To start an ATM business with no money, try partnership deals or find a credit partner. You can apply for an SBA loan to finance the machine and initial expenses. Another option is to use your credit card. However, the interest might be a bit higher. You can also get a partner who will finance the startup costs. They'll cover the capital while you handle daily operations. In return, they get an ATM revenue share.

Here are other ways you can start an ATM business with no money:

- Partnership Deal with ATM Distributors

- Local Commission Deals

- Leasing or Renting ATMs

- Profit Sharing with Investors

- Financial Services for Small Businesses

- Government Grants

- Service Other ATM Operators

This article breaks down ways for starting an ATM business with no money. I’ll discuss how to apply for ATM business financing. The ATM business equipment financing program will also be covered.

Starting an ATM Business with No Money: Financing Options and Business Strategies

SBA Loan: You can apply for financing through the U.S Small Business Administration (SBA). They offer lower interest rates and longer payment terms. It is also less risky because SBA guarantees a portion of the loan.

ATM Partnership with Investors: Look for investors who want to outsource management to a partner. You will handle the daily operations, installation, and ATM maintenance. This commission-based model lets you start an ATM business without upfront cash.

Partnership Deal with ATM Distributors: If you're a venue owner, partner with an ATM provider. They cover the cost of the machine, installation, and maintenance. Some even provide the initial cash load. Your role is to create an effective ATM placement strategy. You’ll share ATM business profits according to your agreed terms.

Leasing or Renting ATMs: Partner with companies that lease ATMs. This method allows you to get a machine without a down payment. You can also pay in installments. Ensure to generate enough revenue to cover leasing and operating costs.

Financial Services for Small Businesses: Small business loans can cover operational cost and the cost of machines. The interest rates range from 3% to 7%. Factors like credit score, loan amount, and loan term may affect the rate.

Service Other ATM Operators: Partner with those who already have an ATM business. Everything's in place and you just take over operations. You handle everything from cash replenishment to machine maintenance and beyond. So, you need to keep substantial vault cash. You may also need to handle customer service.

Credit Card: Use your credit card to finance your ATM business. It’s a risky strategy because of the high credit card rates. You may struggle to pay off credit card debt if your business fails. This may negatively affect your credit score.

Other Ways To Start an ATM Business with No Money According To The Business Guy on YouTube

How To Get a Loan To Start Your ATM Business?

You need a good business plan to get a loan to start your ATM business. This proves to the lender that you can repay your debt. Study the market analytics and identify essential aspects of the business. Determine the location and estimate your expected transaction volume. You also need to provide accurate financial projections. From this, you can calculate expected revenue from transaction fees.

What are the Loan Types for Small Businesses?

- 7(a) Loan: The most popular one for small businesses. It's a versatile loan that you can use for renovations or working capital. Or, use it to buy machinery, equipment, furniture, and fixtures.

- 504 Loan: Long-term and fixed-rate financing. It's most suitable for asset purchase and business expansion. In a 504 loan, SBA finances 40% of the total project cost. Third party lenders cover 50%. And, the borrower covers the remaining 10%.

- Micro-loan: A short-term loan you can use for inventory or working capital. The average micro-loan is $13,000. However, some borrowers may get up to $50,000.

- SBA Express: Faster turnaround time than the 7(a) loan. Borrowers usually get the result within 36 hours. And, you can loan as much as $350,000.

How To Qualify For a Small Business Loan?

Your credit score should be at least 650 to qualify for a small business loan. Some lenders also require businesses to operate for at least a year. Lenders may also require an annual income of at least $50K. Your debt-to-income ratio should be above the threshold. They use this metric to measure your ability to repay your debt. Other lenders may also require a collateral as guarantee.

Pros and Cons of a Small Business Loan

Pros of Small Business Loan

Quick access to capital

Don't need to give up business equity

Tax benefits

Flexible loan options

Cons of Small Business Loan

Stressful and financially straining

High interest rates

Rigorous application process

Risk of borrowing more than what you can afford to pay

How Can You Secure an ATM Without Capital

Secure an ATM without capital through business equipment financing. The interest is lower because the ATM serves as collateral. It's ideal for equipment that has a long service life. Machines that quickly depreciate may not be suitable for business equipment financing. Business equipment leasing is also an option. This allows you to renew the lease or return the equipment once the contract expires. You can also purchase the ATM at a much lower price by the end of the lease term.

How To Own an ATM For Profit?

Buy an ATM through upfront cash or loan/financing. Conduct market research to find a good location for your ATM business. Gas stations, busy sidewalks, and convenience stores are good places for these. Cannabis dispensaries also offer a great placement strategy for ATMs. It's because banks rarely service marijuana-related businesses.

What is the ATM Business Equipment Financing Program?

ATM Business Equipment Financing Program helps operators acquire a machine without upfront capital. It has flexible payment terms, usually 3, 7, or 10 years. They may even offer customized payment schedules. Some lenders finance 100% of the equipment cost. Equipment financing also has tax benefits. Interest and lease payments are deductible as business expenses.

How To Apply for ATM Business Financing?

