The Real World by Andrew Tate has a course called the Crypto Campus. It is one of the most popular courses in The Real World. Cryptocurrency has made people millions of dollars while others have lost their entire investment.

We'll discuss the following topics in this article.

- Top 7 crypto mistakes beginners make

- Crypto Campus Overview

- If crypto trading and investing are worth it in 2024,

- If the Crypto Campus is a pyramid scheme.

- If getting into crypto can pay you a passive income.

I'll also talk about how crypto trading/investing compares to the popular local lead generation business model that is paying people a residual income each month.

Top 7 Crypto Mistakes Beginners Make

1. Investing More Than You Can Afford To Lose

Millions of beginner crypto investors make the mistake of investing more money than they can afford to lose, despite countless "gurus" telling them to only invest what they can afford to lose. These people saw how Dogecoin rose from under a cent to over 20,000% simply because Elon Musk mentioned it on the Saturday Night Live night and thought all coins would do the same. They don't realize how volatile the market is and immediately sell their positions when they see the price go down. All they're filled with is regret for having invested more than they can afford to lose.

2. Not Doing Research

Another big mistake beginners make is not doing any research or crypto analysis. They don't follow any of the crypto projects like Cardano, Algorand, or XRP (Ripple) on social media to stay up to date with the progress they're making, they don't look up crypto terminology to understand what is being said and they don't learn how to read charts. All most beginners do is listen to YouTubers who only speculate on what might happen in the market. If you rely only on what they tell you, it could be detrimental to your portfolio. By the time a YouTuber uploads a video, you might be too late to buy or too late to sell. Do your own research and know what you're getting into.

3. Not Securing Your Crypto Investment

There are various ways to secure your crypto investment. Beginners are either too lazy or don't know what their security options are. There have been many cases of people's crypto accounts getting hacked and they can never recover their investment. If they invested more than they can afford to lose and didn't secure their crypto, they're in for a tough time. It's wise to look into hot and cold wallets to see which one is a good option for you and your portfolio. After all, it's your investment you're dealing with. Can you afford to lose your investment? If not, lock up your crypto.

4. Sending Coins to the Wrong Address

This can happen to anyone by accident and there's nothing you can really do once you send crypto to the wrong wallet. Few people will send it back because it's hard to trace. You may want to send your crypto from one wallet to another. For example, you may want to send the XRP you bought on UpHold to your Coinbase wallet. If you're in a rush and press the wrong thing or don't triple confirm you pasted your address correctly, you may lose it all. This happens all the time to beginners and even people with more experience in the space. If you lose your crypto, you most likely won't recover it.

5. Not Taking Profits

Many beginners don't take profits when the market is up because they are set to only take profits when they see the price go parabolic. This is a mistake because they don't realize that the crypto market is volatile. It goes up and down often. If you don't take profits when you have the chance to, you may miss out on doubling or tripling your initial investment and will have to wait until the next bull run before you can take any profits. This mindset of not taking profits sets you back in your pursuit of making money online with crypto. You might as well look for another online business model to get into.

6. Making Trades Based on Emotion

Many crypto investors make trades based on emotion. When beginners see a coin have a jump in price action and see how Bitcoin went to $60K, they FOMO into Bitcoin or any other coin that does something similar. They have a Fear of Missing Out (FOMO) and they think the price will continue to go up. But as we know, the price has dropped to $19K at one point. Making emotional decisions is the worst thing you can do when investing or trading. Your emotions and FOMO can make you invest in a bad crypto project, invest too late, make you lose all your money within minutes, and more. This is also discussed by Invest Diva in their courses for women entrepreneurs.

7. Panic Selling

When beginners see the price of a crypto dropping exponentially, they immediately panic and sell their crypto. Their thought process is, "let me not lose all of my crypto, let me at least keep some of my money". That way of thinking was understandable during the Terra Luna collapse. In most cases, though, there's no need to panic sell. There is a lot of price movement up and down that takes place. If you've done your homework on a legit crypto project and invested what you're ok with losing, there's no need to panic. Volatility is normal in crypto, so don't be surprised.

