Some recession-proof businesses to start in a bad economy are:

- Local lead generation

- Online video streaming services

- DIY online services

- Teleconferencing and video conferencing solutions

- Freelance services

- PR agencies

- Staffing agencies

- IT and Cybersecurity services

- Marketing consulting services

- Affiliate marketing

Other recession-proof businesses include online courses and e-learning services, e-commerce, loan services, and more. A recession-proof business refers to a company that's immune to economic downturns. This means they keep stable revenue and profit when the economy struggles. A business can be recession-proof by diversifying its cash flows and offerings. Businesses that have many income sources are better positioned to weather economic downturns. On average, businesses earn around $50,000 to $100,000 during a recession, according to the U.S. Chamber of Commerce. LYFE Marketing in Atlanta maintained a $75,000 revenue by diversifying their services. But, your success depends on the industry and diversification strategies of your business.

YouTuber and entrepreneur Marie Forleo recommends diversifying dependencies to avoid reliance on single sources of leads and revenue. She suggests having a safety net of cash to cover operating expenses. You can increase revenue and cut unnecessary spending to accomplish this. She stresses the importance of strong relationships with peers, mentors, and customers. These relationships ensure support and resources in hard times. And it's essential to keep the business essential in the lives of customers.

In local lead generation, this means having clients across different niches. This ensures a steady flow of customers, making your business more resilient to economic downturns. Local businesses are also likely to recommend your services in their network. This creates a steady source of new clients and reduces the risk associated with market fluctuations.

This article covers 51 recession-proof businesses that entrepreneurs can start. We also cover strategies to help you thrive during economic decline. And the best industry or business to get started in order to ensure success.

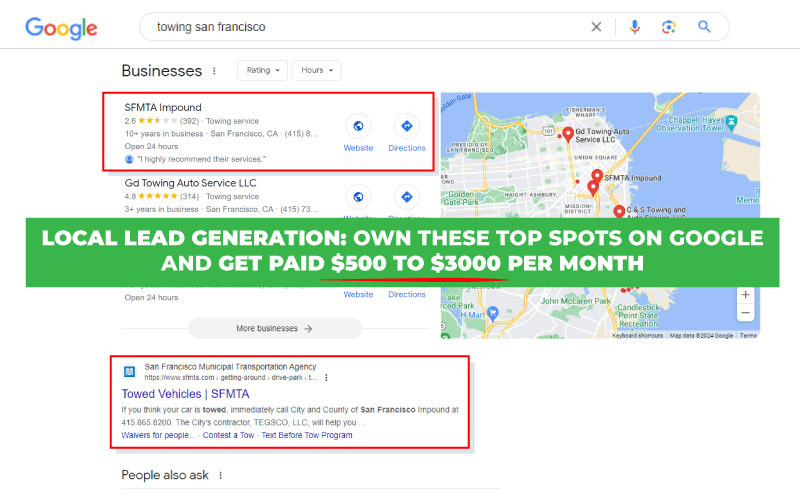

1. Local Lead Generation

Local lead generation is recession-proof, as business owners focus more on customer acquisition. This business model focuses on connecting businesses with potential customers. Small businesses rely on local clientele to sustain operations. It's also a cost-effective option because of its performance-based fee structure. The shop owners only pay for the leads. BrightLocal found 82% of small business owners prioritize local SEO and lead generation.

A report by HubSpot says that local lead generation agencies see a $20,000 to $30,000 revenue bump each year. This shows that this type of service can have a return on investment (ROI) of up to 10 times the investment. And it's the low agency costs that are a big part of what makes it attractive during a recession. The services usually include minimal staffing and the use of digital tools.

2. Online Video Streaming Services

Online video streaming services offer affordable alternatives for entertainment. As spending on out-of-home entertainment decreases, investment in at-home options increases. This showed during the COVID-19 pandemic, with Netflix experiencing a 16.05% return. In 2022, US households adopted ad-supported streaming 29% faster than subscription-based options. HBO Max, and Disney+ launched lower-cost, ad-supported options to cater to budget-conscious consumers. This subscription service allows consumers to tailor their spending to fit their budget.

Parks Associates found that in 2022, 25% of new streaming service signups chose plans with ads. They did this because the plans are cheaper. Leichtman Research Group found that 78% of families make less than $50,000 a year. They have at least one streaming service. This shows that streaming is popular among families with less money.

3. DIY Online Services

Economic recessions lead consumers to opt for low-cost alternatives to professional services. This drives them towards DIY options. And it indicates an inclination towards manageable, budget-friendly home improvement without professional help. The pandemic accelerated this trend, with DIY tool sales up 43% in 2020. This is due to online resources, supplies, and tutorials allowing DIY projects.

DIY YouTube channels also surged during the recession. Many of these channels gained thousands of new subscribers during the pandemic. A Reddit discussion shows DIY online service providers earn about $400,000 per year. And with profit margins as high as 90%. Another study in the Journal of Consumer Research found that DIY projects boost individuals' self-efficacy and lower stress. This is especially helpful during tough economic times.

4. Teleconferencing and Video Conferencing Solutions

Teleconferencing and video conferencing solutions reduce costs and increase efficiency. Oliver Wyman found 31% believe remote work is as effective as in-office work. This shift shows a long-term change in how businesses operate and communicate. For instance, in education, these technologies allow remote learning and virtual classrooms. And in healthcare, telehealth platforms have become important.

These solutions give businesses flexibility and scalability. They let businesses reach global markets without the need for physical presence. This fosters new opportunities and maintains customer relationships. Adding AI and automation to these platforms makes them better. It does this by streamlining workflows and improving communication. According to the Small Business Revenue Report states these services earn $50,000 to $200,000.

5. Freelance Services

Freelancing services are recession-proof due to its flexibility and low overhead costs. During downturns, businesses cut costs by laying off staff. They rely more on freelancers to fill skills gaps. An Upwork report shows that during downturns, 50% of small businesses hire freelancers. The businesses do this to maintain operations without the burden of full-time salaries. This shift allows freelancers to charge competitive rates because of lower operational costs.

Data from Payoneer shows that the top freelancers can earn up to $20,000 per month. They can do this even during economic downturns. This highlights the high earning potential of freelancing services. MBO Partners found freelancers can see a 15% profit increase during recessions. This includes cost-cutting, consulting, or digital transformation.

6. Digital Marketing Agency

A digital marketing agency offers targeted, adaptable solutions that are vital in downturns. These services maintain their visibility in a crowded market. And let businesses capture demand as competitors cut marketing spend. It achieves this using tools like SEO. It also uses PPC ads and social media campaigns. The ongoing need for digital strategies ensures steady demand for digital marketing services. This makes it profitable for business owners, even when other sectors are in decline.