Find a lending company that meets all your business needs. It's best to approach lenders who are knowledgeable of the ATM business. Gather documents like your business plan and financial statements. Some may ask for additional proofs of income/business. Submit your application and wait for the result. The process may take from 36 hours to 30 days.

How Much Do You Need To Start an ATM Business?

You'll need between $4,000 to $18,000 to start an ATM business. This includes the cost of one machine and initial operating expenses. You'll need more capital if you're planning to start with more machines. The cheapest one costs $2,250. If you want to start with 10 units, you'll need at least $20K more.

Newer models with advanced features can cost up to $10,000. You'll need to replenish each machine weekly or bi-weekly. ATM replenishments are from $1,000 to $20,000, depending on the cassette capacity.

You should also have a budget for licenses and permits. This can cost from $150 to $300. You'll also need around $100 to $200 to set up an LLC.

How Much Does It Cost To Own 1 ATM?

It costs $2300 to $10,000 to own 1 ATM, depending on the make and model. ATMs with basic functionalities only cost around $2,250 to $3,000. The Hyosung Halo II is most recommended for the ATM business. It is EMV-compliant and designed with electronic locks. Its cassette can hold up to $4,000 cash.

Another ATM model that's great for startup business is the Genmega Series. It has similar features with the Halo II, but its cassette can only hold $2,000. If you're after the cassette capacity, go for the Hyosung MX4000. It's dubbed the "big boy" because it can hold about $6,000 cash. It's best for gentlemen's club and casinos.

ATM Business: Real-Life Experiences

Koko Shares His Experience 1 Year Into The ATM Business

Koko's Background and Story

Koko is already an entrepreneur before he entered the ATM industry. He used to have an Amazon store. So, he's pretty familiar with entrepreneurship.

Koko's First Year in the ATM Business

Koko started his ATM business in multiple high-traffic venues. Some of his units were in bars and convenience stores. The traffic varies in different locations. He studied his customer's behavior. This helped him decide where to strategically place the machines.

His best-performing location averaged 127 transactions per month. ATMs in other places made from 50 to 120 monthly transactions.

How is Koko's ATM Business Doing Now?

Koko now runs a successful ATM business. He already achieved a return on investment (ROI) by the end of his first year. He said he reached 712 transactions in his best month, March 2022. His machines are now collectively making $1,075 monthly passive income.

Reddit: Is the ATM Business Dying?

Jthomas287 shared his thoughts about the ATM business on Reddit. He said it's best to place temporary ATMs at high-traffic events. The goal is to provide mobile ATM services. Parades and festivals are great occasions for these.

He said the business has become very saturated. Business owners and banks are now competing with you for customers.

Another one asked "is the ATM business dying?". He came to this realization because there are lots of ATMs for sale on FB groups. This may show that many independent atm deployers are giving up the biz.

This guy is on the verge of quitting. He said banks don't trust ATM operators. They'll even accuse you of money laundering. He also shared his struggle with maintenance and repair. If another one of his machines breaks, he'll leave.

Paul Alex also shares great insights on the ATM Together program. This course teaches how to build and grow an ATM business. He also offers done-for-you service and exclusive mentorship.

My Low Capital Alternative to the ATM Business

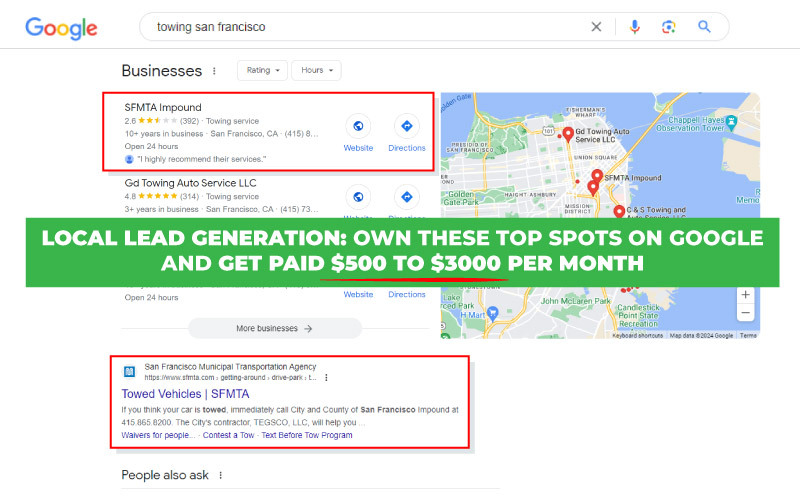

My low capital alternative to the ATM business is local lead generation. This biz builds digital assets that rank on top of Google. Ranking on top of Google places you in front of a global audience. They are actively looking for the products and services you offer. It's like owning billboards in prime locations in the real world. The goal is to create simple websites for local business owners and generate leads from them.

It's better than the ATM business because you don't need to raise a huge capital to start. Once the sites are ranked, they'll continuously generate leads. You then sell these leads to local entrepreneurs and net at least 85%.

Local lead gen is low risk because everything is done online. You don't have to handle and transport huge volumes of cash. You don't need to constantly maintain and repair ATMs. No threat of theft and robbery.

The ATM biz is past its prime years, but local lead gen is just gaining momentum. It is the best time to invest in this business. Local lead gen is an evergreen market. Business owners will always come after you for leads.