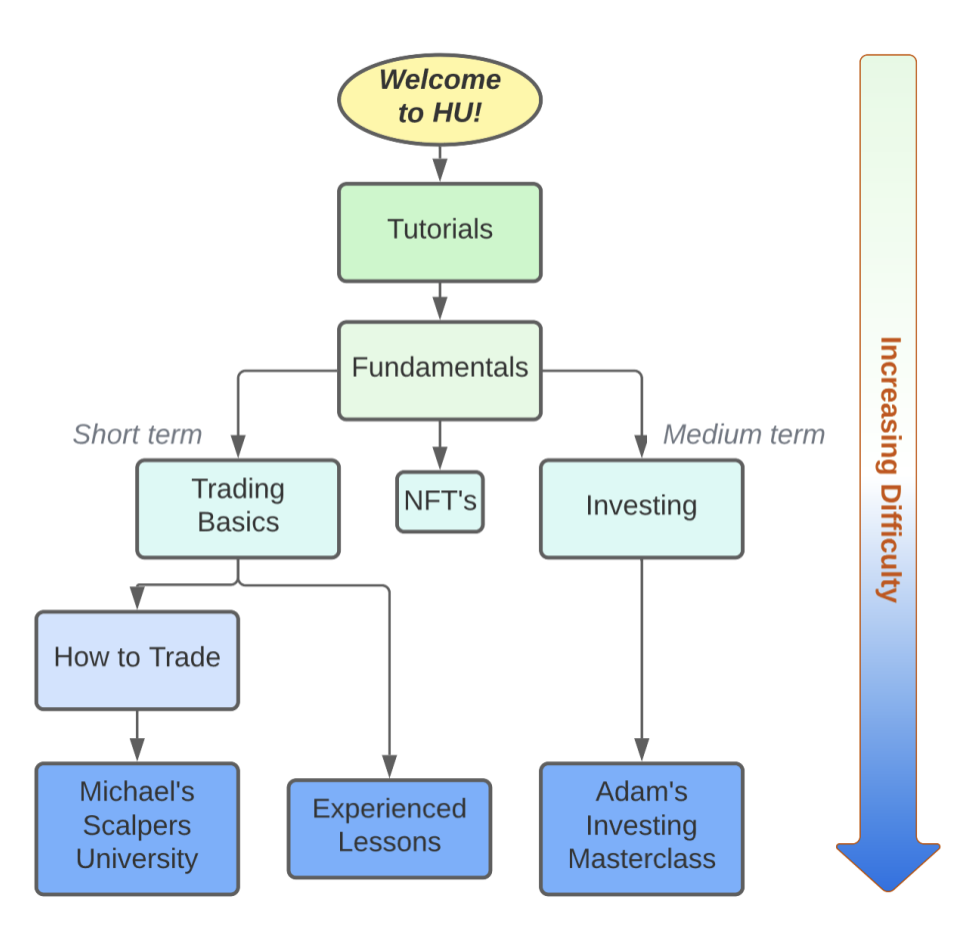

7 Lessons Inside TRW Crypto Campus

Upon becoming a student and joining The Real World Crypto Campus, Professor Adam shares the recommended route you should take when going through the various sections.

Here's an overview of what you'll get in each section and lesson in the Crypto Campus.

These are all the lessons you learn in the Fundamental Lessons section.

0. Fix Your Portfolio

Before getting started, they recommend you to sell everything you have in your existing portfolio into USDC and to copy the portfolio composition they post inside of the Investing-signals section. This is because they believe it is the best place to allocate your money while you increase your knowledge and skills.

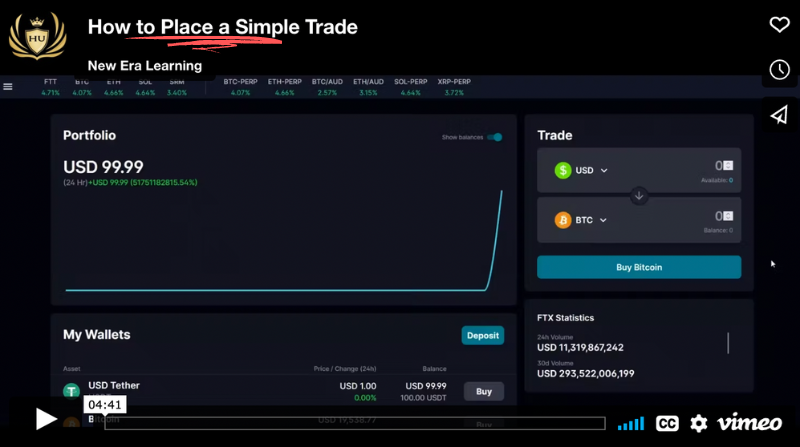

There is also a video where you're shown how to place simple trades.

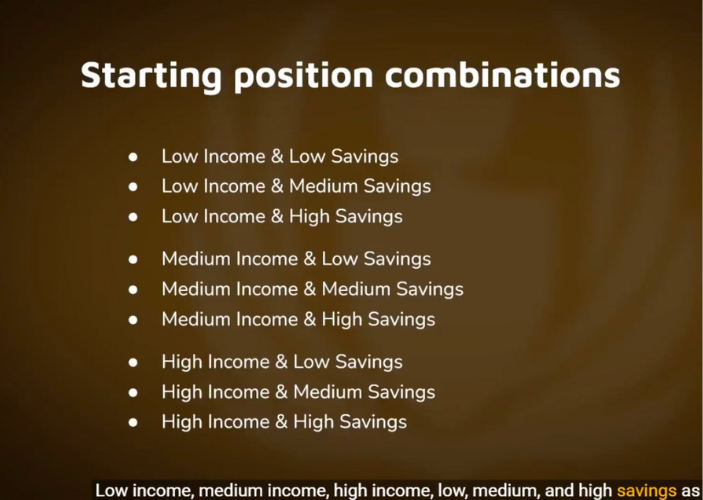

1. Account Size Principles

In this lesson, Professor Adam teaches you how to approach crypto depending on your wealth level.

