Digital real estate investing lets beginners, entrepreneurs, and aspiring business owners make a significant passive income without the high costs of physical inventory. According to Kris Krohn, it's a more profitable alternative to traditional real estate. This business model deals with the purchase and sale of virtual lands or digital assets and products like websites, social media profiles, domains, cryptocurrencies, Non-Fungible Tokens (NFTs), and many more. Beginners in digital real estate investing can also utilize AI and online tools like ChatGPT, Ahrefs, Jasper, Semrush, and Google Analytics to boost their income and success potential.

This online business model has mixed reviews online. Some Reddit commenters tag digital real estate investing as a multi-level marketing gimmick, unsustainable, and an asset that's not "real". Alternatively, a Redditor mentioned how digital assets helped him generate $50K to $250K monthly from $2,500 as a beginner in 2012. Another Quora user detailed the lucrative benefits of digital real estate assets. He said that they're highly scalable and a lucrative source of passive income. Plus, your virtual assets can appreciate over time, given you implement the right traffic generation and audience engagement techniques.

YouTuber Robbie Cornelius shares how he makes money as a digital landlord. He started as a beginner a few years back and gradually learned digital real estate. Robbie focuses on specific cities to narrow down his potential customers and clients. He also suggests driving traffic to your digital properties and adopting the right monetization strategies, such as using sponsored content, offering web development services, and providing online content.

Beginners in digital real estate investing can make around 6 to 7 figures in passive income monthly. However, they require technical digital marketing skills, in-depth customer and competitive analysis, and comprehensive knowledge on digital real estate opportunities. That's why it is crucial to gain valuable insights on various digital product options for beginners, cost-effective monetization methods, and helpful tips from industry experts.

In this article, we take a closer look at the basic concepts of this business model, the costs involved, and the pros and cons of digital real estate investing in 2025. Plus, we'll dive into the best and most profitable way to make money with online assets.

What is Digital Real Estate Investing?

Digital real estate investing is the process of building or buying digital assets to sell for a competitive price. Some famous types of this business model include domain flipping, website or virtual space rentals, social media account selling, and website flipping. It also includes digital products like e-books, courses, audiobooks, applications, cryptocurrency, and many more. The key is to have complete ownership and rights over your supposed digital or virtual assets. According to various Quora posts, you can increase a digital real estate asset's value by amplifying its potential market, customers, and clients. You can do this by creating high-quality content to drive traffic and engagement.

In fact, digital real estate investing isn't that different from traditional real estate investing. Once it has obtained a significant value, you can then sell it or rent it out to prospective clients or businesses. This lets you earn passive income without the complexity of purchasing physical inventory. It's valuable because business owners can get a better brand presence or a higher number of quality leads.

Digital Real Estate Investing Pros and Cons in 2025

Digital Real Estate Investing Pros

You can create an online property with low startup costs. It also takes less time to recover your capital when you invest in digital real estate.

Digital real estate investing offers a higher ROI potential than traditional assets (up to 10X more).

Virtual land increases in value over time.

Digital assets have low maintenance compared to online businesses that require physical inventory.

Digital Real Estate Investing Cons

Virtual assets have incredible volatility and can be highly unpredictable.

There is little to no regulation within the digital real estate market.

Digital assets have a high risk of cyber threats like hacking, spoofing, etc.

You need to drive significant traffic to entice potential clients to buy your virtual properties.

What are the Digital Real Estate Investment Opportunities in 2025?

What is the Best Way To Invest in Digital Real Estate?

