Wholesale real estate can be worth it for those looking for a low capital entry point into real estate investing who are comfortable building out networks and negotiating sales deals. Wholesale real estate can also be worth it for licensed real estate agents looking to drive more revenue for their business because they are already equipped with an understanding of the real estate market. A real estate appraiser on Quora even expresses the opinion that real estate wholesale is not worth it for beginners without a license and understanding of basic laws because of the potential to lose money or get sued if you can’t close a deal.

Even so, there are people who have achieved success in real estate by starting directly with wholesaling, such as Keith Everett Jr. Keith Everett Jr., who is also known by “Real Estate Ditty”, started real estate investing by finding an absentee owner and partnering with another wholesaler to sell the deal, splitting a $5,000 profit on his first deal. Since then, he has dramatically expanded his real estate wholesaling efforts across the country, completing over 500 real estate deals.

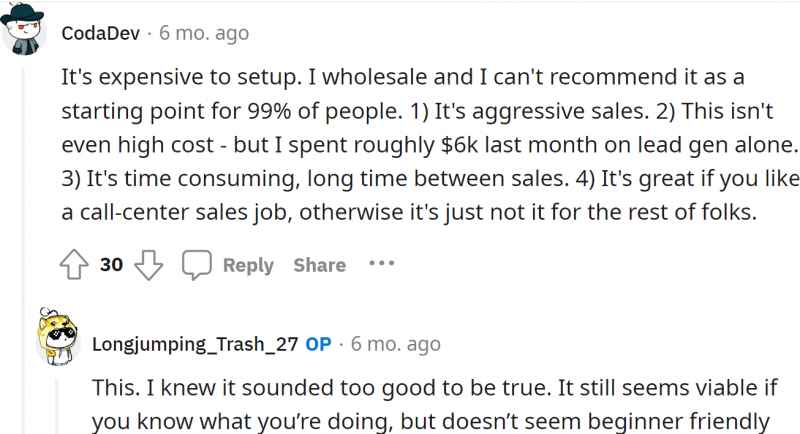

Although real estate wholesaling requires much less capital than traditional real estate investing, it can still require thousands of dollars in upfront investment because you typically need to pay for marketing to find potential deals. One wholesaler on Reddit claims to have spent $6K in just one month for lead generation. As such, real estate wholesaling probably isn’t worth it unless you have $5K to $10K in capital to risk.

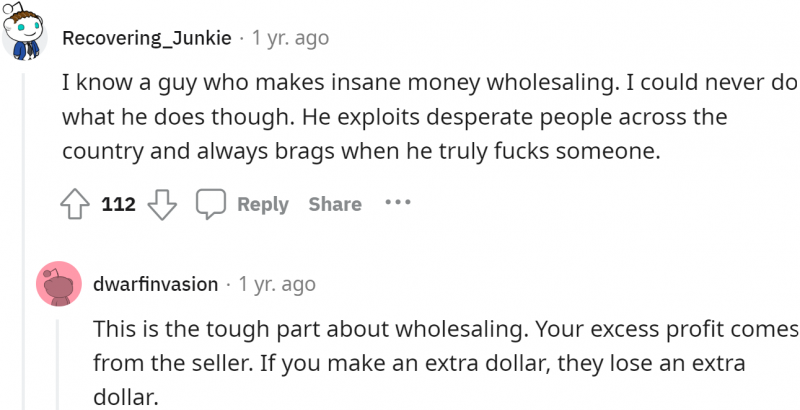

Real estate wholesaling also isn't worth it for those who dislike sales. Although prospecting and networking are major aspects of wholesaling, selling is how you actually make money. You need to convince a property owner to sell their property below market price and convince a real estate investor to buy the contractual rights to the property from you above that price to make a profit. Some people feel this is exploitation.

Many people choose digital real estate over wholesale real estate because it’s much simpler and less risky to get started, while offering consistent long-term profit potential. Digital real estate is a piece of digital property, such as a website. Rank and rent is a popular digital real estate business model that entails creating websites that attract customers for local service businesses, and then renting out the website space to real local service businesses who want ready-made marketing support. Each rank and rent website can be rented out for $500 to $3,000/month in recurring revenue.

