Credit Stacking is a credit stacking course by Jack McColl that teaches you how to do credit stacking without hiring a credit stacking company. This will ideally allow you to achieve high-limit credit funding to invest in your business. For a new business, credit stacking allows access to a large unsecured credit line. This allows greater finance compared to individual business credit cards, which only gives access to limited funding. It is estimated that about 85% of business credit applications are denied.

Customer reviews for Credit Stacking on Trustpilot and BBB are mostly negative, with a 2.8 score on Trustpilot and a C- on BBB. The one positive review praised the multiple coaching calls, while most of the negative reviews complain about the lack of results with credit applications and unwanted charges. This Credit Stacking review will go through the strategy, what you get with the course, and who Jack McColl is, and what his claims are.

Credit stacking is a high-risk, high-reward strategy to build funding that takes a lot of planning and discipline. If your business does not do well enough to pay off the debt, you risk ruining your credit score and being buried in high debt. Start with low-cost, low-risk business models instead, such as local lead generation, to ensure you have a steady cash flow.

Jack McColl's Credit Stacking Review: Pros and Cons

Pros

Jack McColl knows what he's talking about and is an expert in credit stacking.

Weekly and monthly coaching calls.

Lifetime access to the course means you can return to it in the future when the need arises again.

Cons

Most of the information in the course can be found online for free.

A lot of complaints and negative reviews and no real-world examples of success from students.

Overpriced compared to working with credit card stacking companies.

Price

Credit Stacking costs $7,800 for lifetime access to the course.

Refund Policy

Refund entitlement is discussed during the call.

Origin

2021

Reputation

Mixed reviews on Jack McColl's services.

Scam. They promise to connect you with creditors. Never happened.

How Does 0% Interest Credit Stacking Work?

Credit stacking works by applying for multiple credit cards at once, creating an unsecured line of credit that revolves. You can do credit stacking yourself or work with a credit card stacking company. The goal of credit stacking is to increase the overall limit of capital available for you to finance your business. 0% interest rates are only offered as an introductory promotion that will run out in 9-20 months, in which you will start recurring high interest rates. While credit stacking is legal, it is a risky method if you cannot pay your debts while the interest piles up.

Who Is Credit Stacking For?

- Startup entrepreneurs who need credit to start a new business but do not qualify for startup business loans. You need a credit score of at least 650.

- Business owners who do not qualify for business loans or credit lines. Businesses with low revenue often find it hard to qualify for business loans or credit lines.

- Entrepreneurs who do not have assets for collateral to apply for business loans. You do not need collateral to make use of the Credit Stacking strategy.

How Does Jack McColl's Credit Stacking Work?

Jack McColl's Credit Stacking proprietary strategy is a 3-step process. The A-Z process will guide you through creating an application strategy, making the applications in a specific order, and then stacking your credit to maximize your available capital.

Step 1: Awareness

The first step is to build awareness of your current situation. You need to assess your FICO score to see where you can improve to increase your chance of application approval. Optimizing your FICO score will give you the best chance of having your business credit applications approved. You also need to know the pitfalls and what relationships to build to minimize the risks and further improve your approval rate.

- Applying for too many personal credit cards.

- Not following the hierarchy of cards correctly.

- Not requesting credit line increases effectively.

- Not filling out the credit card applications properly.

- Not applying for the high-limit personal cards.

Step 2: Hack the Bank

Step 2 is all about how to look attractive to the lenders that they are incentivized to lend you money. People who need money are the most risky, so you need to make it look like you don't actually need the money by optimizing your application process. Jack was able to get a $500,000 credit stack by building relationships with bank relationship managers. This is how you increase your chances of approval for high-limit 0% interest business credit.

- Online - Because of the popularity of credit card fraud, online applications could easily lead to denial. You have the lowest chance of being approved online as your application is processed through a computer algorithm.

- Through a relationship manager - Jack has built relationships with these managers that help him with applications and clients of Credit Stacking. He also claims to see a 50% higher limits with this process. You won't see $50,000 or $75,000 limits with online and inquiry applications.

Step 3: Credit Stacking

The last step is to use the credit stacking strategy to stack massive amounts of 0% interest capital. Always start with top tier banks and max them out before moving to regional banks and then credit unions. You can balance debt from card to card and if you will risk a relationship with a bank, it will be the smaller banks. Balance transferring can give you 0% interest for 5 years. Last, know the mistakes when applying for business credit in order to maximize your chance of approval.

- Applying for the wrong cards - Only apply for 0% interest business credit cards with high-limit. Avoid applying for a lot of low-limit credit cards. Always look for the best credit cards and never apply for cards that do not have 0% interest promotions.

- Not knowing which bureau the bank is going to pull from - All banks pull from a specific bureau. Knowing this insider information will help you be more strategic with your credit card applications. Credit Stacking has their own proprietary Business Card Locator tool that lists all the banks in the United States and which bureau they pull from.

- Applying at the wrong time - You need to know when to apply and to what bank based on your credit profile and banking relationship. Know the best time to apply to maximize your chance of approval and avoid denials.