In fact, small businesses spend an average of $9,000 to $10,000 per month on digital marketing services. This indicates a large earning potential for digital marketing agencies. And since economic downturns can lead to layoffs at other agencies or companies. This makes it easier to find experienced digital marketing professionals. You can hire them or partner with them as your agency grows. You can provide these services remotely. And lets you work with clients globally with no geographic limits.

7. PR Agencies

PR agencies manage the communication and reputation, which are critical during economic downturns. During a recession, companies face more scrutiny from consumers and investors. A study found companies with strong communication are 3.5 times more likely to keep their market position. A PR agency helps companies build good relationships with the public and stakeholders. Companies also cut costs by shrinking in-house marketing teams. They do this by outsourcing to PR agencies. This allows PR firms to keep and gain clients.

PRWeek says that 60% of PR agencies report getting more clients during the last recession. For a small PR agency, this could mean gaining 3-4 more clients per year. It would raise annual profits by about $50,000 to $100,000, depending on the size and scope of the contracts. That is on top of their annual pay of $83,626 a year.

8. Staffing Agencies

A staffing agency provides temporary or permanent employees to other companies. During a recession, companies may lay off permanent employees to cut costs. They then turn to staffing agencies to fill critical gaps with temporary workers. This allows businesses to adapt to demand without committing to long-term employment costs. Reuters says the Congressional Budget Office projects US growth to rise 1.5% in 2024. With an unemployment growth rate of 4.4%. Creating many chances for staffing agencies to help with hiring.

A recent survey found 64% of bosses in finance and accounting want to hire more contract workers soon. And staffing agencies capitalize on this demand by charging a 20% fee on each placement. Given the average salary of $60,000 for these hires, this amounts to $12,000 per hire. The business hires about 334 people each year. This shows that it is in demand and profitable during economic downturns.

9. IT and Cybersecurity Services

Cybersecurity services provide information, strategies, and designs to improve digital security. They strengthen your online defenses and shield you against cyber attacks. Businesses can't afford to neglect their cybersecurity, regardless of the economy. A report by Cybersecurity Ventures states that there is a cyber attack every 11 seconds. This highlights the constant threat businesses face. This is true even during economic downturns. An (ISC)² survey revealed that the cybersecurity workforce gap has grown. It has grown to over 3.1 million unfilled positions globally. With North America alone needing 359,000 more cybersecurity professionals. This talent gap is coupled with the key role of cybersecurity. It protects digital assets. This makes the industry resilient to economic shifts.

Small businesses are at special risk as they suffer 43% of cyber attacks, according to a report by Verizon. This weakness creates a demand for cybersecurity services. Small businesses seek to protect their digital assets. The survey found that 69% of IT leaders saw or expect cybersecurity budget increases. The increases will range from 10% to 100% in 2024. Almost 20% expect budget hikes of 30% to 49%. Showcasing significant investments in security. In the United States, cybersecurity pros can earn from $50,000 for entry-level roles. You can earn well over $150,000 for senior or management roles.

10. Marketing Consulting Services

A marketing consultant will analyze a client's current marketing strategy, including their target audience, brand message, and presence in their market or industry. They will then find what works and what doesn't. They will use this to make a new marketing strategy. By leveraging metrics, data, and other company information. Demand for marketing consultancies increased by 12% during the last economic downturn. Businesses sought expert advice to navigate the tough market. A marketing consultant will analyze a client's current marketing strategy. This includes their target audience, brand message, and market or industry presence.

The American Marketing Association reports a local bakery increased its customer base by 30% during the recession. They did this by following a marketing consultant's advice. They focused on their media campaigns. HubSpot revealed that businesses using marketing consulting saw a 12% profit margin increase. The increase happened in their first year of use. This could mean that if you start with a modest profit of $10,000, consulting could raise it to $11,200 in the first year.

11. Affiliate Marketing

Affiliate marketing operates on a performance-based model where advertisers only pay for actual results. This pay-for-performance structure makes it an attractive option for businesses. During these times, companies often cut their marketing budgets. So instead, they look for cheap strategies that limit risk and maximize returns. Rakuten Marketing reports businesses earn $6.50 for a $1 spent on affiliate marketing. This shows that affiliate marketing fills this need and lets them maximize their ROI.

Business Insider reports that affiliate marketing boosts small business customers by 30%. It gives them access to a diverse audience through different channels and platforms. According to a survey by VigLink, 9% of affiliate marketers make over $50,000. And 65% of affiliate marketers earn between $5,000 and $50,000 per year. This indicates that affiliate marketing services can be profitable by selling their services to others.

12. Online Courses and E-learning Services

During recessions, people turn to education to improve their skills. This leads to more signups for online programs. Collegis Education's Bob King states that higher education is countercyclical to the economy. With more adult learners enrolling during times of higher unemployment. The flexibility of online learning allows students to balance their education commitments. A 70% increase in internet usage and a 12% rise in online streaming was also seen during the COVID-19 pandemic. Class Central says that over 180,000 new learners per day. Demonstrating the growing demand for online education.

Online courses and e-learning services also benefit from lower overhead costs. These costs are lower than those of traditional educational institutions. They can offer many subjects and skill-based training. This versatility allows e-learning businesses to adapt. They can adjust to changing market demands and the economy. Successful online course creators can earn between $1,000 and $10,000 per month. This translates to an annual income ranging from $12,000 to $120,000.

13. E-commerce

E-commerce businesses have lower overhead costs compared to traditional brick-and-mortar stores. This allows them to operate and maintain profitability even when consumer spending decreases. The ecommerce online sales saw a 43% increase during the pandemic. Experts say that this trend will continue as consumers shift to online shopping. GritGlobal reports a $63,000 revenue boost for e-commerce shops during the pandemic. This shows that online shops can still earn a steady income.

E-commerce also uses consumer data and analytics to adapt to changing preferences. BigCommerce reports 80% of shop owners use data analytics to discern customer preferences. This helps them make informed decisions about inventory and marketing. And it adjusts their product offers and marketing efforts based on real-time insights. Statista reports that an online clothing store increased sales by 30% by selling cheaper items.

14. Loan Services

Loan services have an essential role in managing financial stability during economic downturns. The demand for loans tends to shift rather than disappear during recessions. SBA found that small business loan applications increased by 20% in certain regions. Highlighting the critical need for financial support among small enterprises. Consumer loans may decrease due to economic uncertainty. But, there is a greater need for business loans and debt consolidation services. Loans allow companies to maintain operations and pursue growth in tough times.