He also describes what you should be focused on depending where you're at.

2. What is Bitcoin & Altcoins

In this lesson, you learn about what Bitcoin is, how it's a communication system and a financial asset, as well as what altcoins are and why they exist.

3. Types of Cryptocurrencies

Professor Adam gives you an overview of the different crypto assets, including coins, tokens, stablecoins, NFTs, wrapped tokens, and more.

4. Preferred Exchanges

Here, you get a list of their most preferred exchanges to buy and sell crypto on. FTX is the top exchange they recommend you use.

5. Charting

Professor Dan jumps in and shows you how to use the charting software called Trading View.

6. How to Buy or Sell

This lesson is more than just showing you how to buy a Bitcoin. You're shown the different order types and how to place trades on the FTX exchange.

7. Spot & Futures

In lesson 7, you learn the difference between "Spot" and "Derivatives/Futures". Professor Adam shows you how to identify when you own a token, when you don't, and how to choose the right investing tools for your goals.

8. How to Close a Trade

Lesson 8 is a short video explanation which explains how you should correctly exit a position on FTX.

9. Behavioral Finance Basics

This lesson dives deep into the psychology of a market cycle, the role fear and greed play in the world of trading & investing, and how to get the best out of yourself.

10. Unit Bias

Lesson 10 isn't a video training. It's a slide that talks about "Unit Bias", which is a psychological term used to describe when someone buys something because it's cheap.

11. Sunk Cost Fallacy

Another slide talks about what the 'Sunk Cost' Fallacy is and how it's a mistake to have the type of mindset in crypto.

12. Learning While Earning

Lesson 12 highlights the importance of following signals.

13. Safe Stablecoins

They teach you which stablecoins are safe to hold. They are...

- $USDC

- $BUSD

- $USDT

14. FOREX Trading

Professor Adam talks for over 18 minutes, explaining what the wrong and right way of FOREX trading is. At the end of it all, FOREX trading isn't really worth it.

15. Various Important Lessons #1

This video teaches you how every buyer is matched with a seller, how printing money is good for Bitcoin, and how to not be a crypto loser.

16. Various Important Lessons #2

In this lesson, you learn...

- Why you need to persist with crypto skills over time

- How to make the most money from trends and ranges

- How you can trade as a side-gig

17. Trading Crypto Full Time

Professor Adam doesn't recommend you trade crypto full-time. It should simply be active income you make aside from whatever other income you have.

18. Dangers of Leverage

The last lesson in the Foundations section is a slide that explains what leverage is and the two levels of leverage, which are beginner and advanced.

Professor Michael G teaches the trading lessons within the Crypto Campus. Here's what you learn in each section.

Part 1: Trading Basics

1. How to Buy and Sell Crypto

In the first lesson of this section, you're again show the different order types available. You're also shown different markets and how to choose the right order form for your goals.

2. Your Trading Ammo

In this lesson, they provide you with a list of trading tools that will help you better analyze the crypto markets. They will help you make informed and educated trades. Some tools they recommend are...

- TradingView

- Coinalyze

- Okotoki

- TradingLite

- Coin Lobster, and more

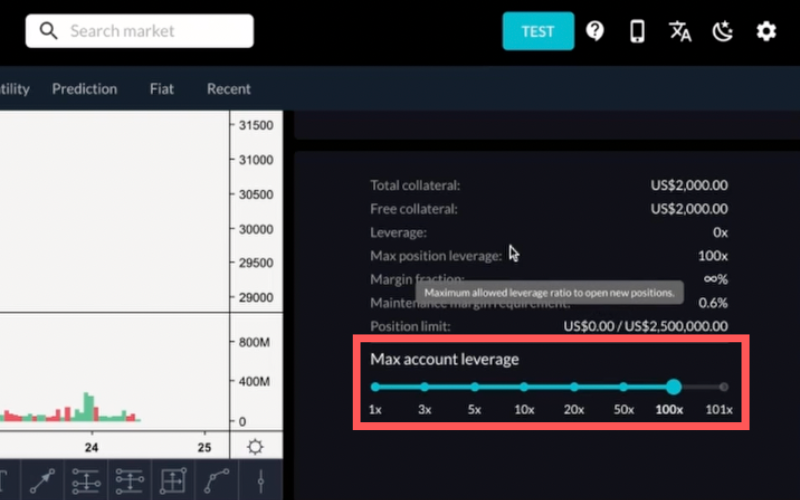

3. Leverage

In lesson 3, Professor Adam gets into leverage. He explains the best use of leverage, how to calculate and apply leverage to your trades, and why the average trader loses consistently.

