Stock Navigators by Tim and Tom Luong is an educational platform for traders. They offer courses for beginners and expert traders. Tom Luong also developed a trading strategy, echo mapping, which they teach to traders.

Stock Navigator reviews are a mix of positives and negatives. Stock Navigators have 225 reviews and an overall 4.6 rating on Trustpilot.

Trading can yield big profits but also big losses. According to the Financial Industry Regulatory Authority, 72% of traders report financial loss. In this Stock Navigators program review, we’ll list its pros and cons, what you can get and who are its founders. And if there is a better business model than stock trading.

Stock Navigators Review: Pros And Cons

Pros

3x question and answer sessions per week.

Self-pace. Students can go back anytime to any topic they find difficult.

Offers programs for both beginner and expert traders.

Cons

High risk business model. Analysts say you should be prepared to deal with loss.

Students reported problems about hidden fees and refunds.

Tom and Tim Luong don't show proof they’re live trading.

Price

Stock Navigators cost $97 for the Money Zone Method. The Expert Trader Program's cost is not disclosed, but students say its price range is $4500 to $7800.

Training

Self-paced

Group

Stock Navigators has an exclusive student community in Discord

Refund Policy

Stock Navigators has a 60 days money back guarantee

Origin

Stock Navigators was founded in 2018

How Stock Navigators Help You To Become An Expert Trader?

Stock Navigators help you become an expert trader by providing a fundamental trading strategy, the Echo Mapping. It helps beginner traders determine the best area to enter and exit the trade.

They put emphasis on timeframes for day trading and swing trading. Comparing the low timeframe against the largest timeframe gives traders vital information about the trend of the trade.

Stock Navigators also provide real life trading examples and trading simulators. So you can start trading your money after you’re confident in your technical analysis of the market.

Stock Navigator’s student, Michael, grew his $3k account to $122k in a year of exploring the markets. Michael said he buried his head in the course for a whole month. According to him, it’s important to know which market works for you.

What Is Stock Navigators?

Stock Navigators is an educational trading company. The company started in 2018 after Timothy Luong became successful in swing trading. Swing trading holds on assets for a few days to weeks before selling. He learned it from his father, Tom Luong, and had the vision to share the strategies to the world.

Tim and Tom started with one face-to-face class with 5 students. Today, they already taught 1,600 students.

What Can You Get From Stock Navigators?

You can get video lessons, real life examples, Q&A sessions and community from Stock Navigators. They also cater to both beginner and experienced traders by offering two courses.

Money Zone Method

Money Zone Method is the Stock Navigator course for beginners. It covers the fundamental trading strategy, the mindset of a trader, analyzing chart patterns and how to pick the best trading platform that fits you best.

Money Zone Method has 13 modules and 3 hours of video lessons. Also includes the bonus module on how to use Renko charts. According to Wealthy Education, many successful traders say the Renko chart is a key part of their trading strategy. Reddit user SensitiveWar6355 said it's great for recognizing key levels and as a secondary screen.

Expert Trader

Expert Trader is the program for experienced traders. It is the flagship course of the company and has 60+ hours of content. Expert Trader teaches techniques for swing traders, day traders and long term investors.

It includes a trading simulator, question and answer sessions 3 days per week, an exclusive student community and a market analysis.

Who Is Stock Navigators For?

Stock Navigators is for anyone looking to learn a strategy on trading. It’s suitable for beginners who want to start trading. Stock Navigators is also for experienced and active trader looking for trading techniques.

Stock Navigators is also for people looking for a side hustle with their 9-5 jobs or making money online.

Stock Navigators Review Online

Stock Navigators Reviews On Trustpilot

Stock Navigators reviews from Trustpilot are mostly positive. Cody from the US said the course helped him learn while being profitable. He praised Stock Navigators’s focus on technical analysis and psychological element of trading. Jeff Kalteux from the US said the Stock Navigator is a great place to become a trader. Jeff mentioned they have Q & A sessions almost 6 days per week.

