, accountants often start doing extra jobs on the side. These side gigs help them earn more money and protect themselves from the problems caused by rising prices. It's like a backup plan to make sure they can handle the financial difficulties that come with inflation

CNBC analyzed the U.S. Bureau of Labor Statistics' consumer price index. It is adjusted for the season. They found that the cost of basics like groceries, utilities, and gas has surged by 20% or more. This surge encompasses a broad spectrum of items, with the overall index registering a 13% increase. This rise in the cost of living affects accountants. It makes it hard for them to keep their standard of living on their regular income.

For instance, the same CNBC analysis reveals that the cost of food prepared at home has risen by almost 20% since April 2021. Specific items like margarine experienced a staggering 54% increase, caused by war in Ukraine.

Gas prices are also crucial. They have been volatile since the invasion of Ukraine in February 2022. Gas costs have trended down since June 2022. But, they are still 22% higher than two years ago. This increase impacts commuting and personal travel expenses for accountants.

Furthermore, the CNBC analysis highlights the rise in travel-related expenses. Airline fares and hotel prices surged by 36% and 31%, compared with April 2021. This big increase impacts accountants. They plan vacations or business trips that add strain.

Staying at home does not shield accountants from rising costs. The CNBC analysis shows a surge in utility prices. There is a shortage of natural gas and coal. It has driven up electricity and piped gas prices by 21% and 26% since 2021.

The statistics provided by CNBC Make It offer a clear picture of the magnitude of these challenges. It stresses the importance of side hustles. They help accountants withstand inflation's impact on their finances.

3.Struggling With Work-Life Balance

The struggle with work-life balance shows the difficulty that accountants face. They must balance their work and personal life. This is very important. Research by Accountancy Age reveals a striking statistic. Over a third (36%) of members of the Institute of Chartered Accountants in England and Wales (ICAEW) are unhappy with their work-life balance.

The importance of work-life balance for accountants cannot be overstated. Long and irregular working hours often lead to big disruptions in personal lives. They hurt relationships, health, and well-being. Balancing the job and personal life is a constant struggle. It can cause stress, fatigue, and lower job satisfaction.

4. Overwhelming Work Hours And Burnout

Burnout is characterized by physical and mental exhaustion because of prolonged stress. It is a significant factor prompting accountants to seek extra income sources. The AICPA conducted a survey. It found that burnout makes accountants quit. The survey highlights that long working hours, high stress, and heavy workloads cause burnout.

The detrimental effects of burnout can affect both the physical and mental well-being of accountants. In addition, a survey by the University of George and FloQast revealed an alarming statistic. It is that 99% of accountants admitted to experiencing burnout. The pressure and workload are constant. They can cause burnout. Burnout hurts job satisfaction and life quality. Many accountants are seeking side hustles to ease the impact of long work hours and burnout. That is why they are doing it.

FAQs About Side Hustles For Accountants

Do Accountants Have Side Hustles?

Yes, accountants have side hustles. One of the most common side hustles for accountants is bookkeeping. ACCA Think Ahead highlights this in their articles. Notably, John D. Rockefeller, a prominent figure, started his career as an assistant bookkeeper at the age of sixteen. According to Encyclopedia Britannica, he worked for a small produce commission firm in Cleveland. The firm was called Hewitt & Tuttle. He started in September 1855. This historical example shows that side hustles are not new. They have been part of the accountant profession for a long time, especially bookkeeping. It also shows that even famous entrepreneurs, like Rockefeller, started their careers with side hustles.

How Much Time Needed For Accountants To Start Side Hustle?

Accountants may need about 11-16 hours to start a side hustle. This is based on Vistaprint's findings. They reveal the average time side hustlers spend on their additional gigs. Also, accountants typically work 40-hour weeks, as Indeed revealed. So, they could dedicate extra hours to a side hustle, especially outside work. Also, Zippia highlights that accountants often work overtime. This is especially true during busy seasons like tax season. This implies that, without working overtime, accountants can set aside around 4 hours after their shift for their side hustle. They could also invest more time on weekends.

How Much Money Can Accountants Make From Side Hustle?

Accountants can make anywhere from $500 to $5,000 from side hustle, depending on the time they invest. Data from Side Hustle Nation shows that people earning less than $100 monthly spend 0 to 5 hours per week on their side hustle. In contrast, those making $500 or more spend at least 5 hours a week. For established side hustles, 40% reported spending 20 hours a week or less. And they earned $5,000. This means that if an accountant works more than 20 hours a week, they can expect to make at least $5,000 from their side hustle.

Conclusion: What Is The Best Side Hustle For Accountants?

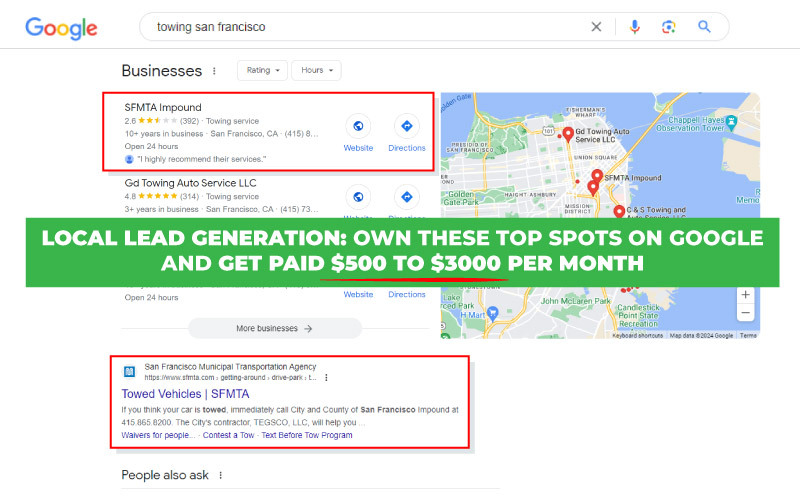

Local lead generation is the best side hustle for accountants because of its low startup cost, less competition, and potential high profit margin. You can start at just $500. This digital real estate venture involves ranking a website on search engines. This is done through organic SEO. Once achieved, the site can be rented out to local businesses in need of leads. Then, it will become a passive income stream ranging from $500 to $2,500 per website monthly with little to zero maintenance. This model contrasts with hands-on hustles. These include managing vacation rentals. They also include working with the logistics of food delivery services with Doordash.

The significant advantage of lead gen biz lies in its drastically less competition. Focus on local markets with 10-15 competitors or fewer. This lets you avoid the saturated platforms like Etsy. It also helps you avoid the crowded field of freelance bookkeeping, where over 1.7 million bookkeepers work in the United States alone. Additionally, the profit margins of local lead generation are notably high, with a 95% profit margin per website. Other hustles, like online arbitrage, achieve only 16% profit margin as per Jungle Scout. Flippers, or resellers, target a 50% profit margin. The lead generation model excels as it incurs no cost of goods. You are selling valuable information (leads) rather than physical products.

To give you practical examples, you can see my tree service site above that keeps me earning $2,000 per month since 2015. With only 15 hours invested in building and ranking the site, it has yielded $168,000 over seven years. This success story shows the appeal of local lead generation. It is especially useful for accountants. They want to escape long work hours and navigate high inflation. So, if you’re looking for a side hustle that offers a low entry barrier, minimal competition, and impressive profit margins, look no further with local lead gen biz.