4. Shorting

Lesson 4 is all about shorting. You learn what it is, how to place a short trade, if you need to use leverage to short, and what stop losses are.

5. How to Close a Trade

You learn how to exit a position the right way without making any mistakes.

6. Trading Terminology

This section gives you the definition of several crypto trading terms. There is also a video that shows you how to follow Professor Michael G's trading signals.

7. Advanced Order Types

In the last lesson of part 1, Professor Michael G shows you how the advanced order options on FTX work. Throughout the lessons, he emphasizes the importance of following exactly what he teaches you to do or else you're going to continue losing money.

Part 2: How to Trade

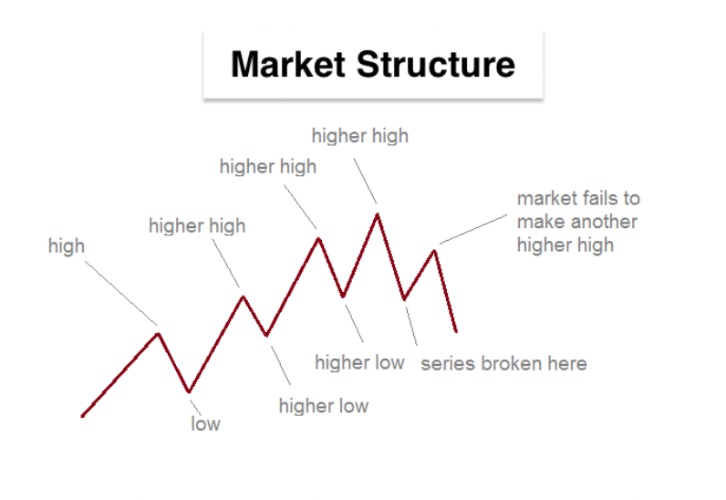

1. Market Structure

To kick off part 2 of the Trading lessons, Michael talks about why Market Structure is the most important concept traders need to understand.

He says that the most reliable way to trade is to wait for the market structure to break and then follow with the new trend line.

2. Emotional Control

Michael then dives into how emotions can get you in trouble if you don't control them. He talks about what Reflexivity is and how to avoid it.

3. Risk Management

To manage risk in a risky crypto trading market, Michael says that you should never be in a position where one trade can wipe out 5% of your portfolio. He recommends you risk only 1-2% of your active trading portfolio per trade. Doing this will help you not make irrational decisions in a volatile market.

4. Trade Management

Lesson 4 shows you...

- When and how to enter the market

- When to move your stop loss

- When to cut a trade early

- When to take profit

- What to do when you change your mind while trading

5. Mean Reversion

In lesson 5, you learn about what Mean Reversion is.

6. Chart Patterns

In this lesson, Michael shows you how he trades with chart patterns so that you can do the same. He says that using patterns shouldn't be your sole method of trading.

7. Reversals

This lesson is all about how you can find bottoms and tops with pricing action.