- Submitting the application the wrong way - Determine what type of cards to apply for based on where you live. Credit Stacking's Business Card Locator tool compiles information on all 0% interests business cards in the entire United States. Some banks don’t give inquiry and these are the banks which you should apply for first as too many inquiries lessen your chance of approval. Credit Stacking also teaches you a unique strategy to get the inquiry removed called an inquiry sweep.

What Do You Get With Credit Stacking?

Credit Stacking Reviews

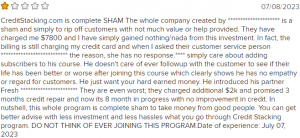

Aside from the video testimonials from students of Credit Stacking that Jack advertises, I could not find any positive reviews online that show how effective the course is. Credit Stacking has a 2.8 rating on Trustpilot with only 1 positive review. Negative reviews point out that most information can be found online for free and that Credit Stacking does guarantee you will even be approved for your credit cards. The only positive review mentions that the coaching calls were the value that helped him create his own credit company.

Credit Stacking Review BBB

Credit Stacking complaints on BBB are about the program not delivering results and extra charges. The complaints have been addressed by Credit Stacking and the refunds have been made. Credit Stacking has a C- BBB rating.

Who Is Jack McColl?

Jack McColl is a serial entrepreneur, credit coach, and creator of Credit Stacking from Beverly Hills. He used credit stacking to get a total of $500,000 in business credit approved in 14 months. He is featured in many articles, such as Forbes and Bloomberg, and is a host on many podcast interviews such as with BiggerPockets and Ryan Pineda. Jack is also the author of the highly rated book "Credit Stacking: Accelerate Financial Freedom with Business Credit."

Jack travels full time but spends most of his time between Beverly Hills, California or Cabo San Lucas, Mexico. Aside from Credit Stacking, he is also the founder of Alpha Automation, which scales Walmart and Facebook stores, Glider, which is one of the largest US based hoverboard companies, and Sendit Cabo, which is a collegiate travel company that acquired by Pollen for 6-figures. He used different financial strategies to fund his businesses, from traditional and alternative lenders, before discovering credit stacking.

Originally from Torrance, California, Jack has a bachelor of business administration from the University of Washington and an associate’s degree in arts from Peninsula College. He started his freelance videography and photography firm, Fresh Cut Films, during college while also working as a professional snowboarder. He founded several other more businesses after college and exited most of them for a profit. Jack also did Airbnb arbitrage in Bali and had 3 ecommerce dropshipping stores.

What Is Jack McColl's Claim?

Jack McColl claims that through his Credit Stacking program, you don't need to have an aged cash flowing business, have any experience with credit, or have any relationships with banks in order to qualify for business credit. He claims that his course can teach you all you need to know to qualify for multiple cards that have high-limit 0% business credit. Jack also claims that his students have a higher approval chance because of his connections with bank relationship managers.

3 Reasons Jack McColl's Claim Are Not Realistic

- Bank relationship managers will still approve business credit based on your application and credit history regardless of their relationship with Jack, simply because their job and their reputation are on the line. Banks need assurance that the credit card debt will be paid and on time and high-limit 0% interest business credit are reserved for the ideal clients.

- The 0% interest rates are offered in the introductory period of being approved for specific business cards. 0% interest rates only last 9-20 months, after which you will start incurring interest. The point of credit stacking is to max out your high credit limit for maximum capital, so when the 0% interest rate is over, the interest will be quite high.

- If the cash flow of your business does not cover your credit card payments, you risk ever increasing payments as you incur late fees, and high interest rates once the 0% interest rate runs out. This can lead to financial ruin or, in the worst-case scenario, a debt collection lawsuit.

Is Credit Stacking Worth It?

Credit Stacking is a legit course. However, the high cost of the course that is meant for people already looking for funding becomes a concern. Credit Stacking does NOT guarantee approval of your credit applications. Alternatively, you can work with a credit stacking company that only charges you for approval. Credit stacking companies often charge 9% to 11% of the approved amount. This is a high price to pay to guarantee approval, which becomes another risk.

Most of the information in the Credit Stacking course can also be found online for free. You can learn how to do credit stacking without adding more debt to your name. If you need help to fix your credit, working with credit repair companies will cost a fraction of what you are charged for the Credit Stacking course. You can also try other low-cost methods of fixing your credit, such as piggybacking. This is done by building your credit score as an authorized user while using someone else's already approved card. Piggybacking credit is legal. Under the Equal Credit Opportunity Act, a bank cannot deny authorized users on using existing credit accounts.

Related Articles on Credit

Create a Low-Cost Passive Income Business With Local Lead Generation

Local lead generation is a low-cost business model that creates passive income. You can start this business with as low as $500 in initial investment and earn as much as $2,000 a month of predictable passive income. You don't need to apply for a business loan or multiple loans that you will be paying for in the long run. Local lead generation can be a great risk-free way to build capital to invest in your business or even become your primary source of income.

To simplify, you create and rank a site on Google using free tactics like SEO, then rent it out to local businesses. These businesses will benefit from the customers who will find them using Google and will gladly keep paying you for the organic leads your site brings in.

Scaling a local lead generation business is also as easy as repeating the process. There is no limit to how many sites you can rank and rent. This means that your potential to earn passive income is virtually limitless. If you are on a tight budget or are looking for a scalable passive income business to create financial freedom, local lead generation is my number 1 recommendation.