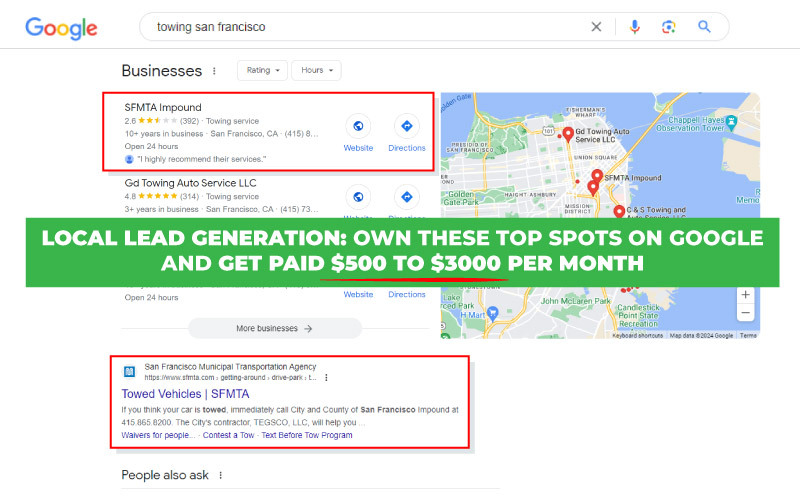

The best way to invest in digital real estate is through selling and renting out your digital assets (websites and landing pages). According to Salesmate, mid- and large-scale businesses only generate an average of 1,877 leads monthly. That's why lead-generating sites and online pages are a gold mine for these companies. It is a chance to secure a steady income stream and a loyal client base. And because you can localize your website niches and target market, it's easier to find potential buyers without the increased risk of global competition. Because there are only a limited number of spots at the top, online brands and businesses will pay serious coin to get in front of that target audience. So you need to treat your assets like real properties and build an array of high-quality virtual products.

You can also rent out your digital properties for long-term passive income. This can be through display ads and sponsored posts, affiliate links and brand partnerships, and Ad Sense and subscriptions. Renting digital assets is one of the best ways to generate a steady cash flow and recurring income. Think of sites like Home Advisor and Thumbtack. Both use their virtual property to generate leads they auction off to business owners.

Philip Laboon, an experienced Sales & Marketing Consultant, mentioned in a Quora post how he makes around $3,750,000 monthly or $45 million yearly from lead generation. He also suggested joining lead generation seminars and courses before trying your luck with this digital real estate investment strategy.

How Much Does It Cost To Invest in Digital Real Estate?

It costs around $100 to $300 to invest in digital real estate, depending on the digital products you sell and the platforms and online tools you use. You can purchase digital property as a website or landing page domain. Domains typically cost between $10-$20 yearly to own. They're like your street address in physical real estate. But you also need to pay for hosting fees, which run between $3-$18 monthly. These are like the house you live in. This totals to around $46-$236 yearly for the site domain and hosting fees.

You can buy domains and hosting from sites like HostGator, GoDaddy, Weebly Designer, and SiteGround. Or if you have a bigger budget, you can buy existing domains from platforms such as Flippa and Empire Flipper. However, purchasing existing sites can cost anywhere from a few hundred dollars to over a million because these online properties already have some value. That's why you need to optimize them to sell them at a more competitive rate. Figure out how to leverage Google and drive online traffic to your websites to increase their value and generate recurring income.

Of course, you can own digital real estate without spending money. Things like social media accounts or YouTube channels cost nothing to create. But it's up to you to monetize your assets in the virtual world so you don't pay cash. However, you need to be prepared to pay with your time. And, you need to research to make sure you pick the right asset. While there are a ton of opportunities, there's only room for one winner. So you need to find a way to develop digital land that fills a gap in the market or that's better than what's currently online.

Can You Make Money Investing in Digital Real Estate?

Yes, you can make money investing in digital real estate if you know how to leverage search engine and social media algorithms. You also need to understand how to drive traffic to your online assets consistently and capture your target market's attention and needs. Digital real estate investing lets you earn around $35,000-$45,000 monthly, according to Mike Vestil. You just need to be consistent and create exciting content that provides a solution. Your goal is to gain attention and grow your audience. Moreover, you need to build your digital real estate platform so it creates value for a person, brand, or business. If you're successful, your asset can be worth big bucks.