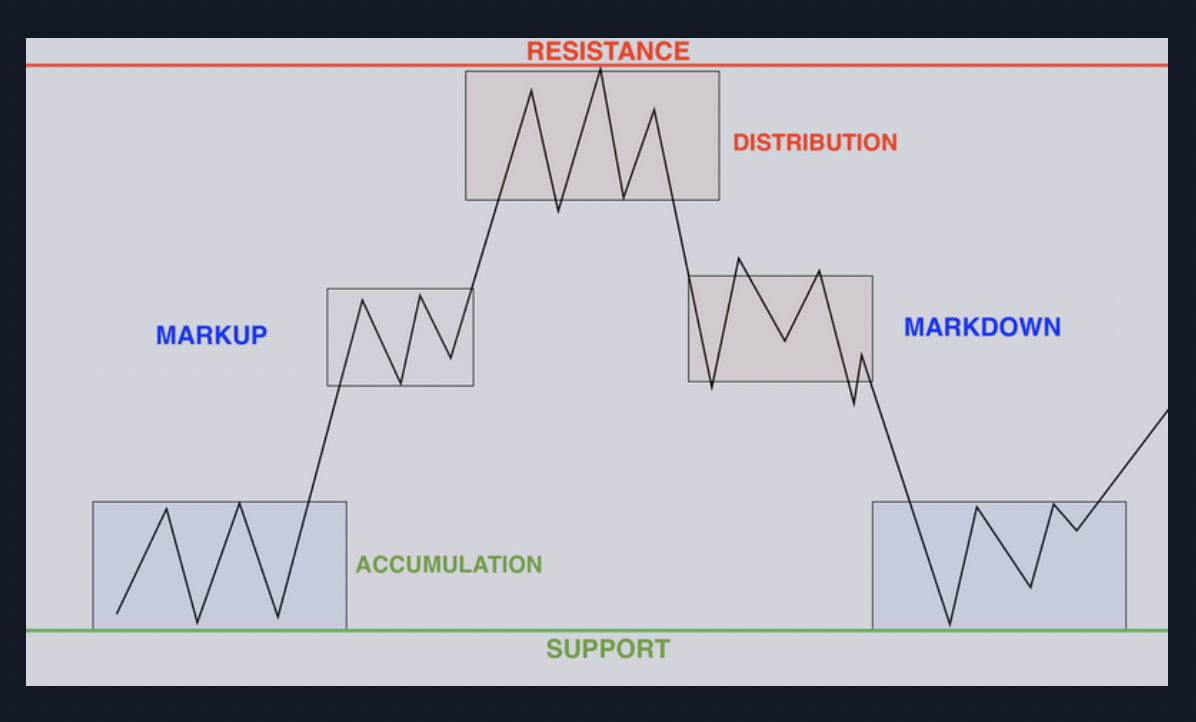

8. Range Trading

In lesson 8, Michael shows you how you can spot a range as it forms and how to make a profit from it.

9. Liquidity

You learn the reason price moves towards liquidity.

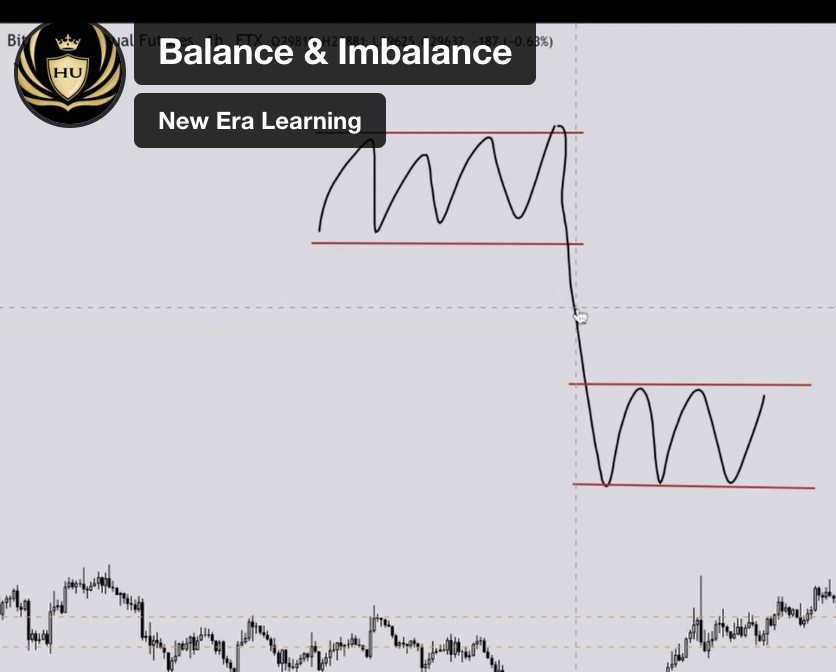

10. Balance & Imbalance

The video in this lesson shows you how to identify and trade balance & imbalance.

11. How to mark Levels

In lesson 11, you'll learn how to find and mark levels on the chart. You'll be able to more accurately spot areas of balance & imbalance with price action.

12. Advanced Leverage

Michael goes deeper into leverage and explains how to execute trades using it.

Professor Silard is your instructor in the NFT section of the course.

6 NFT Lessons

Professor Adam is your instructor in the Investing section of the course. In the first lesson, he goes over what expectations you should have for the market, asset behavior, the importance of different analysis, and market competition.

These are the lessons in the Investing section...

- Price Analysis Principles

- Additional Crypto Principles

- Advanced Investing Philosophy

- Beginners Portfolio Management

- Introduction to Correlation

- Asset Selection Theory or Market Correlation

- Altcoins Investing Dangers

- Alpha & Beta

Scalpers University is another mini-course inside of the Crypto Campus that teaches you how to master the art of short-term trading. Professor G is the one who teaches this course.

There are over 40 hours of video training divided into 5 modules. Topics covered in this course are...