NBER studies showed that businesses with loans during recessions maintained 30% more capacity. The loans ensured their survival and even modest growth. The American Bankers Association reports community banks saw their net income rise. It rose by an average of $50,000 to $100,000. Loan providers can profit from increased demand for business loans and debt consolidation.

15. Healthcare Business/Companies

Health care is recession-proof because people get sick in good times and bad. The healthcare industry won’t have as many cutbacks or job losses. These are problems that other less essential businesses may experience. About 92% of the U.S. population has health insurance. So, medical services stay accessible even during recessions. The ADA reports small dental practices saw a 4% increase in patient visits in 2009 compared to 2008.

This indicates that essential healthcare services continued to be in demand. Home health care services are in high demand, especially with an aging population. A small health care business can earn between $250,000 and $500,000 in annual revenue, with profit margins of 15% to 20%. This results in potential annual profits of $37,500 to $100,000.

16. Insurance

Accidents and natural disasters don't stop for a financial crisis. Insurance claims marginally rise during a recession. More people rely on insurance claims to resolve payment issues. They do this instead of paying out of pocket. Americans consider insurance for life, home, health, and cars to be mandatory payments. Life insurance sales rose 3% in 2020, says the American Council of Life Insurers. Demonstrating that consumers focus on insurance even when cutting other expenses.

This stability benefits entrepreneurs looking for ventures in uncertain times. Small insurance firms earn less than $150,000. With medium-small firms earning between $150,000 and $499,999. Profit margins are between 2% and 3%, but can be higher for specific types of insurance.

17. Financial Services (Advisors)

A financial advisor provides financial advice or guidance to customers for compensation. During recessions, people worry more about their investments. This concern leads them to seek professional advice to navigate the economic turbulence. In 2023, 57% of Americans sought financial advice, according to Northwestern Mutual.

This trend shows an increasing demand as people look for expert guidance. The U.S. Bureau of Labor Statistics reports that the 2020 wage for personal financial advisors was $89,330. And InvestmentNews indicated that independent practices earn between $60,000 and $100,000. While top performers in the industry earn well over $150,000.

18. Education and Training Services

Educational and Training Services provide learning and development for serving personnel. A development program raises all employees to a higher level. It makes them have similar skills and knowledge. This helps reduce weak links in the company, who rely on others to do basic tasks. The Association for Talent Development says that companies with training programs have 218% more income per employee. The ETS's ability to adapt to technological changes allows it to thrive in a recession. Forbes reports that, during the 2008 recession, Coursera and Udemy grew a lot. The intrinsic value of education shields it from the impacts of a recession. This means that this business model has a more stable customer base.

The SBA reports business profit margins of 10-15%. For instance, a service generating $200,000 could earn between $20,000 and $30,000 in profit. Training Industry, Inc. states that small training companies average about $2 million in annual revenue. And reaching profitability within their first year. Low startup costs for online platforms also make this sector appealing. Instructors can start online courses at $39 per month. They can do this on platforms like Teachable or Thinkific.

19. Beauty Services

The beauty industry thrives during recessions due to the "Lipstick Effect." Investopedia defines this theory as consumers purchasing smaller, affordable beauty products during recessions. They buy these instead of expensive items. This allows them to keep enjoying self-care and normalcy. It has minimal financial impact. Beauty services often have built-in renewal needs. For instance, regular haircuts, manicures, and other grooming services need maintenance. Customers continue to seek these services even when cutting back on other expenses. Groupon reports that American women spend $3,756 on beauty products and services per year. This equates to over $10 per day. This shows that self-care can be a profitable business in economic downturns.

According to Startup Opinions, the average beauty salon has a profit margin of around 8.2%. Appointible states that the median income of an average beauty salon owner is around $60,074. And Dojo Business states that the annual income of beauty salons ranges from $50,000 to $80,000. With this annual income, an 8.2% profit margin translates to annual profits of approximately $4,100 to $6,560. This shows that the beauty industry can thrive in less favorable economic conditions. Beauty service owners must manage their expenses. They must also adapt to market demands to have a sustainable business.

20. Logistics Companies

Logistics companies are recession-resistant due to essential demand in the freight industry. Even in tough times, there is always demand for goods somewhere. Magaya points out that the global economy is intertwined with the logistics industry. The movement of goods is key for businesses worldwide. Even in tough times, there is still a need for moving essential goods. This provides a baseline of activity for logistics companies. The ATA reports small trucking companies operate fewer than six trucks. They make up over 90% of the industry. This shows steady demand for trucking, which is a key part of the logistics industry.

FinModelsLab states that logistics companies earn $1 to $2 million. And profit margins fall between 5% and 10%. This means that they can earn between $50,000 to $1 million in annual profits. The steady income is from the high demand for logistics services. This demand is consistent, even during economic downturns. But, the range in potential earnings varies.

21. Repairs and Contracting Services

Repairs are often needed. They keep the machinery of our lives running, no matter the global economy's status. Businesses and people are more likely to fix old equipment and infrastructure. They do this instead of buying new assets. This allows for budget control, maximizing asset use before replacement. And, according to the BLS, it's average households that spend $2,335 on home maintenance each year. While 80% of American households will need handyman services at least once a year. This drives demand for contracting services.

The repair and contracting businesses earn $50,000 to $75,000. This varies with the scale and scope of services. The U.S. Small Business Administration reports that experienced contractors earn $100,000. But, competition may increase as more individuals enter the niche due to job losses. It's essential to build strong relationships with your clients. And diversifying your services helps you stay on top of the competition.

22. Real Estate Businesses

Real estate business is the profession of buying, selling, or renting real estate. This niche provides diversification in an investment portfolio. And serves as a hedge against inflation. Investing in real estate is recession-proof because it offers long-term financial security. The potential returns on investments can be high, but there are risks involved. According to Up Metrics, the median pay of a real estate agent in the US is $46,012. This equals a monthly total of $3,843. Starting an agency and taking on multiple projects can boost your monthly average. It could raise it to between $6,000 and $8,500 or more. Real estate businesses also add to economic development. They do this by creating jobs and housing for communities.

While established real estate firms earn $49,987 to $123,283. Coursera states that agents from Washington and Delaware can earn over $90,000 per year. However, for a real estate business, you can expect to spend $62 to $23,259, with an average cost of $12,272. Running a real estate business involves expenses that add up and impact profitability. These costs include business phone services and technology investments. They also include the costs of hosting open houses or creating virtual tours. Managing these expenses well is crucial to thriving during a recession.