In this article, we help you decide if wholesale real estate is worth it for you by comparing the the pros and cons of the business model and dicussing its profit potential.

Pros and Cons of Wholesaling Real Estate

Pros

Good Entry Point to Real Estate: Wholesaling is a way to enter the real estate industry with minimal financial resources or experience. It can also help you determine if real estate is the right fit for you.

Valuable Skill Development: By cultivating relationships with cash buyers, investors, realtors, and other wholesalers, you’ll improve your communication, negotiation, and networking skills.

Quick Money-Making Potential: Unlike many other businesses, real estate wholesaling allows you to recoup your real estate investment quickly, as you receive your profits promptly upon closing deals.

No Real Estate License Required: Wholesalers aren’t required to obtain a real estate license in most states. This is because you’re only selling the right to purchase a property, not the real property.

Low Risk with Minimal Upfront Investment: Even with no credit (good or bad) and limited capital, you can participate in this field since you’re not required to purchase the properties.

You're Your Own Boss: Wholesaling grants you flexibility and autonomy over your work, which is good for personal and professional growth.

Cons

Unpredictable Income: Since your income depends on you finding motivated buyers and sellers, there may be times when you can’t find available properties or close deals. This is more likely for beginners who don’t have a list of quality buyers yet.

Networking Skills Required: If you don’t have effective networking skills, you’ll have a difficult time finding buyers and negotiating favorable deals with property owners.

Not a Passive Income Stream: Unlike other real estate strategies like rental arbitrage, there’s no long-term profit in wholesaling houses. Once you’ve completed a wholesale real estate deal and made a profit, you have to start the wholesaling process all over again.

Lower Profit Margins: Wholesaling real estate is less risky compared to other real estate investments, but it yields lower profit margins.

Highly Competitive: The real estate market has numerous wholesalers vying for attention within the same cash buyer pool, making it difficult to stand out.

Can Wholesaling Real Estate Make You Rich?

Wholesaling real estate can make you rich and earn you 6-figures in assignment fees per month. But it’s not easy, especially for beginners. You’ll need solid knowledge of your local real estate market. You’ll also need to consistently identify undervalued properties and have effective negotiation skills to get purchase contracts for them.

Once you get things going, you should scale by:

- Investing in marketing

- Building a team of cold callers

- Automating your business using real estate software like InvestorLift to manage your properties

Note that many successful real estate investors don’t rely on wholesaling to build long-term wealth. Instead, they use it as a stepping stone to fund other ventures, such as fix-and-flip properties or long-term rental investments.

How Much Can You Make in Real Estate Wholesaling?

You can make $5,000 to $15,000 per deal in real estate wholesaling. Even if you only close 2-3 deals a month, you can earn up to $45,000. However, not every deal will result in a $15,000 wholesale fee. Some deals may yield lower profits, while others may offer higher returns. It ultimately depends on the specific circumstances of each deal and your ability to find profitable opportunities.

How Much Does It Cost to Wholesale Real Estate?

It doesn’t cost anything to wholesale real estate. You can start wholesaling without startup capital or prior experience in the industry. However, you may encounter some expenses as your business grows, like marketing costs, hiring home inspectors or appraisers, and legal and administrative fees.

How Long Does It Take to Start Making Money with Wholesale Real Estate?

It takes 3 to 12 months to make money with wholesale real estate, from closing your first deal to assigning the purchase contract to a buyer. Many real estate “gurus” and influencers claim that you can profit from wholesaling in just 10 to 30 days, but this isn’t realistic. Although experienced wholesalers can close deals within a shorter timeframe, it takes beginners a bit longer to establish themselves and start making a profit in the wholesale real estate market.

How Hard Is Wholesaling Real Estate?

Wholesaling real estate is a hard venture to succeed in. It’s often portrayed online with sensationalized stories, making it seem like an easy path to quick riches. But wholesaling real estate takes a lot of work. Some crucial aspects that you’ll spend most of your time on include:

Wholesaling real estate requires dedication, expertise, and perseverance. But anyone can learn the skills necessary to succeed in this field. Just make sure to set realistic expectations and be prepared to face challenges along the way.

Is Real Estate Wholesaling Risky?