- Psychology & the crypto markets

- Building a trading plan

- Statistics & probability

- Price action

- Chart patterns

- Indicators

- Trading analysis

- Order flow, and more

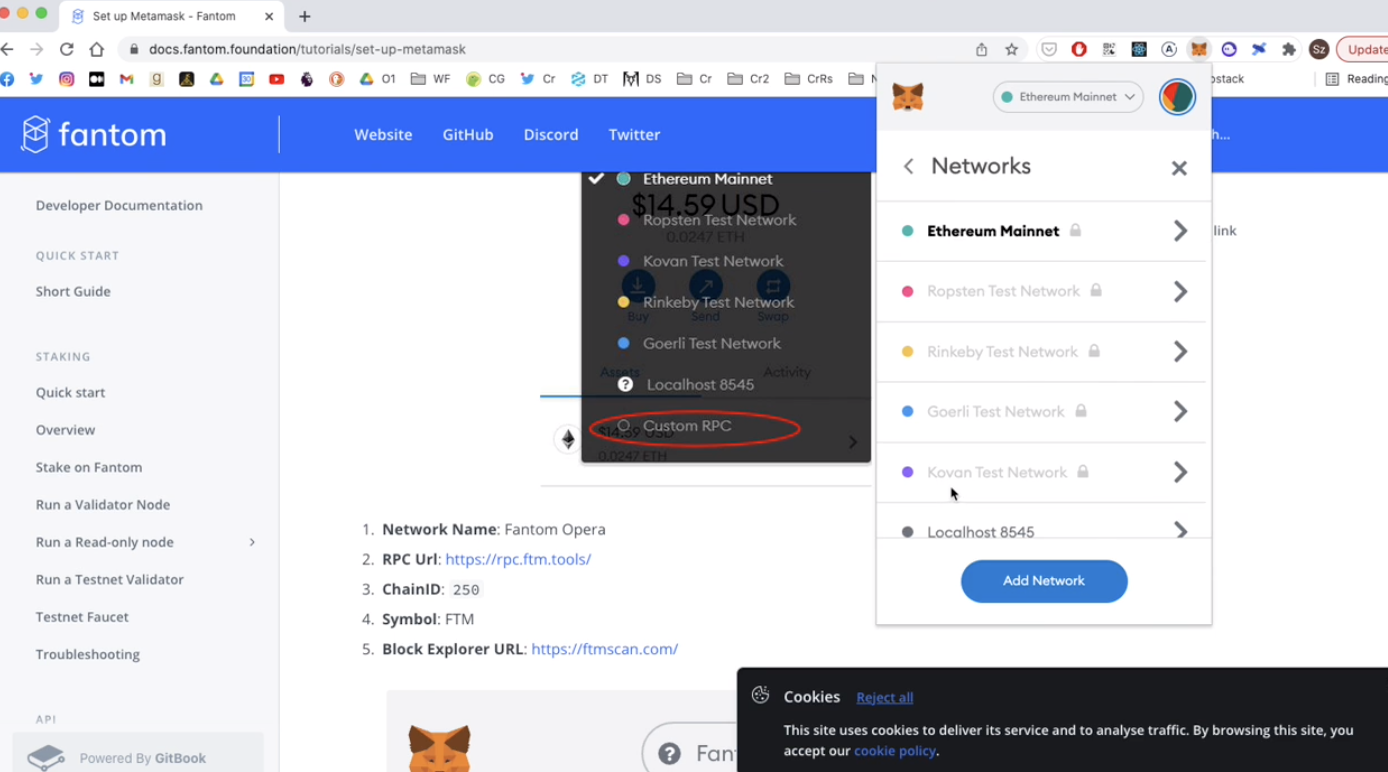

1. Wallets

In the first lesson, you learn all about the different types of wallets and which ones they recommend you use, which are Metamask, Ledger, and Phantom.

2. Metamask

This lesson gives you a basic introduction to the Metamask wallet.

3. Connecting Metamask to different chains

This is a short how-to video.

4. Tokenomics

This lesson is full of Tokenomics definitions.