23. Food and Beverage Industry (Grocery Stores)

Food and beverage companies are well positioned to ride out any economic uncertainty. This is because people need to eat and drink in any economy. During a recession, food sellers keep more customers by offering good value. This includes manufacturers, distributors, retailers, and restaurants. The cost of opening a grocery store can vary based on several factors. But for a grocery store, you can expect to spend $12 to $37,876, with an average cost of $19,815.

Entrepreneur Magazine states that small food businesses can start with $2,000 to $10,000. This makes it accessible for new business owners. Who may not have much capital but are passionate about the food industry. The latest statistics say that small supermarkets make around $84,000 in profit. Medium-sized ones make $191,000. While Large supermarkets can generate higher profits of $386,000 annually.

24. Consumer Staples Manufacturing

Consumer staples refers to a set of essential products used by consumers. This category includes things like food and drinks, household goods, and hygiene products. It also includes alcohol and tobacco. People need to eat, even when the economy hits a rough patch. A household earning $94,003 spent $72,967 on consumer goods in 2022.

A Q2 2022 survey found 82% of manufacturers had a positive outlook. This was despite economic challenges. This suggests that many consumer goods makers had stayed profitable in uncertain times. IBISWorld reports small household goods and food makers earn $250,000 to $1 million. The amount depends on the product and market reach. This demonstrates that even smaller operations can be profitable and sustainable.

25. Auto Repair and Maintenance

Automotive repair and maintenance refers to the service of fixing cars. It also includes changing them, restoring them, towing them and cleaning them. People will pay a few hundred dollars for repairs to avoid a car loan. Regular vehicle service and maintenance pay off big. They also extend longevity, improve performance and reliability, and save on costly repairs. The American Automobile Association reports car owners spend $1,186 on scheduled maintenance. For auto repair shops, recessions are a chance to cut above the competition. They can make their businesses known and trusted in their local communities.

Business Valuation Resources reports the average auto repair shop generates $709,000. And only employs about 4-5 workers. This revenue figure highlights the industry's strength. Many consumers keep their old vehicles rather than buying new ones during downturns. Auto repair shop owners can earn a lot. On average, shop owners earn about $165,000, while technicians make around $43,700 per year. These figures underscore the profitability of the industry, even in challenging economic times. Gross margins for auto repair shops average around 55%. Labor costs make up 18-20% of sales.

26. Economists

An economist studies the relationship between a society's resources and its output. Economists study societies. These range from small, local communities to whole nations and the global economy. During recessions, the need for economic analysis and forecasting becomes even more pronounced. Harvard professor Karen Dynan says economists are key to understanding downturns. Their expertise is vital for creating policies to mitigate recessions and boost recovery. And during the recent COVID-19 pandemic, economists led policy talks and actions.

The average Economist in the US makes $96,226, and they can earn $80,000 to $125,000 a year. Estimates suggest a median-earning economist might spend $4,897 to $6,498 per month. This covers housing, food, healthcare, utilities, transportation, internet, cell phone, and professional memberships. The cost depends on whether they own or rent their home and their location.

27. Home Maintenance Stores (But not Builders)

Home maintenance stores provide tools and materials for home projects. They are likely to see stable or growing demand in a recession. So do many appliance repair service people. During recessions, job losses cause increased remote work. Less spending on travel and entertainment leads people to stay home more. People using their homes more wear out household systems and appliances. This raises the demand for maintenance and repair services. HIRI’s 2023 study shows 79% of homeowners do home improvement projects. The average number of projects completed rose from 2.7 in 2015 to 3.4 in 2023.

Finmodelslab reports that these stores make $250,000 to $2 million per year. And with profit margins of 10-30%. This means that owners can earn $25,000 to $600,000. Depending on their store's size, location, and management efficiency. Home maintenance stores can adapt to changing needs during a recession. Such as focusing on essential repairs and maintenance products.

28. Home Staging Experts

Home staging specialists can be real estate agents or interior design professionals. A staging expert increases the appeal of a home and its likelihood of sale. A report by the Real Estate Staging Association shows that staged homes sell faster. These listings sell 73% faster than those for non-staged homes. Staging a home to sell shows a property’s best features. It helps buyers imagine living there. The National Association of Realtors reports 83% of agents say staging helps buyers envision the home. It's crucial during economic downturns when buyers are more cautious and selective. This is because staging provides a return on investment of up to 586%. It is a cost-effective strategy for sellers in a recession.

Staging Studio states that these businesses generate over $1 million in annual revenue. With profit margins of 20-30%. This suggests that top-performing home staging companies earn $200,000 to $300,000. A solo or small home staging business can charge $250 for a 2-hour consultation. They do 4 consultations per week. It's important to note that these figures are averages and estimates. Income for home staging companies varies.

29. Discount Retailers

A study found that discount stores have a customer satisfaction score of 78 out of 100. This indicates strong consumer approval, even during economic downturns. Discount stores saw a 15% increase in foot traffic during the last recession. This solidified their ability to survive tough economic times. The low startup cost makes this business accessible for aspiring store owners. With an initial investment of $10,000 to $50,000, you can set up your own discount store. A study found discount stores have a customer satisfaction score of 78 out of 100. This indicates strong consumer approval even during economic downturns. Discount stores saw a 15% increase in foot traffic during the last recession. This solidified their ability to survive tough economic times.

According to vlogger and boutique owner Alli Schultz, the cost to start a store can be up to $48,000. She recommends that you budget between $50,000 and $100,000 to be sure you cover all costs. Bargain Bin's Jane Smith also shares that their store generated $250,000 in revenue after it opened. According to her, this is due to the increased demand for discounted essential items. She notes that understanding community needs and competitive pricing is crucial to success.

30. Debt Collection Agencies

Debt collection agencies are companies that work to recover unpaid debts. They often buy consumer debt from lenders and creditors. They often pay much less than the balance owed. After buying the debt, they collect from delinquent borrowers. So, the demand for debt collectors rises in downturns. Recent statistics show that U.S. debt collectors succeed 20-30% of the time. A debt collection agency will recover an average of $20-30 for every $100 of debt.

According to the Federal Reserve Bank of New York, household debt rises. This gives debt collection agencies more chances to recover small, manageable amounts. Small agencies earn $50,000 to $100,000. While established agencies can see revenues between $500,000 and $1 million. However, earnings can vary based on the size and success of the agency. Smith & Associates, a debt collection agency in Ohio, started with three employees and a modest investment. Within two years, they've recovered over $200,000 in unpaid debts. Their success stemmed from personalized service and specializing in business and medical debts. Debt collection will rise in a global recession due to payment struggles.

31. Accounting Firms

Accounting firms experience an increase in business during a recession. This is because many people and small businesses may need a professional's help. They need to ensure they use all the tax benefits available to them. Accounting firms also help find cost-cutting areas and improve financial processes. SCORE data shows 23% of small business owners spend $1,000 or less each year on administrative costs. These costs include accounting and bookkeeping.