Real estate wholesaling is less risky compared to other real estate investment strategies. It requires less capital, as you don't need to purchase the property outright. However, it still carries its own set of risks:

Should You Enroll in a Wholesale Real Estate Course?

You don't have to enroll in a wholesale real estate course. You can find most of the information you need from articles, videos, podcasts, and forums, where experienced investors share their knowledge and insights. However, enrolling in a wholesale real estate course can offer some advantages that self-study may not provide. These include structured learning, expert guidance, and networking opportunities. You can find free courses on Udemy or Alison.

What Is Real Estate Wholesaling?

Real estate wholesaling is a type of business strategy where a person, called a wholesaler, sells a property on behalf of the owner for a profit. They essentially act as the middleman between a motivated seller and a buyer.

A real estate wholesaler doesn’t buy the property that they’re selling. Instead, they enter into a contract with the owner, giving them the right to sell the property for a minimum amount in a set period of time. The goal of the wholesaler is to find a buyer who will purchase the property for more than the price listed in the contract. The wholesaler’s profit is the difference between the original price and the price paid by the end buyer.

How Does Wholesaling Real Estate Work?

Is Wholesale Real Estate Profitable in 2024?

Wholesale real estate is profitable in 2024. There are still plenty of motivated sellers who want to get rid of their properties. And with rising interest rates, many buyers are looking for properties below market value. So, this can be a good year for real estate wholesalers.

However, it’s tougher to find good buyers and sellers this year compared to 2020 or 2021. It’s also more competitive now, so it’s more difficult to differentiate yourself and succeed.

Is Wholesaling Real Estate Legal?

Wholesaling real estate is legal in the USA. However, different states have certain regulations that you should comply with to operate within the boundaries of the law. These regulations may include licensing, disclosure, and proper representation. So, familiarize yourself with your state’s real estate laws. You can even consult with a real estate attorney or contact your local real estate regulatory body to ensure compliance.

What Is a Wholesale Real Estate Contract?

A wholesale real estate contract has two types:

- Purchase and Sales Agreement (PSA) Contract\

- Assignment of Contract

The PSA is a legally binding agreement between a buyer and a seller that outlines the terms and conditions of a real estate transaction. In the context of wholesale real estate, the PSA contract is used by a wholesaler to secure a property under contract with the intention of assigning the rights to purchase the property to another buyer.

The PSA contract typically includes important details such as the property address, purchase price, earnest money deposit, contingencies, and closing date. It also outlines the responsibilities and obligations of both the buyer and the seller during the transaction, such as property maintenance, access, and inspection. Finally, it should have the most crucial part, which is the ability to assign the contract to another party.

On the other hand, the Assignment of Contract agreement involves the wholesaler transferring their rights and obligations as the buyer to another party, usually an investor or a flipper. This contract has similar components to the PSA, such as the parties involved, property address, and legal description. Most importantly, the Assignment of Contract should be clear on the numbers. Aside from the total purchase price, it should specify the assignment fee and deposit agreement.

Disclaimer: This is not legal advice. You can find plenty of contract templates online, but you should consult with a real estate lawyer to ensure you’re complying with local and state laws.

What Is An Example Of a Wholesale Real Estate Transaction?

There's a distressed property, such as a house, in need of repairs and listed for sale for $100,000. A wholesaler believes that the property’s actual value after repairs could be around $150,000. The wholesaler then contacts the seller and negotiates a purchase price of $70,000, taking into account the property's condition.

Once the wholesaler has the property under contract for $70,000, they market the property to other real estate investors. Then, they advertise the property at a higher price, perhaps $90,000, which is still significantly below the potential after-repair value.

A buyer becomes interested in the property. They see the potential for a good deal and agree to the wholesaler's price of $90,000. The wholesaler then assigns their purchase contract to the end investor, transferring the rights to buy the property for $70,000 to the new buyer for $90,000.

In this transaction, the wholesaler makes a profit of $20,000, which is the difference between the contracted purchase price of $70,000 and the assigned purchase price of $90,000. The end investor, on the other hand, gains a property at a discounted price, still below its potential value, allowing them to potentially make a profit through flipping or renting out the property in the future.