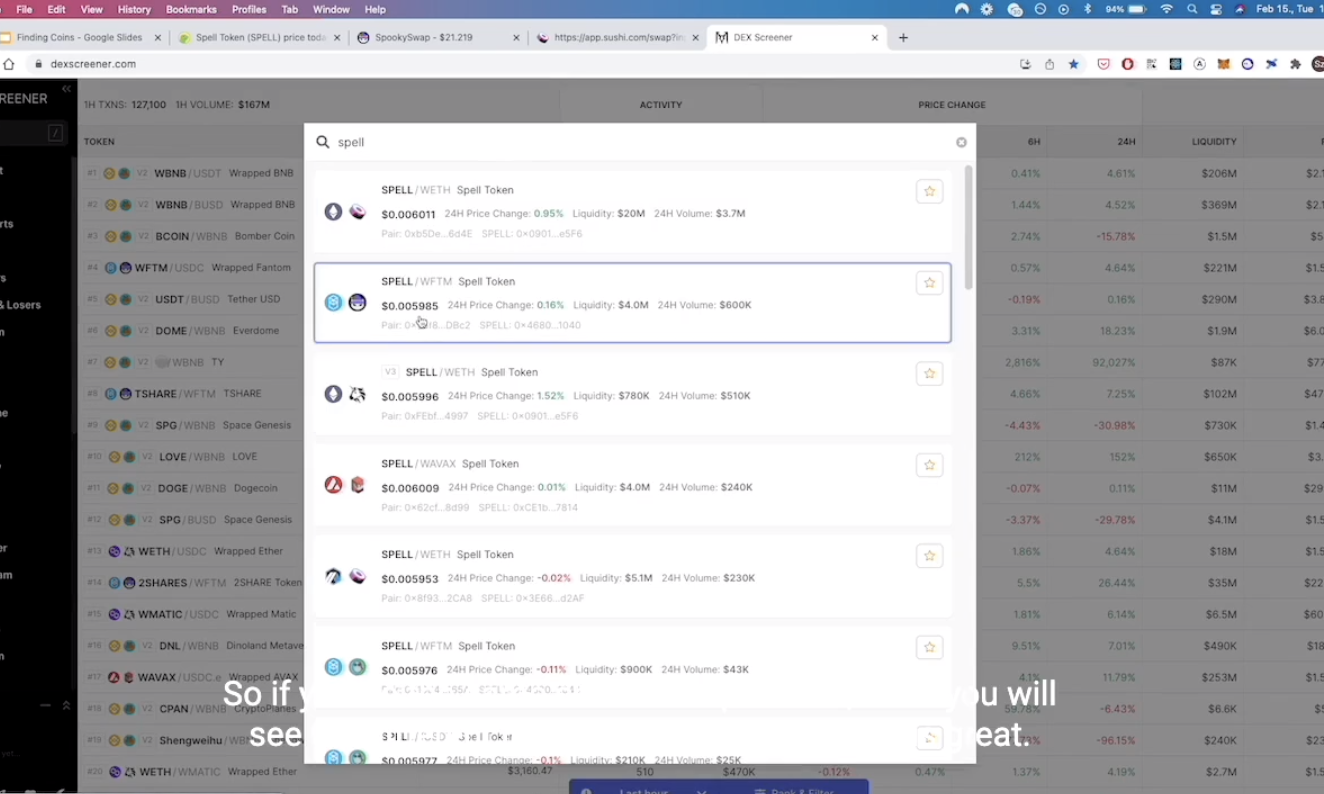

5. Finding Tokens & Token Info

In lesson 5, you learn how to find a token and token info if a certain one isn't available on the exchange you're using.

You're encouraged to use Coingecko or CoinMarketCap to look for the token.

6. Staking

Staking is locking your coins in an exchange for rewards. Lesson 6 opens your mind to the world of staking.

Rewards come in the following forms...

- Voting rights

- Liquidity mining programs

- Revenue share

7. Staking Calculations

There are two terms you need to know in staking.

APR - Annual Percentage Rate

APY - Annual Percentage Yield

They are easily explained and easy to understand in this lesson.

8. AMM (Automated Market Maker)

Lesson 8 is more slides which cover what an AMM is and how it compares to order-book matching.

9. Where you will make the most money

The main point of lesson 9 is to teach you how to make money and survive in the crypto world during bear markets and sideways markets. The most important idea in this lesson is to survive, be patient, and wait for the winners. It all starts in the bear/sideways markets.