On average, small business owners can expect to pay between $1,000 and $5,000 per year for accounting services. The NSBA found 30% of small businesses with accounting services survive a recession. An accountant earning $54,000 can expect $56,262 after two years and $65,000 after ten years. A small accounting firm in Ohio, Smith & Associates, saw a 20% increase in new clients during a recession. Their clients were small business owners seeking cost-cutting and tax optimization advice. The firm helped a local bakery cut its costs by 15%. They did this by finding waste in its supply chain and negotiating new vendor contracts.

32. Bookstores

A bookstore is a business that sells printed and electronic books. It also sells newspapers, magazines, stationery, and merchandise like games and book-related items. The Financial Times attributes the book business's recession-proof nature to books being cheap. And based on its entertainment value. According to the American Booksellers Association, during economic downturns, people buy books for affordable escapism and education. This helps sustain sales. Bookstores saw a 43% increase in businesses during the latter part of the pandemic. Bookstores saw steady wage growth during this time (+16%) and the Great Recession (+16%, +13%).

These statistics earned bookstores the top spot in the recession-proof rankings. The stats show a "moderate startup cost" of about $75,000. The profit margins for new bookstores tend to be small. Industry data indicates that it ranges from 3% to 5%. The Institute for Local Self-Reliance revealed that small bookstores earn $200,000 to $500,000 a year. While some high-performing stores exceed $1 million in sales.

33. Interior Design Services

Interior design businesses can adjust to clients' needs and budgets during a recession. For example, instead of big renovations, designers can offer smaller, cheaper updates. They can also offer consulting. This allows them to continue generating revenue even when clients are more budget-conscious. During the 2008 recession, many industries saw big declines. But, the interior design industry only saw a 13% decrease in billing. This shows that the industry can weather economic storms. It does so better than many other sectors. These include kitchen and bathroom remodels, where interior designers can add significant value.

A survey by Houzz found that 58% of homeowners hired interior designers during a recession. They maximized their existing spaces' functionality instead of expanding or moving. This translates to a steady demand for this type of service during recessions. Since homeowners focus on making the most out of their current living spaces. The U.S. SBA defines small interior design firms as having under 5 employees. They can earn between $50,000 and $100,000 a year. but, this depends on your location and client base.

34. Food Trucks

A food truck is a vehicle equipped to store, cook, and sell food. Forbes Advisor lists food trucks as the top 10 recession-proof businesses in 2024. This industry has a 13.38% growth rate in the number of businesses during the latter part of the pandemic. This growth demonstrates the sector's ability to thrive even in challenging economic conditions. The average startup cost for a food truck is under $50,000. This low startup cost contributes to its recession-proof nature. Making it an accessible option for entrepreneurs with limited capital.

According to a report by Food Truck Empire, food trucks earn a profit margin between 7% and 8%. While thriving trucks reach up to 14% to 15% in profits. A 7% profit margin on $10,000 in monthly sales means earning $700 in profit after expenses. If your truck is doing very well and hits a 15% profit margin, the same $10,000 in sales would result in $1,500 in profit.

35. Car Rental Services

A car rental, hire car, or car hire agency is a company that rents automobiles to the public. They offer temporary access to automobiles for a fee. They can adapt to meet changing demands. This allows them to remain relevant and attractive to consumers during economic downturns. A CarRental survey found 40% rented cars instead of buying. This trend benefits the car rental industry. Since it's an option for those who need temporary transportation.

Many travelers chose road trips and renting cars to avoid air travel. This trend shows the importance of car rental services. They are a flexible and key part of travel, even when the economy is struggling. A survey by Auto Rental News found that small car rental businesses have 20-50 vehicles. They can earn $300,000 to $500,000 per year on average. With a $75,000 investment and $400,000 in first-year earnings, the net profit is about $325,000. This assumes minimal operational costs. This margin makes car rentals an attractive business option for withstanding economic fluctuations.

36. Coffee Bars

Consumers resist giving up their daily caffeine fix even when budgeting. The National Coffee Association states that 64% of Americans drink coffee daily. Making it a staple in their routine. Coffee is cheaper than luxuries like dining out. This has helped coffee shops weather economic storms better than many restaurants. A study by the Specialty Coffee Association found that during economic downturns, consumers spend less at fancy restaurants. Instead, they buy more affordable luxuries like specialty coffee. During the Great Recession, coffee and snack shops grew. And the number of businesses rose by 5.97%, and average wages by 22.76%.

This data suggests that coffee shops survived and thrived during tough times. A Square survey found small coffee shops saw a 4.6% sales increase during the 2008 recession. The low startup costs for coffee bars are often under $75,000. The low cost of goods sold (COGS) for coffee, which is around 15-20% of the selling price. This allows for higher profit margins. They are higher than those of other food and beverage businesses.

37. Pizza Delivery

Pizza delivery is recession-resistant because pizza is an affordable meal option that provides value for money. Especially when feeding families or huge groups. During the 2008 recession, pizza franchises flourished as people sought comforting, budget-friendly meals. Pizza remained a popular choice for those seeking a satisfying, budget-friendly meal. Even high-end pizzerias, like DiFara Pizzeria in Brooklyn, charge $5 for a premium slice. They've reported strong business despite economic challenges. This suggests that people like pizza in many forms and prices. It stays popular even in tough times.

According to a survey by Pizza Today, a small pizza delivery business can earn between $100,000 and $200,000. This income comes from high demand for cheap, easy meals. This is especially true during economic downturns. This suggests that pizza comes in many forms and price points. It's a popular choice in tough times, making it a profitable venture for new entrepreneurs.

38. Property Management

Property management involves overseeing and maintaining real estate for owners. This includes tasks such as rent collection and property maintenance. It also includes tenant screening and handling legal issues. During recessions, owning a home becomes harder. This leads to increased demand for rentals. The U.S. Census Bureau reported that the rental vacancy rate dropped from 10.1% in 2009 to 9.2% in 2010. Indicating a higher demand for rental properties. During the 2008 Great Recession, U.S. rents rose while home values dropped. More people rent in downturns, so this gives property managers a chance to meet the extra demand.

The National Multifamily Housing Council found that 43% of renters rent for flexibility. This trend becomes more clear during downturns. For small business owners in property management, the earnings can be quite substantial. The BLS reports property managers earned a median wage of $59,660 in 2020. For example, a small property management company manages 50 units. It could earn $50,000 to $100,000 from fees alone. The exact amount depends on the market and fee structure, economic uncertainties.