What Are Some Strategies for Wholesale Real Estate Investing? (5 Effective Tips)

1. Develop Strong Relationships with Your Cash Buyers

There are fewer cash buyers in 2024 compared to previous years, so prioritize nurturing your relationships with them. If you understand what they want and present them with good deals, the likelier they are to buy from you.

You want to have a list of high-quality cash buyers. It should be big enough to be a reliable pool of potential buyers for the properties you're wholesaling.

2. Know Your Numbers

Having a firm grasp of your numbers helps you secure deals at the right price. Pay attention to comparable properties (comps) similar to the one you’re dealing with. Look for comps in the same neighborhood with similar schools, crime rates, and demographics. And use fresh data, ideally within the past 30-60 days, to understand current market conditions. You should also consider the after-repair value (ARV) obtained through comps and understand local repair costs.

When you understand your numbers, you can adjust your profit margin accordingly. It also allows you to explain to cash buyers how you arrived at the property’s value, which builds confidence and trust.

3. Get a Real Estate License

Real estate wholesalers aren’t required to be licensed in most states. But it’s recommended to get licensed because it grants you access to multi-listing services (MLS). These databases provide information about active and pending listings in your area, which is useful in finding leads and comparing properties. Additionally, being a licensed real estate professional increases networking opportunities and credibility within the industry. The cost of obtaining a license can range from $350 to $1250. The benefits gained from having one make it a worthwhile real estate investment.

4. Learn Effective Marketing

Real estate marketing is a numbers game. To secure just one deal, you often need to contact thousands of sellers due to low response and rejection rates. While traditional marketing methods like mailing or door-to-door marketing remain effective, they can be costly and time-consuming. More effective strategies include cold calling via autodialers, TV ads, and pay-per-click advertising.

5. Build a Reliable Team

Wholesale real estate investing gets more complex as you scale. You should build a reliable team of professionals to maximize success. Here are a few key roles to consider:

- Cold-calling VA

- Real estate attorney

- Title company

- Repair contractors

- Property inspectors

Is Wholesaling Better Than Flipping?

Wholesaling is better than flipping for beginners in the real estate industry. It requires little to no startup capital because you don’t have to buy the property you’re wholesaling. On the other hand, flipping involves purchasing properties below market value, rehabilitating them, and selling them at a markup, usually to rental property investors. It offers higher profit potential, but it’s riskier and requires more work because you’re repairing or renovating properties. Many real estate investors start as wholesalers because of its low barrier to entry. Then, they move on to a different real estate investment strategy like flipping or property rentals.

Can You Wholesale Real Estate Without a Real Estate License?

You can wholesale real estate without a real estate license in all US states, except Illinois and Oklahoma. Unlike real estate agents, wholesalers don’t sell the owner’s real property. Instead, they sell the right to purchase it, which legally doesn’t require a license in most states. However, it’s still better to get licensed when you’re wholesaling. A license will get you access to the MLS and make buyers take you more seriously.

What Is the Main Difference Between a Real Estate Agent and a Real Estate Wholesaler?

The main difference between a real estate agent and a real estate wholesaler lies in their role, licensing, and business model. Agents work directly with clients, are licensed professionals, and earn commissions from buying or selling properties. Wholesalers, on the other hand, act as intermediaries, connect motivated sellers with buyers, and make their profit by securing properties at a discount and selling them at a higher price. While a licensed agent operates within strict regulatory frameworks, a wholesaler may have varying levels of legal oversight and licensing requirements depending on the jurisdiction.

So, Is Wholesaling Real Estate a Good Idea?

Wholesaling real estate is a good idea if you have a strong understanding of your local market, enjoy networking and negotiation, and are willing to navigate legal complexities. It’s also a good starting point for beginners in the real estate industry, as it offers low financial risk and the potential for quick profits. However, real estate wholesaling can be unpredictable, especially if you lack the systems in place to consistently find distressed properties and you lack a reliable buyers list.

For a more predictable business strategy, consider local lead generation. Instead of physical property, you work with lead-generating digital real estate that you can rent out to local business owners who need leads. With this business model, you can forgo strategies like cold-calling, door-to-door sales, or driving for dollars. Additionally, there’s no constant need to nurture a cash buyers list.