While Ricardo left a 1 star review because of refund problems. He said he canceled the subscription on November 2022 and still fighting for it in February 2023.

Stock Navigators Reviews On Reddit

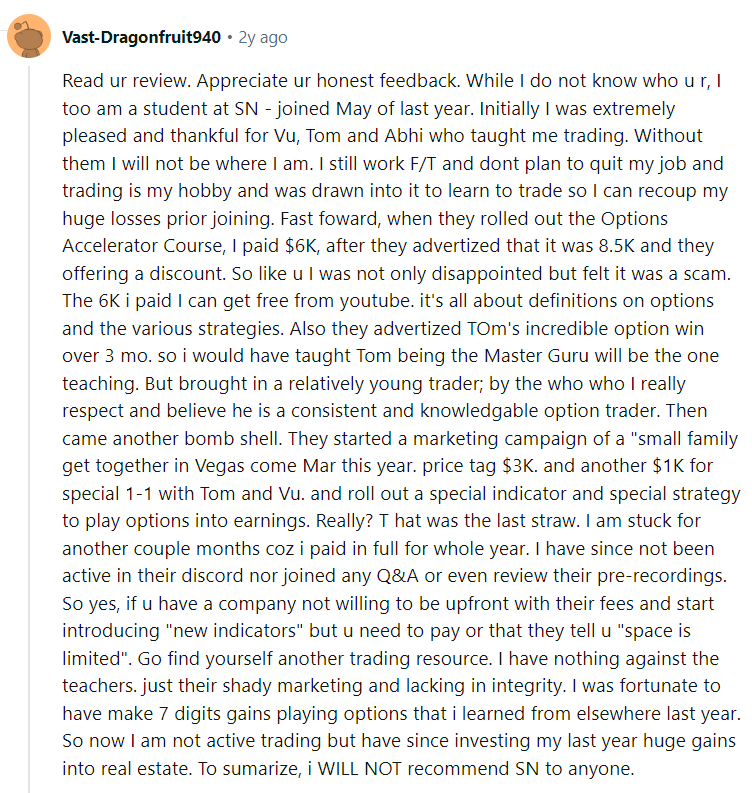

Stock Navigators have more negative reviews on Reddit. User Vast-Draginfruit940 said he was happy at first, but won’t recommend Stock Navigators to anyone. He said the $6k Options Accelerator course made him feel scammed because it’s information he can find on Youtube. And the upsells continued with 1-on-1 with Tom, new indicators, special strategy for options trading.

While EquatorialReins found tons of value in Stock Navigators. The reddit user said it was money well spent because it saved him time.

The latest reply on the reddit thread from ketchuponpizza criticized the overpriced courses of $5k to $10k and the fast pace teaching of Tom. According to ketchuponpizza, Stock Navigators also delete negative reviews on Trustpilot.

Are The Students Of The Stock Navigators Successful?

Yes, students of the Stock Navigators are successful. Bob, a real estate manager planning to retire, averaged $500 per day. His weekly profit ranges from $1700 to $3500. According to Bob, Tom and the community is a key component of his success.

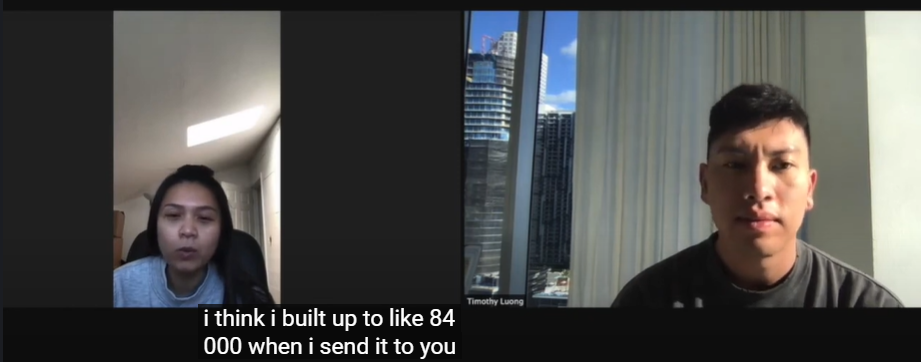

Thu, a mother from San Jose, CA, started her account at $25k. She grew this into $84k with two accounts in less than a year. Thu said she almost quit because the lessons are overwhelming, but she persevered because she saw students winning in the community.