39. Cleaning Services

Regular cleaning is essential in homes, offices, healthcare facilities, and public spaces to maintain health and safety standards. This essential nature of cleaning ensures a consistent demand even during economic downturns. The American Cleaning Institute found 98% of households consider cleaning products essential. This shows that cleaning services are non-discretionary. Cleaning services often use a recurring revenue model. They have regular weekly, biweekly, or monthly appointments. This structure provides steady income. It's predictable and offers stability in uncertain times. During downturns, some businesses may rely more on outsourced cleaning.

Companies looking to cut costs might lay off in-house custodial staff. They would then contract with professional cleaning services. This might lead to increased business for cleaning companies. Starting a cleaning service can be affordable for small businesses. Entrepreneur magazine says that the startup costs for a cleaning business can be $2,000 to $6,000. The cost depends on the scale and scope of services. This includes expenses for cleaning supplies, equipment, insurance, and marketing. The U.S. Small Business Administration says a small cleaning business can earn $30,000 to $50,000 in its first year. It can grow to $100,000 or more as it gets more clients.

40. Day Care/Elder Care Services

Daycare involves caring for young children while parents work. Elder care provides support to older adults needing help with daily activities. Both services are essential for many families, which contributes to their recession-proof nature. The U.S. Bureau of Labor Statistics reports childcare worker employment will grow by 2% from 2021 to 2031. This shows a steady demand for daycare services even during economic downturns. The National Institute on Aging highlights this too. 70% of Americans turning 65 will need long-term care.

This trend creates steady demand for this type of service. The societal norms and preferences also contributed to its recession-proof status. While in elder care, there's a growing preference for aging in place. Many seniors opt for in-home care, rather than moving to nursing facilities. Business owners can earn between $30,000 and $100,000. This depends on location and number of clients they have. But, these figures prove the potential for profitability even for small-scale operations.

41. Death Care Services

Death care involves managing the deceased and supporting the bereaved. This industry includes many types of professionals and activities. They begin at clinical death and encompass various cultural, religious, and personal practices. The main argument for death care being recession-proof is the inevitability of death. As Bank of America analyst Joanna Gajuk points out, "death care is recession resistant". This is because the death rate does not fall in downturns. During the 2008 financial crisis, the U.S. death rate remained at about 8.1 deaths per 1,000 people. This is according to the Centers for Disease Control and Prevention.

An ICCFA blog claims no funeral homes closed during the Great Depression, but lacks hard data. In fact, many funeral directors had to "give away a lot of funerals" then. They did it to keep their client base. But they still need basic death care services such as embalming, cremation, and burial. The NFDA reported that the average cost of a funeral with viewing and burial in the U.S. was about $7,640 in 2019. This shows a steady demand for these services despite economic conditions.

42. Water-Sewer-Trash-Utility Services

Water-sewer-trash utilities provide clean water, manage wastewater, and supply electricity. People can't cut these utilities from their lives. They're basic necessities, regardless of economic conditions. The government regulates many of these services. This helps keep prices stable and demand steady. Historical evidence also supports the recession-resistant nature of utility services. During the 2008 Great Recession, the Dow Jones Industrial Average dropped by over 35%. Other sectors saw large declines. While many economic sectors have this need.

But utilities like Pacific Gas and Electric and American Water Works held their value. They've even shown slight gains. The performance happened during one of the worst recent economic downturns. For instance, a report by the American Public Power Association highlighted this. It found that municipal utilities saw only a small drop in revenue. They earned it back when the economy stabilized. It shows the utility sector's resilience. Water utility workers in New York earn an average hourly wage of $22.18, according to ZipRecruiter. While water treatment plant operators in California earn between $46,940 and $100,600. This shows that at the operational level, the water-sewer-trash-utility sector provides steady wages.

43. Appliance Service & Repair

The essential nature of household appliances contributes to this industry's resilience. People still need working fridges, washers, and other vital appliances. This necessity ensures a consistent demand for repair services. The National Association of Home Builders found households use washing machines about 300 times a year. This underscores the critical need for functional appliances. IBISWorld reports that the appliance repair industry saw a 0.5% revenue increase in 2023. This was despite economic challenges.

The Appliance Standards Awareness Project also notes this. They say that household appliances last 10 to 15 years. This means that regular maintenance and repairs are essential to avoid costly replacements. The U.S. Bureau of Labor Statistics says the median annual wage for home appliance repairers is about $39,270. This makes it a viable and stable career choice even during economic downturns. This further motivates consumers to extend the lifespan of their appliances through repairs.

44. Laundromat Services

During economic downturns, people still need clean clothes, making laundromats indispensable. This need ensures a steady customer base. The Coin Laundry Association says laundromats serve 300-400 customers weekly in recessions. Martin-Ray Laundry Systems also highlights this. He says that laundromats were considered essential during the COVID-19 pandemic. They stayed open when many other businesses had to close. During the pandemic, laundromats saw minimal revenue decline. They maintained 95% of their usual business, according to a survey by American Coin-Op. The industry’s ability to adapt further enhances its stability during economic recessions. It uses cashless payments and offers pick-up and delivery services.

Laundromats offer a high return on investment (ROI) of 20-35%. They have low labor costs and need little inventory. These factors contribute to their financial resilience. The average laundromat in the U.S. generates an annual gross income of $300,000. With a net profit margin of approximately 25%. The business model has low overhead costs. It offers potential passive income, making it attractive to investors. The initial investment for a laundromat is low compared to other businesses. The startup costs range from $100,000 to $300,000, making it accessible for new entrepreneurs.

45. Wedding Planning Companies

Weddings are ingrained in cultural and social traditions. This makes them a priority for couples regardless of economic conditions. The Knot reports the average couple spends about 14 months planning their wedding. This indicates a long-term commitment unlikely to be abandoned due to short-term economic shifts. The industry can offer value-added services like budget management and vendor negotiations. These services become even more critical during tough economic times. Couples are more likely to seek professional help to manage their wedding budget. This is to ensure they get the best value for their money.

Entrepreneur says that the startup costs for a wedding planning business range from $2,000 to $10,000. The range depends on factors like location, marketing, and initial inventory. Earnings for wedding planners can vary. This is based on experience, location, and the number of clients. The Bureau of Labor Statistics notes that the median annual wage for wedding planners is around $50,000. Small business owners in the wedding planning industry can earn more. Some experienced planners earning upwards of $75,000 to $100,000.

46. Pawn Shops

Pawn shops offer quick cash to those without traditional services or credit. In downturns, more people turn to pawnshops for quick cash. This is because traditional services or credit become less accessible. Pawnshops offer loans based on collateral instead of credit checks. This makes them attractive for those facing financial hardship. The National Pawnbrokers Association reports the average pawn loan is $150. This is a manageable amount for many people who need immediate funds.