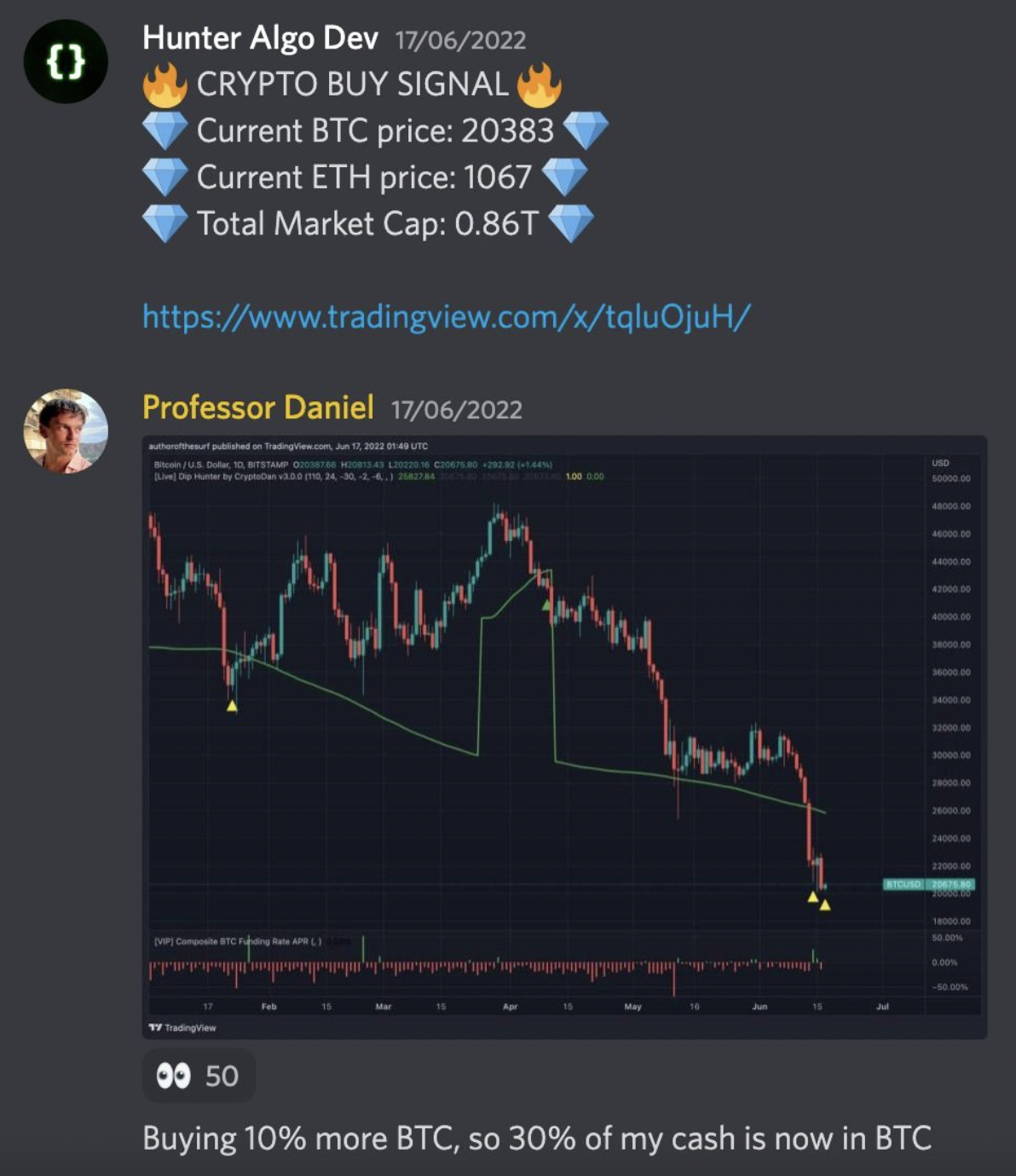

10. The Hunter Algorithms

According to TRW professors, The Hunter Algorithms are one of the most accurate investing systems in crypto that was designed by Professor Daniel. It allows you to buy tops and bottoms with 90% accuracy for 95% of coins in the market. Buy or sell signals are sent within the #Experienced-investing channel and they help you stay on top of potential turning points in the market.

Here is what a signal from Professor Daniel looks like.

In the Investing Masterclass, you learn about the following...

- Basic philosophy of investing

- Market behavior

- Coin selection & analysis

- Enhanced long & short-term components

- Position commitment & sizing

- Swing timing, and more

Is the Real World Crypto Campus a pyramid scheme?

The Real World Crypto Campus is not a pyramid scheme. It is a legit, in-depth online training that teaches you a lot more than you'll learn on your own or on YouTube. Of all training that is included within the Real World, which includes the Amazon FBA Campus, the Crypto Campus might be the only course that is very much under-priced for all the value you're given.

Each lesson ends with a quiz that won't let you continue on in the course if you get the answers wrong. You actually have to prove that you're learning as you go through the course.

If you're a complete beginner to crypto, the $49 dollar price tag of TRW is worth it if only to go through the Crypto Campus on the platform Andrew Tate put together. You can also check out information on automated crypto trading via The Crypto Code by Joel Peterson and Adam Short.

Is trading crypto worth it in 2024?

Trading crypto in 2024 can be worth it if you know what you're doing. For this to be the case, you need to do plenty of market research and avoid all the common mistakes beginners make.

If you're looking to earn a true passive income with crypto, it will not happen, even if you jump into a staking pool. You've always got to monitor the price action just in case you want to either take profit of increase your position, or if you want to sell. Crypto is better off as a long term investment because it's not a get rich quick scheme or short term solution to your money problems.

Making money trading crypto can work and can exponentially multiply your investment faster than day trading, but overall, it doesn't offer all the benefits local lead generation does.

Final Thoughts

With local lead generation, there is no volatile market. You don't need to read charts all day, think of complex trading strategies, or even worry about investing more than you can afford to lose.

All you're doing is sending leads to local small business owners and getting paid hundreds and thousands of dollars each month off of your digital real estate.

This tree care site I built over 7 years ago, when I became an entrepreneur, is still paying me $2,000 per month on autopilot.

All I did was build this site that offers tree care services, ranked it on Google in Grand Rapids, Michigan and sent all the leads to a local small business who needs more work each month.

After I rank the site, leads are generated, and my job is practically done. I may check on the sites now and then to make sure everything is running well, but that's it. Automate your monthly payments and your income becomes passive and recurring.

To learn how you can achieve financial freedom and become cash and time rich, without having to invest in risky crypto projects or stress out as you read trading charts, check out the local lead generation training program.