In a Quora post, Siddhartha Jana shared an inspiring story of a forklift driver who tried digital real estate for fun and ended up making millions. CNBC's article dives into the story of Abraham Piper who makes $17 million yearly by investing in digital real estate. He started off writing content for fun. Eventually, this led him to generate 1.43 million page views from just 2,500 daily. This shows the potential of the digital real estate investing with the right skills, motivation, and knowledge.

You can build an authority blog or a lead generation site or promote other people's products and services through affiliate marketing or an an e-commerce website. Some digital real estate investors become an influencer or offer a premium service, sell merchandise, participate in crowdfunding, or create sponsored content or software that they can sell over and over again.

5 Tips To Succeed in Digital Real Estate Investing as a Beginner

Is Digital Real Estate a Good Investment in 2025?

Yes, digital real estate is a good investment in 2025 if you create digital assets you're good at and know how to monetize them properly. You can generate significant income from buying and selling virtual assets. According to Hubspot's marketing report, 63% of businesses globally have increased their marketing budget to keep up with the ongoing digitalization. That's why investing in this industry as early as now helps you build a more robust online presence and digital properties with high traffic rates.

According to Quora user Jenniferkate, you need to consider factors like risk tolerance, future trends, market movement, investment strategies, industry knowledge, and financial goals. These will help you decide what digital real estate assets to build. She stressed the importance of thinking of the long-term impacts of your digital real estate investments and the ongoing economic shifts and market trends.

Statista's latest data reveals that digital investments will grow by 6.19% yearly from 2025 to 2027. This shows that there are plenty of opportunities in the digital real estate industry. Plus, it's easy to scale once you have a proven concept. However, succeeding with this online business model means constant upskilling and market research. You need to put in the effort and time to develop your digital marketing and entrepreneurial skills. Digital real estate investing is not for individuals who want to get rich quick with minimal effort.

My Number One Digital Real Estate Investment Recommendation in 2025

Digital real estate investing for beginners is challenging but profitable in the long run. Aspiring online business owners and entrepreneurs can diversify their potential income by selling or renting out various digital assets and products like websites, domains, courses, subscriptions, e-books, and many more. In fact, Silicon Valley Girl YouTuber Marina Mogilko talks about how content creation and subscription-based services are two of the most profitable online business ideas in 2025.

On the other hand, local lead generation is much easier to start and maintain. It is the best digital real estate investment that takes a few hours to build, but offers lucrative income. Unlike starting a blog or YouTube channel that can take 12-18+ months to establish and create value, you can opt for a more straightforward business model like local lead gen. You get to own an investment opportunity that acts as a lead magnet just like a landlord who owns rental property and gets a monthly check from their tenants. And once you have a system, you just rinse and repeat.

Local lead generation is a rank and rent business model based on a similar premise than common digital real estate but on a much smaller scale. You get to focus on a specific niche in a local market. This way, it is easier to rank in search engine result pages than broad markets in a global scale. First, choose a service niche that has a high search volume using tools like Semrush and Ahrefs. Then, build your website and create high-quality content to organically rank for the top positions in Google. Once your site is ranked, you'll get a continuous flow of leads at zero cost. You can sell these leads to local contractors at around $1K+ per lead or rent out your website and earn over $10K monthly per site.

The digital world provides all kinds of choices when it comes to investing and making money online. But you need to determine your skill set and focus on what brings value in the long term like the local lead gen biz model.

Interesting and informative.

I have soo many questions! Mind you….I'm admittedly digitally illiterate. Where's the "start a lead generation website for dummies"

book? I could use some of that passive income flow. Can you point me in right direction to get started? Appreciated. Jenny

Hey, Jenny. We can definitely help you get started with the basics for building your own online business and passive income stream. Check out https://ippei.com/best/ for more info about our program.

I believe in investing in digital real estate and owning your own web properties. It's safer to own a site or piece of property on the internet that you can monetize (or sell when it becomes profitable), so that nobody can take it away from you. Plus if you need to change monetization options on a site or property, you can do so whenever with just a simple decision – because you own it.