The pawn industry's dual role as a lender and retailer contributes to its stability. In a strong economy, pawn shops benefit from higher sales of unique or discounted items. During recessions, they see an uptick in lending activity as people look for quick cash. The NPA says that, during economic downturns, the number of pawn loans increases by 10-15%. And the average pawn shop in the United States generate $400,000 to $500,000 in annual revenue. So if a pawn shop earns $450,000, a 10% increase translates to an additional $45,000. This brings the total to $495,000. And a 15% increase could add $67,500, resulting in a total annual revenue of $517,500.

47. Chocolate and Candy Shops

Chocolate and candy shops are recession-proof as affordable, comforting luxuries. During the 2008-2009 recession, many small candy shops reported steady or increased sales. This is because people sought small, affordable indulgences to lift their spirits. The NCA says consumers view these treats as it's essential. The National Confectioners Association found 83% of consumers. They consider chocolate and candy crucial for their well-being. This is especially true during tough economic times.

Candy shops' average profit margin ranges from 35% to 50%, according to the SBA. And an annual revenue of $50,000-$100,000. This makes them a lucrative venture even in tough economic times. People are more likely to buy affordable luxuries like candy and chocolate. They do this instead of buying pricier items. This pattern ensures a steady flow of customers.

48. Liquor & Beer Stores

The alcohol industry benefits from what economists call "inelastic demand." This means that consumption remains stable regardless of price changes or economic conditions. A study shows that alcohol abstinence rates rose during the Great Recession. But, the total alcohol consumed also rose. This was because existing drinkers drank more often. Sales at liquor stores also increase as people opt to drink at home to save money. This translates to on-premise spirits volume decreasing 2.2%. While the off-premise volume grew by 2.9%.

The diverse product range of liquor stores insulates them from economic fluctuations. This was clear during the 2020 recession. Subpremium beer sales rose by 11.3%, but beer sales increased by 27.5%, and craft beer sales grew by 22.8%. This shows that different parts of the alcohol market do well. This happens even as consumer tastes shift. Entrepreneur Magazine reports that small liquor store owners can earn $50,000 to $100,000. For example, a liquor store owner in a mid-sized town reported annual earnings of about $75,000. They credited their success to selecting products that matched local tastes.

49. Vape and Cigarette Shops

Vape and cigarette shops are recession-proof because nicotine is addictive. It also relieves stress associated with smoking and vaping. During hard times, people turn to these products to cope. Tobacco analyst Nik Modi stated that tobacco is economy resilient. He said the category "has held up 'very well' despite high unemployment rates. These rates have been the highest since the early '90s recession.

The U.S. vaping industry employs over 60,000 people across various roles. This adds to local economies by creating jobs, renting spaces, and joining events. Cigars POS states that independent smoke shops generate $50,000-$500,000. While large, successful shops generate $1 million in revenue.

50. Retail Consignments

Retail consignments sell slightly used items on behalf of individual consignors. The shop only pays the original owner once an item is sold. They split the proceeds between the store and the consignor. During the 2008 recession, two-thirds of resale stores reported a 31% sales increase. This is because people look for cheap clothing and household items. And consignment shops cater to these needs. They offer a wide range of products, from kitchenware to apparel, at low prices.

America's Research Group reports 12-15% of Americans shop at consignment stores annually. This percentage is similar to the 11.4% who shop at factory outlet malls. It's close to the 19.6% who shop at apparel stores. These shops can generate annual revenues ranging from $50,000 to $200,000.

51. Pet Services

The pet-owner bond drives demand for pet services. The Human-Animal Bond Research Institute, 98% of pet owners see their pets as family. This deep emotional bond means that pet owners often focus on spending on their pets. They do this even when facing financial problems. The American Pet Products Association found that 68% of pet owners focus on their pet's health over savings.

The pet industry's resilience is further shown by its consistent growth. Even during the COVID-19 pandemic, the pet industry experienced massive growth. During the pandemic's first year, veterinary visits rose by 6%, per the American Veterinary Medical Association. In fact, pet ownership reached an all-time high of 70% of U.S. households in 2020.

How can Entrepreneurs Pivot Effectively to Thrive Throughout a Recession?

Entrepreneurs can effectively pivot to thrive during a recession by adapting online operations. Moving operations online broadens your audience and maintains revenue. Pattycake Bakery saw a 30% sales increase by offering online orders and home delivery. Keeping a flexible and innovative mindset is also essential. During a recession, entrepreneurs can find new opportunities. They need to stay open to change and try new ideas. Pure Barre Texas saw a 25% membership increase by offering virtual fitness classes. This demonstrates that adaptability, which creates new revenue streams, ensures long-term sustainability.

The business that benefit from a recession include financial advisory and accounting services. Economic downturns increase the need for expert financial advice. Businesses and people need to address money stress. They need to plan for an uncertain future. The Bureau of Labor Statistics projects 15% growth for financial advisors by 2031. This shows the industry's resilience during economic downturns. A business can be recession-proof by focusing on essential services. Or products that remain in demand regardless of economic conditions. This will expand the customer base and allow offering digital services. This is especially important during recessions when in-person interactions are limited.

Jessica Yarbrough recommends targeting clients who value time over money. These clients are often high-earning professionals and busy executives. They are more likely to invest in high-value services. These services offer quick and effective solutions to their problems. She also advises on how to strengthen your position as an expert. This will help you attract quality clients. Presenting yourself as an authority appeals to decision-makers seeking the best solutions. This enhances your potential to secure big contracts, even in downturns.

A reddit user says businesses should market more aggressively. This is because shop owners now compete for fewer customers. Getting rid of bad customers creates value. It will keep the business running and profitable. They also advise avoiding firing employees. It's because it lowers morale and causes others to leave.

Another key is to control hard costs well. This ensures that owners have cash. They need it to absorb a loss. Reddit user jay428 who operates in the construction sector pivoted their customer base towards the public sector contracts. This is to fill the low market demand. The private sector has it, since the government always has construction projects.

What Business is Best in Recession?

The business that is best in a recession is consumer staples. This stems from the basic nature of these products. Even if spending drops, consumers will still buy essentials. These include items like toothpaste, toilet paper, and groceries. The National Bureau of Economic Research says families spend $50 more monthly on basic needs during recessions. The demand for home repair and maintenance services also rises. This is because people still need plumbers, roofers, electricians, and other essential home maintenance professionals during a recession. Local lead generation drives traffic to these businesses and attracts potential customers who need their services. Alignable found that 75% of small business owners believe local networking is crucial. They think it's key for their business to survive during a recession. This highlights the crucial role of local lead generation to help businesses thrive during economic downturn.