However, Stock Navigators has a disclaimer that these amounts are not guaranteed for every student. The success of students is a result of their own hard work

Is Stock Navigators Legit?

Stock Navigators is legit since they provide the basics and trading techniques as advertised. However, students also said Tom is only available during Q and A calls. And most of them signed up to learn from him and his decades of experience in trading.

Stock Navigators is worth it if you have huge money to spare and really want to do stock trading. According to the Data Science Society, day trading’s success rate is only 4%. And the Expert Trader course is expensive with a lot of upsells.

Who Is Timothy Luong?

Timothy Luong is an active trader, founder and CEO of Stock Navigator. He graduated with a degree in Economics at University of California in Los Angeles.

He quit his job at Wall Street to learn trading from his father, Tom. They refined Tom’s trading strategy for 3 months. Then Tim founded the Stock Navigator after hitting 6-figures using his father’s strategy. Tim is based in Miami, Florida. He currently hosts his own podcast, Timfluence.

Who Is Tom Luong?

Tom Luong is from Vietnam. Tom and his father escape the country by boat to Indonesia. When he came to the US, he studied and worked at the same time.

Tom Luong finished Electrical and Computer Engineering at San Jose State University in San Jose, California. Tom worked as an electrical system engineer. He started buying tech stocks in the 1990s and lost all of it when the market crashed in the 2000s.

Tom took it upon himself to learn about the market then. Now, he’s day trading and the chief market strategist of Stock Navigators. Tom lives with his wife in San Jose, California.

Timothy And Tom Luong Claim

Timothy and Tom claim Stock Navigators can provide aspiring traders a new way to make money in just 3 hours per day. Regardless of market and without experience or technical knowledge.

Timothy And Tom Luong Claim Debunked

Can You Make Money By Trading Stocks?

Yes, you can make money by trading stocks but only 13% of traders are consistently profitable for 6 months according to the University of California. Quantified Strategies stated traders will likely experience 50% loss than 50% gain. So risk management is vital in trading. It can be a stop loss order or diversification of portfolio.

A stop loss order can lessen your loss. Once your stock reaches the price limit you set, it’ll be sold. While diversification of portfolio is allocating your fund to different assets.

Stock trading is not a get-rich-quick business model. George Soros bet against the British pound and profited $1 billion. Soros watched Britain join the European exchange rate in 1990 and the political unrest in 1992. He kept tabs and made the decision based on it for 2 years.

Is Stock Trading A Practical Way To Make Passive Income?

Yes, stock trading can be a practical way to make passive income if you have long term investments. According to Nerd Wallet, long term investments have 10% annual profit based on S&P 500.

Conclusion: Why Local Lead Generation Is The Better Business Model Than Stock Trading?

Local lead generation is the better business model than stock trading because it’s less risky. The biggest problem with stock trading is its high risk. According to the University of Berkeley, 80% of trades are unprofitable. It's more certain you'll lose money than gain it.

Stock trading is also highly competitive. You’re against professionals working for major financial institutions. They can access paid trading software to make the right call before everyone else. According to My Trading Skills, 40% of traders quit within a month.

Local lead gen doesn’t have all those problems. It’s less risky because you can create a website with $500 and rank it on Google. And you can rank with only 10-15 pages in just 6 months. Local lead gen is also scalable. You can build multiple websites from 50+ niches and accumulate $50k per month. From all the websites I own today, I earn a passive income of $52k monthly. So if you’re looking to make money without risking your whole savings, local lead generation is the better choice.