The most recession-proof industry is one that provides necessities and services. Local lead generation is one way to do this. This is because it connects businesses to local customers. The Local Search Association found that 82% of consumers use local search to find nearby businesses. This highlights the importance of local visibility even during economic downturns. Small businesses focusing locally in the 2008 recession had a 30% survival rate. This was compared to those that did not use local lead generation services to drive traffic to their business.

Jason Lee recommends becoming a 3D virtual photographer for real estate. These services are in demand due to ongoing needs in the real estate market. Virtual photographers can earn $350 per house up to $5,000 monthly. He also suggests creating a YouTube channel. And posts motivational quotes over stock footage. This content stays popular as people look for affordable entertainment and inspiration. You can also act as a sponsor broker. And connect YouTuber creators with brands. And earn a 10-20% commission, potentially earning $4,000 to $8,000 monthly.

The entertainment industry doesn't also falter in recessions. This is because people look for entertainment. It eases their worries amid economic decline. This type of services and products will allow shop owners to weather down the recession. Innovative products and services will make your venture valuable. They will also help you avoid economic turbulence.

Automation emerges as a particularly robust business model during economic recessions. During these times, companies often look to cut overhead and operational costs. They do this by downsizing their workforce. By integrating automation technologies, they can maintain productivity without the associated labor costs.

How Does a Recession Impact Businesses?

A recession impacts businesses by disrupting their cash flow. As a result of decreased consumer spending. Many small businesses in the U.S. reported a big drop in monthly sales during The Great Recession. Some had declines as steep as $5,000 to $10,000, according to the National Small Business Association.

To manage these challenges, companies use cash reserves, loans, or cut their workforce. These adjustments result in worse service and lower customer satisfaction. They also cut revenue and risk the financial stability and growth of businesses. As a result, 20% of small businesses fail within their first year.

What are Ways to Promote your Business on Social Media?

Is Starting an Online Business Worth it?

Starting an online business is worth it because it offers the potential for big money and personal fulfillment. But, you must be ready to work hard and persevere. You can make a six-figure income, but this venture isn't a shortcut to quick wealth. About 90% of online startups fail due to early discouragement. Online entrepreneurs succeed at making large passive income. They also get to build communities and have an impact. For example, Pat Flynn from Smart Passive Income amassed a net worth of over $3 million. He did this through affiliate marketing and selling online courses.

Conclusion: Why is Lead Generation Recession-Proof?

Local lead generation is recession-proof because it remains essential for business growth during economic downturns. During recessions, many businesses cut big marketing campaigns. They instead focus on targeted, cost-effective strategies. This shift in marketing strategy helps local lead generation businesses. They offer a cheaper and better way to attract potential clients. And it has lower overhead costs than larger marketing firms.

Local lead generation also involves over 400 niches. You can use them to choose the ones most likely to thrive in a recession. This diversity mitigates risk and maximizes potential revenue by focusing on resilient markets. Owning your digital properties, such as websites that generate leads, provides control over your assets and the leads they produce. This means you can adapt to changing market conditions.

The earnings of a local lead generation business can be high. This is especially true given their low costs and high demand. For instance, a small local lead generation business has 10 clients. They pay an average of $1,000 per month. So, the business generates $10,000 in monthly revenue. And as your business scales and gains more clients, your revenue potential increases. This longevity and passive income potential make local lead generation business recession-proof.

I like the efforts you have put in this, regards for all the great content.

Hi Amanda-glad you enjoyed the article. Thanks for your kind comment. Was there an idea that you liked the best?

What up Ippei?

The 57 recession proof business that I'm more inclined to choose are:

1. Pizza delivery

2. Affiliate marketing(currently learning it)

3. Digital marketing and content creation

4. IT Service & Support

5. Digital marketing & content creation

There is another great recession-proof business which you forgot to mention, namely Forex. It can be quite profitable in an economic downturn.

If you open the right position(short or long makes no difference) and the market goes into your favor, guess what?

You can ride that wave till you whether the stormy recession.

However, almost all the ideas in this article are awesome, but they do have a few monetary downsides, in that they require a lot of capital upfront, especially the pizza delivery business…

Because it will not only require you all those things depicted in your infographic, you know registering your state, creating a business account etc, but it will also require you to have a fleet of motorcycles or cars depending on you store theme…

So as you can see, it can & will be profitable in the long term, but getting to the break-even mark will require a person to deliver 'a boatload of pizzas'.

Thanks for all these great ideas.

I think I'll look into pet grooming one of these days – I think there's potential there. It has a relatively low bar for entry as with affiliate marketing 🙂

Love the hustle here. Despite the circumstances, there's ALWAYS opportunity. You just need to be looking for it. Thanks for the inspiration yet again

Cheers Mick!

It’s all about the hustle!

As always I enjoyed reading your posts because they always make me stronger in times of need I realized that in order for a business to succeed you have to market it online so it can evolve and grow and I understood how to do it

That is a long list of businesses that many people run in all corners of the world.

I feel that many people when they start these businesses, it kind of becomes like a daily chore where they have to spend 10-12 hours every day and they live with very less savings.

With so much advancement in technology and the world, it is still shocking to see that people have to work so many hours everyday.

I personally feel that the digital world has better opportunities where someone can make more money and can work less as well.

It all depends on the person who is willing to find better ways of getting things done and make sure that they get more out of their work. Very important to keep experimenting and finding better opportunities.

Almost every bussiness need leads whether it is in recession or growth economy so it important if their is customer than their will the lead. .

So I can say lead generation will be also in recession proof and this will be forever.

Nice content.

Thank you for sharing.

Personally, I've used my cooking and baking skills as a side hustle. I never really thought of it as something somebody would pay for, but that's me being blind to those around me who may not have the time or desire to bake or cook. I've sold prepared meals and cookies by doing what I already do everyday. Everybody has a dozen skills they can do on the side for extra money.

An easy was to add to the list is to keep a log of all the services, products you use and events you go to for a month. Just last week, my wife ( an english language teacher) made a little birthday image on canva and posted it on a whatsapp teacher group. Her boss liked the design and hired her to post on the school's facebook page 12 times a month. There are opportunities all around you if you train your eyes to see them! Ippei, I believe that I read that you had 70+ lead gen sites now. Do you have a habit of creating X amount of lead gen sites each month?

That’s awesome, yes I’m always setting specific monthly goals that I make sure I hit, continually making sure I got more lead gen sites and more rankings each month ensures that my income keeps growing